In today’s newscast, we examine Ag-Pro Companies latest acquisitions and changes to the “Big Dealer” list, how off-lease equipment are impacting the used equipment market, electric-based systems for ag equipment, and the latest earnings reports from AGCO, CNH Industrial and Art’s Way.

Leave a comment Get New Episodes Delivered to Your Inbox

On the Record is brought to you by Ingersoll Tillage.

Ingersoll specializes in seedbed solutions. Whatever seedbed challenges you have, Ingersoll can give you the right tools to get the job done. For every tillage and planting practice, there's an ideal Ingersoll application.

On the Record is now available as a podcast! I encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We're interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

You May Also Be Interested In...

In Little League, coaches tell young players to “keep your eye on the ball.” The advice applies to both fielding and batting, but it is just as applicable to running a successful farm equipment dealership. That’s just what Don Van Houweling, owner of the 2016 Dealership of the Year, has done at Van Wall Equipment.

I’m managing Editor Kim Schmidt, welcome to On the Record! Here’s a look at what’s currently impacting that ag equipment industry.

Ag-Pro Companies Moves Up on ‘Big Dealer’ List

Ag-Pro Companies, a John Deere dealer group that serves the southeast completed its acquisition of 9 Deere stores in northern Alabama and northern Georgia. The acquisition brings Ag-Pro’s total locations to 47, making it the largest ag equipment dealer for John Deere in North America, according to Ag Equipment Intelligence’s Big Dealer Report. It is now larger than Cervus Equipment, which has 42 ag stores.

Seven of the new stores, previously operated as Snead Ag, were located in Centre, Fort Payne, Gadsden, Oxford and Snead, Ala., and Cartersville and Jasper, Ga. In addition, Ag-Pro has also acquired 2 other stores in Guntersville and Piedmont, Ala., and opened its newest location in Gainesville, Ga.

FARM

MACHINERY

TICKER

AFN: $54.82 +0.21

…

AGCO: $64.32 +2.64

…

AJX: $0.51 +0.03

…

ALG: $77.12 +0.58

…

ARTW: $3.70 +0.55

…

BUI: $4.60 -0.21

…

CAT: $93.96 +0.58

…

CNHI: $9.58 +0.54

…

DE: $109.12 +4.10

…

KUBTY: $81.72 +6.09

…

LNN: $75.30 +1.27

…

RAVN: $24.65 +0.80

…

TWI: $12.86 +2.38

…

TRMB: $31.70 +1.74

…

VMI: $142.85 +3.00

…

CVL: $15.20 +0.16

…

RME: $10.61 -0.10

…

TITN: $13.46 -0.42

…

TSCO: $73.54 -1.25

...

Closing Stocks as of 2/9/17 (Compared to Close on 1/19/17)

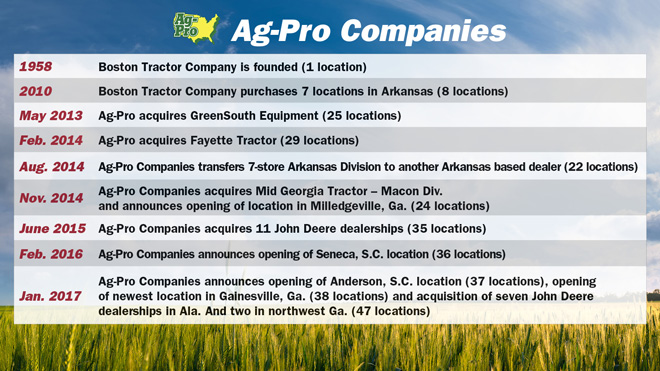

Ag-Pro got its start as a single-store John Deere dealership in Boston, Ga., in 1958. It had made 3 single location acquisitions up until 2010 when the dealership had its first large acquisition. At that time it acquired 7 stores in Arkansas that were previously known as Agricultural Productivity Companies.

The dealership group grew to 25 stores in 2013 and has steadily been growing through acquisition and new store openings since then.

