Lindsay Corporation (NYSE: LNN), a global manufacturer and distributor of irrigation and infrastructure equipment and technology, today announced results for its first quarter of fiscal 2021, which ended on Nov. 30, 2020.

First Quarter Summary

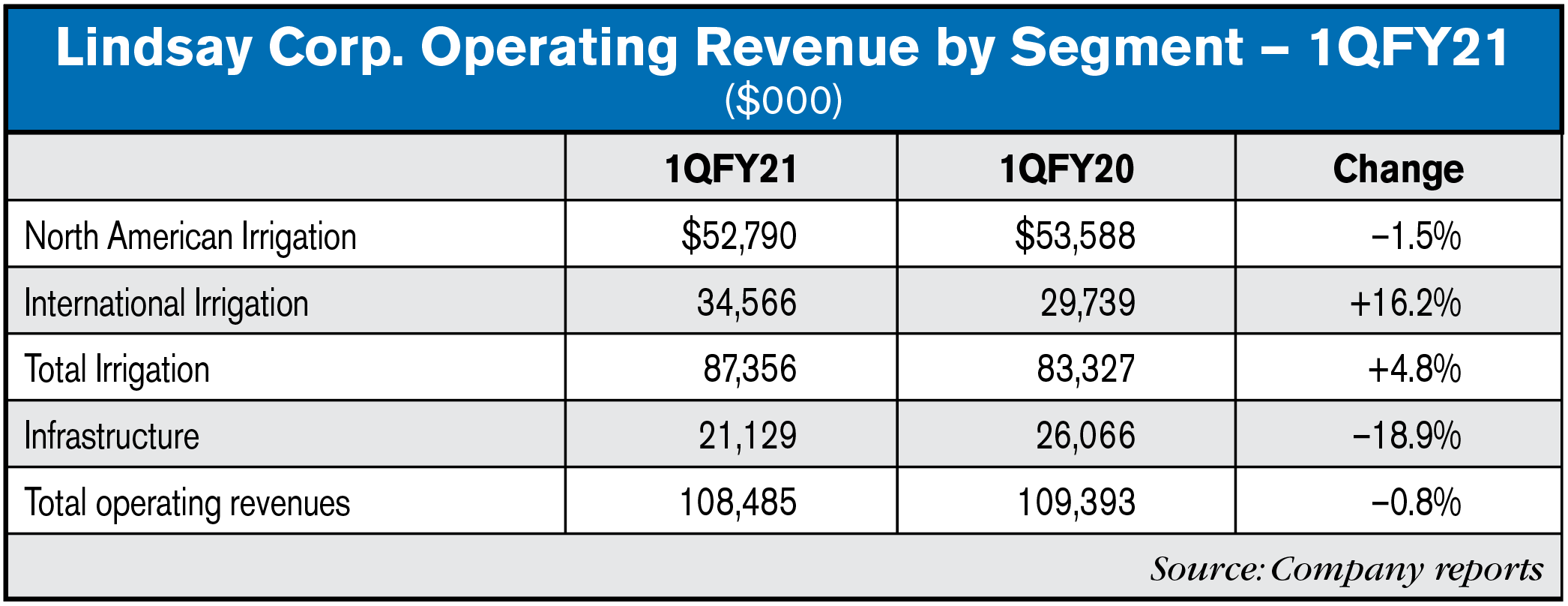

Revenues for the first quarter of fiscal 2021 were $108.5 million, a decrease of $0.9 million, or 1%, compared to revenues of $109.4 million in the prior year first quarter. Net earnings for the quarter were $7.1 million, or $0.65 per diluted share, compared with net earnings of $8.3 million, or $0.77 per diluted share, for the prior year first quarter. Net earnings for the quarter include an income tax benefit of approximately $1.7 million, or $0.16 per diluted share, related to the release of a valuation allowance in a foreign jurisdiction.

"Irrigation market conditions improved during the quarter with rising agricultural commodity prices and higher projected net farm income. This resulted in stronger than expected order flow for irrigation equipment, particularly in the latter part of the quarter." said Randy Wood, president and CEO. "Our infrastructure business performed well, although results were lower than a very strong first quarter in the prior year."

First Quarter Segment Results

Irrigation segment revenues for the first quarter of fiscal 2021 increased $4.1 million, or 5% to $87.4 million, compared to $83.3 million in the prior year first quarter. North America irrigation revenues of $52.8 million decreased $0.8 million, or 2%, compared to the prior year first quarter. The decrease resulted primarily from lower engineering services revenue related to a project in the prior year that did not repeat that was partially offset by higher irrigation equipment unit volume. International irrigation revenues of $34.6 million increased $4.8 million, or 16%, compared to the prior year first quarter. The increase resulted from higher unit sales volumes in several regions which were partially offset by the unfavorable effects of foreign currency translation of approximately $2.4 million compared to the prior year first quarter.

