The latest episode of On the Record is now available! In this week's episode we look at the preliminary results of Farm Equipment and Ag Equipment Intelligence's latest Brand Loyalty Study. Also in this episode, dealers adjust their sales forecast for 2020 and Dealer Optimism takes a huge hit in March. Rocky Mountain Dealerships reported a decline in first quarter earnings and the Kansas City Federal Reserve Bank says farm lending slowed in the first quarter. In the Technology Corner, Jack Zemlicka discusses some non ag opportunities for precision services.

On the Record is brought to you by B&D Rollers.

This episode of On the Record is brought to you by B&D Rollers. B&D Rollers is the only manufacturer in the world to make new aftermarket hay conditioner rollers. The Crusher hay conditioning rollers have the ability to run on any machine, regardless of color or brand. Between 2018 and 2019, B&D Rollers saw 93.7% growth purely in hay conditioning rollers and is continuing to see similar growth trends into 2020. For more information or OEM inquiries, visit bdrollers.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Is Brand Loyalty Fading?

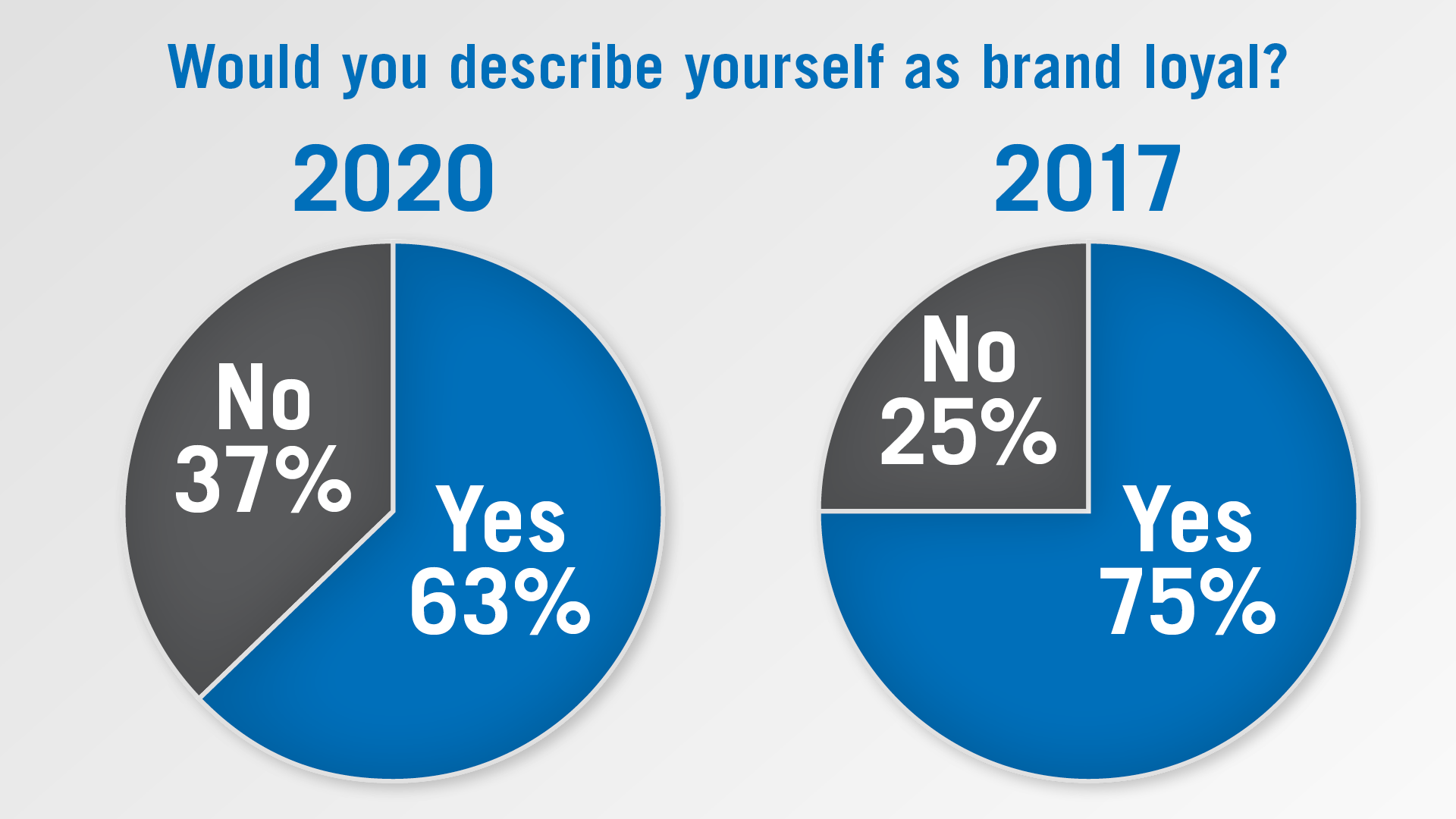

Customer loyalty to a particular brand of product is what every manufacturer and retailer aims for and farm equipment is no different. But it appears that U.S. farmers have taken a step back from their tradition of being rabidly devoted to a specific brand of ag equipment.

