A few years ago, while visiting a Case IH dealer in the upper Midwest, the conversation turned toward farm equipment brands and branding. While staunchly loyal to the red equipment he had sold for several decades, the dealer quipped, “I wish we could do something like Deere has done when it comes to marketing and brand recognition. There’s just something about seeing those green tractors out in the field.”

Then he offered an anecdote that revealed how deeply that strong brand and the loyalty that follows it has become embedded in North American agriculture.

He described the time when a local farm family walked into his dealership. The dealer knew the father was a life-long loyal John Deere customer, but they stopped in to look at a shortline product that this dealership carried.

He noticed the little girl was wearing a green John Deere hat. He said to her, “You should be wearing one of our red hats.”

She replied, “No! Red means stop. Green means go.”

This dealer didn’t need to wonder where that little girl got the message that green was better than red. Strong branding runs deep.

In late October, Farm Equipment and Farm Progress Companies conducted a random survey of 2,000 Midwest farmers to determine their equipment preferences and how it affected perceptions about their dealers. These were farmers with annual incomes of $500,000 or higher.

The findings of this 6-question survey will serve as the baseline for this report and the basis of future information Farm Equipment will compile and disseminate.

Despite wishful thinking that U.S. farmers may be becoming color blind when it comes to their preference for equipment brands, the survey results indicate this is not the case. The fact is brand loyalty in the farm equipment business is not dead.

What did emerge from the survey is the key role dealerships play in maintaining brand loyalty.

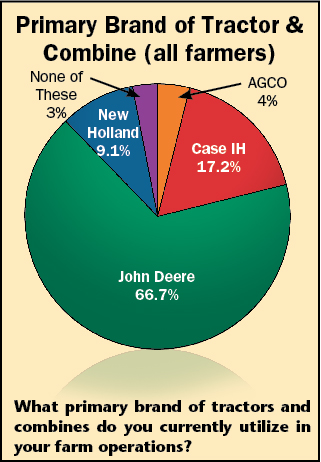

Among all respondents, 66.7% said their primary brand of tractor and/or combine was the green equipment of John Deere. Slightly over 17% named red Case IH machinery as their personal preference, while 9.1% said they lean toward the colors of New Holland. Only 4% named one of the AGCO brands — Massey Ferguson, Challenger and Gleaner — as their primary farm equipment brand, and 3% didn’t claim any of the majors as their preferred brand of machinery.

Still the Same or Better

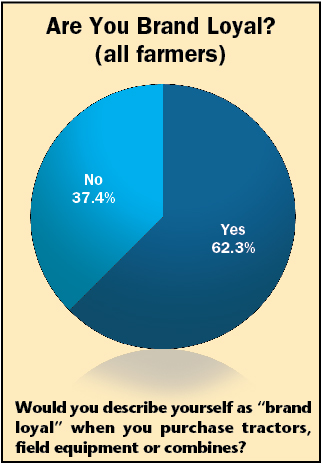

When farmers were asked, “Would you describe yourself as ‘brand loyal’ in your purchase of tractors, field equipment or combines?” nearly two thirds — or 64.6% — of all respondents said “yes.” Overall, they continue to be faithful to their primary brand when purchasing farm machinery.

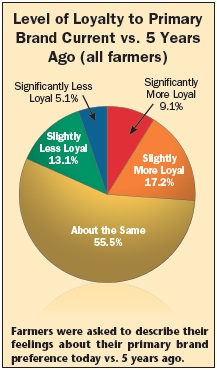

As a group, these farmers also say their brand allegiance has not shifted much — except to get somewhat stronger — during the past 5 years.

When asked to describe their feelings about their primary brand today compared to 5 years ago, only 18.2% were “slightly less loyal” or “significantly less loyal.”

More than half — 55.5% —feel “about the same” about their primary equipment brand as they did a half decade ago.

At the same time, 26.3% of the farmers were either “slightly more loyal” or “significantly more loyal” to their primary equipment brand compared to how they felt 5 years ago.

