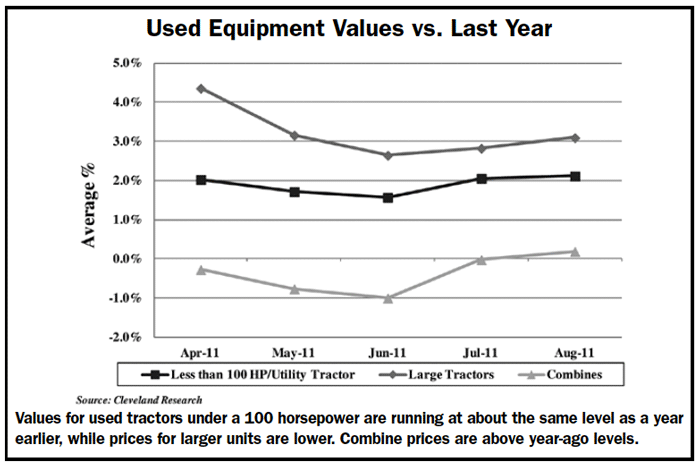

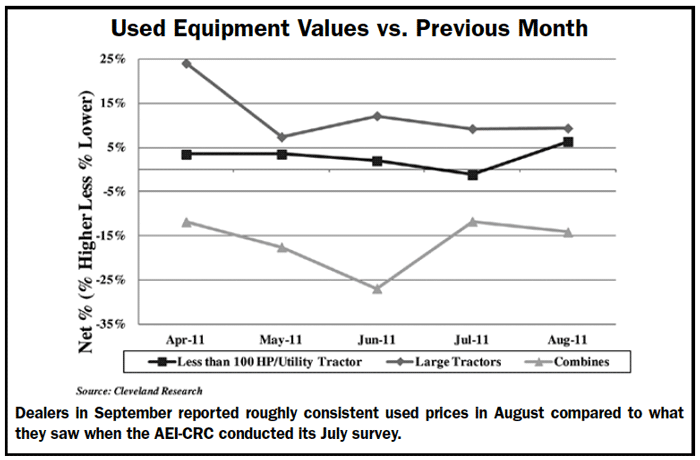

Dealers responding to the September Dealer Trends & Business Outlook Survey report that used equipment prices remained consistent in August compared to July. By category, tractors over 100 horsepower were up 3.1% year-over-year on average in August vs. 2.8% in July. Pricing for used tractors under 100 horsepower were up 2.1% in August, which was consistent with July. Used combine values came in slightly higher year-over-year, up 0.2% in August from a flat reading in July.

Ag Equipment Intelligence and Cleveland Research Co. conduct the survey monthly. The September version ran during the last two weeks of the month and included responses from 345 U.S. and Canadian dealers that represented combined annual revenues of roughly $13.2 billion.

According to Curt Siegmeyer of Cleveland Research, sequentially, a net 6% of dealers reported higher values for under 100 horsepower utility tractors (11% higher; 85% same; 5% lower), up from July’s finding of a net 1% reporting lower values.

For over 100 horsepower tractors, a net 9% of dealers report higher values vs. last month (16%/77%/7%), consistent with July. A negative net 14% reported used combine values were lower in August vs. the previous month (12%/63%/26%), down from a negative net 12% in July.

High Inventories

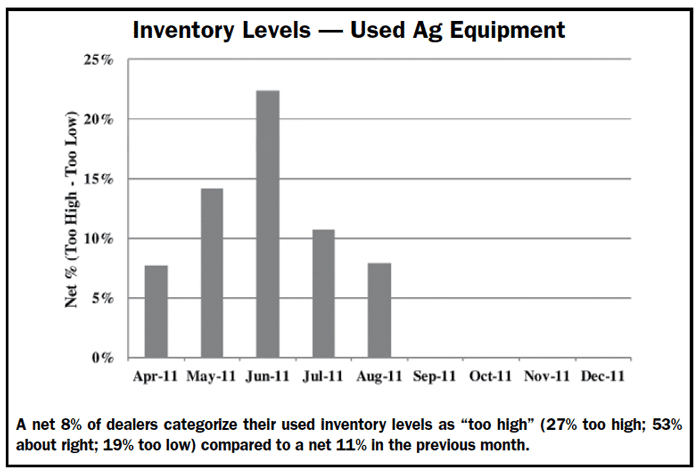

While pricing for used machinery has remained relatively stable, a net 8% of dealers categorize their used inventory levels as “too high” (27%/53%/19%) compared to a net 11% in July. “While still high, it’s encouraging to see more dealers feeling more comfortable with used equipment, as strong seasonal sales appear to be contributing to the improvement,” says Siegmeyer.

At the same time, a net 27% of dealers reported used combine inventory levels declined compared to last month (10%/53%/37%). Commentary on combine inventory suggests that, while there was sequential improvement, a significant overhang still exists, but it appears manageable.

Post a comment

Report Abusive Comment