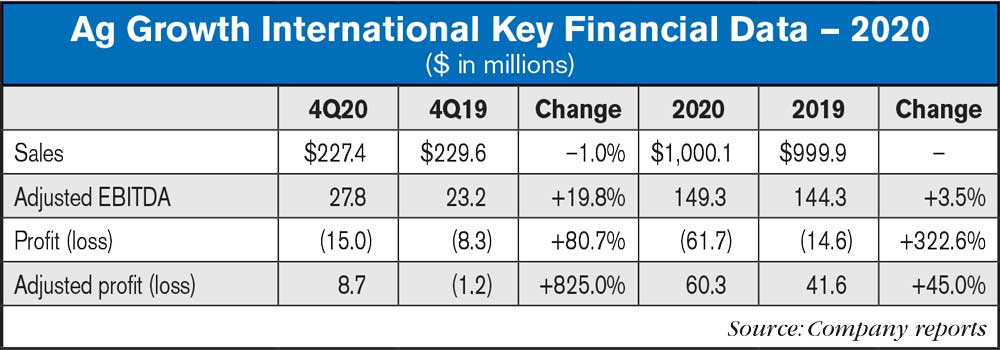

Resilient results in the fourth quarter closed out a year marked with numerous challenges but

substantial strategic progress. The company's investments in building its 5-6-7 diversification strategy contributed to a relatively strong performance given the challenges throughout the year created by the COVID-19 pandemic.

“We are pleased with the relatively strong performance of AGI in Q4 and 2020 given the difficult environment and the impact on our markets from COVID-19.”, said Tim Close, president and CEO of AGI. “Momentum was robust across AGI as we came into 2021 and has accelerated since the beginning of the year with, as of today’s date, consolidated backlogs now up approximately 40% over this time last year. A variety of factors are contributing to this growth with the majority of the momentum coming from market share growth and solid performance in many of our key regions including Brazil, India, EMEA, the U.S. and our North America Farm segment. A rebound in commercial activity, high planting expectations globally, strong crop prices and steel dynamics are also contributing to the strong environment.”

In North America, AGI's Farm segment trade sales grew 9% year-over-year with notably strong demand for portable farm equipment. North American Commercial markets were the most impacted by COVID-19 as large capital projects saw routine delays due to planning challenges, general market uncertainty and a tendency for customers to be focused on status quo operations. All together 2 these factors resulted in an overall decrease in sales within the North American Commercial segment of 27% vs. 2019.

International regions were strong despite COVID-19 challenges. EMEA and South America manufacturing facilities continue to show operational performance improvements resulting in enhanced margins despite COVID-19 related production interruptions. South America continues to have substantial sales growth of 18% vs. 2019 coming from growing market share. Asia Pacific saw strong sales, growing 36% over 2019 or an increase of 6% excluding the March 2019 Milltec acquisition. EMEA Commercial markets were also impacted due to COVID-19 and project delays resulted in an overall decrease of 10%.

Farm Segment

Farm sales activity and backlog have increased substantially over prior year levels as AGI's dealers move to replenish inventories and get ahead of steel price increases in anticipation of a busy year correlated to high planting intentions. All of these factors have resulted in Farm backlogs increasing 56% in Canada and 26% in the U.S. over Dec. 31, 2019.

International Farm backlogs are also strong with a substantial increase in Brazil and augmented with increases in Australia and EMEA bringing these backlogs up 109% over Dec. 31, 2019. Brazil volumes continue to grow as the AGI brand is established in both the robust domestic market as well as export markets that are propelled by increasing crop sizes, increased global demand and underpinned by strong crop prices and a favorable exchange rate.

The Australian market is predicted to have the second biggest harvest on record and, in the EMEA region, AGI is continuing to work with existing and new dealers / distributors to increase inventory in key locations to facilitate in season sales.

Commercial Segment

Management expects that expanded planting intentions in North America combined with a post COVID-19 rebound in project activity will drive demand for grain and fertilizer systems. While COVID-19 had a substantial impact on project activity, quoting, project development and project progression across North America, the impact on projects in western Canada was more severe than in the US as growth projects were placed on hold in favor of essential maintenance.

The Canadian Commercial backlog was down 55%; however, management believes that the impact of COVID-19 on Canadian commercial projects is temporary and investment in commercial infrastructure in Canada will begin to increase in the back half of 2021. Eastern Canada is already seeing increased project activity leading to an expectation for an earlier rebound as compared to Western Canada. Overall, quoting activity has seen increased activity month over month indicating a positive trend in this impacted region.

Commercial trend lines are also positive in the United States and management expects sales to continue to improve with a steady flow of maintenance and smaller capital projects in the near term. The trade tensions that have contributed to delays in capital investments in the U.S. Commercial space over the last two years appear to be improving as crop export volumes normalize. U.S. Commercial backlogs have increased 30% compared to the prior year leading to further expectation of growing investment across the US grain infrastructure.

International Commercial sales continue to demonstrate strength and quoting activity across all regions has essentially rebounded to pre-COVID-19 levels leading to a 13% increase in backlogs over Dec. 31, 2019.

Related Content

Ag Equipment Manufacturers — Executive Compensations: Ag Equipment Intelligence has gathered financial data from the filings of the ag industry’s key publicly-traded manufacturers and compiled its own list of these companies’ executives’ compensations.

![[Technology Corner] Pessl Instruments CEO Talks Dealer Benefits From Lindsay Corp. Investment](https://www.agequipmentintelligence.com/ext/resources/2024/04/25/Pessl-Instruments-CEO-Talks-Dealer-Benefits-From-Lindsay-Corp.-Investment.png?height=290&t=1714144307&width=400)

Post a comment

Report Abusive Comment