Brand by Brand

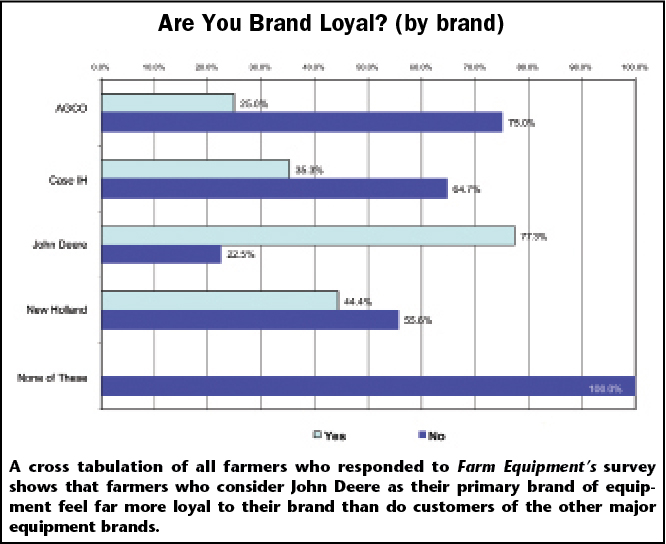

As would be expected, the degree of brand loyalty among farmers varies dramatically in some cases. It’s evident that brand loyalty translates into higher sales and bigger market share.

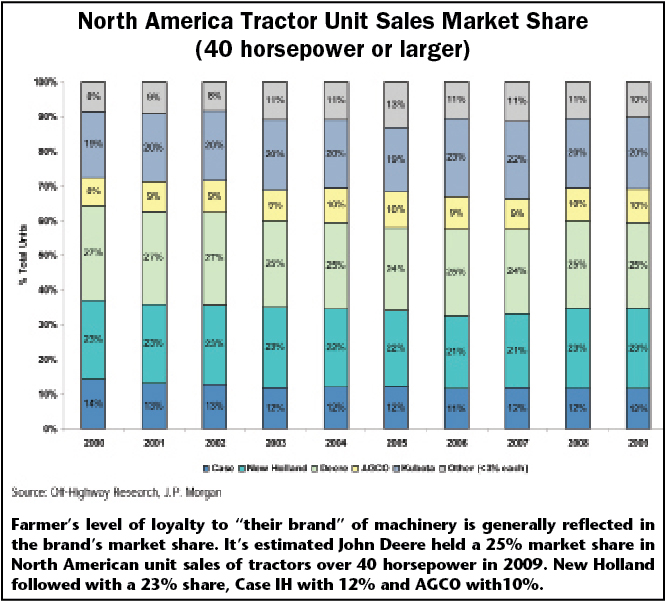

For example, in 2009, it’s estimated that John Deere held a 25% market share in North American unit sales of tractors over 40 horsepower. New Holland followed with a 23% share, Case IH at 12% and AGCO at 10%. Other brands make up the remaining 30%.

Generally, this is how farmers participating in the Farm Equipment/Farm Progress survey conducted in October 2010 ranked the brands in terms of loyalty.

In terms of how farmers feel about “their brand” today compared with 5 years ago, a large majority (81.8%) feel “about the same,” (55.5%) “slightly more loyal” (17.2%) or “significantly more loyal (9.1%).” Only 18.2% indicated they feel less loyal today than they did 5 years ago.

John Deere

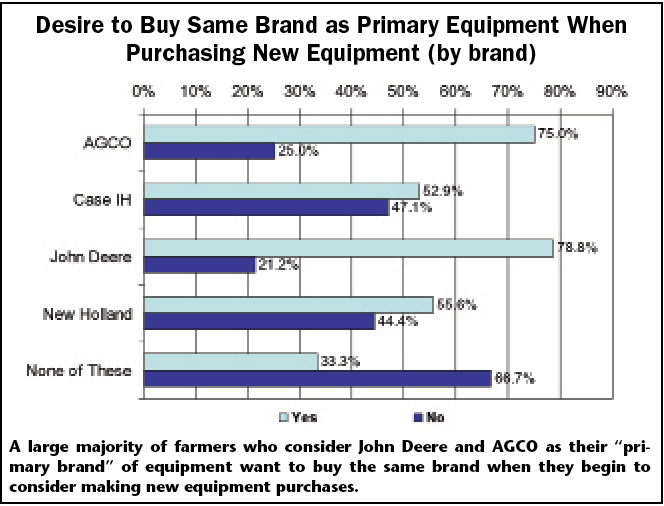

Not only did John Deere farm customers dominate when it came to the largest percentage of responses (67%), but they also demonstrated a higher level of loyalty to “their” brand.