The results of a recent survey show that fewer farmers are as doggedly loyal to their red, blue or green equipment than there were 3 years ago.

Every 3 years beginning in 2011, the editors of Ag Equipment Intelligence and Farm Equipment magazine have conducted a study to determine how brand loyal farmers in 12 states in the heartland of the U.S. consider themselves to be in terms of the machinery they purchase and us in their operations.

Results of the 2020 survey show that less than two-thirds — or 63% — of the farmers who responded to the poll consider themselves brand loyal. This is down from 75% of dealers who called themselves “brand loyal” in the 2017 study.

The reason for the slippage may center on the rising cost of new equipment during this prolonged slump in prices farmers receive for the crops.

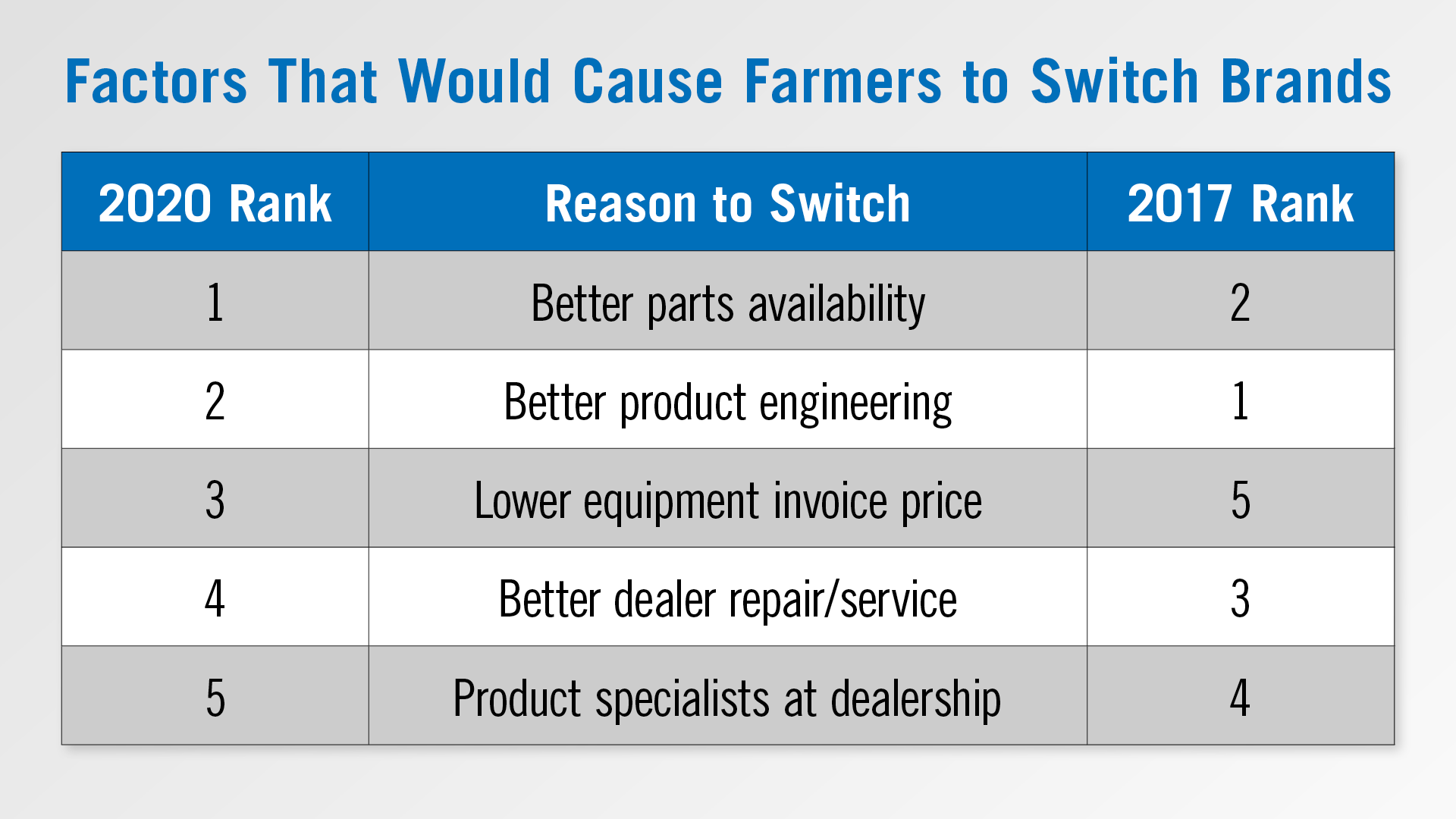

When asked what factors would cause them to consider switching brands, the 5 top reasons in 2020 were the same as they were in 2017, but the ranking changed. Lower equipment invoice price rose two spots to the number 3 ranking on the list, which was up 2 spots from number 5, in 2017.

The survey reinforced the fact that ag equipment dealers are critical to farmers’ level of brand loyalty.

An in-depth report on the 2020 Brand Loyalty survey results will appear in the June issue of Farm Equipment, and the full report will be available from Ag Equipment Intelligence later this month.

Dealers on the Move

This week’s Dealers on the Move include Coeur d’Alene Tractor, Ohio Ag Equipment and WCTractor.

New Holland and Kubota dealer Coeur d’Alene Tractor has purchased a Kubota dealership in Lewiston, Idaho. The new location will operate under the name Adam tractor Lewiston. This is the group’s 4th location.

AGCO dealer Ohio Ag Equipment will open a new store in Lima, Ohio on May 4. This will be Ohio Ag Equipment’s 7th location and the new facility has over 100 acres of tillable ground dedicated to training, customer demonstrations and equipment testing.

