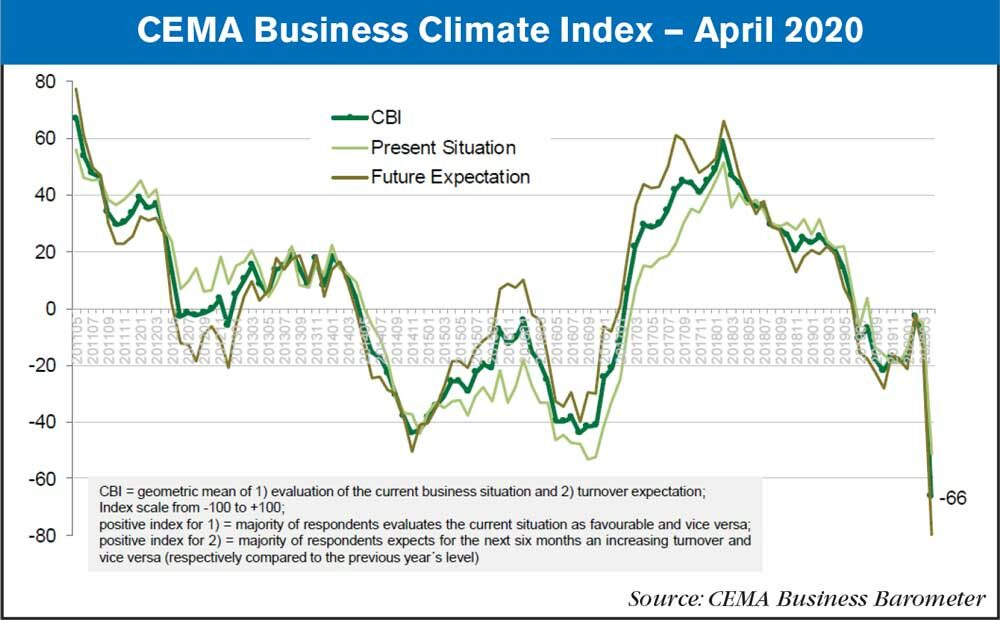

According to a report from CEMA, the general business climate index for the ag equipment industry in Europe has experienced its sharpest drop since since the financial crisis of 2008-09.

While the evaluations of current business have deteriorated to their worst level since 2016, the future expectations have dropped even more sharply to a historical low. Survey participants have lowered their expectations practically without differentiation across all segments and markets. This raises the question of whether the massive deterioration in future expectations is a temporary overreaction. Furthermore, the actual incoming orders collapsed in the month of March, but not by quite as much as future expectations.

The developments in the course of COVID-19 have only started to have a major impact since mid-March. Restrictions have played a major role. On average, among all companies participating in the survey, the production capacity is at 60% compared to levels before the pandemic. About 79% of surveyed companies report shortages on the supplier side. And on the distribution side, the partners are able to run business at only 58% of the level before COVID-19. Compared to the previous month, participants have also significantly downgraded their turnover forecast for the total year 2020, with the median moving from 0% to –15% and the average from +1% to –13%.

![[Technology Corner] Quantifying the Impact of a Precision Ag Pioneer](https://www.agequipmentintelligence.com/ext/resources/2024/08/23/Quantifying-the-Impact-of-a-Precision-Ag-Pioneer.png?height=290&t=1724422794&width=400)

Post a comment

Report Abusive Comment