Both CNH Industrial and John Deere consider their technology stack, the set of technologies stacked together to build an application, central to their companies’ strategies for growth. Today, we’re comparing the two OEMs’ high-level explanations of their tech stacks.

Deere and CNH have been making acquisitions to support their tech stacks and further their autonomous capabilities.

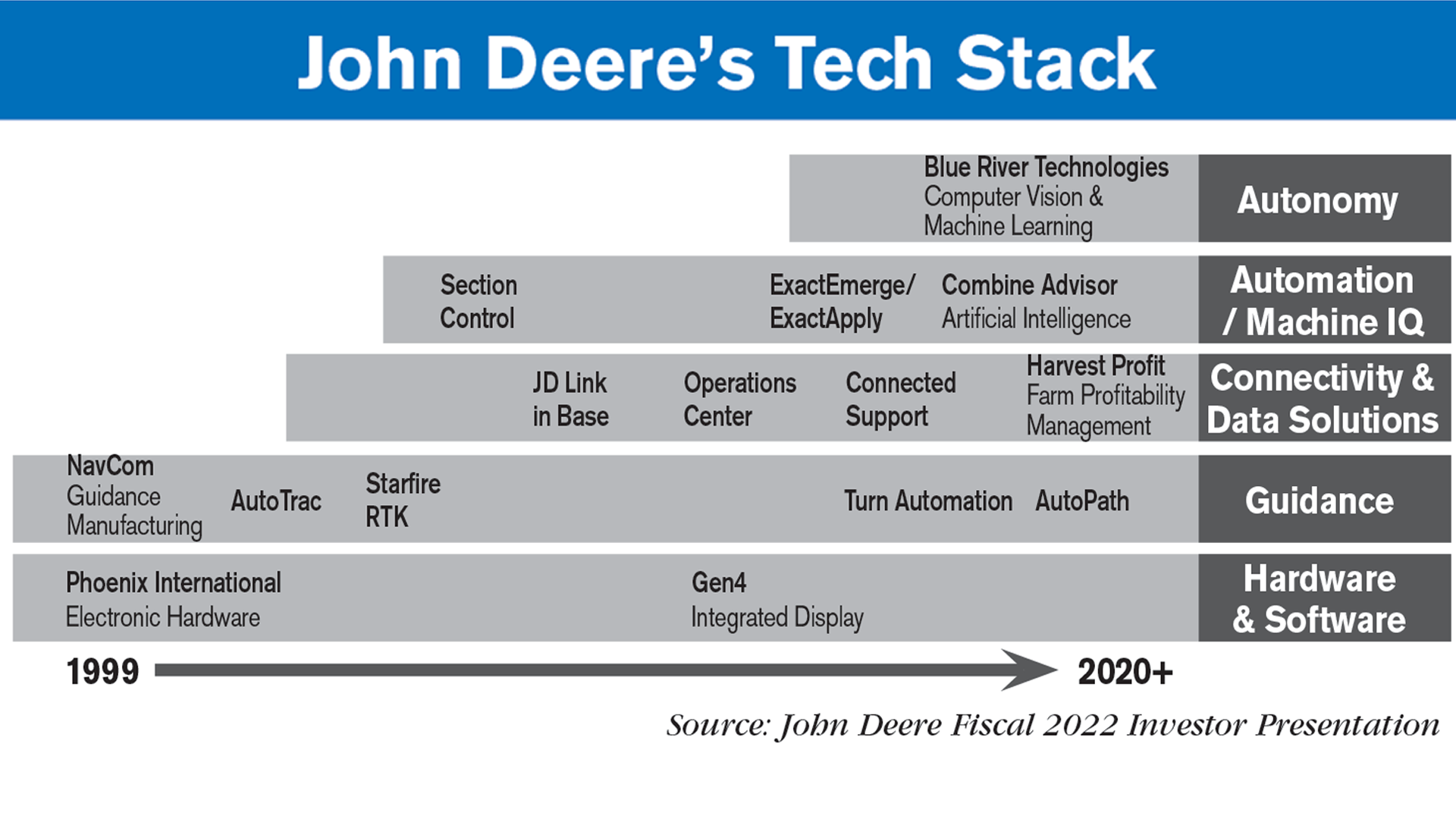

Deere illustrated its tech stack in its fiscal year 2022 investor presentation. The company has been establishing the foundation of its autonomous capabilities since acquiring guidance manufacturer NavCom and electronic hardware manufacturer Phoenix International in 1999.

Deere moved into autonomy with the purchase of Blue River Technology in 2017. Blue River’s tech powers the Deere autonomous 8R tractor announced at the beginning of this year. Deere also acquired Bear Flag Robotics, a startup that retrofits autonomous driving technology onto existing machines, in 2021.

