The latest episode of On the Record is now available!

In this week’s episode, a net 82% of dealers report their new equipment inventory is too low and say they are seeing price increases from the OEMs ranging from 4% to as high as 22%. In the Technology Corner, Michaela Paukner reports on the proposed precision loan program Sen. Deb Fischer and Sen. Amy Klobuchar recently introduced. Also in this episode, German shortline manufacturer Horsch says it will almost double production capacities with a number of world-wide investment projects within the next 2-3 years. According to the 2022 Dealer Business Outlook & Trends report, dealers are forecasting new equipment revenues to increase next year, along with price increases from their OEMs. And, the Business Climate Index for the Agricultural Machinery Industry in Europe dropped for the third month in a row to 63 points.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Pricing & Inventory Continue to Plague Dealers

As demand for ag equipment continues to hold strong, dealers report continued inventory shortages coupled with price increases from their manufacturers.

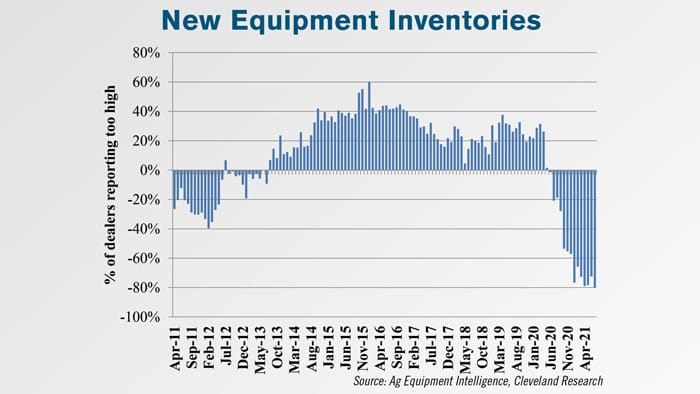

In the latest Dealer Sentiments Report, a net 82% of dealers reported their new equipment inventory was too low. This is the highest net percentage of dealers reporting depleted new equipment inventories since the start of the survey in 2011.

In the latest Dealer Sentiments Report, a net 82% of dealers reported their new equipment inventory was too low. This is the highest net percentage of dealers reporting depleted new equipment inventories since the start of the survey in 2011.

The latest survey also showed price contribution was up 3.1% in August, vs. up 2.7% in July.Commentary suggests the increase in price is the result of freight and material surcharges.

Dealers have reported steel surcharges as low as 4% and as high as 22%. Long-time dealers say they’ve never seen anything like this.

Leo Johnson, dealer principal of Johnson Tractor says, “I’ve seen price increases, steel surcharges, fuel surcharges and a host of other pricing gouges in my 40 plus years of doing this, but never to the level we’ve seen in the last 12 months. My only experience with this hyperinflation was visiting Brazil 25 years ago when the restaurants had to go to chalk boards instead of printed menus because they had to raise the prices every day!”

Dealers on the Move

This week’s Dealers on the Move are Marshall Machinery and Pattison Agriculture.

Kubota dealer Marshall Machinery has acquired Goodrich Implement in Johnson City, N.Y. Marshall Machinery now has 5 locations.

Canadian John Deere dealer Pattison Agriculture announced plans for a new facility in Humboldt, Sask. The project will span over 30 acres, with 51,000 square feet in the main building, plus an additional 16,000 square feet of storage. The Humboldt location is expected to transition to the new building as early as December 2022.

Proposed Precision Loan Program Could Help Growers, Dealerships Generate More Revenue

A new bill introduced in the U.S. Senate would provide loan financing to farmers and ranchers to purchase precision agriculture equipment.

Sen. Deb Fischer, R-Neb., and Sen. Amy Klobuchar, D-Minn., announced the Precision Agriculture Loan Act on Sept. 15. It’s the first federal loan program dedicated entirely to precision agriculture.

