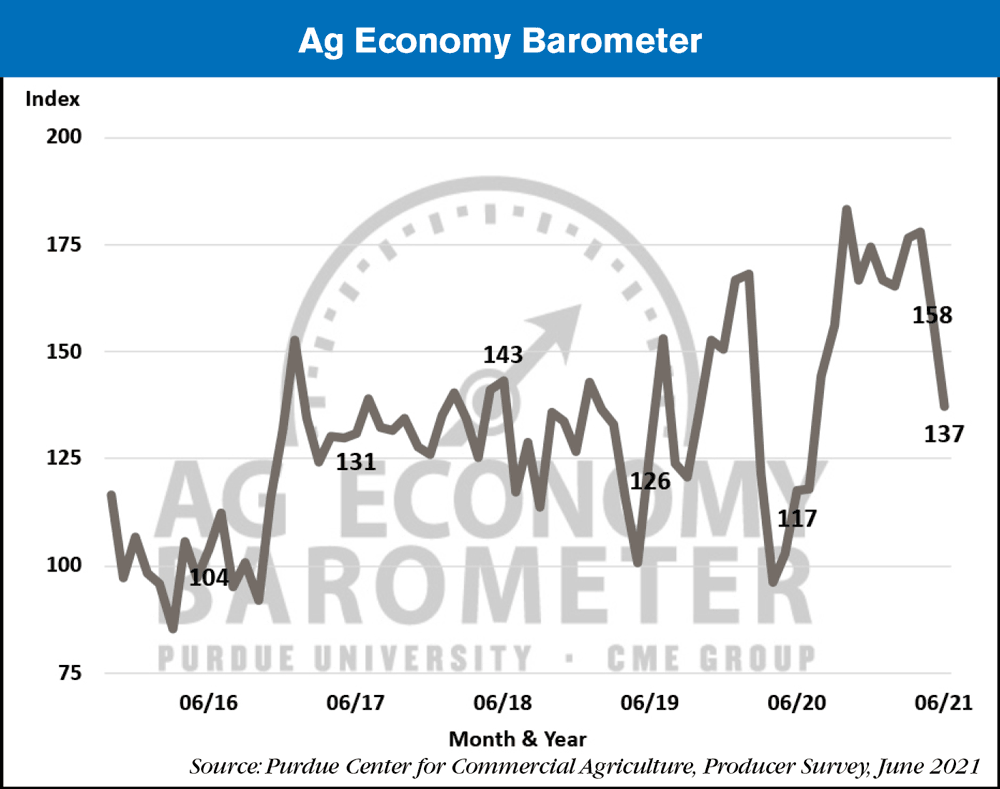

For the second month in a row, the Ag Economy Barometer declined sharply, falling to a reading of 137, which was 21 points below a month earlier, and the weakest ag producer sentiment reading since July 2020. Producers in June were less optimistic about both current conditions on their farming operations as well as their expectations for the future.

Weakening perceptions of current conditions on their farms was the biggest driver of the barometer’s decline as the Index of Current Conditions declined 29 points to 149, the lowest Current Conditions Index reading since September 2020. Producers were also less optimistic about the future as the Index of Future Expectations declined 17 points to 132, the lowest Future Expectations Index reading since July 2020. The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from June 21-25, 2021.