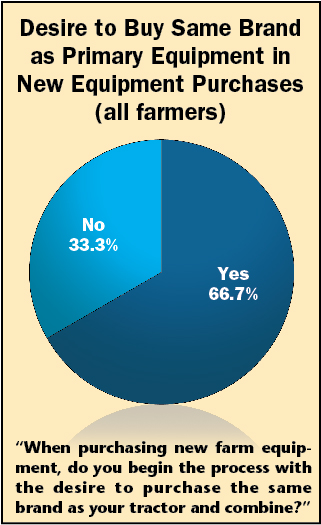

Of all farmers who identified themselves as John Deere customers, 77.3% also described themselves as “brand loyal.” Among this group, 78.8% also said “yes” when asked, “Do you begin your purchase process for new equipment with the desire to purchase the same brand as your tractor and/or combine?”

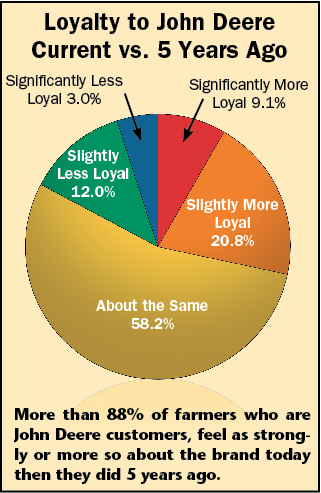

Asked to describe their feelings about their primary brand today vs. 5 years ago, nearly one third, or 30.3%, of Deere customers said they were “slightly more brand loyal” (21.2%) or “significantly more brand loyal” (9.1%) today. Nearly 58% said they feel the “about the same” about John Deere as they did 5 years ago. Only 12.1% reported feeling “slightly less brand loyal” (9.1%) or “significantly less brand loyal” (3%) today compared with 5 years ago.

New Holland

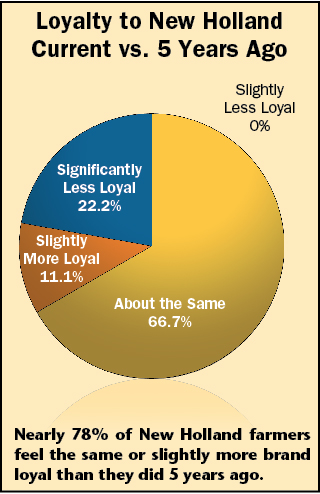

Second in terms of brand loyalty, but trailing by a significant margin in the “loyalty ratings” was New Holland. A little more than 44% of the farmers who called themselves “brand loyal” also identified themselves as New Holland customers. When they begin shopping for new ag machinery, 55.6% of this group says they first look to purchase New Holland equipment.

Nearly two thirds (66.7%) of these same producers indicate they are about as loyal to the New Holland brand as they were 5 years ago. Slightly over 11% say they’re “slightly more loyal,” while 22.2% report feeling “significantly less loyal” to New Holland equipment then they did 5 years earlier.

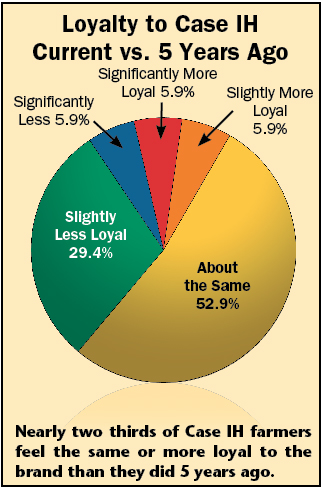

Case IH

Of those farmers who say they’re customers of Case IH, a little over one third (35.3%) consider themselves to be “brand loyal.” When this group begins looking for new equipment, 52.9% will first look at what Case IH has to offer.

