The latest episode of On the Record is now available!

In this week's episode we look at how ag equipment manufacturers compare to other machinery sectors in their recovery. In the Technology Corner, Michaela Paukner looks at how the massive “all-in-one” machine by NEXAT handles every work step in production agriculture, including soil cultivation, sowing, crop protection and harvesting. Also in this episode: a number of dealers are making acquisitions in Dealers on the Move, Deere acquires battery technology provider Kreisel Electric and Ben Thorpe examines how the major OEMs' R&D expenses compare to their ag sales.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Ag Equipment Among Leaders in Machinery Sector Recovery

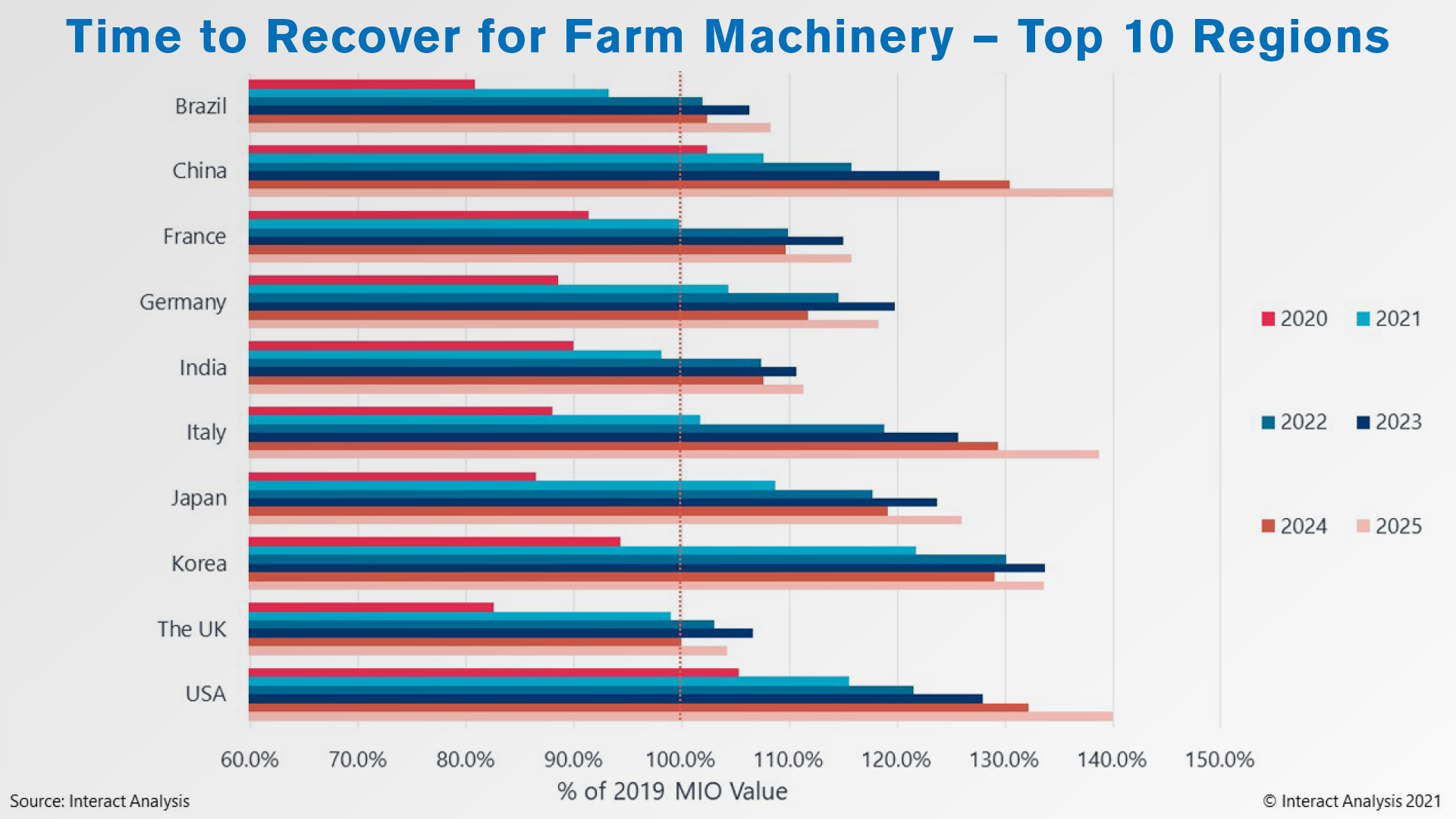

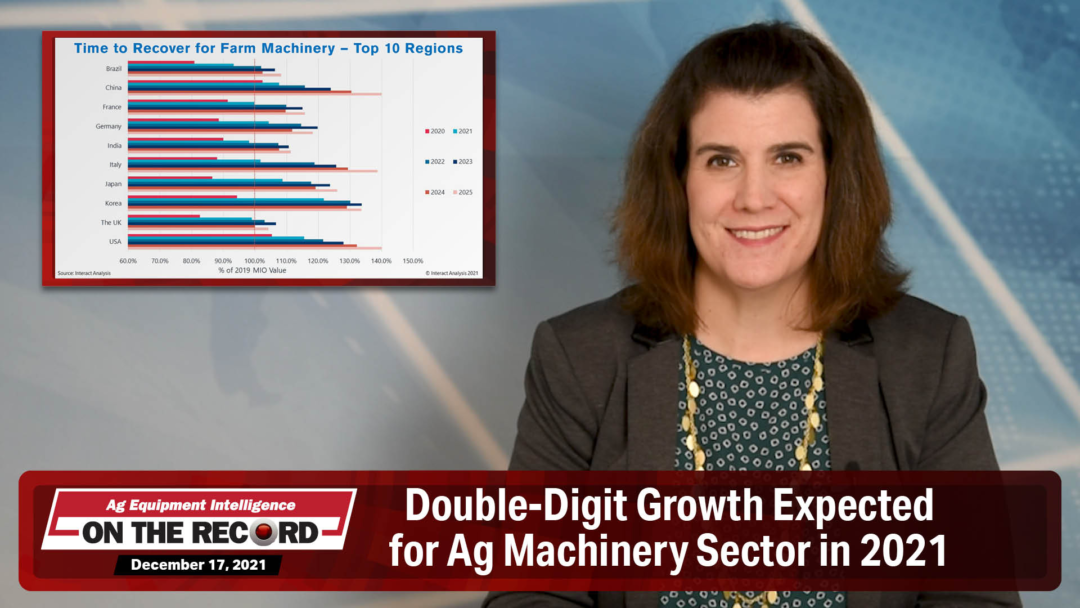

Sluggish activity in the farm machinery market in the year prior to 2021 positions farm machinery demand for strong growth over the coming 5 years.

Adrian Lloyd, CEO of Interact Analysis, says the ag sector saw growth during COVID-19 lock downs as eating habits changed and there was an uptick in demand for fruit, vegetable and meat from household consumers.

Lloyd says a number of factors points to the short-term future being healthy for farm equipment manufacturers. He says, “Firstly, crop prices are currently very high and this, coupled with high yields and low interest rates, has encouraged agriculturalists to