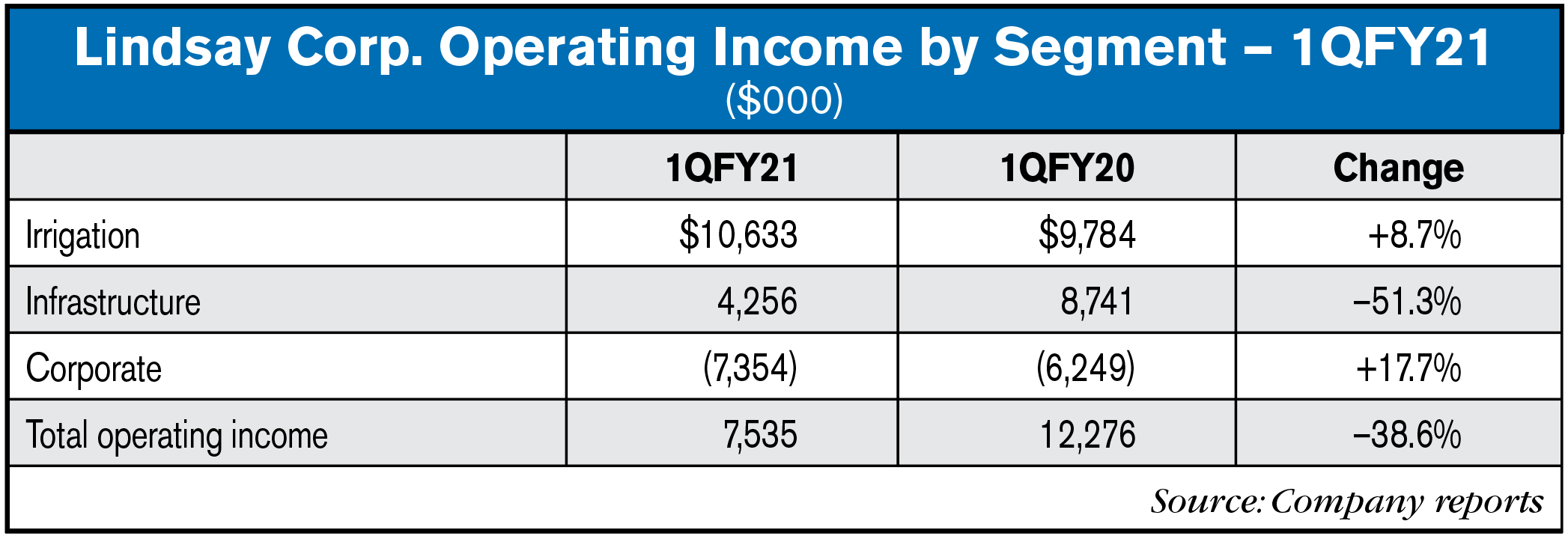

Irrigation segment operating margin was 12.2% of sales, compared to 11.7% of sales in the prior year first quarter. The increase resulted primarily from the impact of higher irrigation system unit volume and was partially offset by the impact of higher raw material and freight costs.

Infrastructure segment revenues for the first quarter of fiscal 2021 were $21.1 million, a decrease of $5 million, or 19%, compared to $26.1 million in the prior year first quarter. The decrease resulted primarily from a large order delivered in the prior year that did not repeat and from lower road construction activity in the current year.

Infrastructure segment operating margin was 20.1% of sales, compared to 33.5% of sales in the prior year first quarter. The decrease resulted primarily from lower revenue in higher margin product lines and an increase in raw material and other costs compared to the prior year.

The backlog of unfilled orders at Nov. 30, 2020 was $89.2 million compared with $69.2 million at Nov. 30, 2019. Included in these backlogs are amounts of $5.4 million and $5.2 million, respectively, that are not expected to be fulfilled within the subsequent 12 months. The increase in backlog is primarily attributable to higher order activity in North America irrigation.

Outlook

"Our backlog of irrigation equipment orders in North America supports solid revenue growth for our second quarter. We also expect improved activity levels to continue in international irrigation markets. At the same time, we are seeing rapid and significant increases in steel and freight costs that will pressure margins in the short term until pricing actions are fully implemented." said Mr. Wood. "In our infrastructure business, we continue to be encouraged by the quality of our Road Zipper sales funnel. However, the timing of those projects can be difficult to predict, particularly in the current environment with coronavirus-related effects on road construction activity.

"Our financial position remains strong, providing support for our innovation growth strategy across our businesses that address global megatrends and provide solutions that conserve natural resources."

Related Content

Ag Equipment Manufacturers — Executive Compensations: Ag Equipment Intelligence has gathered financial data from the filings of the ag industry’s key publicly-traded manufacturers and compiled its own list of these companies’ executives’ compensations.

Post a comment

Report Abusive Comment