In terms of how they feel about the Case IH brand today vs. 5 years ago, 52.9% say they feel “about the same.” Another 11.8% of these growers report feeling “significantly more brand loyal” (5.9%) or “slightly more brand loyal” (5.9%) toward Case IH farm machinery compared with 5 years ago. More than 35%, though, indicate their loyalty toward the red equipment has declined “significantly” (5.9%) or “slightly” (29.4%) over the past 5 years.

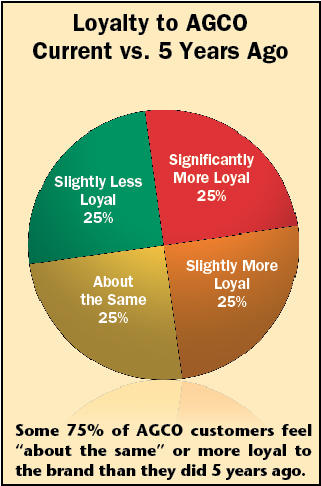

AGCO

One-quarter (25%) of the farmers who call one of the AGCO equipment brands — Massey Ferguson, Challenger or Gleaner — their primary choice, describe themselves as “brand loyal.”

When this group of producers begins the process of purchasing new equipment, 75% look at AGCO branded machinery first.

Compared with 5 years ago, these growers are evenly split on how they feel about the AGCO brands today: 25% report being “significantly more loyal,” 25% say they’re “slightly more loyal,” 25% indicate they feel “about the same” and “25% answered that they were “slightly less loyal.” None of the AGCO machinery buyers indicated they were “significantly less loyal” than 5 years ago.

Equipment of a Different Color

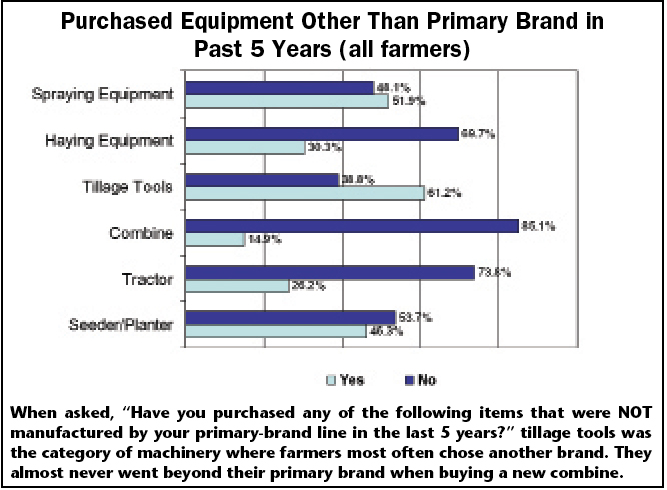

While it’s a real challenge getting farmers to switch from their favored brand of tractors and combines, they’re far more open to looking at other brands when it comes to different types of ag machinery.

Combines are the toughest nut to crack when it comes switching farmers away from their favorite brand. When asked, “Have you purchased other equipment NOT manufactured by your primary brand line in the past 5 years?” 85.1% of all respondents said “no” when it came to the purchase of combines.

Getting producers to change tractor brands is nearly as difficult, with 73.8% of farmers indicating they have not purchased a tractor that was not manufactured by their primary equipment brand line in the past 5 years. Hay equipment can also be challenging, say farmers.

Less than one third (30.3%) report buying haying equipment in the past 5 years that was not manufactured by the favored major equipment maker.

The best opportunity a dealer has in converting a “brand loyal” farmer to another brand comes in tillage tools. In the last 5 years, more than 61% of growers surveyed purchased tillageequipment that was not produced by their primary brand.

Dealers also have a better than 50/50 shot at selling a brand-loyal farmer a different brand of planter or drill. More than 53% of growers had purchased planting or seeding equipment that was manufactured by someone other than their primary supplier during the past 5 years.

