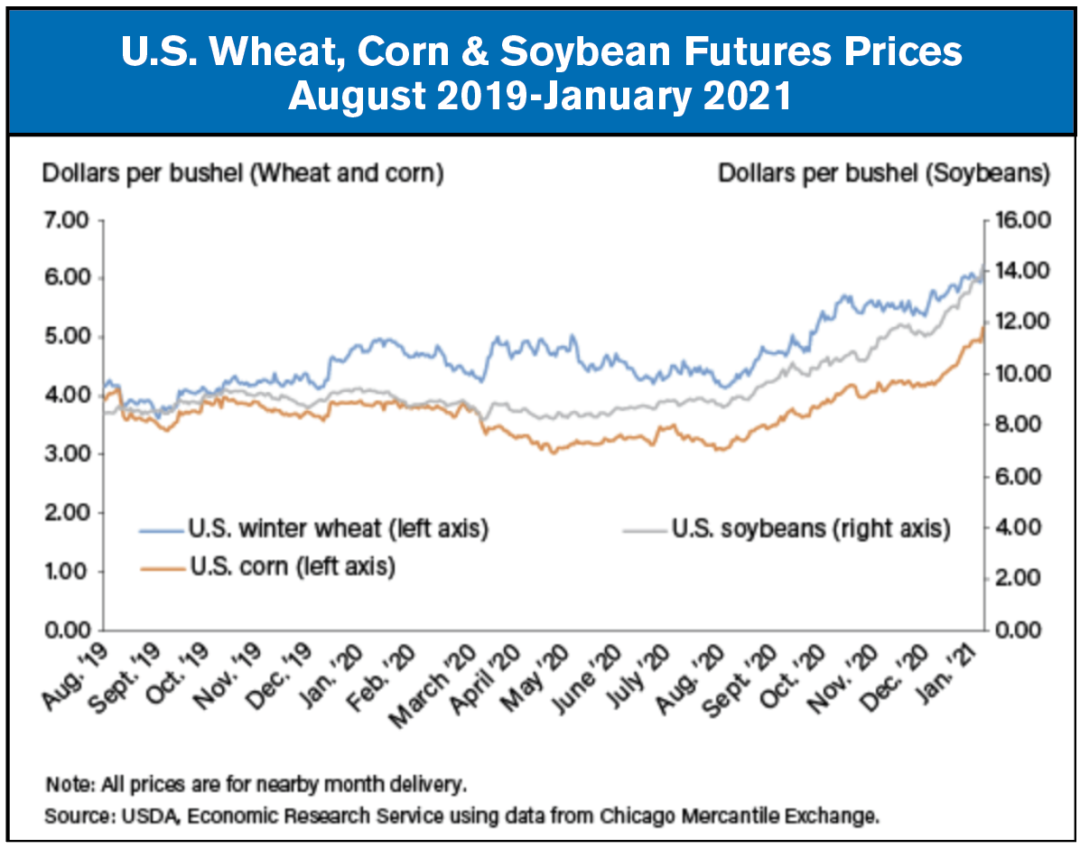

Futures prices—the price of a contract to deliver a commodity at a certain time in the future—for wheat, corn, and soybeans have been trending upward since August 2020. This 6-month trend of rising prices accelerated in the first weeks of 2021, demonstrating stronger price gains in anticipation of USDA’s revised production forecasts for major U.S. grains in the World Agricultural Supply and Demand Estimates (WASDE) for January 2021.

Hard red winter wheat futures prices for the nearby month (e.g., prices associated with an active futures contract with the shortest time to maturity/delivery) rose 72 cents per bushel (13%) during the 30-day period just ahead of the Jan. 12, 2021 release of the WASDE. During the same 30-day period, corn and soybean contracts for nearby month delivery rose 98 cents and $2.69 per bushel, respectively (approximately 23% each), and the season average farm price of soybeans reached their highest level since the marketing year of 2013-14. The realization of tightening supplies coupled with robust demand from export markets, most notably China, have stimulated steady price increases for the big three U.S. row crops—wheat, corn and soybeans. Additionally, dry conditions in key areas of corn and soybean production in South America have reduced regional production prospects and the outlook for global supplies, providing further support to associated U.S. commodity prices.

This chart is drawn from the USDA, Economic Research Service’s January 2021 Wheat Outlook, Oil Crops Outlook, and Feed Grains Outlook reports.

Post a comment

Report Abusive Comment