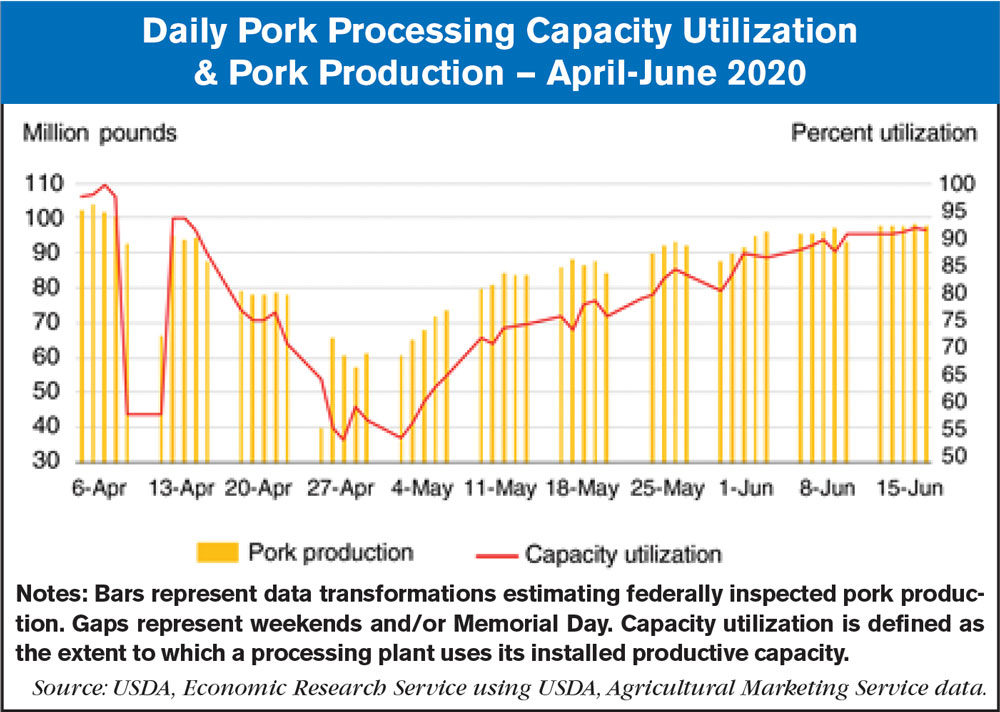

According to a report from USDA, capacity utilization in the U.S. pork processing industry is on the rebound as workers in plants, earlier infected by COVID-19, recover and return to work. Defined as the extent to which a processing plant uses its installed productive capacity, capacity utilization in the U.S. pork sector was operating at or near full capacity at the beginning of April. Starting on April 6 with the temporary closure of a major plant in Iowa, virus-related labor force absences and necessary plant deep-cleaning have caused a succession of plant slow-downs and temporary closures.

However, since April 29, when capacity utilization bottomed-out at 53.9% with a daily production of 60.4 million pounds, capacity has averaged 78.5%, with daily production averaging about 86 million pounds. For the balance of 2020 and into 2021, processing sector guidances issued by the Centers for Disease Control and Prevention and the Occupational Safety and Health Administration are likely to hold capacity utilization to below pre-pandemic levels.

Pork production for 2020 is forecast at about 27.8 billion pounds, less than 1% above 2019 production. In 2021, commercial pork production is expected to accelerate, with total pork production forecast at about 28.2 billion pounds, 1.7% above forecast production in 2020. Hog prices are likely to continue to lag processing industry recovery rates, reflecting back-ups of slaughter-ready animals on hog farms. Prices are expected to average $42.40 per hundredweight (cwt), almost 12% below average prices for 2019. Higher hog prices are expected for most of 2021, with prices for the year expected to average $46.75 per cwt, more than 10% above prices forecast for this year.

This chart is drawn from the Economic Research Service’s June 2020 Livestock, Dairy, and Poultry Outlook.

![[Technology Corner] Pessl Instruments CEO Talks Dealer Benefits From Lindsay Corp. Investment](https://www.agequipmentintelligence.com/ext/resources/2024/04/25/Pessl-Instruments-CEO-Talks-Dealer-Benefits-From-Lindsay-Corp.-Investment.png?height=290&t=1714144307&width=400)

Post a comment

Report Abusive Comment