open their wallets and invest in new equipment. Furthermore, sluggish activity in the market over the previous five years has meant that many farmers are using old machinery and are getting ready to replace or upgrade their machines. Interact Analysis predicts overall growth in the sector to reach 12.3% in 2021, with machinery manufacturers in Japan, Korea, Italy and Germany all posting double-digit growth. Japan’s growth is expected to be in excess of 20%.

Interact Analysis predicts overall growth in the sector to reach 12.3% in 2021, with machinery manufacturers in Japan, Korea, Italy and Germany all posting double-digit growth. Japan’s growth is expected to be in excess of 20%.

Dealers on the Move

This week’s Dealers on the Move include United Ag & Turf, Pape Machinery. Gooseneck Implement and P&K Equipment.

John Deere dealer United Ag & Turf has acquired 4 Harvest Equipment locations in Vermont, Theriault Equipment in Presque Isle, Maine, All Power Equipment in Granby, Mass., and Tom’s Lawn and Garden Equipment Inc. in Portsmouth, R.I. The merger brings United Ag & Turf’s footprint to 63 John Deere Ag & Turf stores, plus an additional 14 locations of John Deere Construction & Forestry dealerships operated by its sister company, United Construction & Forestry.

The dealership also announced it is relocating its Texarkana, Texas location. The new location is currently under construction and will sit on 22 acres.