WCTractor a New Holland and Kubota dealership in Texas has acquired Tipton International in Waco.

Planning for Precision Growth, Outside of Ag

Although many precision farming specialists are in the thick of spring planting and logging long hours, the growing season can create a service void for precision teams prior to preparing for fall harvest.

But even amidst the socioeconomic challenges confronting the ag industry, there are revenue opportunities dealers can pursue to bridge the seasonal gap for precision farming employees.

HTS Ag, an independent precision dealership based in Harlan, Iowa, has carved out successful niches selling and supporting grain bin monitoring technology and providing UAV solutions, outside of the ag industry.

During the last year, the dealership has entered the public safety market, providing drone services to law enforcement and fire departments for aerial support. There will likely be additional growth potential in public safety as an outcome of the coronavirus pandemic, according Arlin Sorensen, founder of HTS Ag.

“There's a lot of aspects of public safety where drones are kind of just getting started. And especially with this COVID-19 thing, I've been watching some of the technology developed with drones there, and I'm pretty sure we're going to see drones taking temperature readings of people as they enter into facilities with infrared or other technologies. We've seen some challenges with choppers going down in some metros and that's expensive, and it usually costs some lives. The drone are not nearly as effective, maybe as a chopper in some ways, but they are very effective in other ways. There's just a lot of places where a drone can do a lot of good in public safety. So we're going to see that. I think the drone marketplace is just getting going. It's going to be part of the delivery system. It's going to be part of transportation. It's going to be everywhere.”

Sorensen adds that while selling UAV hardware is part of the equation, the service side will be far more lucrative when working with both ag and non-ag customers.

