The latest episode of On the Record is now available!

This week’s episode of On the Record includes a look at what to expect now that 2 lawsuits against John Deere related to right to repair have been filed, Precision Plantings new vision-based camera system that will be u sed to identify weeds and spot spray them and how 2021 ended in terms of tractor and combine sales. We also take a look at 2 recent surveys of dealers, one which suggests we could see normalizing inventories on dealers’ lots by 2023.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Deere Hit with Right to Repair Suits

Right to repair has been making news from a legislative standpoint for years, and now 2 recent lawsuits filed against John Deere bring it to the legal realm as well.

On Jan. 12, Forest River Farms, owned by Robert Blair, filed an antitrust lawsuit against Deere 7 Co. over alleged “monopolization of the repair service market for John Deere brand agricultural equipment and onboard central computers…”

Just 7 days later, a similar lawsuit was filed in Alabama on behalf of Trinity Dale Wells. Wells suit alleges that Deere’s “proprietary tractor software is creating a monopoly that’s unfair to small farmers.”

Josh Evans, general counsel and vice president of government relations for the Equipment Dealers Association, says that likely won’t be the end of the lawsuits filed. In class action cases like this, he says often once the initial suite is filed every other plaintiff’s firm of a certain size will go out and start looking for more plaintiffs to file their own lawsuit. Evans explains the end goal is get on a plaintiff’s committee and ultimately all the lawsuits get combined into federal district court as a multi-district litigation.

In Evans estimation, the lawsuits illustrate a fundamental misunderstanding and misconception of the farm equipment dealership industry. Evans and EDA stress that dealers need to take this opportunity to tell their story, and make sure that state and federal governments and the news media, understand the industry. Dealers need to stress that while they are connected manufacturers, they are independently owned businesses as well.

Dealers on the Move

This week’s Dealers on the Move include Redlund Equipment and Townline Equipment.

AGCO dealer Redlund Equipment recently opened 4 Colorado locations. Redlund is a new business venture and recently completed the purchase of G&M Implement and the ag assets of Wagner Equipment.

Kubota dealer Townline Equipment has purchased 3 Sharon Springs Garage Kubota dealerships in New York. The dealership now has 5 locations and expands its service area from central New Hampshire and Vermont through the Albany area and central New York.

