By Ty Kreitman, Assistant Economist and Cortney Cowley, Economist

Farm loans outstanding at commercial banks declined in the third quarter and non-performing loans edged slightly higher. Reduced lending at agricultural banks contributed most significantly to the further decline in outstanding loan balances. Alongside lower levels of farm debt, delinquency rates on agricultural loans continued to trend higher at a gradual pace.

Third Quarter Commercial Bank Call Report Data

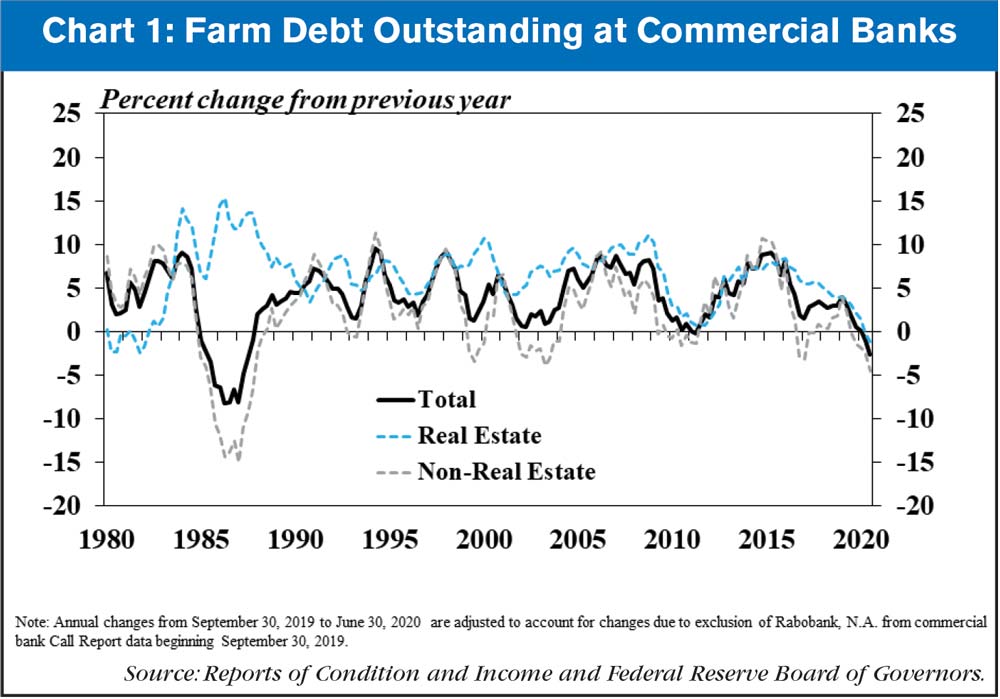

Agricultural loan balances at commercial banks continued to decrease in the third quarter, according to Call Report data. Most of the recent decrease was driven by non-real estate loans, which were nearly 5% less than the previous year, the largest drop in more than 15 years (Chart 1). Farmland loans also decreased for the second consecutive quarter and at a faster pace than the previous quarter. The combined pullback in both loan types led to the largest decline in overall farm debt in any quarter since the late 1980s.