Dealers Adjust 2020 Sales Forecast to Down 6%

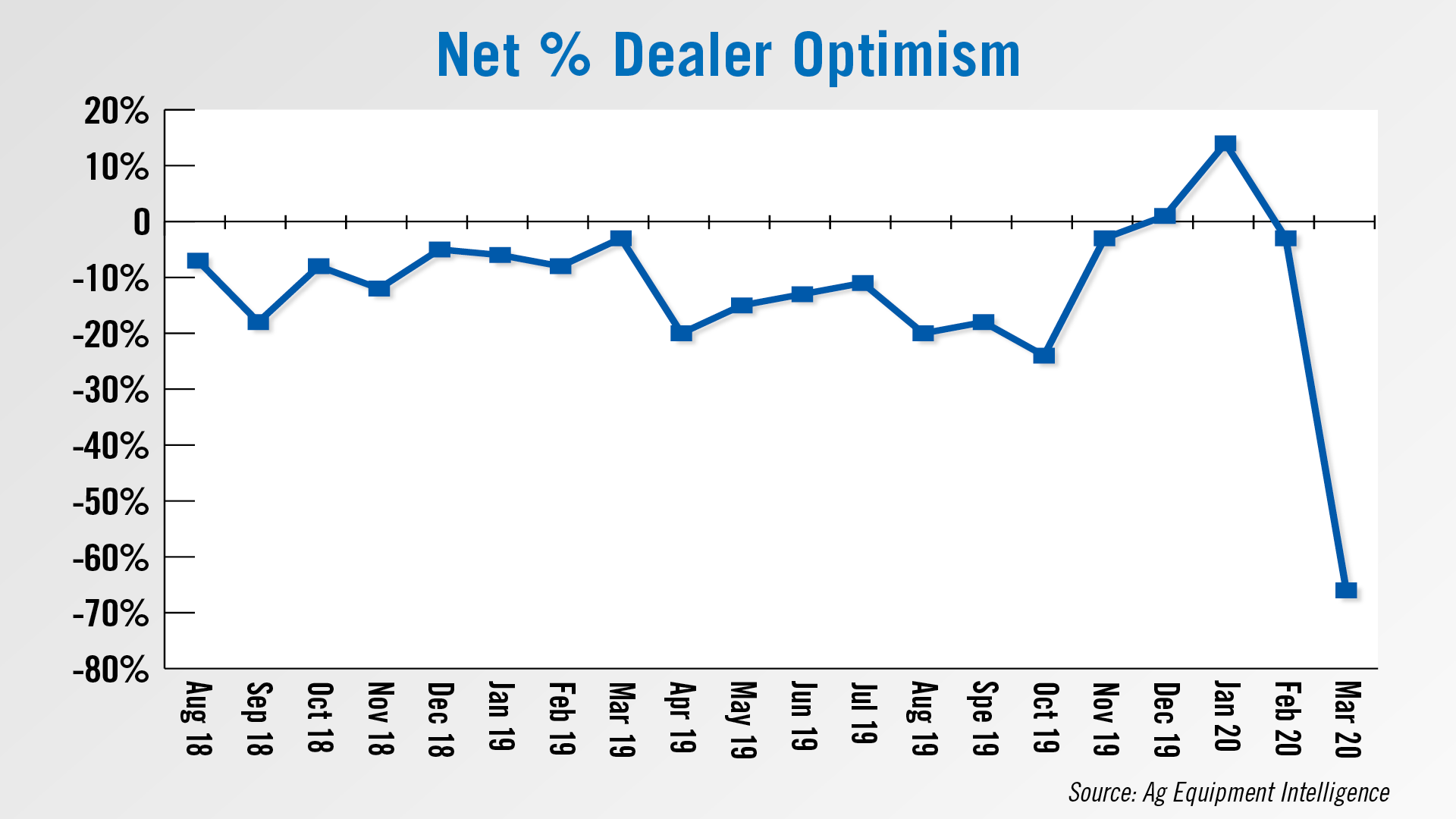

As the coronavirus took hold across North America in March, dealers have lowered their sales outlook for 2020. Ag Equipment Intelligence’s latest Dealer Sentiments report shows dealers forecast sales to be down 6% year-over-year. Previously dealers were expecting a flat year.

One dealer in the Lake States/Northern Plains region says, “the coronavirus, decline in commodity prices and the high price of equipment has us concerned.”

Another dealer from the Southeast says, “Coronavirus changed our business immediately. Our customer base is uncertain about the general well-being of the economy and have delayed or stopped purchases.”

Last week, we spoke with some of Farm Equipment’s Dealer Advisory Board, and the consensus was that ag business is holding steady right now, largely due to planting season. However, the dealers said all segments of the business — ag, construction and lawn and turf — are down. This is a particularly significant challenge as usually when one segment is down the others are up.

Tom Rosztoczy, president of Stotz Equipment, a 25-store John Deere dealership based in Avondale, Ariz., and a member of the advisory board, says they don’t have a customer base that isn’t being impacted right now. And, that translates to a tough year for equipment sales in 2021, he says.

“Government agencies, cities, schools, counties, states, those guys are all going to be way short of money for fiscal 21 because they're losing all the sales tax revenue, and they're having to pay out all this unemployment money. I think about our fiscal 2021, I think we're going to be looking at a pretty dead equipment market. So, our own approach is basically between now, this season, we got to get our balance sheet as clean as possible going into the next season. We're looking to have a nice, tight balance sheet by the end of September. Then hopefully we're in a good spot to get through whatever the next challenging year is.”

The uncertainty that the pandemic has brought can be seen in the latest Dealer Optimism Index reading. Dealer Optimism took a huge hit, with a net 66% of dealers reporting being less optimistic in March compared to a net 3% reporting being less optimistic in February.