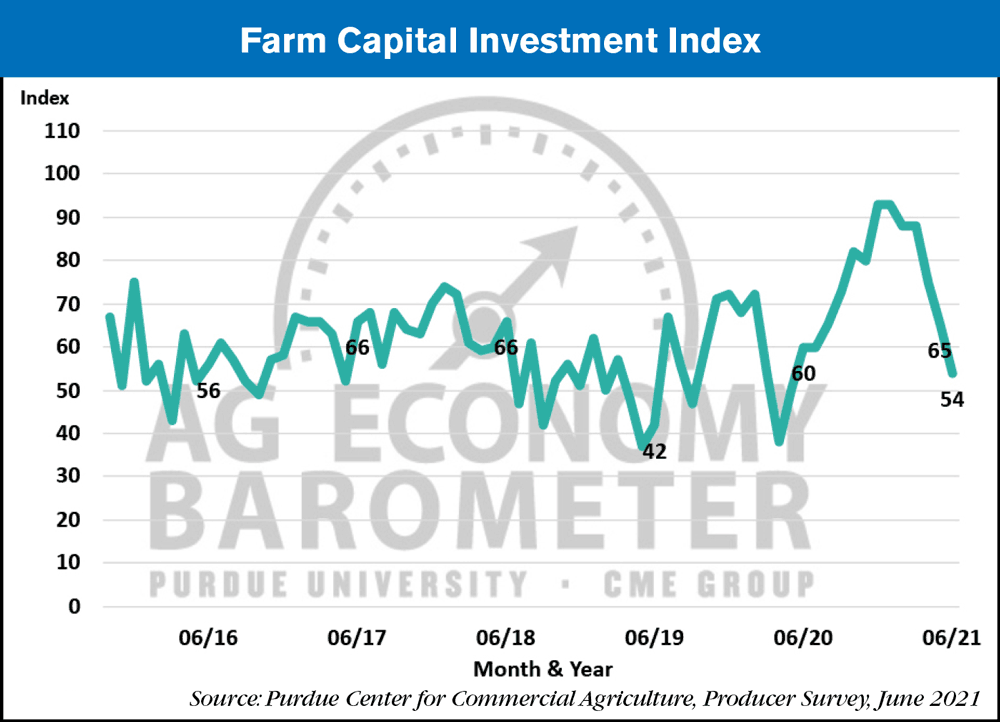

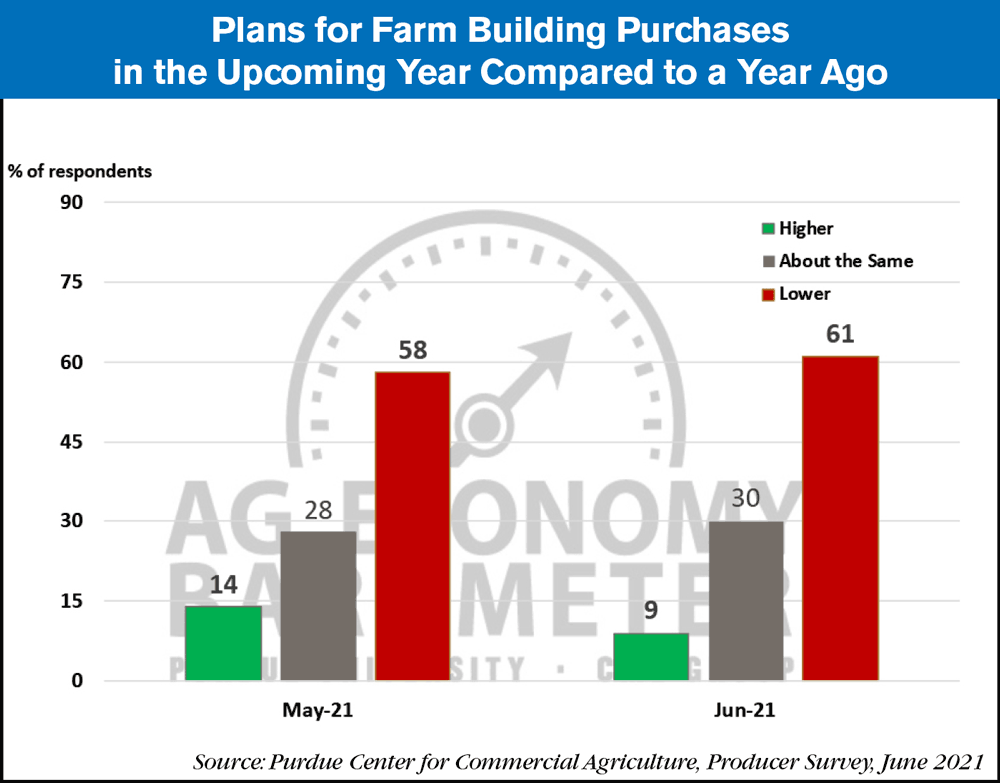

Since peaking in April, producers’ perception of their farms’ financial performance has fallen sharply. This month’s Farm Financial Performance Index, which is based on a question that asks producers about expectations for their farm’s financial performance this year compared to last year, declined 30 points (24%) from a month earlier to a reading of 96. This was the index’s weakest reading since last July. Weakening perceptions of farm financial performance spilled over into the Farm Capital Investment Index which declined 11 points to a reading of 54, the lowest investment index reading since May 2020. Weakness in the investment index appears to be driven more by plans to hold back on constructing new farm buildings and grain bins than farm machinery. The percentage of producers who said they’ve reduced plans for new construction rose to 61% from 58% in May and the percentage planning to increase new construction fell to just 9% vs. 14% a month earlier. This contrasts with results from a similar question regarding farm machinery purchases. The percentage of producers who plan to reduce their machinery purchases fell just 2 points to 44% while those planning to hold purchases constant rose to 45% from 40% with the percentage planning to increase purchases falling to 10% vs. 14% back in May.

Post a comment

Report Abusive Comment