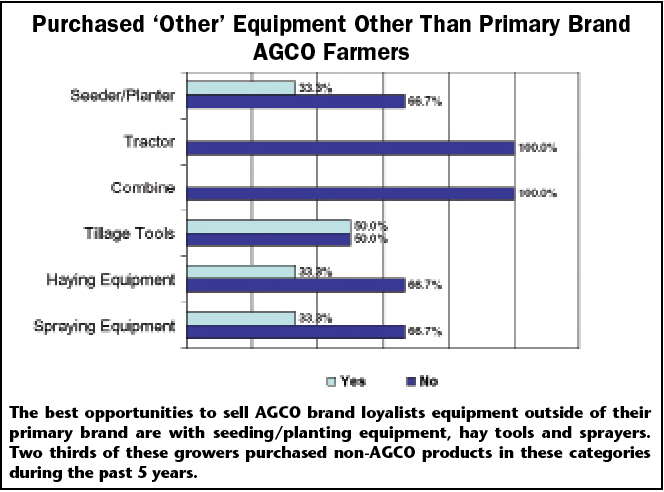

The best opportunities to sell AGCO brand loyalists equipment outside of their primary preference is with seeding and planting equipment, hay tools and sprayers. Two thirds of these growers say they’ve purchased these products in the past 5 years that were not manufactured by AGCO.

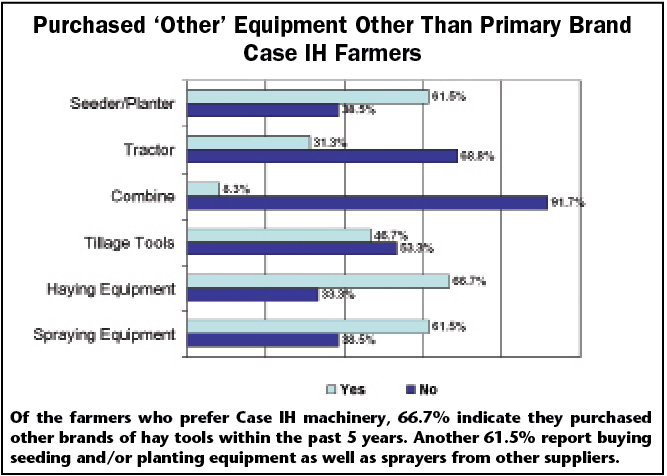

Likewise, for customers who prefer Case IH machines, 66.7% indicate they purchased other brands of hay tools within the past 5 years. Another 61.5% report buying seeding and/or planting equipment as well as sprayers from other suppliers.

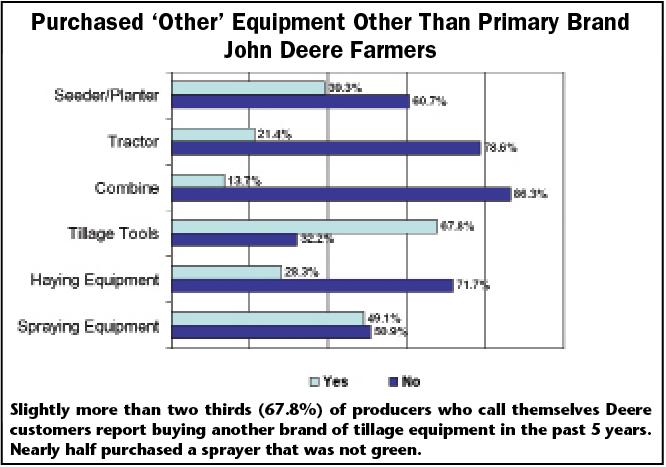

As many dealers already know, getting loyal John Deere equipment users to switch to a different brand can be daunting, but opportunities do exist.

For example, slightly better than two thirds (67.8%) of producers who call themselves John Deere customers report buying another brand of tillage equipment in the past 5 years. Nearly half purchased a sprayer that was not branded by Deere.

