In today’s newscast, we discuss a quick update on the North Dakota dealer protection law, whether or not we’re currently at the bottom of the trough in the ag economy cycle, a new joint venture among 4 agribusinesses, and the latest earnings reports from Cervus Equipment, John Deere and Buhler Industries.

Leave a comment Get New Episodes Delivered to Your Inbox

On the Record is brought to you by AgDirect.

Built for agriculture and powered by Farm Credit, AgDirect serves the ag equipment financing needs of equipment dealers across most areas of the U.S. It’s among the fastest-growing equipment financing programs of its kind – offering equipment dealers and manufacturers a reliable, risk-free source of credit for equipment financing and leasing on ag equipment — including irrigation systems. Along with attractive rates, AgDirect’s financing terms are among the most flexible in the ag equipment business — matching the income stream of ag producers. Discover why more dealers and their customers are choosing AgDirect to finance, lease and refinance ag equipment by visiting AgDirect.com.

On the Record is now available as a podcast! I encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We're interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

You May Also Be Interested In...

What do you get when the son of the local New Holland dealer marries the daughter of the local Case IH dealer? While this sounds like the start to a bad joke, it’s actually the foundation of the Ellens Equipment ownership team, a couple who knows a thing or two about running a successful dealership and who treats the business like another one of their children (including knowing when it’s time to let them spread their wings).

I’m managing editor Kim Schmidt, welcome to On the Record! Here’s an update on what’s currently impacting the ag equipment industry.

Judge Puts Hold on ND Dealer Law

As we reported last time, the Assn. of Equipment Manufacturers, AGCO, CNH Industrial, Deere & Co. and Kubota filed a lawsuit challenging the North Dakota “Dealer Bill of Rights” law.

According to published reports, a federal judge has ordered North Dakota Attorney General Wayne Stenehjem not to enforce or “institute an action for any alleged violation” of the new law until the issue can be resolved.

Is This the Bottom of the Trough?

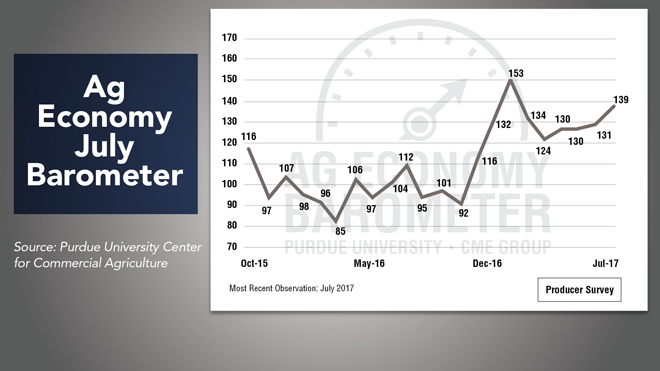

Farmers and dealers alike are feeling more optimistic about the state of the ag economy. The latest Ag Economy Barometer released earlier this month by Purdue University and the Center for Commercial Agriculture, showed producers are more optimistic about current conditions and their future expectations.

The July Barometer reading was 139 and the report’s authors say, “Sentiment this summer among the nation’s agricultural producers is markedly more positive than during summer 2016, when barometer values ranged from the mid-90s to the low 100s.”

In Ag Equipment Intelligence’s July Dealer Sentiments report, on average dealers forecast flat sales growth for 2017, the most positive forecast over the last 12 months.

FARM

MACHINERY

TICKER

AFN: $57.79 -0.16

…

AGCO: $66.42 -3.61

…

AJX: $0.49 -0.05

…

ALG: $88.80 -2.74

…

ARTW: $2.05 -0.65

…

BUI: $4.19 +0.03

…

CAT: $114.78 +1.61

…

CNHI: $10.96 -0.57

…

DE: $115.44 -11.90

…

KUBTY: $86.84 -0.93

…

LNN: $85.72 -5.38

…

RAVN: $29.75 -4.00

…

TWI: $8.08 -1.66

…

TRMB: $38.01 +1.83

…

VMI: $142.35 -4.00

…

CERV: $13.35 +1.14

…

RME: $11.26 -0.24

…

TITN: $15.79 -0.82

…

TSCO: $57.69 +4.50

...

Closing Stocks as of 8/24/17 (Compared to Close on 8/10/17)

We spoke with Steve Hunt, vice president of H&R Agri-Power, a 12-store Case IH dealership based in Hopkinsville, Ky., during the Dealership Minds Summit earlier this month. Hunt also serves on the Case IH dealer advisory board. From his perspective, we’re currently nearing the bottom of the trough in the cycle.

Dealers on the Move

This week’s Dealers on the Move include Canada West Harvest Centre, Redline Equipment, Beard Implement Co., James River Equipment and Papé Machinery.