Pape Machinery Agriculture & Turf announced it has completed the asset purchase of Valley Truck & Tractor, a 9-store John Deere dealership group in California. Valley Truck & Tractor was Farm Equipment’s 2017 Dealership of the Year.

John Deere dealer Gooseneck Implement has announced plans to build a new dealership in Dickinson, N.D. This new location will house the parts, sales and service all in one location. This will be the dealership's 14th store.

P&K Equipment has expanded to a total of 20 locations with the acquisition of Standridge Equipment, Co., a John Deere dealership with locations in both Chickasha and Duncan, Okla. The two newest locations will join P&K Equipment’s 18 existing locations, including 16 throughout Oklahoma and 2 in Arkansas.

Technology Corner

A massive “all-in-one” machine by NEXAT can handle every step in production agriculture autonomously, from soil cultivation and sowing to crop protection and harvesting.

The holistic crop production system is based on the interchangeable carrier vehicle that you see here. It drives horizontally on the field and vertically on roads. The technology needed for each step in production can be installed as a module on the machine, and the system can operate autonomously.

The company says swapping modules can be done by one person in 10 minutes, with plans to automate this step in the future.

The system has working widths from about 19 feet to nearly 79 feet. An operator can monitor the machine working from a swiveling booth on the end of the system. The machine’s electric generators are powered by two 550 horsepower diesel engines, and the system is prepared for green hydrogen fuel cells. NEXAT says the all-in-one machine delivers 50% more power with 40% less weight.

The vehicle can be used for controlled traffic farming and is prepared for full autonomy because of its consistent working width. NEXAT says the machine won’t drive over 95% of the total arable area. The company translates the reduction in compaction to a possible 10-20% yield increase and a 20-50% increase in profitability for a grower.

Additional benefits to growers include soil improvement, CO2 savings and erosion reduction.

The system has been successfully used in crop production under real conditions for 3 years, including for corn, soybeans and sunflowers. It recently won a 2022 gold Agritechnica Innovation award.

NEXAT was founded in 2017 by Kalverkamp Innovation with help from other agricultural manufacturers, including Swedish ag equipment company Väderstad.

Deere Moves Toward Electrification with Kreisel Acquisition

On Dec. 14, Deere announced it was acquiring a majority ownership of Kreisel Electric, an Austrian battery technology provider. The acquisition gives Deere access to two of Kreisel’s unique products: high-density electric battery modules and its charging infrastructure platform.

According to Deere’s press release, the acquisition will allow Deere to integrate vehicle and powertrain designs around these battery packs while leveraging the charging technology to build out infrastructure for customer adoption.

Deere said it anticipates a growing demand for batteries as a sole- or hybrid-propulsion system for off-highway vehicles, with products like turf equipment and compact tractors possibly using only battery power.

Senior Analyst with RW Baird Mig Dobre said in a note to investors that the fast-charging infrastructure could play a crucial role in Deere’s electric equipment offerings.

“Fast charging capabilities remain a barrier to widespread off highway EV adoption. Offering a one stop solution of equipment and infrastructure will increase adoption.”

Kreisel’s charging infrastructure would also give farmers the ability to charge their equipment with wind or solar power according to Dobre, which could “relieve the cost pressures of power grid charging during peak hours.”

Kreisel’s battery technology will also offer Deere benefits in the way of cheap and automated production. Dobre points out that Kreisel uses modular architecture to combine voltages, energy densities and power, leading to high scalability and low development costs for new applications.