HHP Tractor, Combine Sales Continue to Climb in 2021

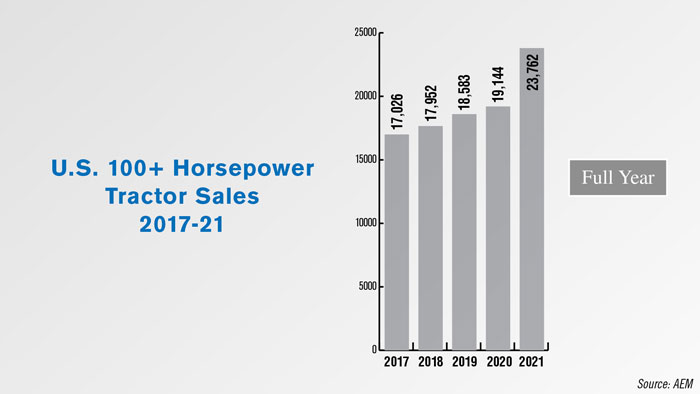

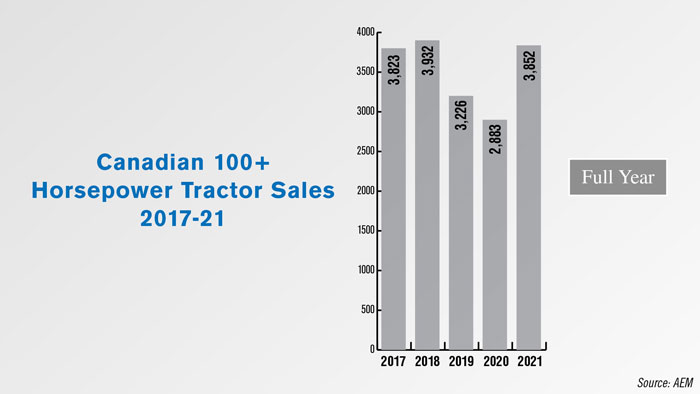

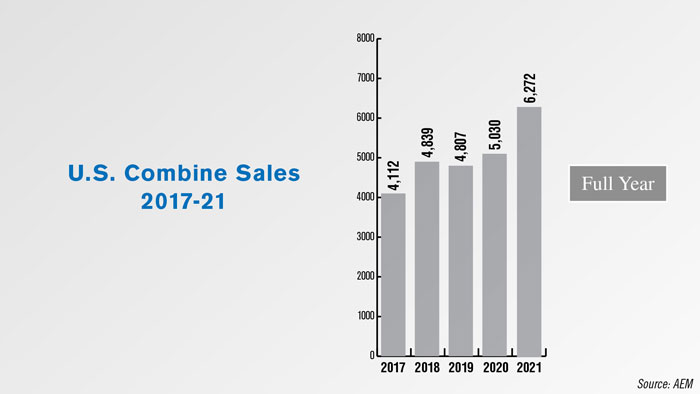

According to the January ag tractor and combine reports from the Assn. of Equipment Manufacturers (AEM), U.S. and Canadian sales of row-crop tractors and combines in 2021 were the highest they’ve been in several years.

Over 100 horsepower tractor sales in the U.S. totaled 23,762 units in 2021, up 24% from 19,144 units in 2020. This was the most units sold in the last 6 years, falling just short of the 23,930 units sold in 2015. This was also the fourth year in a row of high horsepower tractor sales growth in the U.S.

In Canada, high horsepower tractor sales totaled 3,852 units in 2021, a 34% year-over-year increase. This was a reversal of the declines seen in 2019 and 2020 sales and was the most sales reported since 2018’s 3,932 units sold.

In the U.S., last year’s combine sales came in at 6,272 units, a 25% increase over the 5,030 sold in 2020. This represented the second year of growth in U.S. combine sales and the most sold in the last 7 years, coming up short of the roughly 8,000 units sold in 2014.

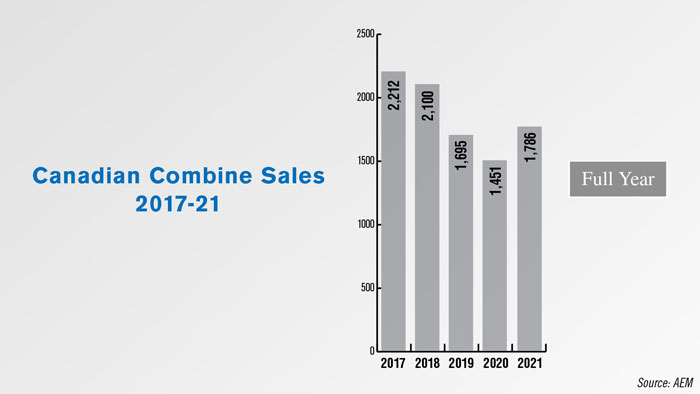

Canadian sales were also up in 2021, rising 23% to 1,786 units sold. This was the most combine sales reported in the last 3 years, surpassed by the 2,100 units sold in 2018.

Survey Shows 60% of Dealers Expect Normal Inventory by 2023

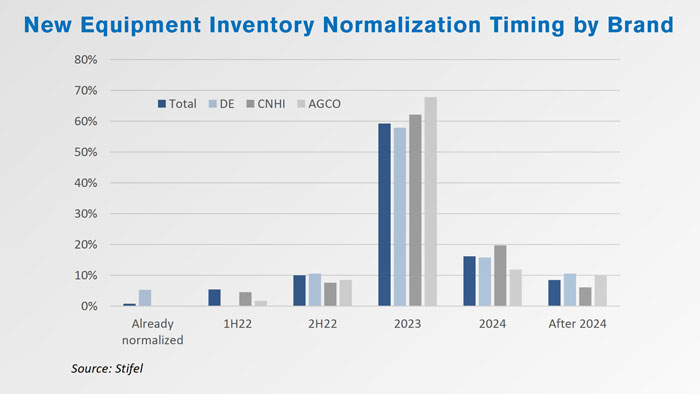

A recent ag equipment dealer survey from investment bank Stifel found that almost 60% of dealer expect their new equipment inventory to return to normal levels by 2023.