Rocky Mountain Dealerships 1Q20 Sales Down 25%

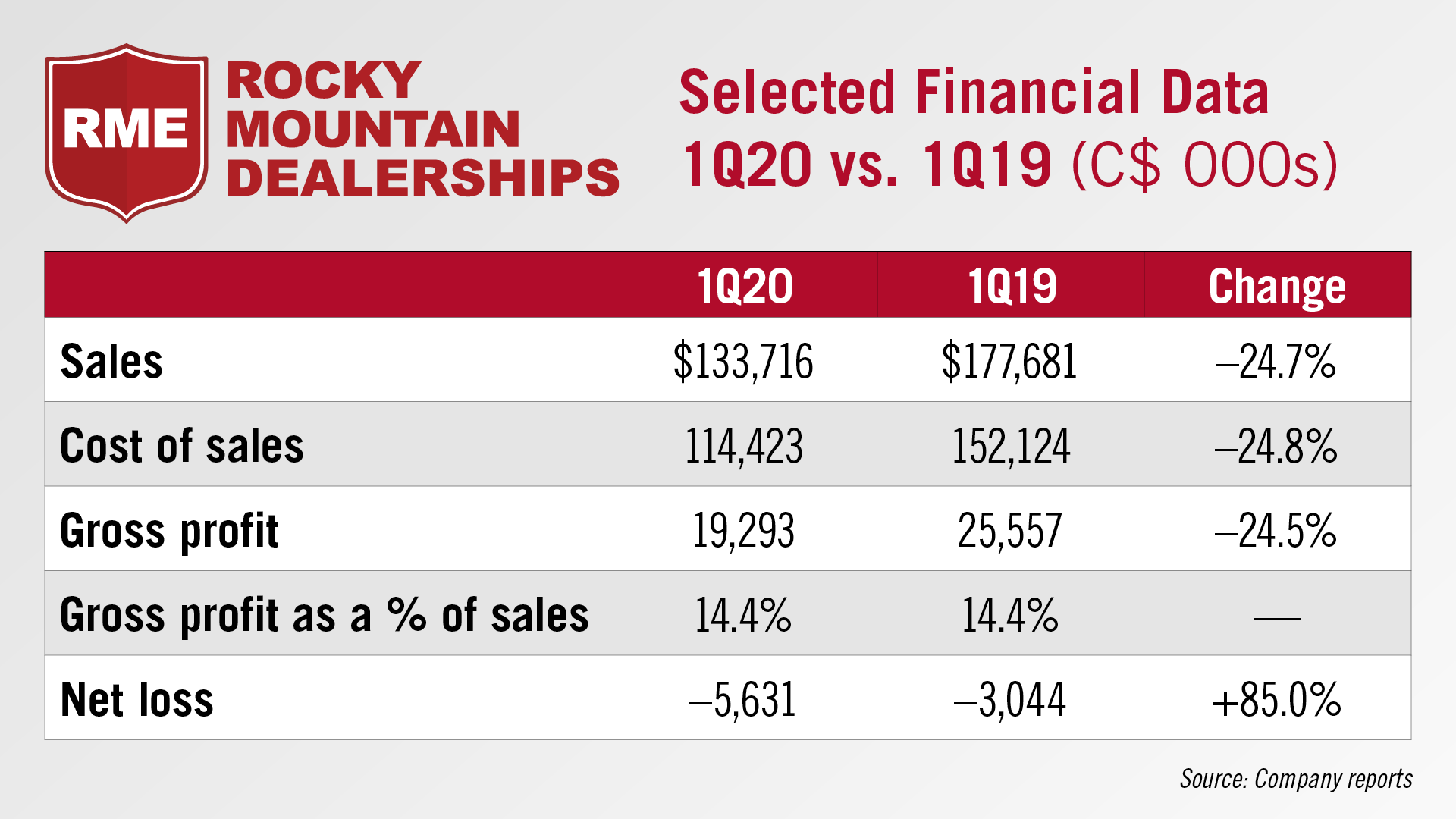

The latest earnings report from Rocky Mountain Dealerships, Case IH’s largest Canadian dealer group, showed ag equipment sales continuing to trend downward. The dealer group reported total sales of $134 million dollars in the first quarter of 2020. This is down $44 million compared to $178 million reported in the first quarter of 2019, a decline of 25%. The company said this was partially driven by $11.2 million in undelivered equipment sales created by the COVID-19 pandemic, coupled with negative farmer sentiment.

The dealership says, “Despite being deemed essential, RME can be affected by the pandemic’s knock-on effect in the capital markets and broader economy, as demonstrated with the closing of CNH Industrial's factories at the end of March. Those closures, along with the slowed import process moved $11.2 million of potential first quarter sales into the second quarter.”