Comparing OEMs’ R&D and Ag Sales

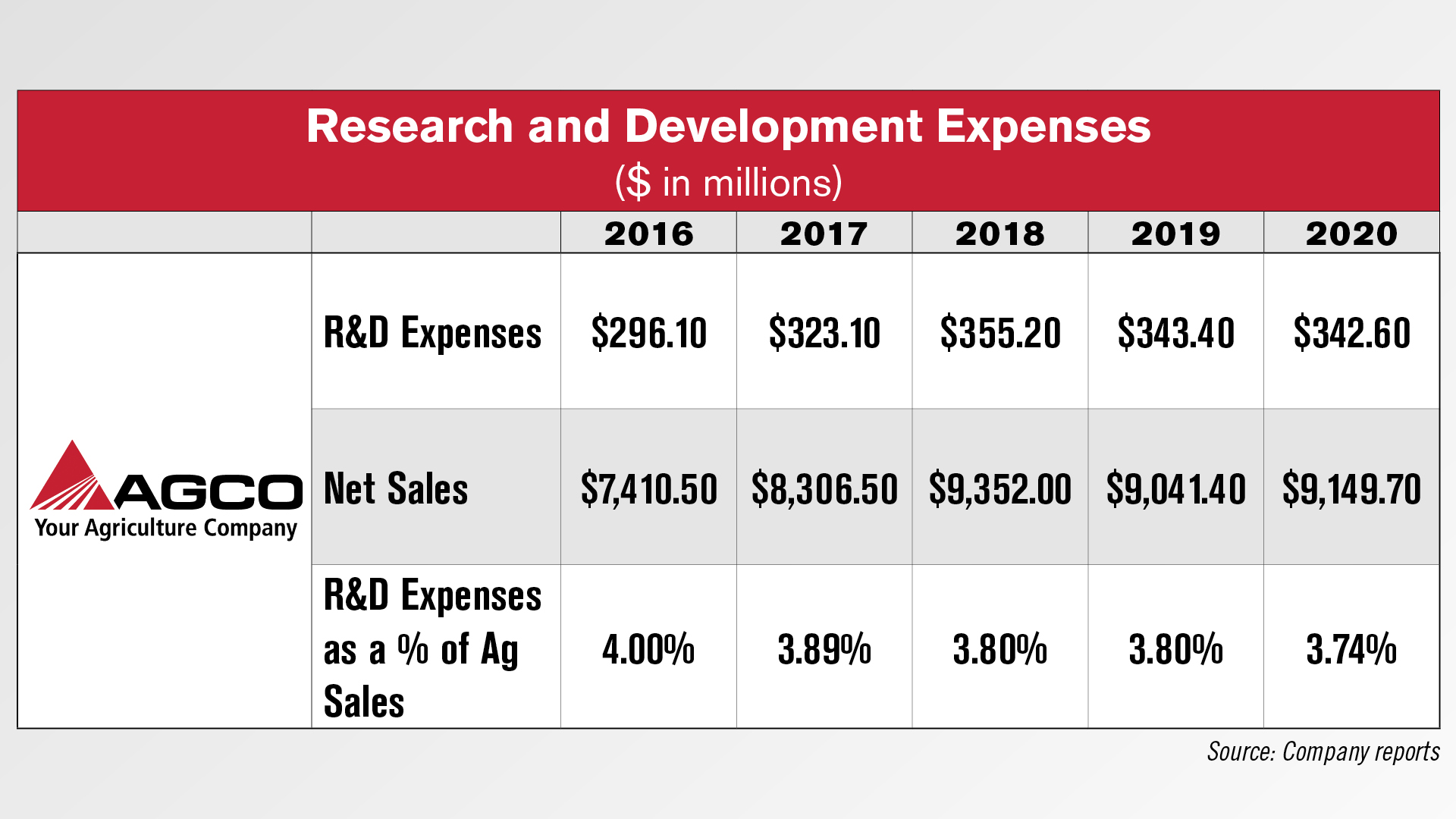

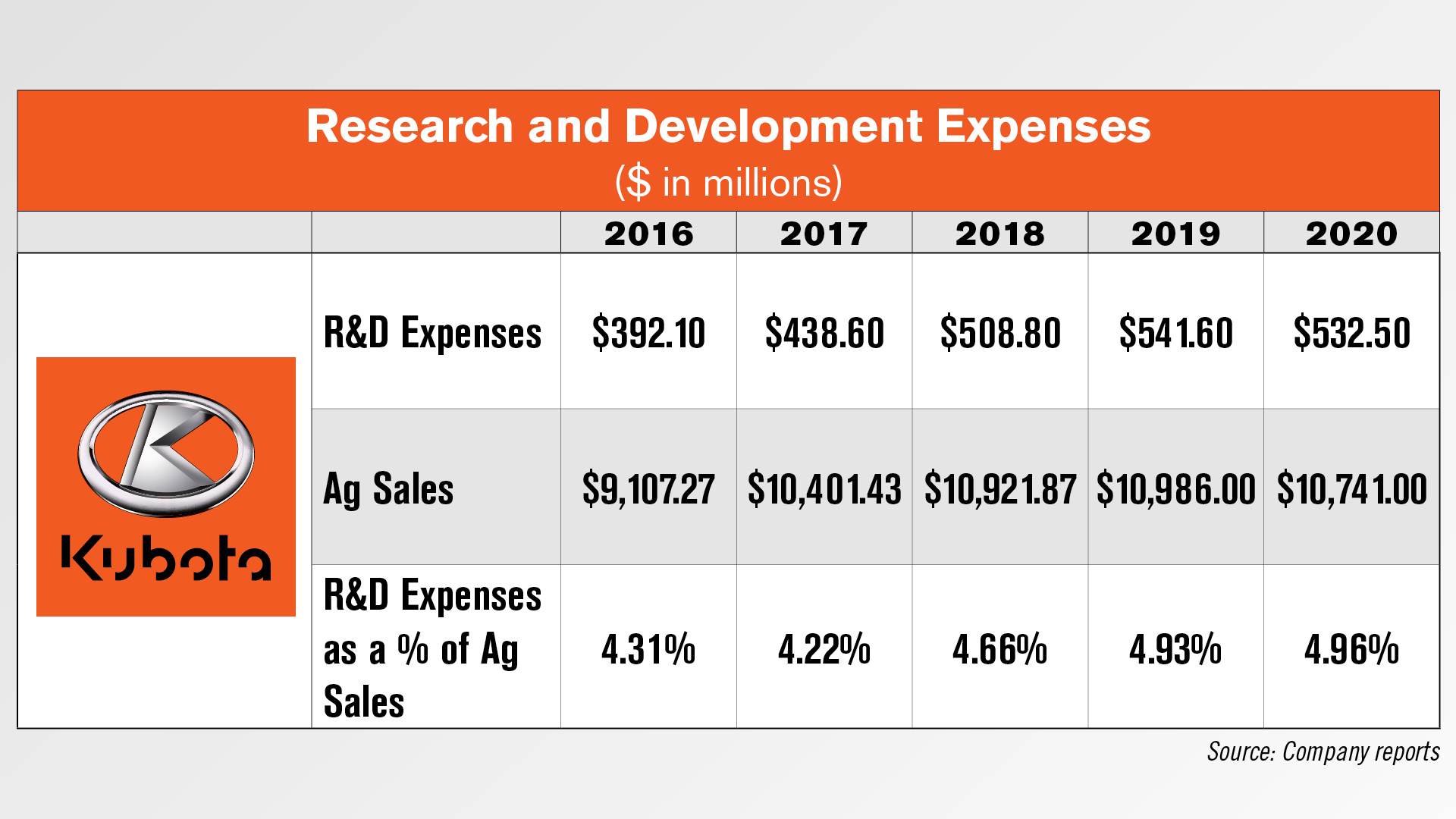

In a recent report, Ag Equipment Intelligence isolated the R&D expenses of the 4 majorline manufacturers and compared them to those manufacturers’ ag equipment sales. This offers a look at the relationships that exist between the health of these manufacturers’ ag equipment business and the money they invest into creating new products.

R&D data reporting does vary slightly by manufacturer and the expenses reported here are not specific to ag equipment sales and likely include expenses put toward other segments. AGCO’s R&D expenses as a percentage of its ag sales were the lowest each year for the last 5 years, peaking at 4% in 2016. AGCO also reported the least total R&D expenses of any manufacturer each year, with a high of $355 million in 2018.