Roughly 68% of AGCO dealers forecast their new inventories to normalize by 2023, along with 61% of CNH Industrial dealers and 58% of Deere dealers. Roughly 5% of Deere dealers considered their new inventories already normalized, while no other dealers did.

In total, roughly 10% of all surveyed dealers expected normal inventories in the second half of 2022, 16% estimated inventories would normalize in 2024 and 8% expected normalcy after 2024.

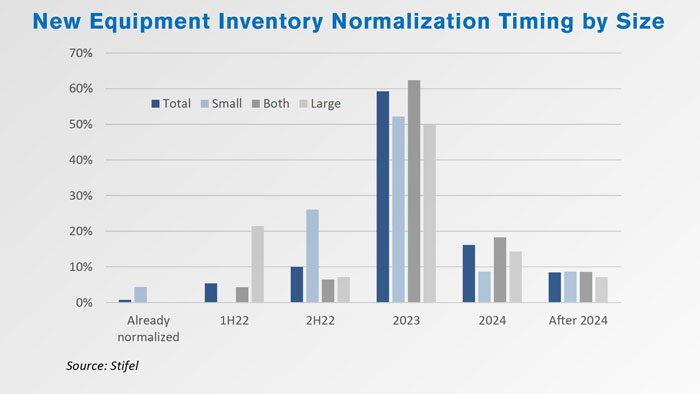

By type of dealership, 4% of small ag equipment dealers considered their new equipment inventories normalized, while another 25% expected normalization in the second half of 2022. Roughly 52% of small ag equipment dealers expect their new equipment inventories to normalize in 2023. By comparison, no large ag equipment dealers reported having normal inventories currently and 21% expected normal inventories in the first half of 2022. Exactly half of large ag dealers forecast normal inventories by 2023. Dealers that sell both large and small ag equipment were less optimistic on the near future, with only roughly 9% expecting normal new inventories before 2023.

New Equipment Pricing Hits New High Second Month in a Row

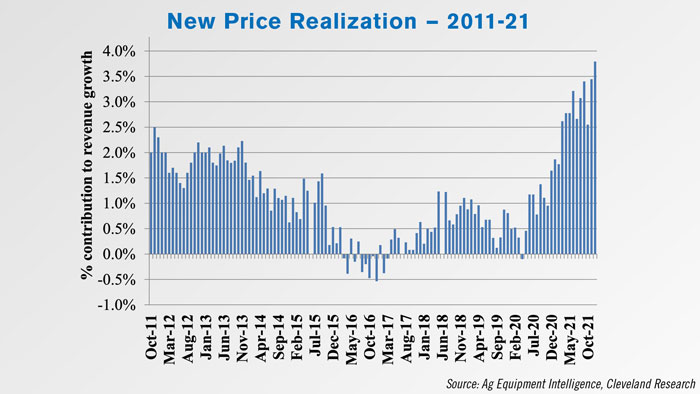

This month’s Ag Equipment Intelligence Dealer Sentiment & Business Condition Update saw new equipment pricing hit a record high for the second month in a row

New price realization hit 3.8% in December 2021, up from 3.4% in November, both of which are record highs at their time of publication. Price realization has been on the rise since early 2020 and broke into new highs in early 2021.

One dealer from the Lake States felt higher prices were just one of the potential challenges to current equipment demand, saying, “We are nervous that demand will trend downwards after price realization, less discounting and now higher interest rates and input costs hit farmers’ balance sheets.”

As always, we welcome your feedback. You can send comments and story suggestions tokschmidt@lessitermedia.com. Until next time, thanks for joining us.

Post a comment

Report Abusive Comment