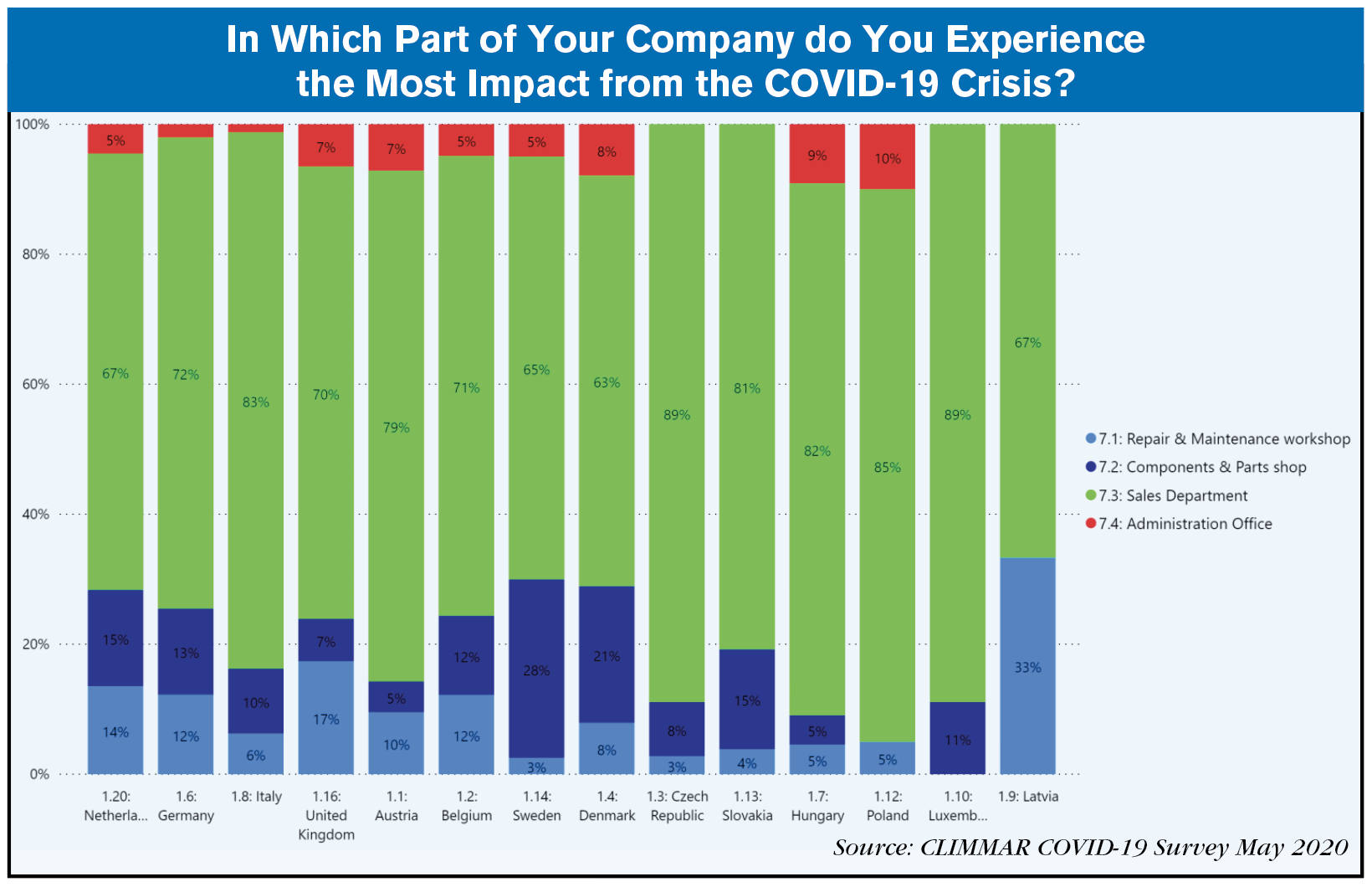

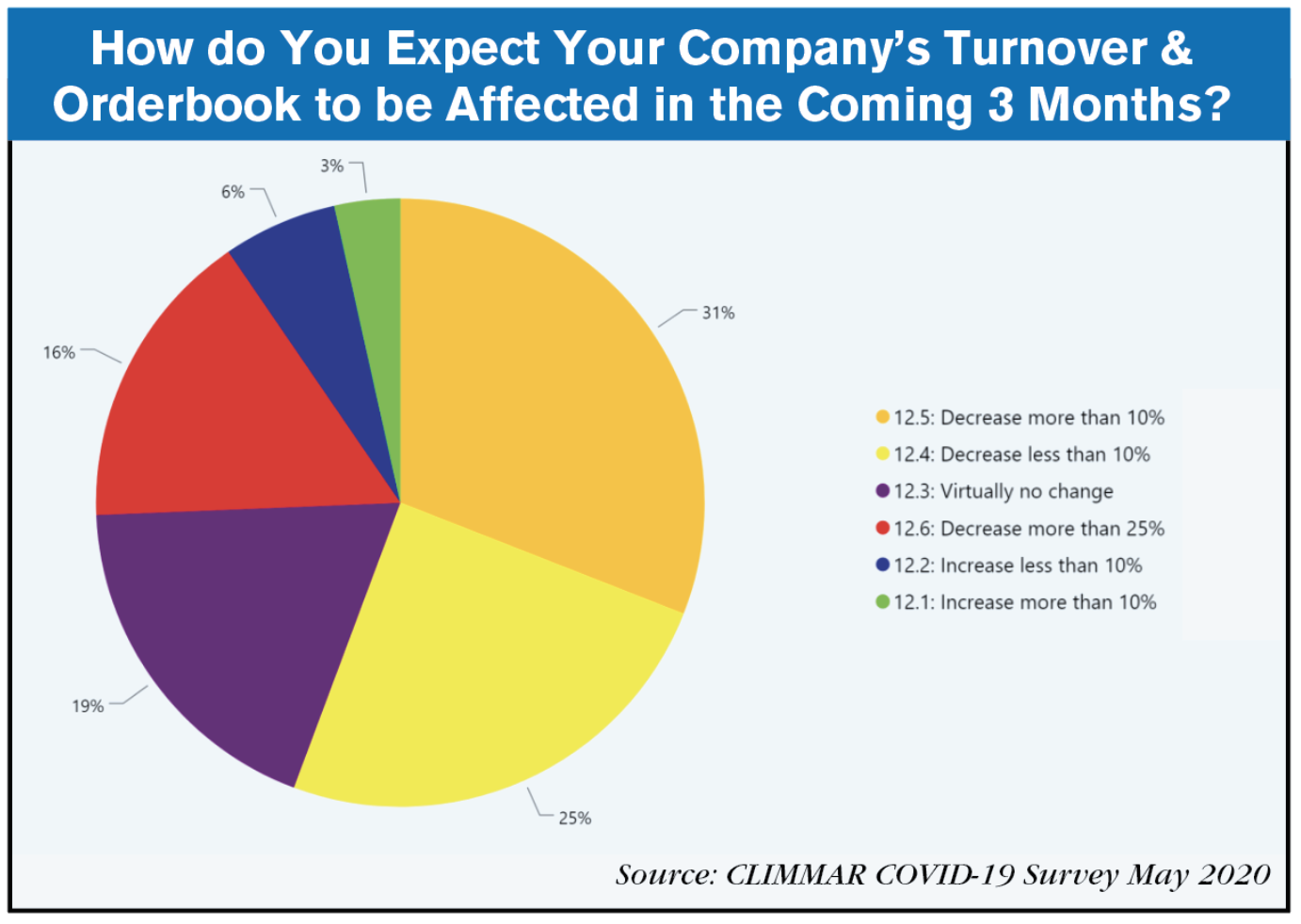

Results of a recent survey by CLIMMAR on the COVID-19 situation among European farm equipment dealers, show that 80% of the participants have been affected to some degree. The biggest impact has been on the sales of new machinery. The sale of used machinery has also been affected significantly, but to a lesser degree than the sale of new machines. Some 70% of the 660 participants from 14 EU countries anticipate a significant decline in sales as well as decreased order book activity in the near term.

CLIMMAR, the International Liaison Center for Agricultural Machinery Dealers and Repairers, is the umbrella group representing 16 national farm equipment dealer associations throughout the EU.

The effects of the coronavirus on the repair and maintenance sales have not been as significant compared to wholegoods turnover, according to the dealers. CLIMMAR reports that “dealer companies in general still have enough work here. This is partly due to the fact that customers, especially in the agricultural sector, simply had to do their spring work and machines were used to full extent for that. Repair and service of these machines have therefore been executed consistently and that has ensured that work in the workshops of the dealer companies in general remains at acceptable levels.”

