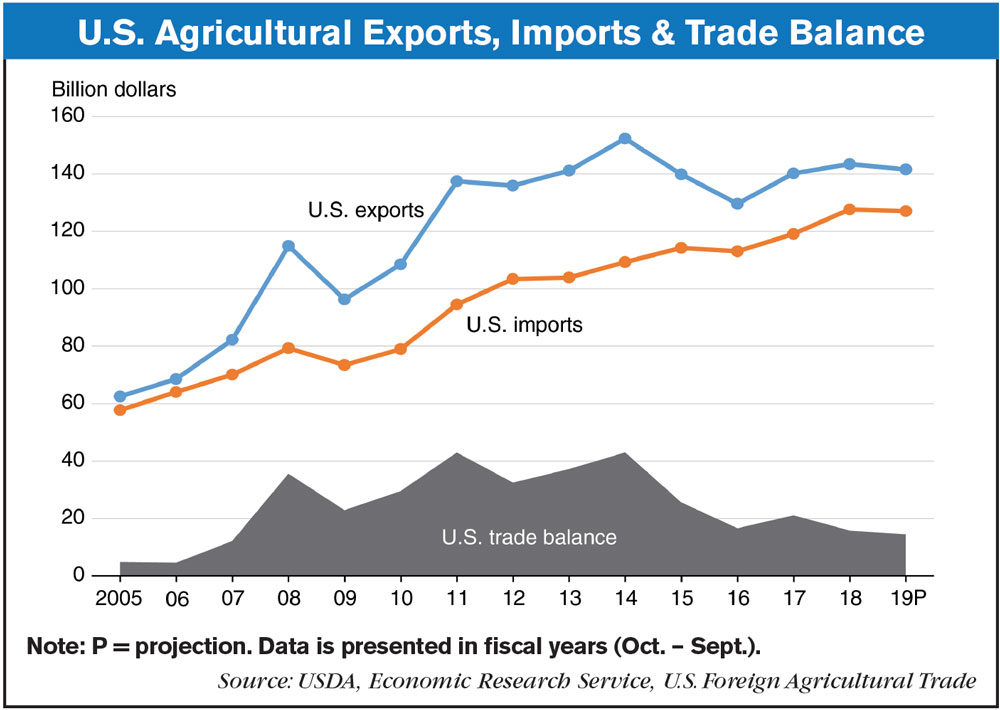

According to USDA’s Economic Research Service’s agricultural trade projections, U.S. ag exports are projected to total $141.5 billion in fiscal year (FY) 2019, while ag imports are expected to total $127 billion. This would indicate a trade surplus of $14.5 billion.

Unlike overall U.S. trade in goods and services, U.S. trade in the agricultural sector consistently runs at a surplus. The $14.5 billion surplus projected for FY2019 is the lowest since FY2007, when the U.S. exported $12.2 billion more in agricultural goods and services than it imported.

As expected, the U.S. ag trade surplus depends on changes in exports and imports. While exports have increased in value since 2016, the value of imports has risen at a slightly faster rate, leading to a declining trade balance. This is further compounded in FY2019 by significant declines in projected exports to China.

The forecast value for U.S. agricultural exports in FY2019 reflects a $3 billion decrease from the previous forecast and a $1.9 billion decrease from FY2018. At the regional level, exports to East Asian countries are forecast to decline by $6.7 billion — the result of an expected decrease of $7.3 billion in agricultural exports to China from the 2018 total of $16.3 billion.

Chinese demand for U.S. soybeans is expected to drop sharply because of China’s retaliatory tariffs, which also curb demand for other products, including sorghum, pork and products, as well as dairy. The decline in export value to China is being countered by higher expectations for exports of wheat and horticultural products like fruits, vegetables and tree nuts. Those products are expected to increase in value by $3.2 billion relative to FY2018.

U.S. ag imports in FY2019 are forecast at $127 billion, $600 million lower than in FY2018, but higher than all years prior. The high U.S. imports are supported by strong consumer spending and favorable business investments, which are expected to continue through 2019. Among the products expected to see the biggest rise in import value are sugar and other tropical goods like coffee and chocolate. Horticultural imports are also expected to rise from the previous forecast, reflecting the U.S. status as a major consumer and importer of fruits, vegetables and tree nuts.

(This article originally appeared in the December 2018 issue of Amber Waves.)

![[Technology Corner] Pessl Instruments CEO Talks Dealer Benefits From Lindsay Corp. Investment](https://www.agequipmentintelligence.com/ext/resources/2024/04/25/Pessl-Instruments-CEO-Talks-Dealer-Benefits-From-Lindsay-Corp.-Investment.png?height=290&t=1714144307&width=400)

Post a comment

Report Abusive Comment