OMAHA, Neb., Oct. 18, 2018 — Lindsay Corp. (NYSE: LNN), a global manufacturer and distributor of irrigation and infrastructure equipment and technology, today announced results for its fourth quarter and fiscal year ended Aug. 31, 2018.

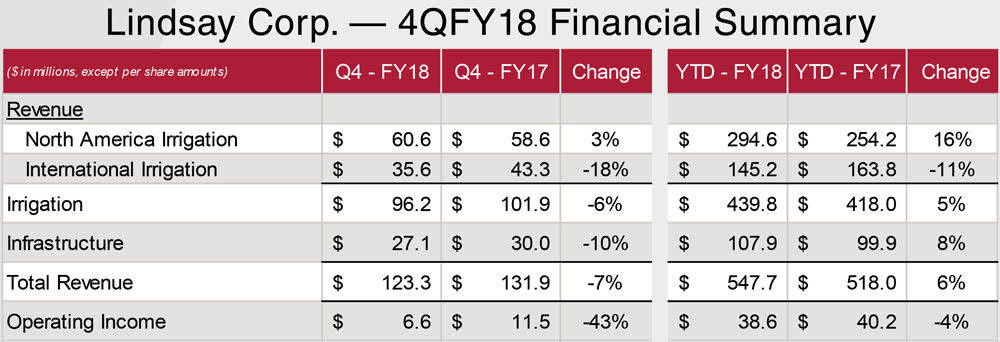

Revenues for the fourth quarter of fiscal 2018 were $123.3 million, a decrease of 7% compared to revenues of $131.9 million in the prior year’s fourth quarter. Net earnings for the quarter were $5 million compared with net earnings of $6.3 million for the same period in the prior year. Adjusted net earnings for the fourth quarter were $4.5 million.

Total revenues for the year were $547.7 million, an increase of 6% compared to revenues of $518 million in the prior year. Net earnings for the year were $20.3 million compared with net earnings of $23.2 million in the prior year. Net earnings for the year were reduced by tax expense of $2.5 million due to the enactment of the U.S. Tax Reform and by after-tax costs of $8.8 million related to the company’s Foundation for Growth initiative. Adjusted net earnings for fiscal 2018 were $31.6 million.

“Despite challenging market conditions resulting from tariffs and falling grain prices, our fourth quarter North America irrigation equipment sales were improved over the prior year,” said Tim Hassinger, president and CEO. “Our full year revenue growth of 6% was led by 16% growth in North America irrigation and 8% growth in our infrastructure segment. We also continue to make good progress on our Foundation for Growth objectives that we introduced earlier in the year.”

Irrigation segment revenues decreased 6% to $96.2 million, compared to $101.9 million in the prior year’s fourth quarter. North America irrigation revenues increased 3% to $60.6 million, reflecting an increase in irrigation system unit volume. International irrigation revenues decreased 18% to $35.6 million due to the market disruption in Brazil that continued during the quarter and lower project activity in developing markets compared to the prior year.

Irrigation segment operating margin was 10.8% of sales in the fourth quarter (8.8% adjusted), compared to 9.6% of sales in the prior year. A net gain of $2 million from business divestitures was partially offset by a $1.6 million incremental LIFO inventory valuation expense resulting from raw material inflation.

“Market headwinds in North America are expected to continue into our fiscal 2019 due to uncertainty regarding the outcome of global trade negotiations and pressure on grain prices.” said Hassinger. “We expect improvement in international irrigation as Brazil returns to a level of normalcy and developing markets continue to grow.”

Analysis

According to analysts at Zack’s Equity Research, Lindsay shares have added about 8.6% since the beginning of the year vs. the S&P 500's gain of 5.1%. “This quarterly report represents an earnings surprise of –50.59%. A quarter ago, it was expected that this irrigation equipment maker would post earnings of $1.39 per share when it actually produced earnings of $1.66, delivering a surprise of 19.42%. Over the last four quarters, the company has surpassed consensus EPS estimates just once. The company has topped consensus revenue estimates two times over the last four quarters,” said Zack’s analysts.

Post a comment

Report Abusive Comment