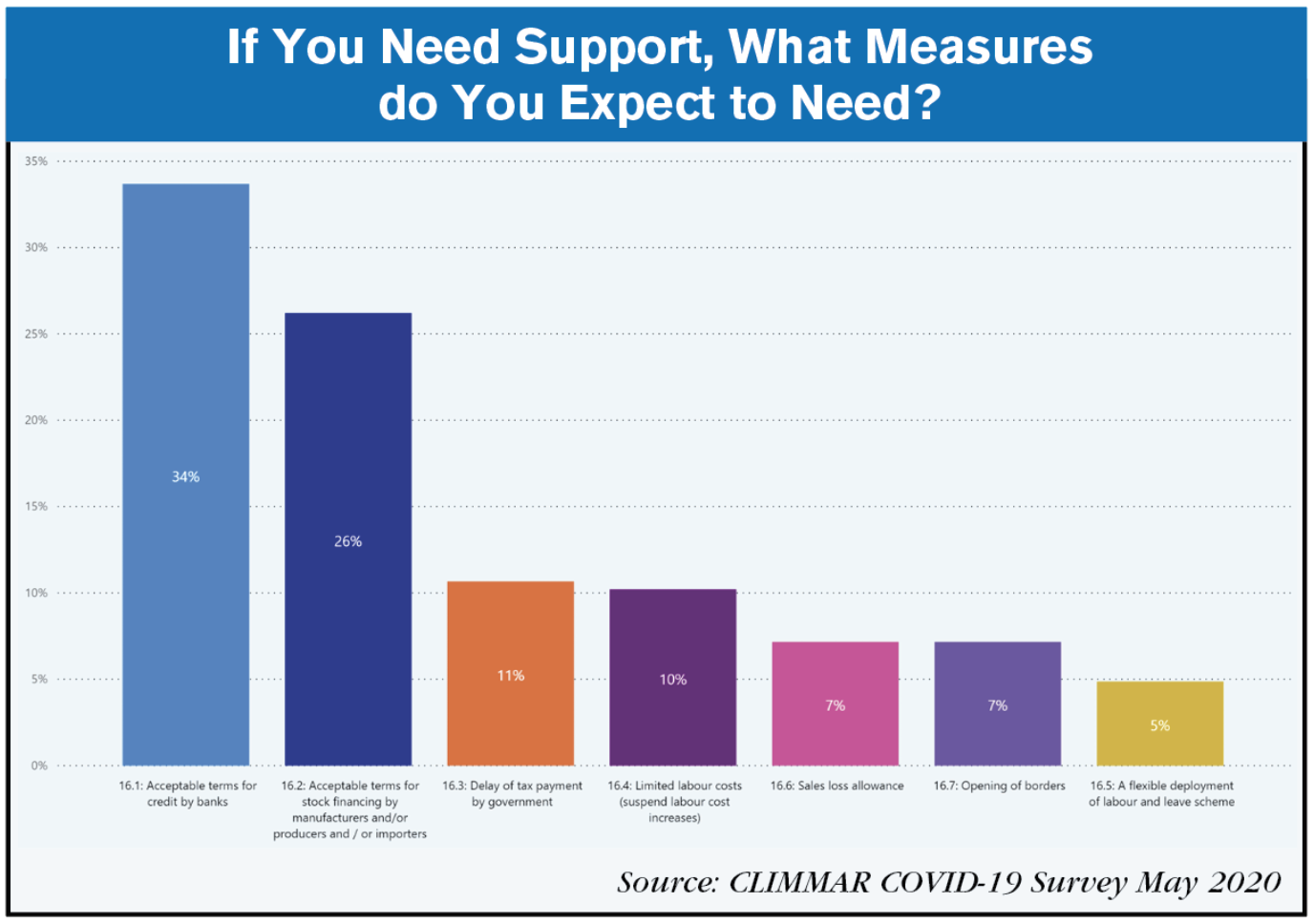

Need Support. To survive the COVID-19 crisis, about 45% of the dealers responding to the survey say they will, in all likelihood, need financial support. Around 13% of the dealers, on the other hand, insist they will not require any aid and can manage without any support.

Of the dealers who indicated they would require support, a little over one-third (34%) said they need “acceptable conditions for credit from banks.” Another 26% said the needed “acceptable financing terms” from their manufacturers. Additionally, 11% felt they would need to delay their tax payments to the government, while 10% feel they would need to postpone any employee wage increases.

Short Term Pessimism. The dealers expressed pessimism about sales and improvement in their order books during the next 3 months. More than 70% of them indicate that they expect a significant decrease, of which 16% of companies even expect a decrease of more than 25%.

A full copy of the report can be found on the CLIMMAR website: www.climmar.com.

Post a comment

Report Abusive Comment