The latest episode of On the Record is now available!

In this week's episode, we report on Cervus Equipment's record second quarter earnings as well as the dealership's announcement that it has agreed to be acquired by Brandt Tractor. In the Technology Corner, Michaela Paukner discusses Purdue University's new precision ag course for high school teachers. Also in this episode: AGCO CEO Eric Hansotia says they are positioning Challenger as a "track tractor" brand, dealer optimism drops amid inventory challenges and Deere's third quarter earnings report.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Cervus Announces Record 2Q, Acquisition

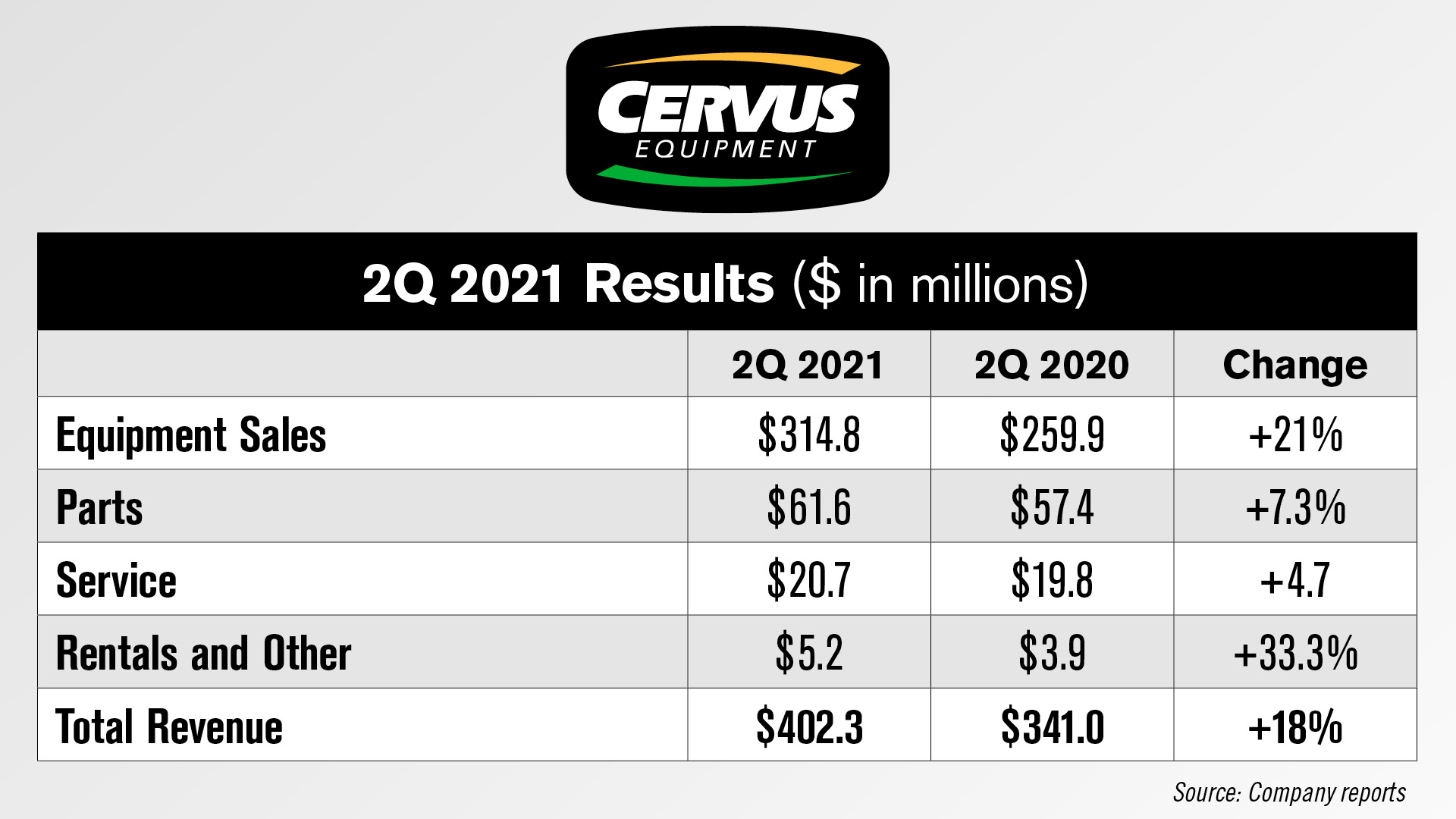

Cervus Equipment, Canada’s largest John Deere dealership, announced record second quarter results earlier this month. The publicly traded dealership reported revenues during the quarter were up 18% to $402 million vs. the same period last year.