Claas dealer Canada West Harvest Center announced plans to open a new location in Yorkton, Saskatchewan. The purchase adds a fourth dealership to the region within the span of 3 years, joining the Regina, Saskatoon and Swift Current locations.

Redline Equipment, a Case IH dealer with 8 locations across Michigan, Ohio, and Indiana, is set to acquire Koenig Equipment’s 4 Case IH stores in Indiana.

Beard Implement Co., a Case IH, New Holland and Kubota dealer with headquarters in Arenzville, Ill., has added two new locations in Hannibal Mo., and Pittsfield, Ill. The Hannibal location plans to be Case IH exclusive while the Pittsfield operation will offer all three lines.

James River Equipment, a John Deere dealership with 39 locations across North Carolina, South Carolina and Virginia, has acquired Blueridge Farm Center based in Buchanan, Va.

John Deere dealer Papé Machinery broke ground on a new dealership and service center in Ponderay, Idaho. The new store will sell ag and turf equipment as well as John Deere’s construction and forestry line of equipment.

Now here’s Associate Editor James DeGraff with the latest from the Technology Corner.

Agronomic Expansion for Wheat Growers

Precision farming partnerships are nothing new, especially in terms of developing robust agronomic offerings to farm customers. According to the 2017 Precision Farming Dealer Benchmark study, nearly 40% of dealers and retailers offering agronomic services are utilizing third party partnerships.

Continuing the trend, this week, four agribusinesses announced a joint venture to form FieldReveal, a service platform designed to help agronomists work more closely with farmers.

The four collaborating companies are Wheat Growers, Landus Cooperative, Central Valley Ag and WinField United, all of which are expected to hold equity positions in the new joint venture, pending final approval from each organization.

The joint venture will license its FieldReveal precision farming platform to additional ag retailers across North America and could be incorporated as part of retailers’ existing precision ag offerings.

The genesis of the FieldReveal platform was the MZB precision farming system from Wheat Growers, Precision Farming Dealer’s 2014 Most Valuable Dealership. Precision farming manager Brent Wiesenburger (Wise-en-burger) says the key to the new agronomic tool is that it was designed to enhance the partnership between ag retailers, agronomists and their customers.

Wisenburger says,

“When you think about the technology space in agriculture, it is very dynamic. FieldReveal can’t develop everything. This joint venture will allow us to digitally connect to best-in-class technologies that bring our producers the best value. I myself think about it as a “shark tank” for ag. Think about four ag retail businesses that represent millions of acres in a room together with a company that provides a great technical solution for all of us.”

Wiesenburger adds that the joint venture positions the companies well for future growth in the agronomic space, creating an enlarged footprint to preview or launch each company’s new technologies.

Cervus 2Q Revenues Up 21%

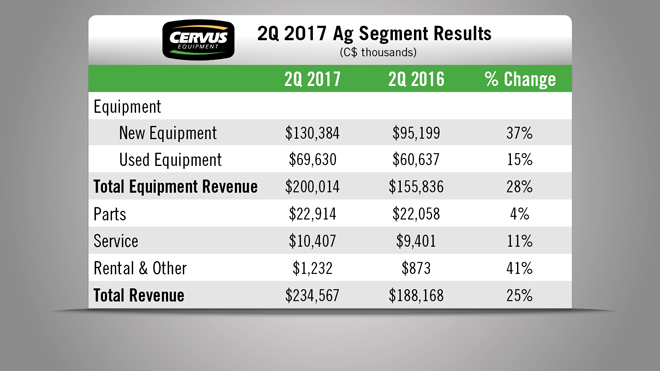

Cervus Equipment, John Deere’s largest dealership group in Canada, reported record second quarter revenues on Aug. 10.

Revenues for the quarter were $357.4 million, up 21% vs. the second quarter of 2016. Revenues for the first half of the year are up 17% vs. last year.

The agriculture segment achieved record second quarter equipment sales of $200 million, up 28% vs. the same period last year. Revenue from new equipment sales was up 37% vs. the second quarter of 2016. Used equipment revenue was up 15%.

Graham Drake, president and CEO, says the dealership’s ongoing focus on service optimization increased overall service gross profit margin by 1.8% compared to the second quarter of 2016.