Ag-Pro moved up to the number 3 spot on the Big Dealer List from number 8 in 2016, and this will bump them up to number 2. Case IH dealer Titan Machinery is the largest dealer in North America with 80 ag stores, however yesterday the dealership group announced a restructuring plan that includes closing 14 ag stores. We’ll have more on Titan’s plan in our next episode

The 2017 Big Dealer Report is currently being compiled and will be released in April.

Dealers on the Move

Other Dealers on the Move this week include LandPro Equipment, Henderson Implement, 4Rivers Equipment and Crown Power & Equipment.

Lakeland Equipment and Z&M Ag and Turf, Western New York’s two John Deere dealers, announced a new partnership with Argonne Capital Group. The two dealer groups will merge their assets into a new company called LandPro Equipment LLC that is backed by Argonne and existing shareholders of Lakeland and Z&M. The dealership group has 12 locations, making it the largest John Deere dealer in the northeastern U.S.

New Holland dealer Henderson Implement & Outdoor Power Co., based in Columbia, Mo., added a second location through the acquisition of Modern Farm Equipment in Fulton, Mo.

4Rivers Equipment, a 16-store John Deere dealership, recently completed the expansion of the service shop at its Fort Collins, Colo., store. The dealership group has stores throughout Colorado, New Mexico, Texas and Wyoming.

Case IH dealer Crown Power & Equipment acquired Fritz Implement in Monett, Mo. This brings the Crown group’s total locations to 7 throughout Missouri.

Now Here’s Jack Zemlicka with the latest from the Technology Corner.

Is Electric the Gateway to Autonomous Vehicles?

Fully autonomous vehicles in agriculture are likely still several years away, but there also may be a simpler, more efficient pathway to extending the life of farm machinery, while also improving performance.

Electric-based systems are one of the alternatives being pursued by engineers to improve fuel economy, while reducing repair costs. At last month’s Precision Farming Dealer Summit in St. Louis, Kraig Schulz, president of the Autonomous Tractor Corp., broke down the benefits of a “Tesla for tractors” model in the ag industry vs. a transition to fully autonomous vehicles.

One of his key takeaways was that electric motors improve tractor durability and retention of value because they can last longer and require less maintenance.

“If you go to the (U.S.) Department of Energy and you look at their expected lifespans for large motors greater than 100 horsepower, the average expected lifespan for an electric motor is 29 years — 200,000 hours of use — 10 times what you’d get out of a traditional tractor. That’s pretty shocking and that’s part of the reason, not the only reason, but part of the reason why you see Teslas retaining way more than half their value even after roughly half of their expected lifespan. This would certainly help with the cost side for the farmers if their equipment lasted for 25 years and didn’t need the repairs. Some of those costs that they’re facing would go down and start to help with that price vs. costs calculus that they have to do.”

While electric-based systems may be a more practical avenue to semi-autonomy, Schulz notes that the path isn’t without its obstacles. The biggest challenge being the need to reduce the cost of lithium ion batteries to run a high-horsepower tractor. Current estimates project a battery with 1,500 kilowatt hours would cost upwards of $350,000.

Used Equipment Trends to Watch

In our last episode, we discussed Machinery Pete’s fourth quarter Used Values Index and the surprisingly strong prices for used planters and combines in November and December.

During a presentation at the Precision Farming Dealer Summit, Greg Peterson, discussed 6 trends he’s seeing in the used equipment market right now. In addition to the strong prices at the end of 2016, he listed the following trends:

- Prices vary based on geography

- “Busting” soybean yields in some areas resulted in more optimism at auctions this past fall

- Dealers’ inventories of used equipment are slightly lower. Peterson says there were a lot fewer dealer-wholesaler auctions in December 2016 compared to December 2015

- The prices for used equipment in good condition are up, while the values for average condition equipment have been sliding over the last 18 months

- The number of auctions is up as much as 60%

- A wave of equipment is coming off lease and entering the used equipment market. Peterson says so far these machines are not impacting used values

We asked Peterson what impact the influx of off-lease equipment entering the market could have on farm equipment dealers.