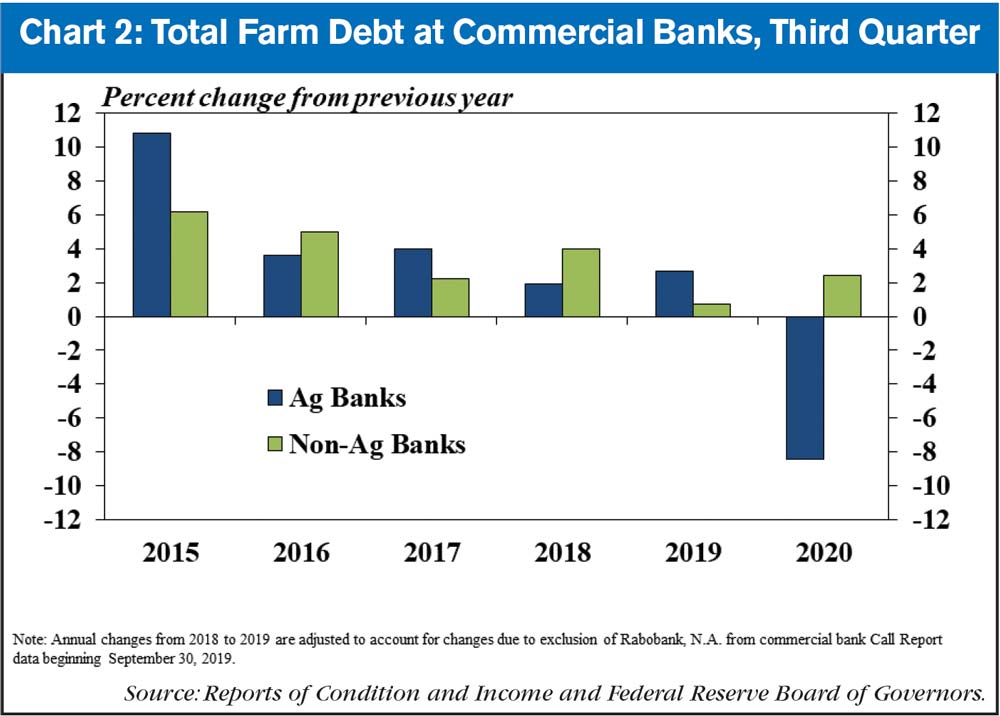

The drop in overall farm debt was driven by lower balances at small banks most concentrated in agricultural lending. Total farm debt declined more than 8% from a year ago at all agricultural banks, and over two thirds of that decline was at agricultural banks with less than $200 million in total assets (Chart 2). In contrast, balances of agricultural loans grew by more than 2 percent at all other banks, and all of that increase was at banks with more than $500 million in total assets.

Also continuing a trend from recent quarters, the rate of non-performing farm loans increased at a steady pace. Compared to the third quarter a year ago, the volume of non-performing farm real estate and non-real estate loans were 16% and 14% higher, respectively (Chart 3). While the volume of total farm loans past due more than 90 days continued to trend upward, loans past due less than 90 days declined by about 20%, an indication of lower volumes of newly delinquent loans in the third quarter.

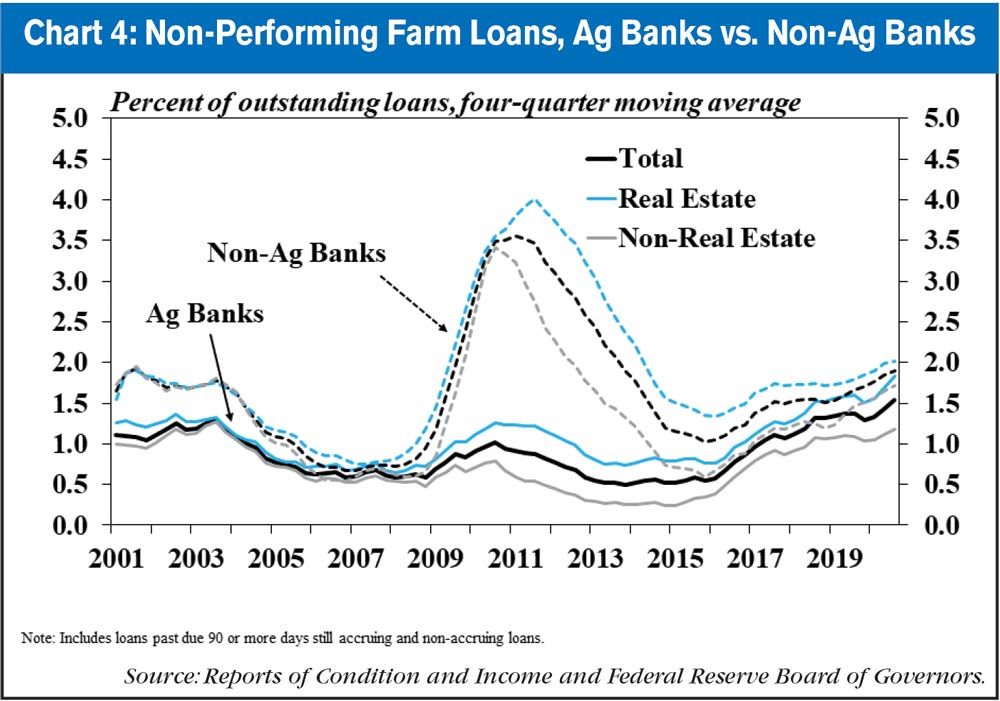

Importantly, however, the rate of non-performance on farm loans remained lower at agricultural banks than non-agricultural banks. In recent periods of increased delinquency on farm loans, rates of non-performance have been comparably lower at agricultural banks (Chart 4). Stress in the sector continued to place gradual pressure on the ability of producers to repay loans across all banks, but performance of farm loans continued to be slightly better at agricultural banks.

Conclusion

Compared to last year, lending activity at agricultural banks slowed in the third quarter, contributing to lower levels of total U.S. farm debt. Although the overall rate of non-performing farm loans increased, loan quality remained higher at agricultural banks. Difficulties related to the COVID-19 pandemic continued to weigh on farm lending and loan performance, but government programs also may have offset some borrowing needs and supported financial conditions for farmers.

![[Technology Corner] What are the Top 5 Applications in Autonomy Right Now?](https://www.agequipmentintelligence.com/ext/resources/2024/11/08/What-are-the-Top-5-Applications-in-Autonomy-Right-Now-.png?height=290&t=1731094940&width=400)

Post a comment

Report Abusive Comment