Gross profit was $19.3 million, down 24.5% from $25.6 million reported in the first quarter of 2019. Gross margin percentage for the quarter was 14.4%, in line with the same period in 2019. This was impacted by both negative pricing pressure and decreased OEM incentives on equipment sales but was offset by stability in the Rocky Mountain’s product support offerings.

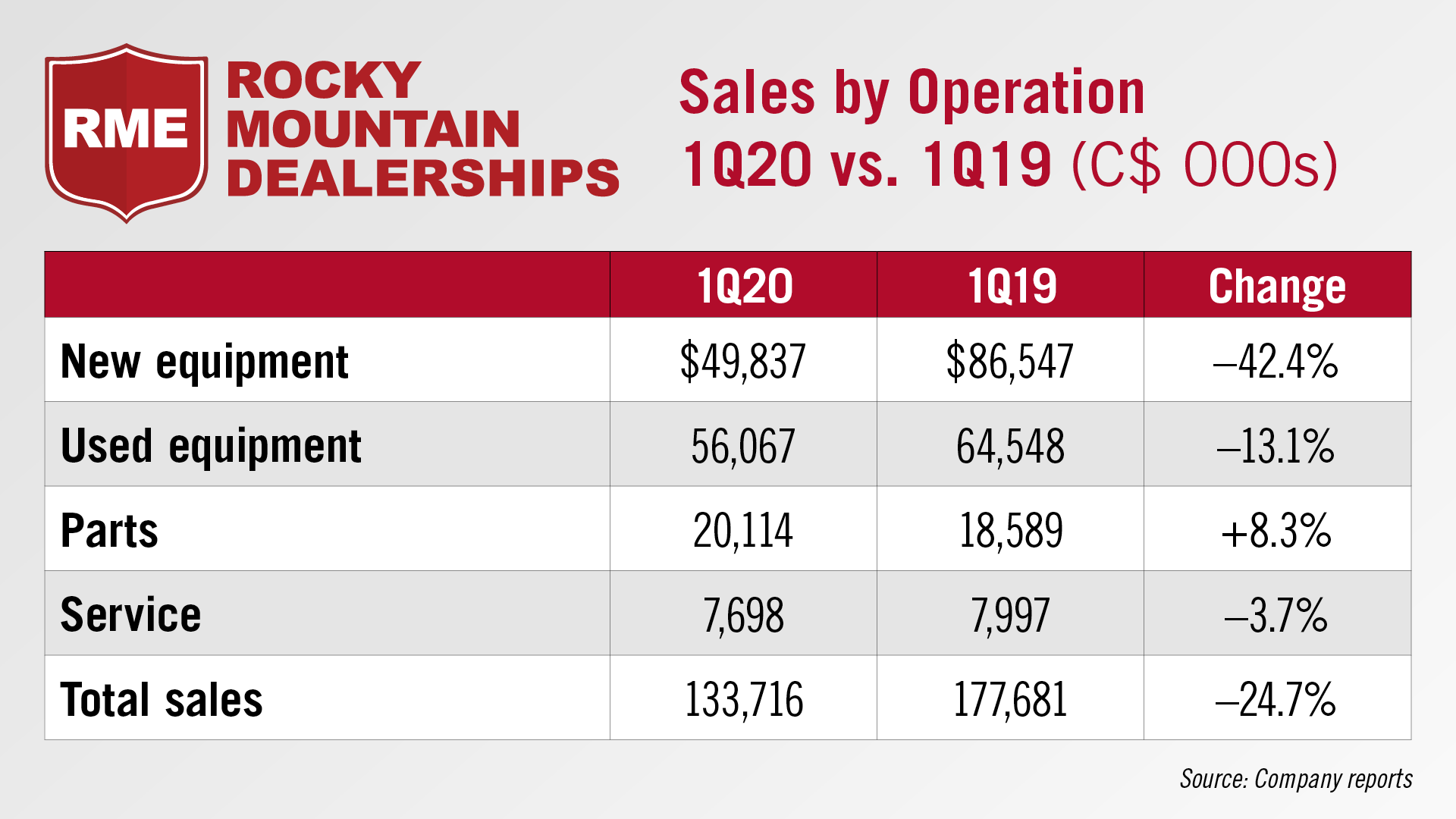

Used equipment sales for the quarter were $56 million, down by about $9 million, or 13.1%, from $65 million in the same quarter last year. Service sales also saw a decline, falling from $7.9 million in the first quarter of 2019 by nearly $300,000, or 3.7%, to $7.7 million. Parts was the only segment that saw an increase in sales for the quarter, up $1.5 million, or 8.3%, to around $20 million.