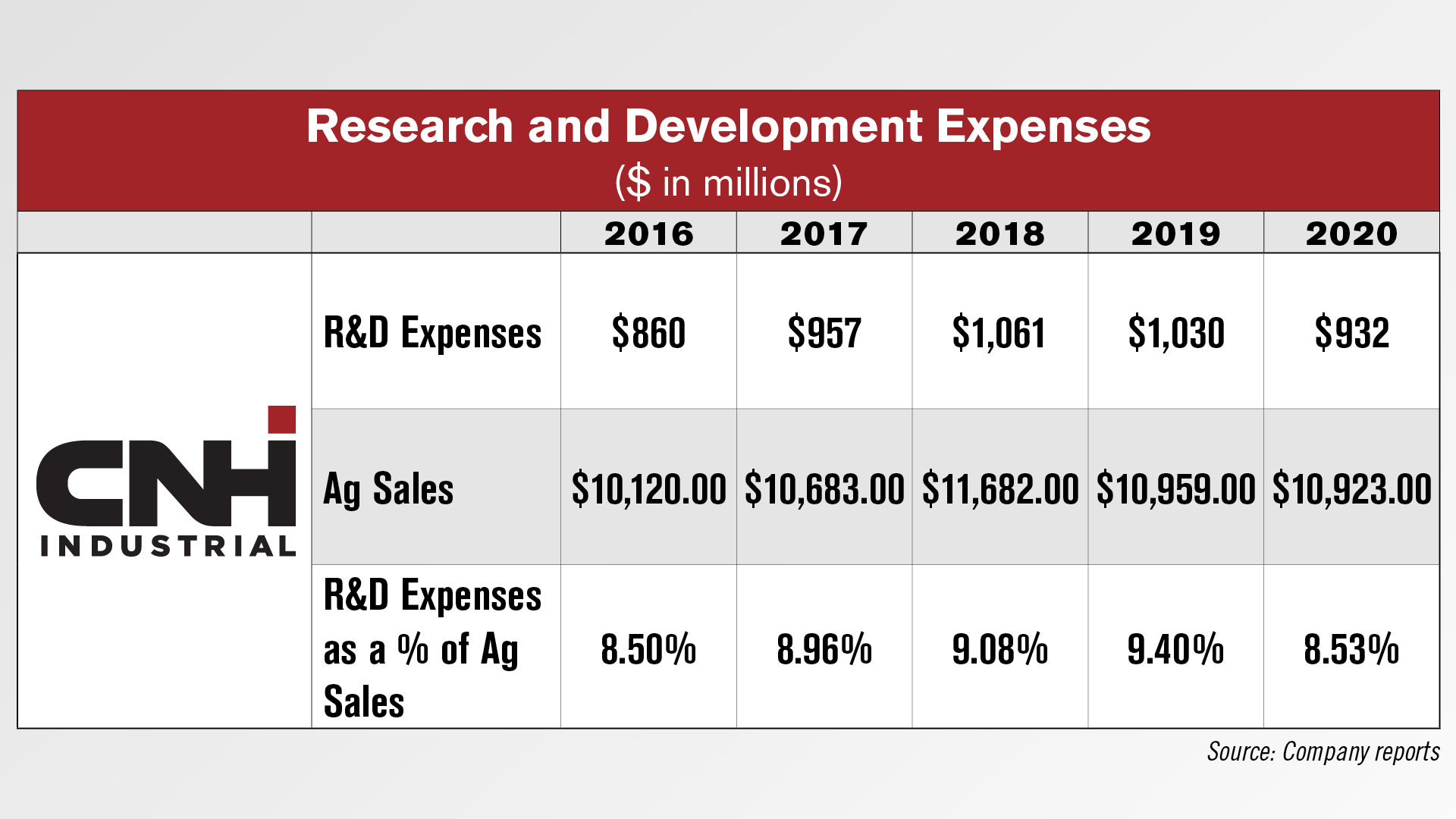

AGCO’s R&D expenses as a percentage of its ag sales were the lowest each year for the last 5 years, peaking at 4% in 2016. AGCO also reported the least total R&D expenses of any manufacturer each year, with a high of $355 million in 2018. CNH Industrial, on the other hand, had the highest percentage of its R&D expenses as compared to its ag sales each year, peaking at 9.4% in 2019. CNHI’s R&D expenses peaked at $1.1 billion in 2018, the same year that its ag sales peaked at $11.7 billion.

