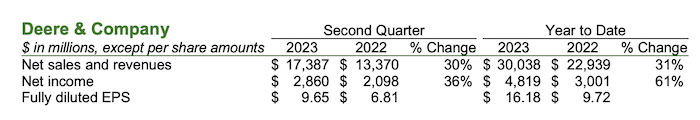

- Sound execution contributes to net sales gain of 34% and higher earnings.

- Results benefit from healthy demand for farm and construction equipment and improved operating environment.

- Full-year net income forecast increased to $9.25 billion to $9.50 billion with cash flow from equipment operations expected to be $10.00 billion to $10.50 billion.

Company Outlook & Summary

Net income attributable to Deere & Company for fiscal 2023 is forecast to be in a range of $9.25 billion to $9.50 billion.“Based on Deere’s results to date, it’s clear we are well on our way to another year of exceptional achievement,” May said. “This is due in no small part to the success of our smart industrial operating model and our ability to provide value to our customers by helping them be more profitable, productive, and sustainable."

Post a comment

Report Abusive Comment