Rising interest rates have become a leading reason for growers to not buy farm equipment, according to the latest update to the Ag Economy Barometer.

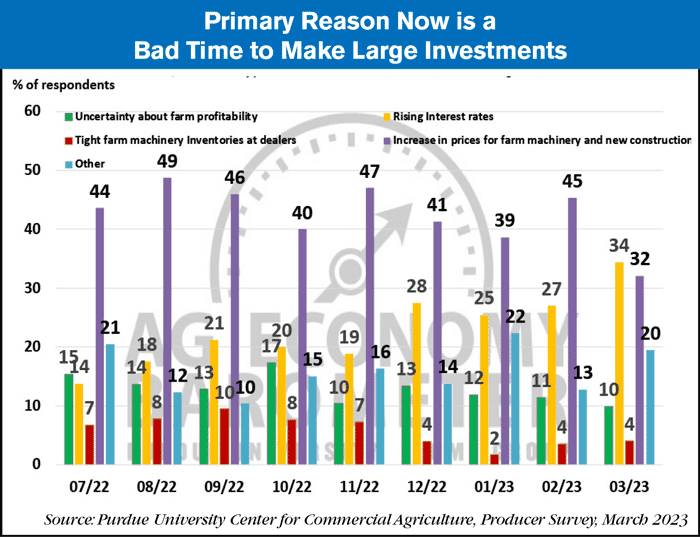

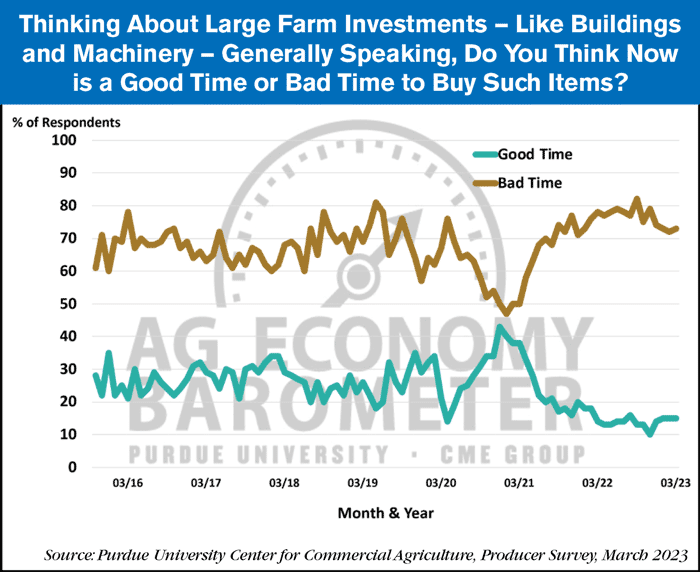

One-third of surveyed farmers said rising interest rates were their primary reason that now is a bad time to make large investments — such as farm machinery and new construction — in the April update. This made it the most selected option for the first time since the question was first asked last year. The increasing prices of farm machinery was the second-most selected option at 32%, which was down from 45% in the previous update. Overall, over 70% of surveyed farmers said now is a bad time to make large investments in their farming operation.

When responding to the open-ended comment question posed at the end of the survey, multiple respondents voiced concerns about the banking sector’s problems and its potential to hurt the economy, which likely also weighed on producer sentiment, according to the report.

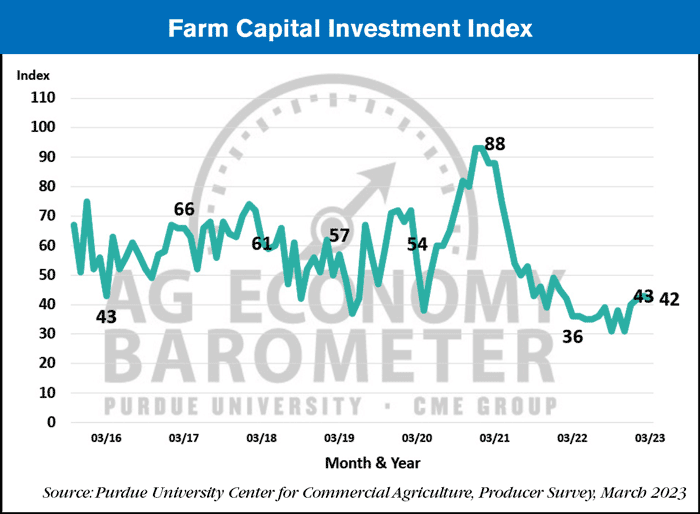

The Farm Capital Investment Index was down slightly in the latest update to the Ag Economy Barometer to a reading of 42 vs. 43 in the previous update, its third month in a row of little change.