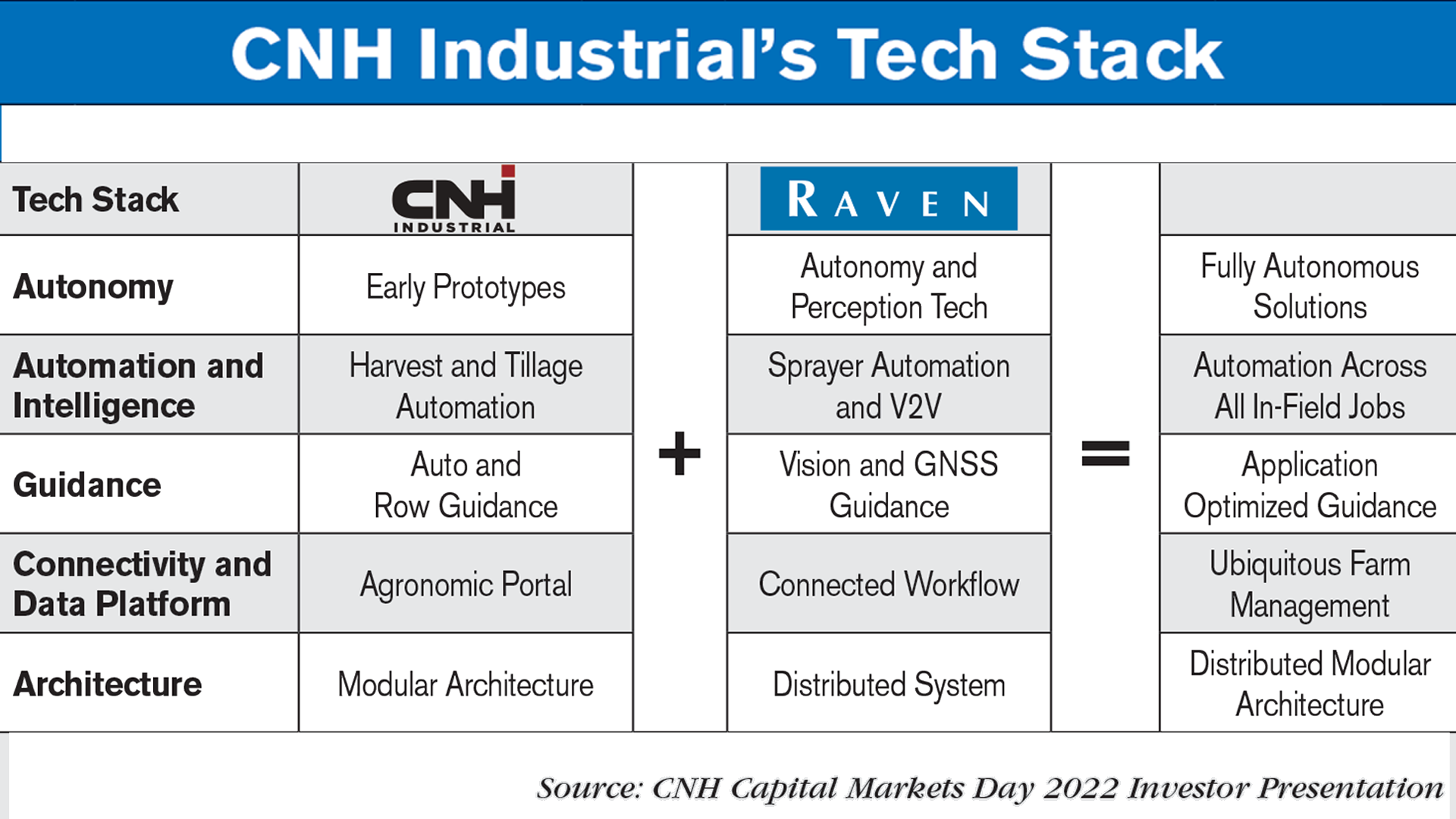

In 2016, CNH introduced an early prototype of autonomous equipment, a cabless Case IH Magnum tractor intended for broad-acre and row-crop farmers.

The company made its major move into autonomy with its acquisition of Raven Industries in 2021. CNH’s chief digital officer of precision technology told investors the acquisition bridged CNH’s “autonomous gap” and added automation capabilities that position CNH to make gains over its competitors.

Looking ahead, CNH intends to build a tech stack that automates all in-field jobs. In February, CNH’s president of agriculture said the company plans to bring a significant amount of autonomy to market over the next 3 years.

Analyst Shane Thomas of Upstream Ag Insights says tech that focuses on agronomy is an area of opportunity for CNH in the future.

“If you look at previous annual reports or investor days, there was more of an emphasis on the physical hardware than the agronomic data itself. This is likely an area for CNH to further partner or acquire, and empower the dealer network as well.”

Deere, meanwhile, has been openly incorporating agronomy at its dealerships for a number of years and making acquisitions to support agronomic-focused equipment like its green-on-green See & Spray Ultimate smart sprayer.

Ag Equipment Intelligence went more in-depth into agronomic technology offerings and opportunities for CNH and Deere in this recent article.

Post a comment

Report Abusive Comment