Equipment sales revenue for the quarter was $314.8 million, up 21% vs. the second quarter of 2020. Parts revenue increased 7.3% to $61.6 million and service revenue came in at $20.7 million, an increase of 4.7%

Agriculture equipment revenue increased 10% in the quarter and 4% year to date, primarily driven by increased customer demand for new equipment, supported by strong market fundamentals in all geographies.

Product support revenue from ag equipment increased 1% in the quarter and 6% year to date, which Cervus attributes to its execution on strategic parts initiatives, including online and on the road parts sales, and the addition of 2 new locations after the first quarter of 2020, was partly offset by the impact of parts supply shortages and a relatively easy seeding season in the second quarter of 2021.

Ahead of the earnings release, Cervus announced it had agreed to be acquired by Brandt Tractor, the world’s largest privately-owned John Deere construction and forestry equipment dealer. Brandt will acquire Cervus for $19.50 per share in cash or an equity value of $302 million. Bryan Fast, analyst with Raymond James, says the transaction price implies a 1.2x book value. Brandt had already owned a 9% share of Cervus.

Brandt Tractor is part of the Brandt Group of Companies, which is also comprised of Brandt Agricultural Products, Brandt Engineered Products, Brandt Equipment Solutions, Brandt Road Rail and Brandt Positioning Technology.

With this move, Case IH dealer Titan Machinery will be the only remaining publicly owned dealership group in North America.

Dealers on the Move

In addition to Cervus Equipment, this week’s other Dealer on the Move is Johnson Tractor.

The 5-store Case IH dealer Johnson Tractor has relocated its Rochelle, Ill., location. The new 50,000 square foot facility features an open layout with an expo room, large showroom and modern air-conditioned service center.

Purdue to Offer Free Precision Ag Course for High School Ag Teachers

Purdue University is targeting the next generation of growers with a new online Precision Agriculture course.

The online course will be available at no charge for high school agriculture teachers, starting with teachers in Indiana and then expanding to schools around the U.S.

The course will be a revamped version of Purdue’s other online precision ag courses, made possible by a $300,000 grant from the U.S. Department of Agriculture. The project is expected to take three years.

Upon completion, the course will feature a series of modules with resources to improve knowledge of precision agriculture and its applications, including curriculum that can be integrated into classrooms and labs.

The goal of offering the online course to teachers for free is to help prepare students to go into the increasingly information-technology centric field of agriculture.

Bruce Erickson, the head of Purdue’s Agronomy e-Learning Academy, said he wants to attract young, bright minds to agriculture and show them that it’s a viable and meaningful career.

“A lot of students may have a different viewpoint of agriculture than we do. They may think of it as low pay and long hours and not very exciting, but we want to show them this whole other side of agriculture that is a lot of technology and a lot of thinking and exciting things and we’re feeding the world and all of that and helping the environment, and that’s the type of thing that we think will attract tomorrow’s workers that we have in agriculture.”

Erickson said the data lifecycle will be an important part of the new course.

Curriculum will explore everything from sensors to wrangling data from different types of sensors to analyzing the data to get meaningful information.

Purdue currently offers four precision-agriculture courses for ag professionals through its Agronomy e-Learning Academy for a fee.

AGCO Positions Challenger as a ‘Track Tractor’ Brand

In a recent interview at a Fendt press event in Lake Geneva, Wis., AGCO CEO Eric Hansotia addressed the future of the Challenger brand in light of a recent Ag Equipment Intelligence report about AGCO taking the brand to a “retail-only” business model. He says the company currently considers it well positioned in the AGCO portfolio with a focus on track tractors.

“It's [Challenger’s] got a great reputation with track tractors and that machine form, as well as kind of an affiliation with the RoGator product, because a lot of times those dealers will sell both of those products. And so we want to honor that history and for those customers, for which that's important, we want them to have access to that product that still has a great reputation for rugged, reliable, durable brand image. So that fits nicely. So we're allowing the market to pick what they want. And so if they want, in many of these places, if they want to choose the Fendt route, they can go that direction. If they want to go the Challenger route, they can go that direction. And we're really being specific about what role Challenger plays. And it's largely now a track tractor position in the portfolio.”

Hansotia adds that, while AGCO feels Challenger is currently positioned where it needs to be, they’ll be watching customer demand and, if farmers want something different from Challenger, the company will adjust over time.