Farm Lending Slows

According to the latest data from the Federal Reserve Bank of Kansas City, agricultural lending activity showed further signs of slowing in the first quarter, despite an increase in the volume of operating loans.

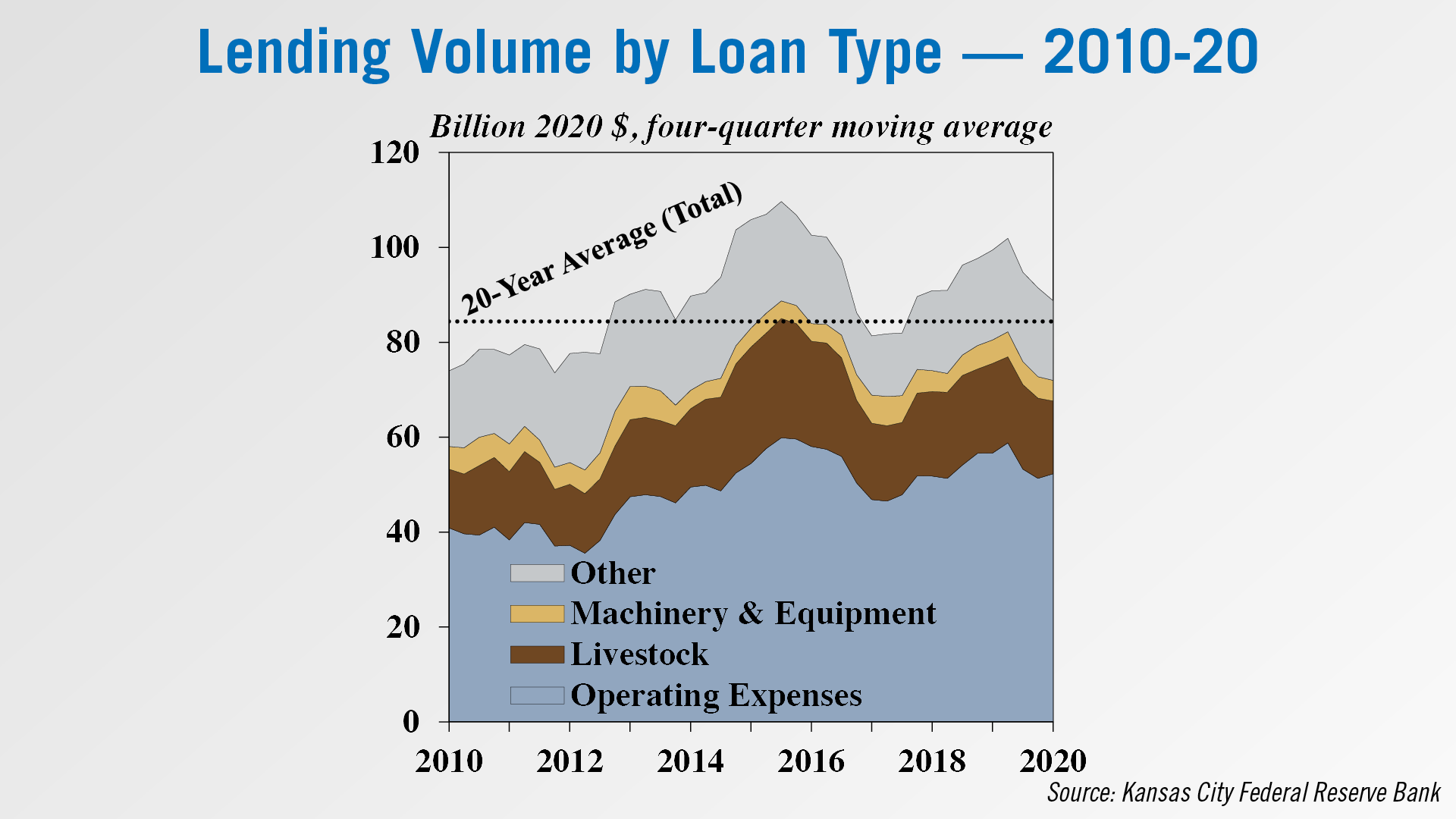

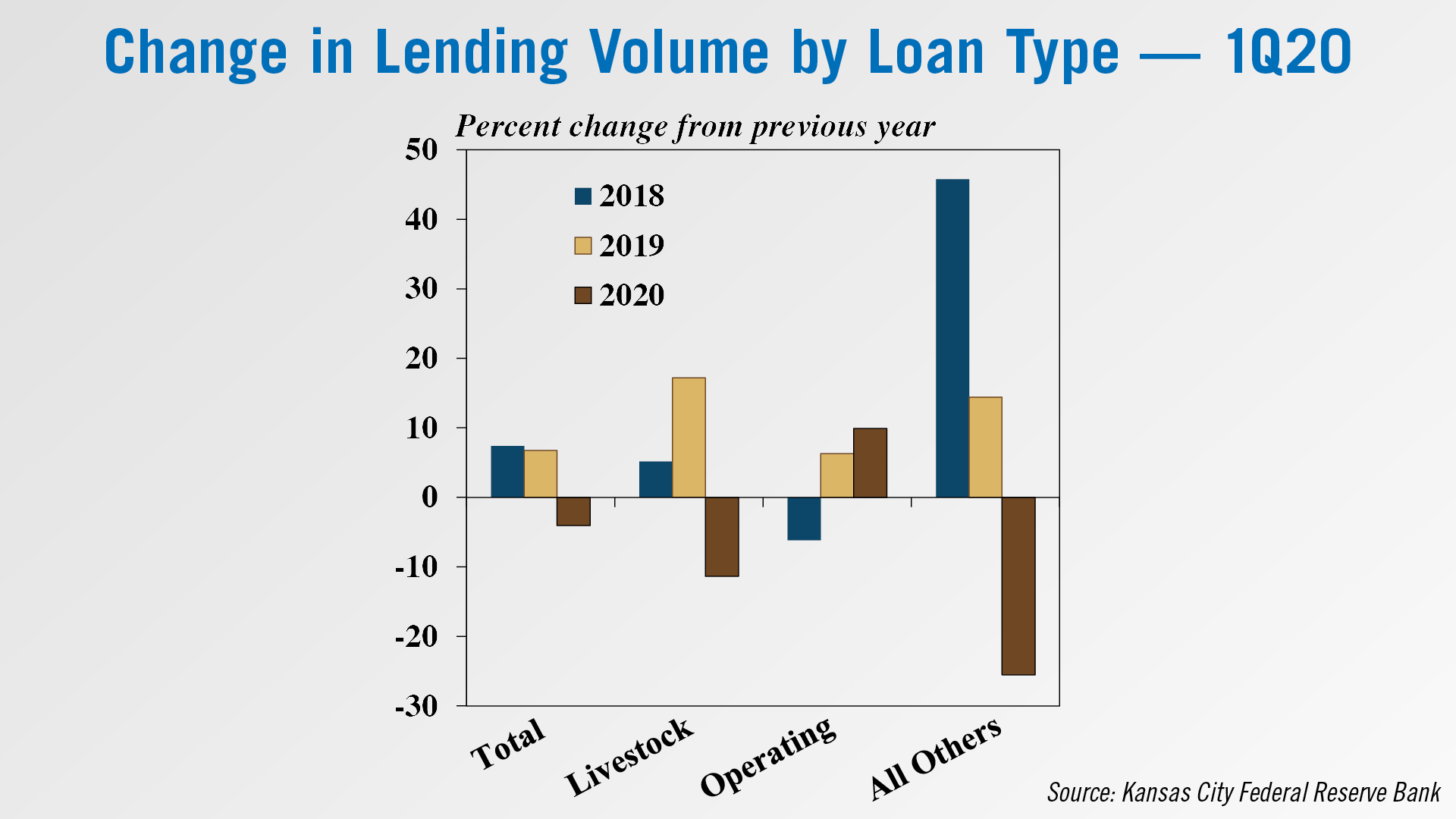

The total volume of non-real estate loans remained above the historical average but were about 10% lower than a year ago. Despite a decline in most types of lending, loans for operating expenses increased nearly 10%. The overall decline was driven by a drop of about 30% in both livestock loans and loans for miscellaneous purposes including farm machinery and equipment.

Since 2010, the average size of farm loans has trended steadily higher, but the pace of the increase has slowed following a sharp rise in late 2018 and early 2019. Similar to loan volumes, operating loans were about 10% larger than a year earlier, while loans for all other purposes were smaller. However, the average size of all loan types over the past four quarters was below the trend level of growth through the first quarter.

According to Kansas City ag economists, it is unclear exactly how events related to the COVID-19 pandemic will affect farm lending moving forward, but demand for farm loans may increase as economic disruptions associated with the pandemic could put additional pressure on farm finances.

![[Technology Corner] Quantifying the Impact of a Precision Ag Pioneer](https://www.agequipmentintelligence.com/ext/resources/2024/08/23/Quantifying-the-Impact-of-a-Precision-Ag-Pioneer.png?height=290&t=1724422794&width=400)

Post a comment

Report Abusive Comment