CNH Industrial Full Year Sales Drop 4.1%

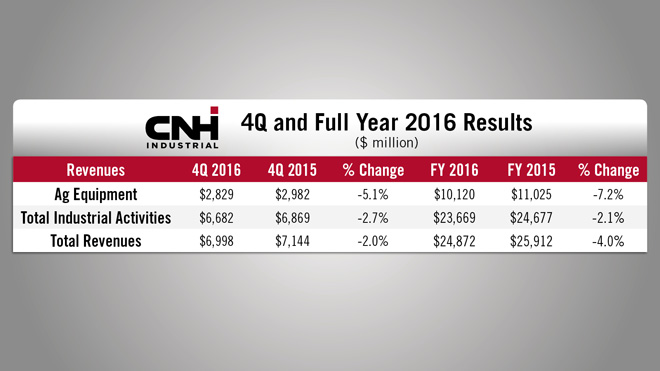

On Jan. 31, CNH Industrial released its financial results for full year 2016. Net sales were $24,972 million, down 4.1% from 2015.

Agricultural equipment sales also fell 8.2% in 2016. The full year operating profit was $818 million, down $134 million from 2015.

The company said the decline in ag equipment sales is a result of unfavorable industry volume and product mix in the row-crop sector in NAFTA and in the small grain sector in Europe, the Middle East and Africa.

Richard Tobin, CEO of CNH Industrial, remained optimistic for 2017.

He said, “While the Agricultural Equipment market remained at historically low demand levels in 2016, our margin performance was in line with our expectations and we made significant progress on further reducing channel inventory.”

To improve in 2017, CNH will be doing several restructuring actions as part of its Efficiency Program. The program will result in saving approximately $60 million in 2017. The company also hopes to become more balanced in the agricultural equipment division, improving fixed cost absorption and getting a positive impact from LATAM end-user demand.

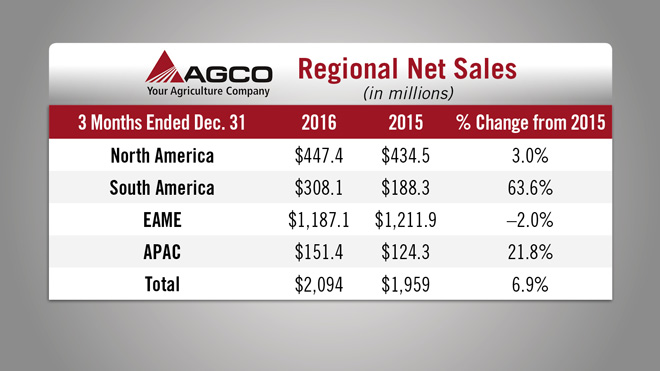

AGCO Sees Sales Gain in 4Q

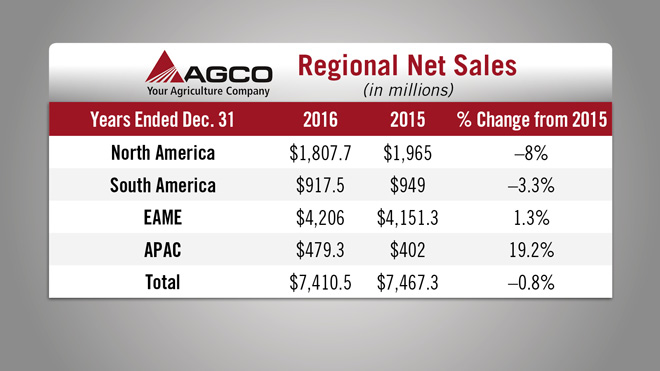

AGCO released its fourth quarter and full year financial results on Feb. 7. Fourth quarter sales came in at $2.1 billion, an increase of about 6.9% compared to the same period in 2015. For the full year 2016, AGCO recorded net sales of $7.4 billion, a drop of less than 1% from 2015.

When the unfavorable impact of currency translation is excluded, AGCO’s full year net sales increased approximately 1.9% vs. 2015.

On a regional basis, South America saw the largest increase in net sales for the fourth quarter at up 63.6%, followed by APAC at up 21.8%. North American sales were up 3%, and the only region experiencing a loss was Europe, the Middle East and Africa at down 2%.

