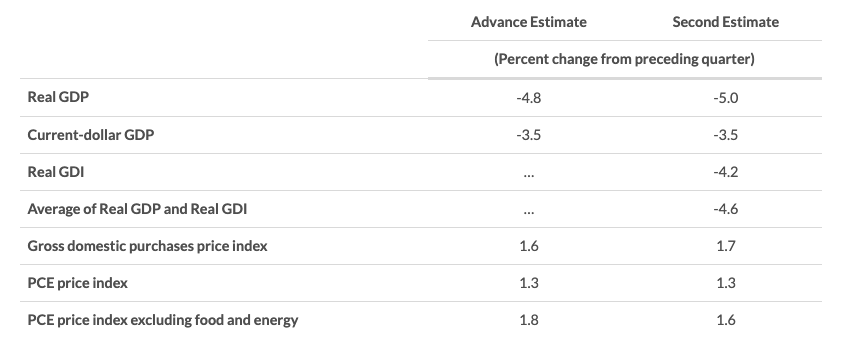

Real gross domestic product (GDP) decreased at an annual rate of 5% in the first quarter of 2020, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.1%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the decrease in real GDP was 4.8%. With the second estimate, a downward revision to private inventory investment was partly offset by upward revisions to personal consumption expenditures (PCE) and nonresidential fixed investment (see "Updates to GDP" on page 2).

The decline in first quarter GDP reflected the response to the spread of COVID-19, as governments issued "stay-at-home" orders in March. This led to rapid changes in demand, as businesses and schools switched to remote work or canceled operations, and consumers canceled, restricted, or redirected their spending. The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the first quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified. For more information, see the Technical Note.

The decrease in real GDP in the first quarter reflected negative contributions from PCE, private inventory investment, nonresidential fixed investment and exports that were partly offset by positive contributions from residential fixed investment, federal government spending, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased (table 2).

The decrease in PCE reflected a decrease in services, led by health care as well as food services and accommodations. The decrease in private inventory investment was mainly in nondurable goods manufacturing, led by petroleum and coal products. The decrease in nonresidential fixed investment primarily reflected a decrease in equipment, led by transportation equipment. The decrease in exports primarily reflected a decrease in services, led by travel.

Real gross domestic income (GDI) decreased 4.2% in the first quarter, in contrast to an increase of 3.1% (revised) in the fourth quarter. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, decreased 4.6% in the first quarter, in contrast to an increase of 2.6% in the fourth quarter (table 1).

Current‑dollar GDP decreased 3.5%, or $191.6 billion, in the first quarter to a level of $21.5 trillion In the fourth quarter, GDP increased 3.5%, or $186.6 billion (tables 1 and 3).

The price index for gross domestic purchases increased 1.7% in the first quarter, compared with an increase of 1.4% in the fourth quarter (table 4). The PCE price index increased 1.3%, compared with an increase of 1.4%. Excluding food and energy prices, the PCE price index increased 1.6%, compared with an increase of 1.3%.

Post a comment

Report Abusive Comment