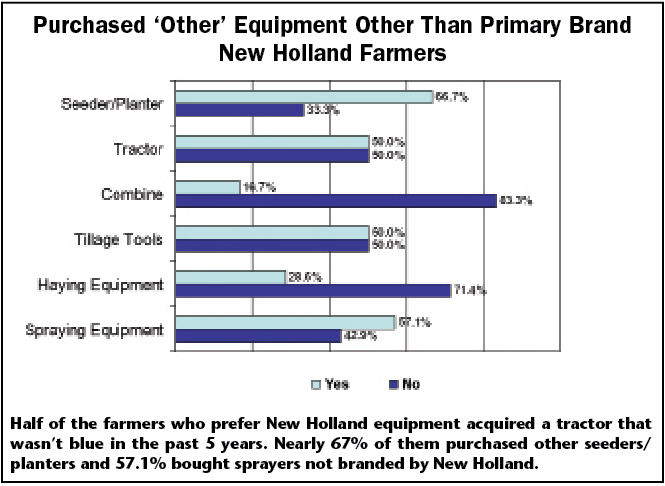

Based on the survey results, farmers who point to New Holland equipment as their primary brand may be the most vulnerable to a brand conversion. While 83.3% of this group say they have not purchased a combine that wasn’t produced by New Holland in the past 5 years and 71.4% haven’t purchased a hay tool other than that of their primary brand, 50% have acquired a tractor that wasn’t New Holland blue.

Why Farmers Switch Brands

As challenging as it is to convert farmers to a new brand of equipment, several factors can make them think twice about steadfastly sticking with a brand they know well. And it’s clear dealers are critical in their decision to stay put or move on.

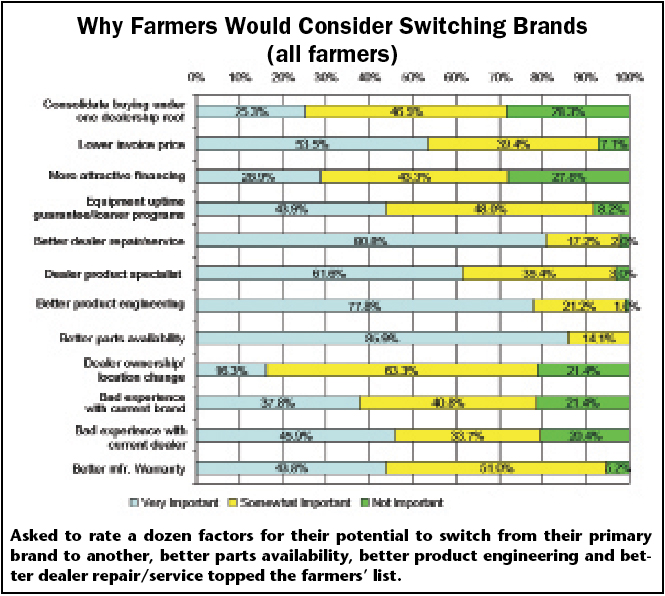

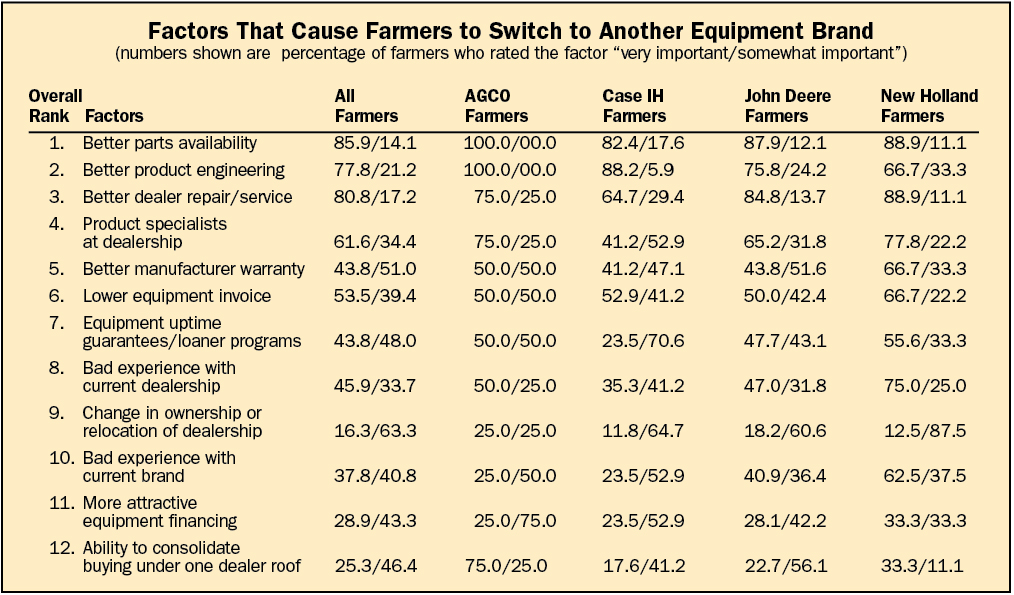

For this survey, farmers were asked to rank a dozen factors for their potential to cause them to switch from their primary brand to another. They were asked to rate them on a scale of “very important,” “somewhat important” and “not important.”