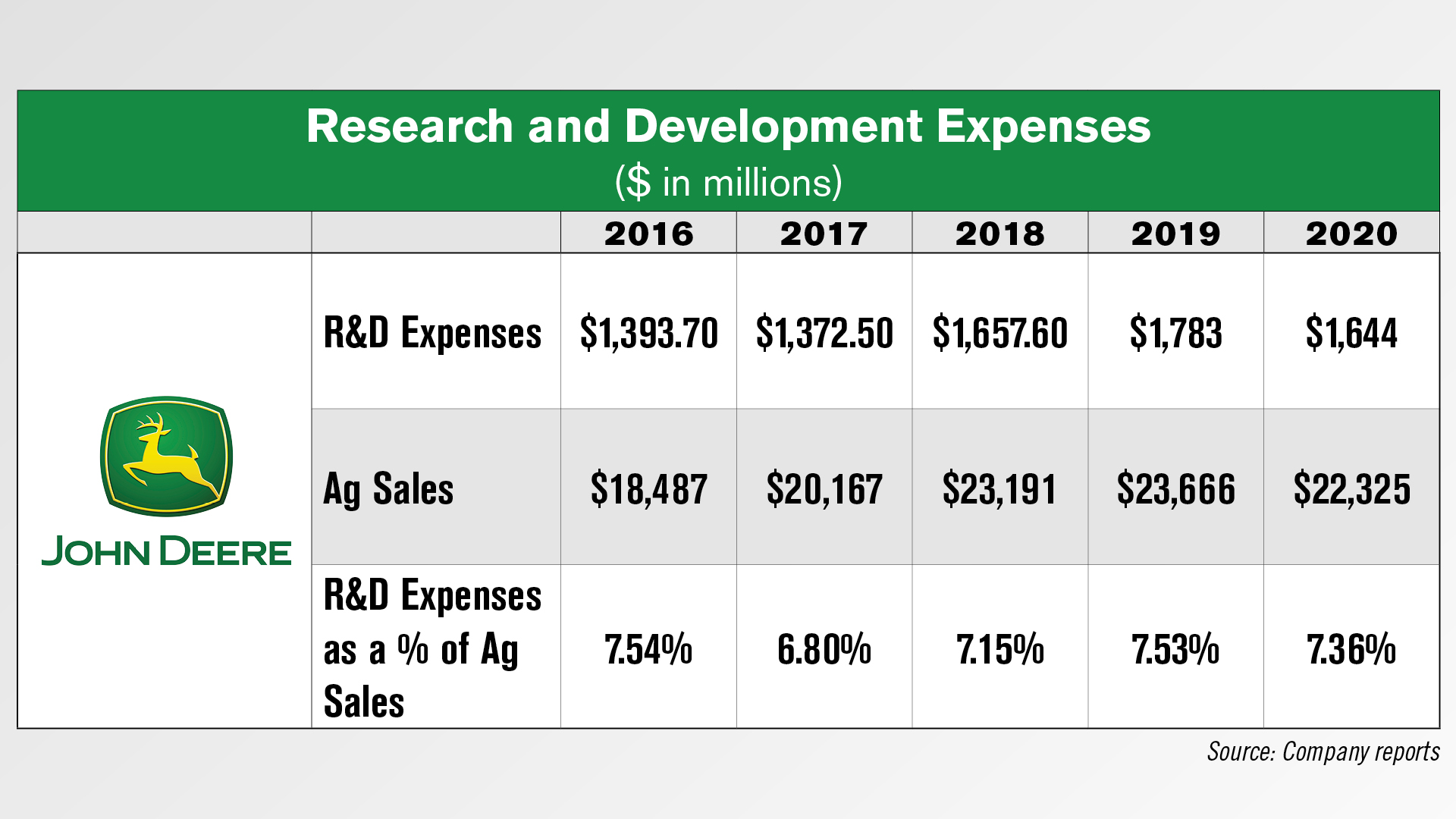

CNH Industrial, on the other hand, had the highest percentage of its R&D expenses as compared to its ag sales each year, peaking at 9.4% in 2019. CNHI’s R&D expenses peaked at $1.1 billion in 2018, the same year that its ag sales peaked at $11.7 billion. John Deere R&D expenses as a percentage of ag sales peaked in 2016 at 7.54% before dropping to a 5-year low of 6.8% in 2017. Both Deere’s R&D spending and ag sales have risen since 2016, by around 18% and 21% respectively.

John Deere R&D expenses as a percentage of ag sales peaked in 2016 at 7.54% before dropping to a 5-year low of 6.8% in 2017. Both Deere’s R&D spending and ag sales have risen since 2016, by around 18% and 21% respectively. Kubota reported the greatest increase in R&D spending in the last 5 years, rising 36% to $532 million in 2020. Ag sales rose around 18% in that same period to $10.7 billion. As a percentage of its ag sales, Kubota’s R&D expenses rose from 4.31% in 2016 to 4.96% in 2020, a 5-year high.

Kubota reported the greatest increase in R&D spending in the last 5 years, rising 36% to $532 million in 2020. Ag sales rose around 18% in that same period to $10.7 billion. As a percentage of its ag sales, Kubota’s R&D expenses rose from 4.31% in 2016 to 4.96% in 2020, a 5-year high.

Post a comment

Report Abusive Comment