Third quarter agricultural credit conditions deteriorated while farmland values again saw only slight changes relative to a year ago for the Federal Reserve Bank District of Chicago, according to the latest quarterly report from the Fed Bank district.

The quarterly report by David Oppedahl, Chicago Fed senior business economist, shows the availability of funds for lending by agricultural banks was lower than in 2017 for the fifth quarter in a row. At the same time, the demand for non-real estate farm loans was higher than a year earlier.

Some 41% of ag lenders who responded to the quarterly survey indicated higher demand for non-real estate loans than a year earlier, while 13% noted decreased demand. Just 3% of respondents indicated their banks had more funds available to lends while 12% said they had less.

Repayments were also lower in the third quarter relative to the same period of 2017; 2% of bankers observed higher rates of loan repayments while 39% observed lower rates. Loan renewals and extensions on non-real estate ag loans were higher in the quarter, with 43% of bankers reporting more of them vs. 1% reporting fewer.

Farmland Values

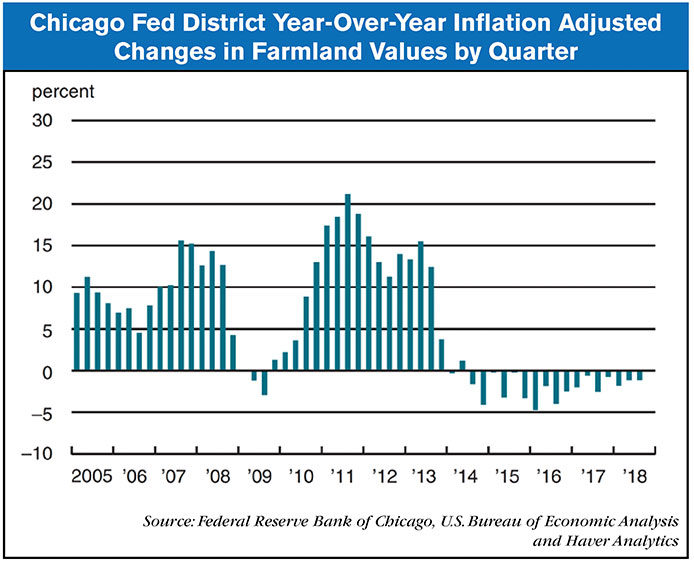

In nominal terms, farmland values in the district have not changed much over the last couple years. Values rose 1% in the third quarter relative to the same period last year, marking the eighth consecutive quarter in which the district recorded a less than 1% year-over-year increase or decrease in land values.

After adjusting for inflation, however, district farmland values were down 1% relative to the third quarter of 2017. This follows the trend reaching back to the third quarter of 2014 where nominal land values have remained fairly stable but “real” (adjusted for inflation) values have actually been decreasing.

“Agricultural land values would have experienced more downward pressure in the absence of exceptional crop yields,” writes Oppedahl. “In 2018, District-wide corn and soybean yields jumped to all-time highs (198 bushels per acre for corn and 59 bushels per acre for soybeans). According to U.S. Department of Agriculture (USDA) forecasts, the five District states’ [Illinois, Indiana, Iowa, Michigan and Wisconsin] harvest of corn for grain in 2018 would increase by 1.5% from 2017, and their soybean harvest would surge by 8.7% from the previous year, setting a new record.”

Looking Forward

A net 30% of bankers in the third quarter survey said they expect farmland values to decrease in the final quarter of 2018. Specifically, nearly two-thirds predicted farmland values would be stable, 32% of respondents expected farmland values to decrease and 2% said values would increase.

Additionally, bankers indicated they expect loan repayment rates to decline vs. a year ago. Just 2% forecasted a higher volume of farm loan repayments over the next 3-6 months compared with the prior year, while 57% forecasted a lower volume. Some 61% said they expect forced sales or liquidations of farm assets owned by financially distressed farmers will increase in the next 3-6 months while only 1% anticipated a decrease. Non-real estate farm loan volumes for the coming quarter are expected to be higher vs. the same period of 2017.

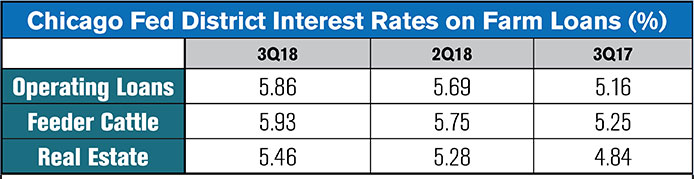

Oppedahl writes, “An Iowa respondent emphasized the ‘concern from row-crop farmers regarding interest rate increases next year and low commodity prices.’ This concern was echoed by livestock operators. So, there was a decidedly downcast outlook for agriculture based on the latest survey responses.”

![[Technology Corner] What are the Top 5 Applications in Autonomy Right Now?](https://www.agequipmentintelligence.com/ext/resources/2024/11/08/What-are-the-Top-5-Applications-in-Autonomy-Right-Now-.png?height=290&t=1731094940&width=400)

Post a comment

Report Abusive Comment