In addition to revealing which factors were most crucial in their decision of what equipment they purchase, this part of the survey also underlined what they look for from their dealers.

Combining the percentage of farmers who rated the factors as “very important” and “somewhat important” provided the list of what growers see as essential in their decision making process.

The farmers also cited three “other” factors. One farmer said, “distance to dealer from base,” was very important to him. Another added that “multi-purchase discounts” would be reason enough to switch brands. Another offered, “I purchased a Sunflower disc chisel because it did a better job than my John Deere.”

Of the first six on the list affecting the farmers’ purchase decision, dealers play a critical role in 4: better parts availability, better dealer repair/service and product specialists at the dealership. Both the manufacturer and dealership contributes to the final “equipment invoice price.”

When survey results are broken down by “brand preference,” it becomes abundantly clear that the more loyal a farmer feels toward his brand and the deeper his relationship with his dealer, the less likely he is to look for a reason to change brands.

With some variances, when rating the 12 factors for their potential to cause them to switch from their primary brand, farmers tended to agree which had the most potential and the least potential regardless of brand.

Overall, the farmers ranked their ability to consolidate purchasing under one dealership roof as the least important factor in their decision about what to buy or not to buy. By brand, this was least important to New Holland customers (55.6% “not important”) and Case IH dealers (41.2% “not important”). But only 21.2% of John Deere farmers indicated that it was “not important.” This would seem to indicate that Deere customers are far more interested in working with one dealer or dealership group than the others.

More attractive financing was ranked second to last on the farmers’ list, but the variance wasn’t as nearly pronounced between brands, except for AGCO customers, 75% of which indicated this was “not important.” One third (33.3%) of New Holland farmers said financing was not important, 29.7% of John Deere customers and only 23.5% of Case IH farmers agreed that financing was among the least of their worries.

While Case IH and John Deere farmers are on the same page when it comes “bad experiences” with the brand or their dealership, New Holland customers are quite a bit more tolerant of “bad experiences” with the manufacturer than they are with their dealer.

In the case of Case IH farmers, an equal number (23.5%) said poor experiences with their brand and the dealer weren’t important. With John Deere customers, 22.7% said bad experience with their brand was “not important” and 21.2% said bad experiences with their dealer was “not important.”

On the other hand, 37.5% of New Holland farmers indicated that bad experiences with the manufacturer were “not important,” while only 25% said that poor experiences with the dealership were “not important.” This would seem to indicate that a poor experience with a dealer is more likely to cause them to switch brands than a bad experience with the equipment.

Is Brand Loyalty Dying?

Based on the survey results presented here, it’s more than a little evident that brand loyalty in the farm equipment business is not dead.

Perhaps the more pertinent question would be, “Is brand loyalty dying?” How does the farmer’s penchant for certain equipment colors today stack up with his preference from a decade earlier or with that of the previous generation?

Since the data presented here is the first developed by Farm Equipment, no earlier information exists with which to compare. But this data will serve as the baseline for future work Farm Equipment will conduct.

In the meantime, Mike Lessiter, editor/publisher of Farm Equipment, spoke with a variety of farm equipment dealers in the past couple of months to get their take on the current status of brand loyalty. You can read his report, “Dealers Weigh in on Brand Loyalty Erosion” by clicking here.

As a dealer, it’s imperative to remember that, while high-quality products are the basis of building brand loyalty, it isn’t the only reason that farmers steadfastly repurchase a certain equipment brand. Dealers are critical in building and maintaining the allegiance to the brand. You carry the message, that a farmer’s “brand” is not only a great product, but his “dealership” is a great dealership they can depend on to help them sleep at night.

Post a comment

Report Abusive Comment