Deere 3Q Ag & Turf Sales Up 13%

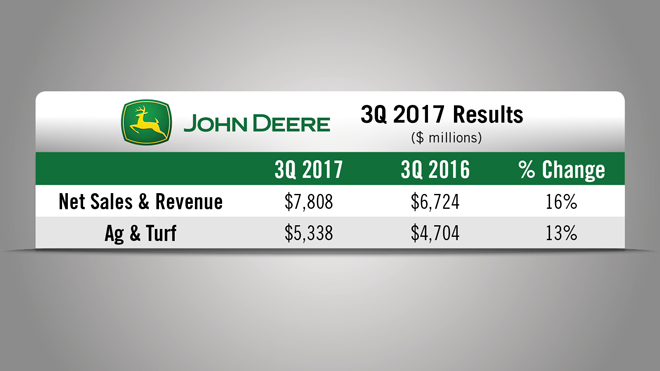

Deere & Co. reported its 3rd quarter earnings on Aug. 18. Worldwide net sales and revenues were up 16% for the quarter to $7.8 billion. Net sales from equipment operations were $6.83 billion vs. $5.86 billion for the same period last year.

Ag & Turf sales improved by 13% vs. the third quart last year.

Deere’s worldwide sales of ag and turf equipment are forecast to increase about 9% for fiscal year 2017. Industry sales for agricultural equipment in the U.S. and Canada are forecast to be down about 5% for 2017, reflecting weakness in the livestock sector and the continuing impact of low crop prices.

During Deere’s earnings call with analysts, Dr. J. B. Penn, Deere’s chief economist, provided commentary on the global ag economy.

He says a turnaround in farm income is forecast for calendar year 2017, the first increase since the peak in 2013. Deere’s experience suggests that traditional farmer capital purchase patterns are returning now that used equipment inventories are approaching more traditional levels.

He adds, “The agricultural credit situation still is relatively good across the sector. Loan volume has increased to be sure; we see that in the John Deere financial revolving credit line. But, most repayment and creditworthiness indicators and the John Deere financial portfolio loan loss experience, still are well within the normal balance.”

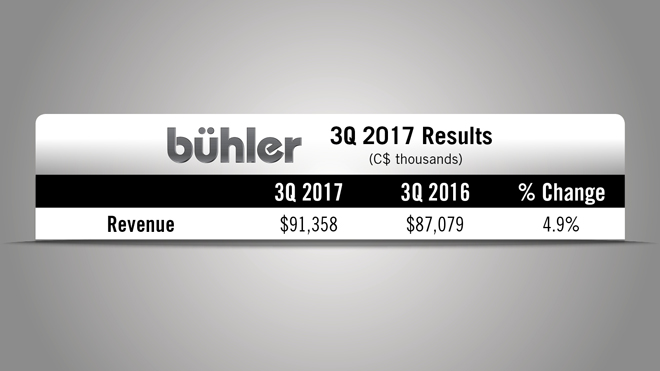

Buhler 3Q Revenues Increase 4.9%

Buhler Industries, manufacturer of Versatile and Farm King products, released its 3rd quarter earnings report on Aug. 14. Total revenues for the quarter wer $91.4 million, up 4.9% vs. the same period last year.

While continued weak commodity prices have hindered sales levels for the company as a whole, order totals in North America have bounced back this year, leading to an increase in U.S. sales. Meanwhile, Eastern European sales remain steady year over year.

Looking ahead to the fourth quarter and year as a whole, Buhler expects sales to increase from the 2016 totals. Confidence stems from an elevated demand for equipment in 2017, despite the difficulties with lower commodity prices.

According to the company, dealer inventory levels for front-wheel assists and four-wheel drive tractors are down from last year in both Canada and the U.S., which will create opportunities when demand for new equipment increases.

And now from the Implement & Tractor Archives…

Implement & Tractor Archives

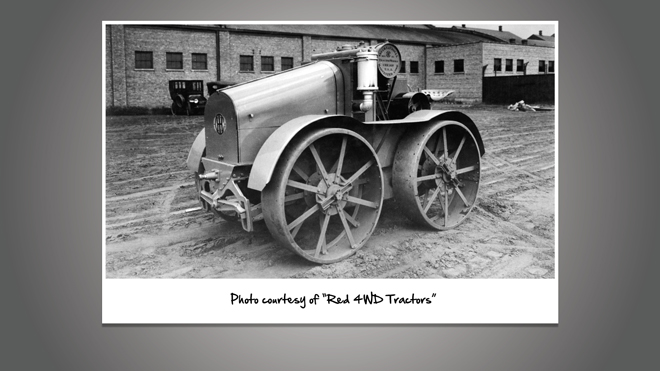

International Harvester identified the need for a 4WD tractor as early as 1910. The characteristics of what was needed for a successful tractor drove a whole generation of IH development. But it would be decades before production of a 4WD would begin. The 4WD 8-16s that IH first experimented with were good tractors, but had short wheelbases. This caused trouble in rough terrain, exactly where 4WDs were needed.

As always we welcome your feedback. You can send comments and story suggestions to kschmidt@lessitermedia.com. Until next time, thanks for joining.

Post a comment

Report Abusive Comment