The act would create a program within the U.S. Department of Agriculture to provide loans at interest rates lower than 2% with loan terms from 3 to 12 years in length. Under the proposal, farmers could take multiple loans up to an aggregate limit of $500,000 to use on any precision technology that improves efficiency or reduces inputs.

In her Senate floor speech on Sept. 20, Fischer said precision equipment has the ability to transform how producers manage farms, especially those running small family farms who may not be able to afford precision equipment currently.

“My bill would help the math start to make sense for our producers who would like to adopt these technologies, but they haven’t been able to afford them,” Fischer says.

The Association of Equipment Manufacturers released a statement supporting the act, saying it gives farmers a new set of tools to help achieve climate goals while continuing to feed and fuel the world.

Scott Hoober — one of the owners of the 10-store dealership Hoober Inc. in Pennsylvania, Delaware, Maryland and Virginia — also sees the act as good for dealerships’ business.

“Most dealerships today have a significant precision ag department or individuals who are involved with precision ag, so that can add additional customers to our customer base, and the customers that are there, help them to invest even more,” Hoober says. “In either case, it could help to generate revenue in the dealerships.”

Under the proposal, farmers would be able to take loans to purchase new precision equipment or retrofit older equipment with new technology. Hoober predicts dealerships would see customers requesting a combination of both with the financing.

“Typically what we see is for those that aren't as heavily involved (with precision agriculture), we’re usually retrofitting to get them started,” Hoober says. “Once they start seeing the benefits on stuff that retrofitted, then they'll trade up and go to a complete system that's already installed on a unit or a new unit completely. At the same time, it depends on the individual’s desires and in their ability to purchase new equipment.”

The bill has been referred to the Senate Committee on Agriculture, Nutrition, and Forestry. It must pass the Senate and House before heading to the president’s desk to be signed into law. As of Sept. 28, no future action has been scheduled.

Horsch Aims to Double Global Production Capacity

Factory expansion projects will nearly double Horsch production capacity over the next few years as the German manufacturer of cultivators, seed drills, planters and crop sprayers looks forward to continued growth.

In Germany, a $20 million project already underway will provide increased office accommodation and an additional assembly hall at the company’s Ronneburg facility for large cultivator and seed drill production by the middle of next year.

A new painting facility for the Schwandorf headquarters plant is likely to be completed by the end of 2022, and plans are being developed to increase assembly and painting capacities at Landau to cater for growing sales of Horsch crop sprayers, which now include tractor-mounted as well as trailed and self-propelled models.

The manufacturer also has plans for a new factory in Curitba, Brazil. Expanded production capacities in Russia are also planned. Director Phillipp Horsch said in total, they “will almost double production capacities with these world-wide investment projects within the next 2-3 years.

Dealers Forecast New Equipment Revenue, Prices Increases

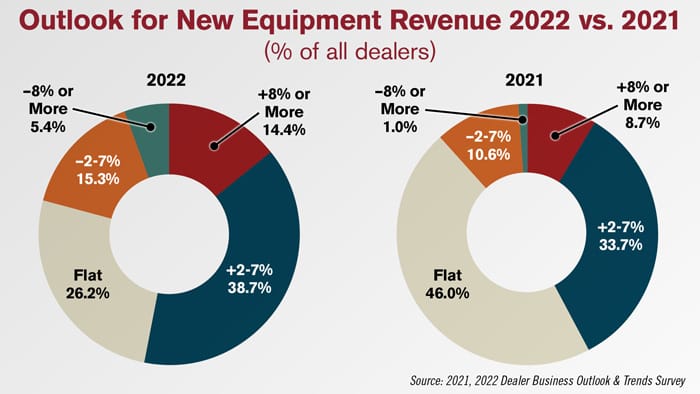

Based on results from the 2022 Dealer Business Outlook & Trends Report, dealers’ forecasts for new equipment revenue were much higher than the last 2 years. Some 53% of dealers expect new equipment revenue to be up by at least 2% year-over-year in 2022, surpassing the 42% who forecast the same in last year’s report.

