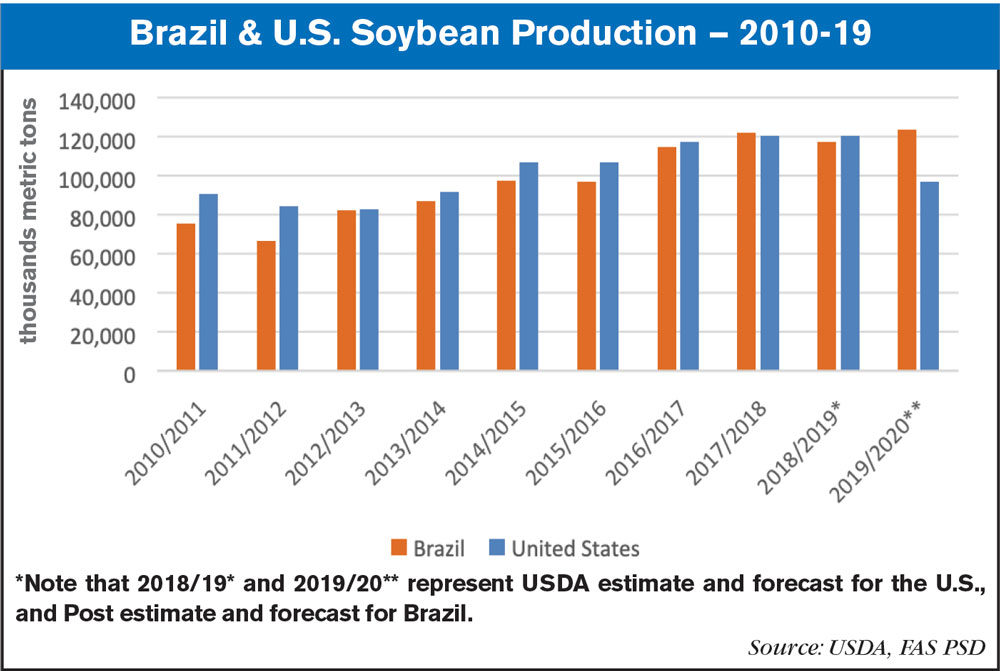

According to a recent report from USDA, Brazil is forecast to overtake the U.S. as the leading worldwide soybean producer during the 2019-20 season. The USDA Foreign Agricultural Service’s Brasilia post has revised up their forecast for 2019-20 soybean planted area to 90.9 million acres, based on the market exuberance over soybean prices in the last several months.

The Brasilia post forecasts a record crop for the 2019-20 year, at 123.5 million metric tons. According to the forecast from the World Agricultural Supply and Demand Estimate (WASDE) issued by the USDA, the U.S. soybean harvest will be less than 100 million metric tons in 2019-20, a drop of almost 20% on the previous season. Brazilian soybean exports are forecast at 75 million metric tons for 2019-20.

The Brazilian real has weakened against the dollar from about R$4.09 in October to R$4.17 to the dollar for the first two weeks of December. The Brasilia post believes these price developments pushed some producers to sow a slightly larger area than they otherwise would have and that the area expansion could have been larger if the local market believed that global soybean consumption would be higher. Anxiety reportedly remains over dampened Chinese demand due to the widespread prevalence of African Swine Fever (ASF), which has impacted swine herds and reduced feed needs.

The Brasilia post forecasts domestic meal consumption to increase by 4%, as livestock and poultry industries continue to expand production to meet rising global demand. As a result, meal exports are forecast to remain nearly flat. There is rising potential that Brazil and China will conclude an export agreement for soybean meal. However, in order for Brazil to be able to export soybean meal to China, it would also need to conclude a separate sanitary and phytosanitary (SPS) agreement, meaning that Chinese market access is unlikely to come in the near future.

The report forecasts soy oil exports to level off in 2019-20 to 500,000 metric tons from 1 million metric tons in the current season. The forecast is based on the expected surge in demand from the domestic biodiesel industry.

Post a comment

Report Abusive Comment