For the full year, North American sales were down 8%, South America was down 3.3%, Europe, the Middle East and Africa sales grew 1.3% and APAC was up 19.2%.

AGCO’s outlook for 2017 calls for flat sales compared to 2016, with softer end-market demand in both North America and Western Europe.

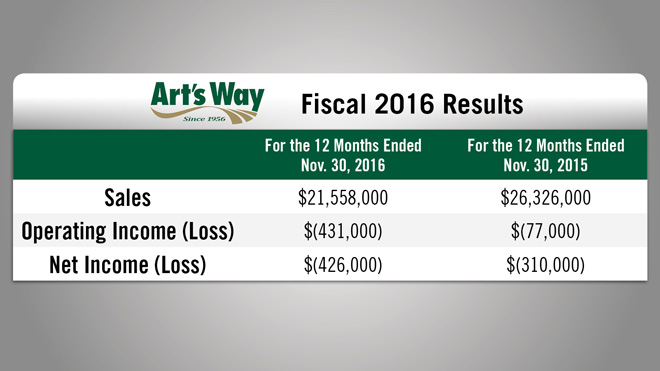

Art’s Way Net Sales Drop

On Feb.1, Art’s Way Manufacturing Co, a diversified, manufacturer and distributor of farm equipment, also released its fiscal revenue totals for 2016, which saw declines in several areas of the business.

The company’s net sales were $21.6 million , down 18.1% from 2015’s earnings of $26.3 million. The net loss was $426,000, compared to $310,000 in 2015. The company attributes the decline to decreased sales in the agricultural products segment.

The largest decline in agricultural products came from the forage box line, OEM equipment and grinder sales.

Chairman of the Board of Directors, Marc McConnell said, “low demand in fall resulted in very low shipments for October and November, particularly, that could not be overcome by adjustments in our cost structure.”

He said the company will continue reducing inventory and improving their purchasing to improve the overall operation.

Art’s Way remains optimistic for 2017 despite the difficulties this year.

McConnell said, “While our fourth quarter and full fiscal year brought great challenges, we are pleased to report that we have seen an improvement in demand since fiscal year end in all business segments, resulting in a significantly increased backlog that we anticipate will drive improving performance in fiscal 2017.”

And now from the Implement & Tractor Archives…

Implement & Tractor Archives

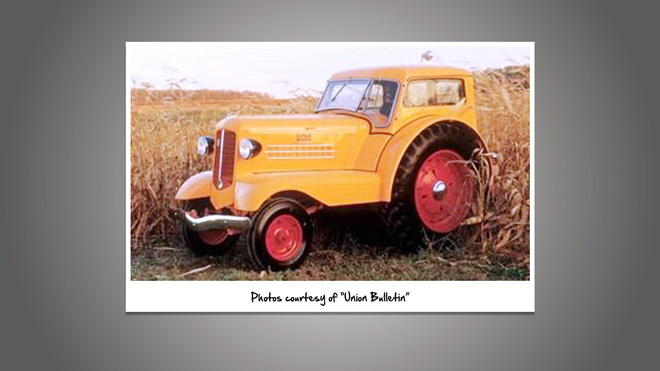

Manufacturers are always looking for ways to increase comfort in their machinery — this includes the tractor industry. As the Union Bulletin reports, “challenging weather conditions and convenience appear to have inspired inventors to develop a tractor that could go from the field straight into town.” Minneapolis-Moline met these two qualifications with their 1938 Comfortractor. The modern tractor combined utility with comfort in its bright yellow cab design. Its sales, however, were not successful. It sold for $1,900 in 1938 when in comparison a John Deere was priced at $1,000 and a Ford sedan $725. Some say the price resulted in the dismal sales while others say it was a tractor 20 years ahead of its time.

As always, we welcome your feedback. You can send comments and story suggestions to kschmidt@lessitermedia.com. The Ag Equipment Intelligence team will be traveling to Louisville next week for the National Farm Machinery Show, and we’ll have coverage from the show next time. Thanks for watching, I’ll see you next time.

Post a comment

Report Abusive Comment