This year, 14% of dealers forecast new equipment revenue to increase 8% or more, above the 9% who thought the same last year. Additionally, the percentage estimating new equipment revenue up 2-7% rose from 34% last year to 39% this year. The percentage of dealers forecasting at least a 2% decrease in new equipment revenue also rose from 12% to 21%, and a little over 5% of dealers forecast new equipment revenue down 8% or more in 2022.

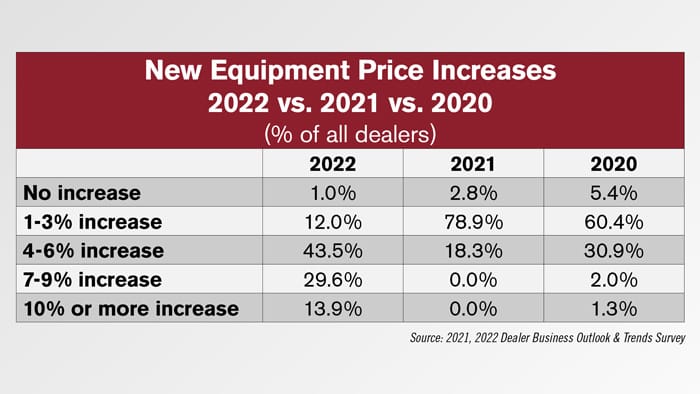

Just 1% of surveyed dealers expected no price increase from their OEMs in 2022, showcasing the severity of price increases as supply chains struggle to meet increasing demand.

Some 14% of surveyed dealers are forecasting a price increase of 10% or more from their OEMs next year, while almost 30% are expecting an increase of 7-9%. In total, 87% of surveyed dealers forecast a new equipment price increase of 4% or more for 2022.

European Ag Equipment Industry Sentiment Remains Positive

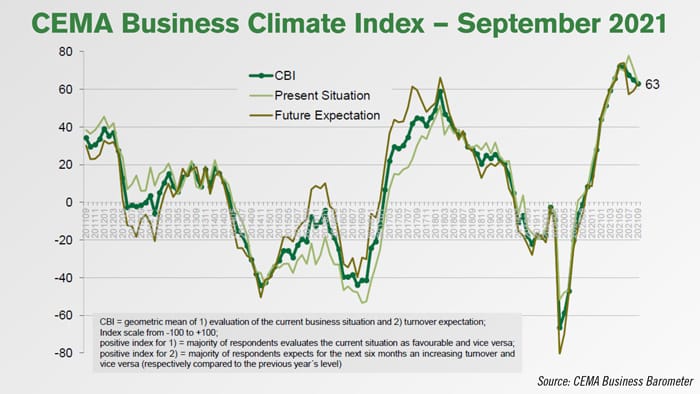

The Business Climate Index for the Agricultural Machinery Industry in Europe seems to have reached its peak in May and June of this year. In September, the index decreased slightly for the third month in a row to 63 points and was the result of some companies evaluating their current business less favorably.

Uncertainty continues as to what extent orders can be realized against the backdrop of extreme price increases and shortages on the supplier side. Meanwhile, 40% of the companies expect a production stop due to a lack of certain parts in the coming month.

Uncertainty continues as to what extent orders can be realized against the backdrop of extreme price increases and shortages on the supplier side. Meanwhile, 40% of the companies expect a production stop due to a lack of certain parts in the coming month.

On the other hand, demand from end customers in Europe seems to remain robust. The industry still sees a high need for investment for almost all of Europe, especially among farmers within Central to Eastern Europe. Accordingly, every European market shows a majority of survey participants expecting turnover increases in the next 6 months.

Against this background, European industry representatives remain confident on closing the year with strong results. With regard to the full year 2021, on average, survey participants expect for their companies a turnover increase of 13%.

Post a comment

Report Abusive Comment