Few will argue with the fact that the very generous depreciation rules for farm machinery introduced in 2008 have played a significant role in the protracted run of strong sales years for ag equipment dealers and manufacturers. The current Section 179 allows for accelerated depreciation of an asset in the year of purchase; the current law allows for up to $500,000 in deductions in 2013, but expired at the end of 2013. If this occurs, the depreciation schedule will revert back to the pre-2008 levels of $25,000.

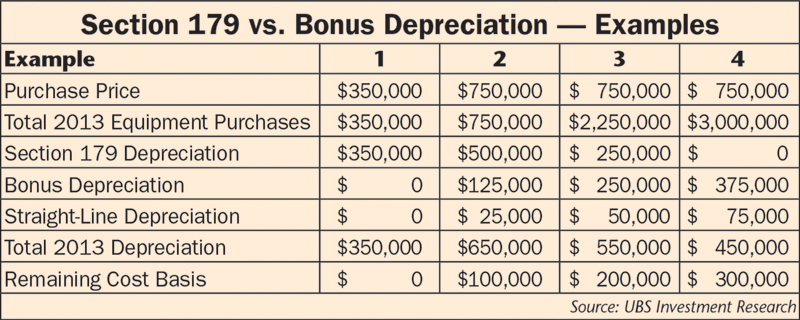

The table below shows examples of the impacts of Section 179 vs. Bonus Depreciation on the purchase of farm equipment.

As expected, Congress didn’t get around to either re-authorizing or adjusting the rules before the end of last year. But according to an Ag Equipment Intelligence source, Congressman Dave Camp (R-MI), who is the current chairman of the Ways and Means Committee, will introduce a measure that would lower the current $500,000 limit to $350,000. At the same time, Camp reportedly will push to make the measure permanent, which would go a long way in stabilizing purchasing patterns in the ag equipment business; a big positive for everyone involved, including farmers, dealers and manufacturers.

Post a comment

Report Abusive Comment