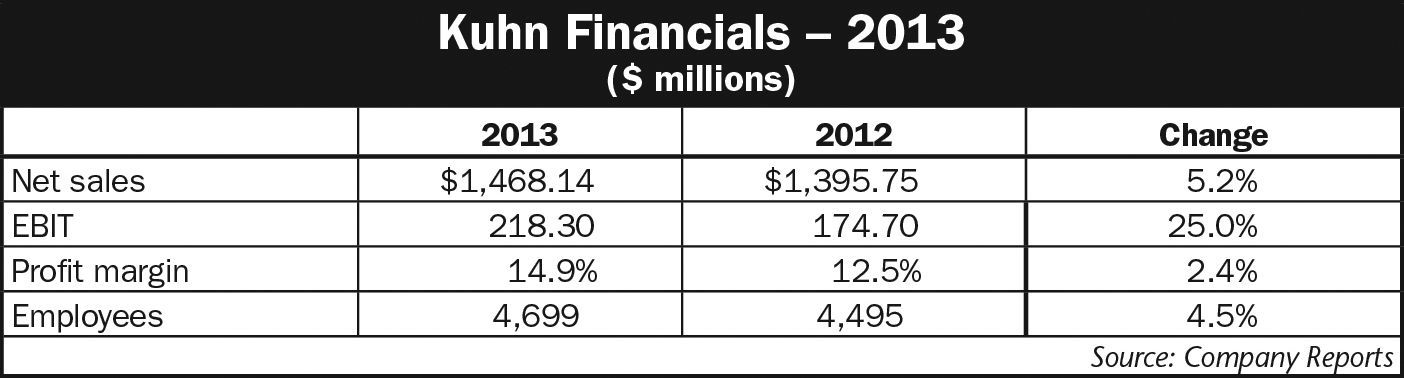

Fueled in part by its growing North American sales, the Kuhn Group reported that, while its net sales in 2013 grew by 5% vs. the previous year, its profits rose by nearly 25% and profit margins increased by 2.5%.

Managers at its parent company Bucher Industries credited Kuhn Group with achieving ‘outstanding profitability’ when it reported record results for the Swiss group and its agricultural equipment division.

“Various operational factors, such as lower purchasing costs, optimal production planning, greater vertical integration and in-sourcing contributed to an outstanding operating profit,” says Philip Mosimann, Bucher CEO. “The operating profit margin of 14.9% — an all-time high — exceeded expectations.”

Kuhn’s 2013 order intake and net sales increased 5% on the year prior, with net sales peaking at the equivalent of $1.46 billion, just under 50% of Bucher group sales. Operating profit (EBIT) of $218 million was 25% up on the year before, with the profit margin improving by 2.4 percentage points.

“Kuhn made the most of favorable market conditions, underpinned primarily by rising demand in the principal markets in Europe and in North and South America,” adds Mosimann in Bucher’s annual report. “The U.S. market saw brisk demand for agricultural machinery for milk and meat production, and for growing cereals.”

The successful integration and expansion of U.S. production facilities at Kuhn Krause has seen more efficient material flow and a 20% increase in production capacity. This helped avoid production bottlenecks and maintained delivery capabilities as Kuhn exploited positive market conditions to strengthen its position in the U.S. tillage market with a combination of imported and locally produced implements.

Kuhn continues to invest heavily elsewhere in its global manufacturing and support network.

Capacity expansion for production of large capacity feed mixers is underway at Kuhn-Audureau in France and the “Kuhn Centre for Progress” was completed in October last year near the headquarters plant in France.

This new facility provides extensive training, engineering and showroom facilities for dealers and customers, and will facilitate easier technological know-how exchange between end users and product development teams, says Kuhn.

Extension and modernization of the global logistics center will provide enhanced availability and delivery for the 90,000 different parts it stocks for European-manufactured products. It is designed to accommodate an additional 3,000 parts every year; such are Kuhn’s plans for new product development.

In Brazil, Kuhn has completed its acquisition of self-propelled sprayer and spreader specialist Montana sooner than expected and is now being run by managers at Kuhn’s existing operation in the country, which should help rapidly integrate the new business.

This should give a boost to sales in the current year when Kuhn managers anticipate a slight decline from the high level of demand in western European markets if prices for soybeans, maize and wheat continue to decline in the year ahead.

Demand in Eastern Europe is likely to be sustained by the need to improve mechanization efficiency in agricultural production, they forecast, while investment by farmers in North America is expected to stabilize at current levels.

Their outlook for South America is positive despite a likely decline in Brazilian farm income from soybeans because they expect attractive state-sponsored financial support for farmers in this market.

Post a comment

Report Abusive Comment