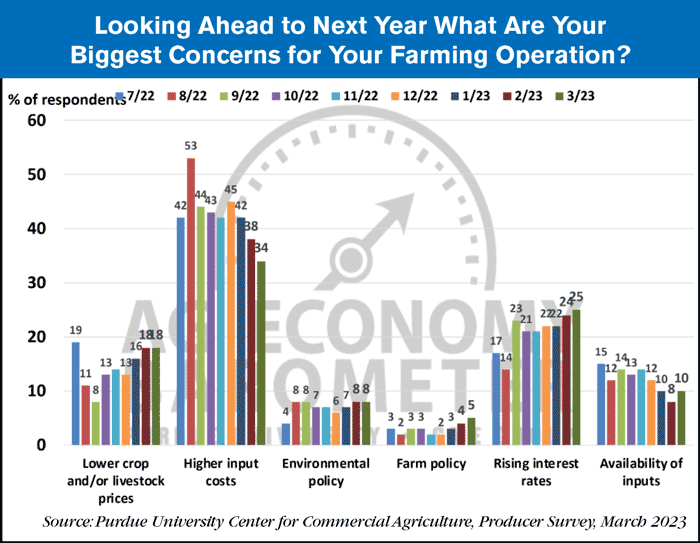

Growers' top concern looking into next year remains higher input costs with 34% of growers choosing this option. Rising interest rates were the second most-selected option at 25%

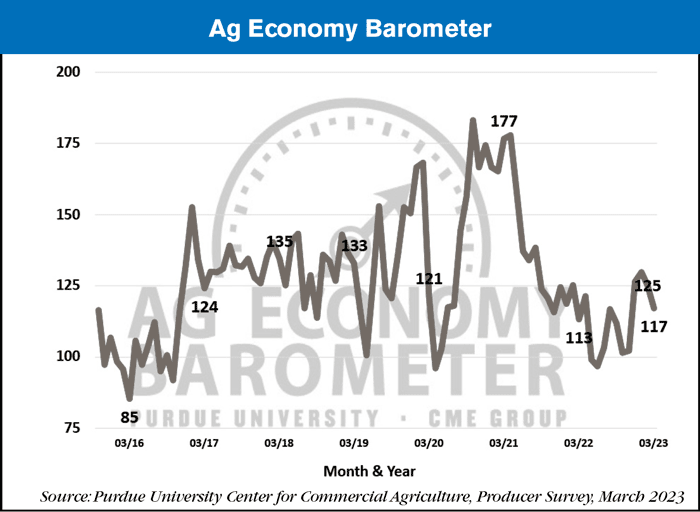

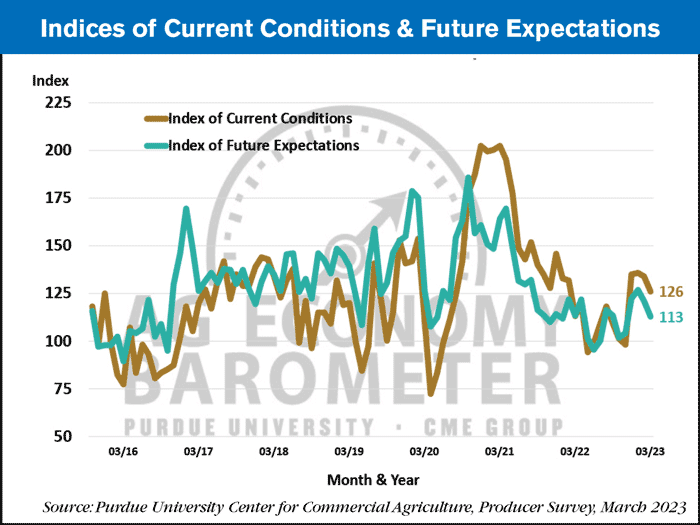

Farmer sentiment weakened again in March as the Purdue University-CME Group Ag Economy Barometer fell 8 points to a reading of 117. Both the Index of Current Conditions and Index of Future Expectations declined 8 points in March leaving the Current Conditions Index at 126 and the Future Expectations Index at 113. Weaker prices for key commodities including wheat, corn, and soybeans from mid-February through mid-March were a key factor behind this month’s weaker sentiment reading.

Click here for more Industry News.

Post a comment

Report Abusive Comment