Dealer Optimism Drops Amid Inventory Challenges

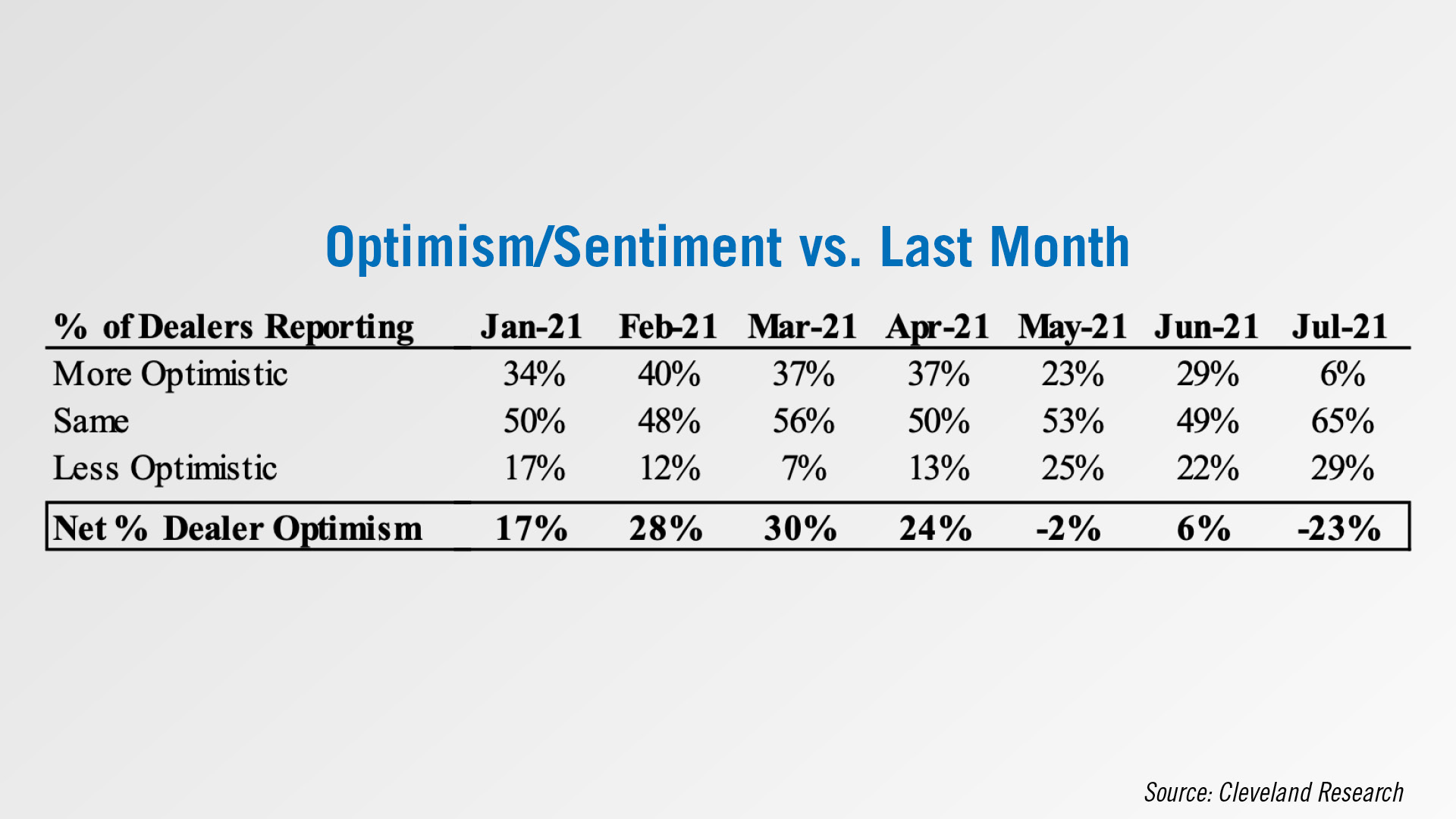

Supply chain issues have been putting pressure on manufacturers and dealers have been tight on inventory for most of 2021. That pressure is starting to take a toll on dealer optimism.

While equipment sales have been strong through the first 7 months of 2021, dealer optimism saw a large drop in the latest Dealer Sentiments & Business Conditions survey.

A net 23% of dealers reported less optimism in July vs. the net 6% of dealers who more optimistic in June. The decrease in both new and used inventories, delayed deliveries, inflation and continued supply chain headwinds appear to be causing some concern among dealers.

One dealer from the delta states and southeast/southern plains region said, “Price increases and lack of availability for whole goods and parts is becoming alarming. We are nervous about 2022.”

Another dealer from the same region commented, “We are less optimistic as inventories run low at the dealer level and within the manufacturers shops. We are also concerned about the general wellbeing of the economy, especially inflation into next year.”

Equipment price increases — both new and used — as well as input costs are also weighing on dealer optimism, and one dealer in the lake states/northern plains says those two factors are impacting year end capital purchases significantly.

