We recently shared some perspective in this segment on what the dealership of 2030 could look like, with a major emphasis on precision technologies like robotics and hyper-specialized services.

But what are dealers forecasting as their best bets for growing precision revenue in the next 3 years? Results of the eighth annual Precision Farming Dealer benchmark study — with contributions from dozens of farm equipment dealers, input retailers and independent precision companies — trend toward hardware-driven revenue.

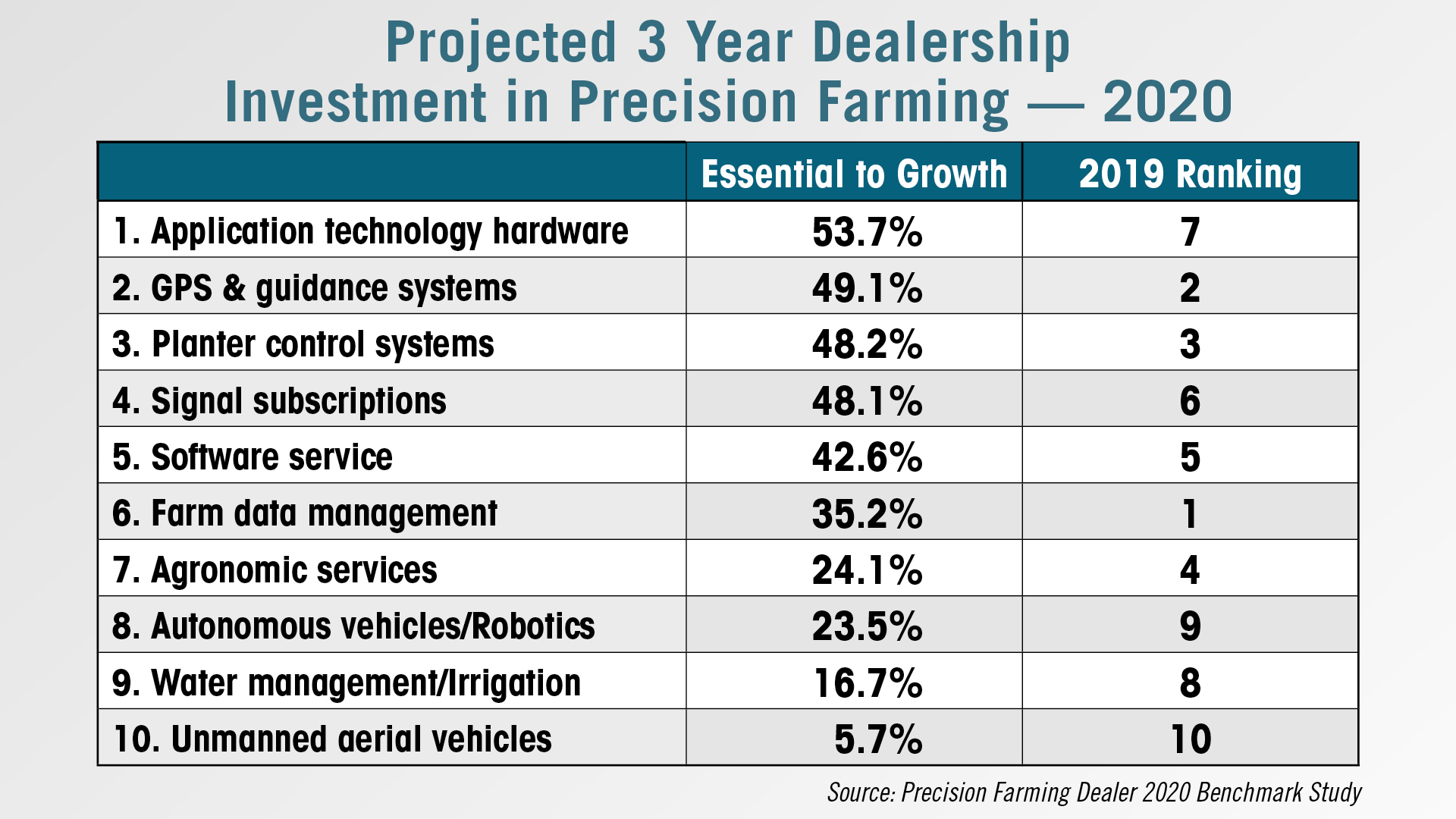

The 2020 data — collected during the first and second quarters — showed several shifts in dealers’ expectations for their future revenue. Topping the list of revenue sources considered essential for growth was application technology hardware, reversing its 3-year downward trend.

Just over half of survey respondents considered this an important source of revenue growth in the next 3 years, compared to 34% feeling the same in the 2019 study, when it ranked seventh.

Signal subscriptions jumped up to fourth in this year’s study from coming in at sixth in 2019. This came along with a moderate increase in dealers considering it an essential part of revenue growth, from 34% in 2019 to 48% in 2020.

Farm data management was displaced from the top slot in the 2020 survey, dropping to sixth place. Some 35% of respondents considered it an essential revenue source in the next 3 years, down from 52% in the 2019 study and 51% in the 2018 study.

GPS and guidance systems retained its second place slot at 48% of respondents considering it essential for revenue growth, up slightly from 44% taking the same position in last year’s study.

Planter control systems had a similar experience, holding the third-place spot with 48% considering it essential, up from 42% in 2019.

You can find the complete 2020 benchmark study report and analysis in the Summer issue of Precision Farming Dealer and extended coverage of past studies at PrecisionFarmingDealer.com.

Post a comment

Report Abusive Comment