Deere 3Q Net Sales & Revenue Up 29%

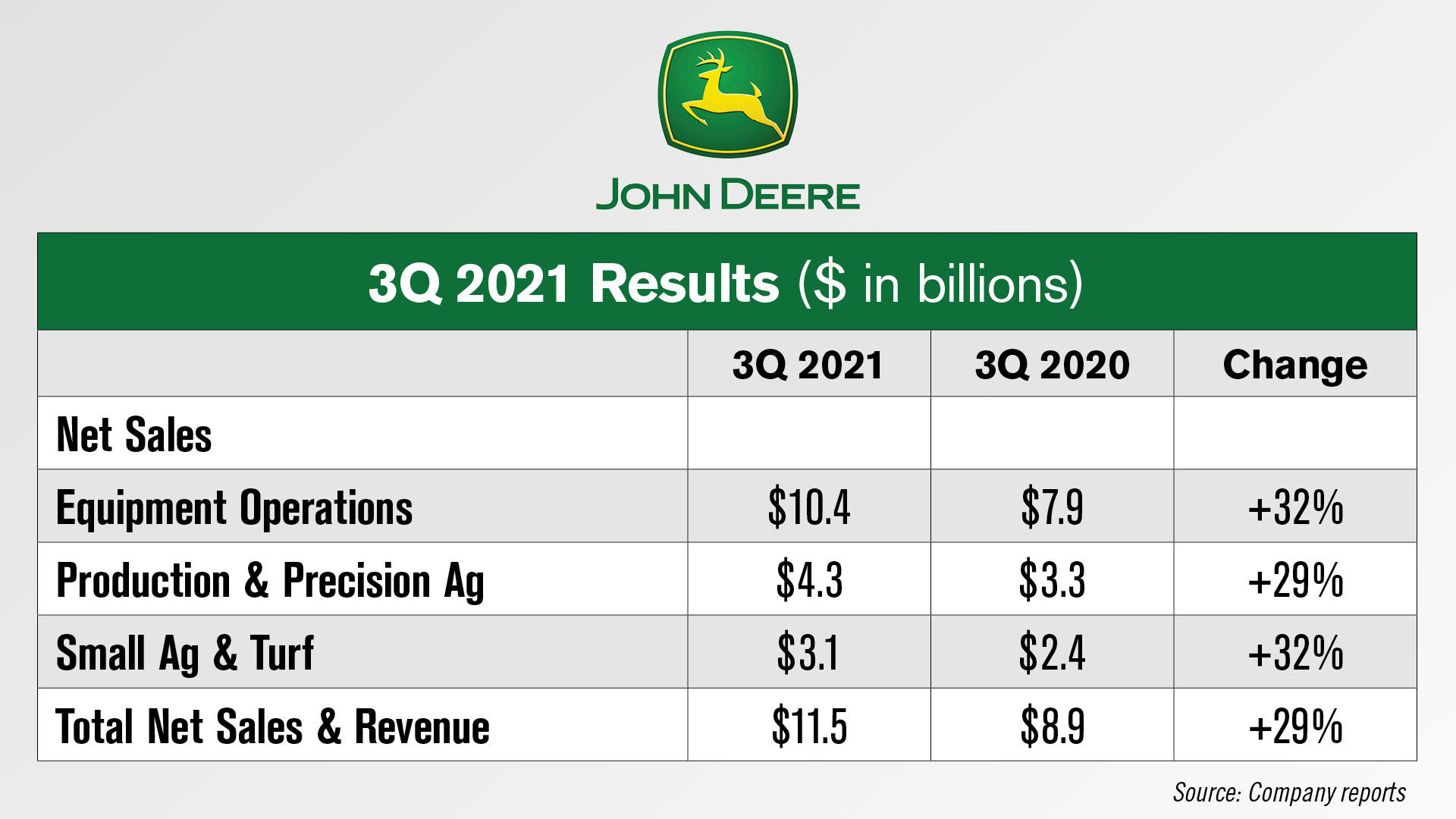

Deere & Co. reported third quarter 2021 net sales and revenues of $11.5 billion, up 29% vs. the same period in 2020. Net sales from equipment operations were $10.4 billion for the quarter, up 32% over the third quarter last year.

Net sales for the production and precision ag segment were $4.3 billion, up 29% over the same period last year. For small ag and turf, net sales were up 32% from last year to $3.1 billion.

Commenting on the supply challenges the industry has been dealing with, Josh Jespen, Deere’s director of investor relations, said, as expected the back half of the year is proving to be more challenging. Deere has seen more disruptions and impacts to production that resulted in losing days of production at different facilities at different times throughout the quarter.

He adds that Deere does not anticipate that easing up as we get into the fourth quarter and into 2022. Jespen says one of the challenges is it’s a wide variety of issues from materials to labor to logistics across the supply chain.

Post a comment

Report Abusive Comment