The latest episode of On the Record is now available! In this week's program, we take a look at the recently signed Louisiana law that is aimed at strengthening dealers' positions when it comes to incentive bonuses and "coerced" stocking of parts and equipment. In the Technology Corner, Ben Thorpe takes a closer look at some of the 2021 Precision Farming Dealer Benchmark study results, including aftermarket precision sales. Also in this episode: more on CHI Industrial's acquisition of Raven, dealer optimism turns negative for the first time since April 2020 and China's corn imports from the U.S. rebounded in 2020.

This episode of On the Record is brought to you by Agrisolutions.

Agrisolutions is the market leader in wearable parts, components, accessories and solutions for tillage, seeding, planting, fertilizing, hardware and inventory management solutions. Improve performance and durability with a wide range of in-field and extended life solutions. To learn more about Agrisolutions and their globally recognized brands, such as Bellota, Ingersoll Tillage and Trinity Logistics, visit Agrisolutionscorp.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Louisiana Strengthens Dealer Buyback Laws

The state of Louisiana recently passed an act aimed at strengthening dealers’ positions when it comes to incentive bonuses and “coerced” stocking of parts and equipment.

Signed into law on June 15, ACT 359 addresses “the repurchase of … mechanical equipment by a … manufacturer,” and applies to “written contracts or oral agreements … between any person, firm or, corporation … and any … manufacturer … whereby the retailer agrees … to maintain a stock of … parts, … complete equipment … or attachments.”

ACT 359 establishes three ways in which manufacturers can violate the law when it comes to repurchase agreements with dealers.

The first is by “coercing dealers to accept delivery of equipment parts or accessories which the dealer has not ordered voluntarily, or to seek payment for any such equipment parts or accessories, or their return.”

The second is imposing the burden of proof regarding an incentive agreement on the dealer, meaning that when dealers object to their manufacturer’s market statistics, the manufacturer must provide:

- The name of the entity that purchased the contested equipment upon which the amount of the incentive payment or penalty is based and

- Sufficient evidence of the first substantial use of the contested equipment within the dealer's area of responsibility.

The bill establishes that “sufficient evidence” in this instance must consist of either “Geospatial telematic data from the reported equipment's hardware” or the name of the buyer, the city and state the equipment was delivered to, the delivery receipt, serial number, product segment, model class and size class.

The third way manufacturers can violate this act is by penalizing an equipment sale if the first substantial use of that equipment is outside the dealer’s area of responsibility for ag equipment sales, regardless of the location of either the seller or the customer’s residence.

Dealers on the Move

This week’s Dealer on the Move is N&S Tractor. The Case IH and New Holland dealer has acquired Ag West Supply’s 5 locations in Hillsboro, Woodburn, Rickreall, Harrisburg and Madras, Ore. The dealership now has a total of 13 locations in California and Oregon.

Dealers Report Rising Aftermarket Precision Sales

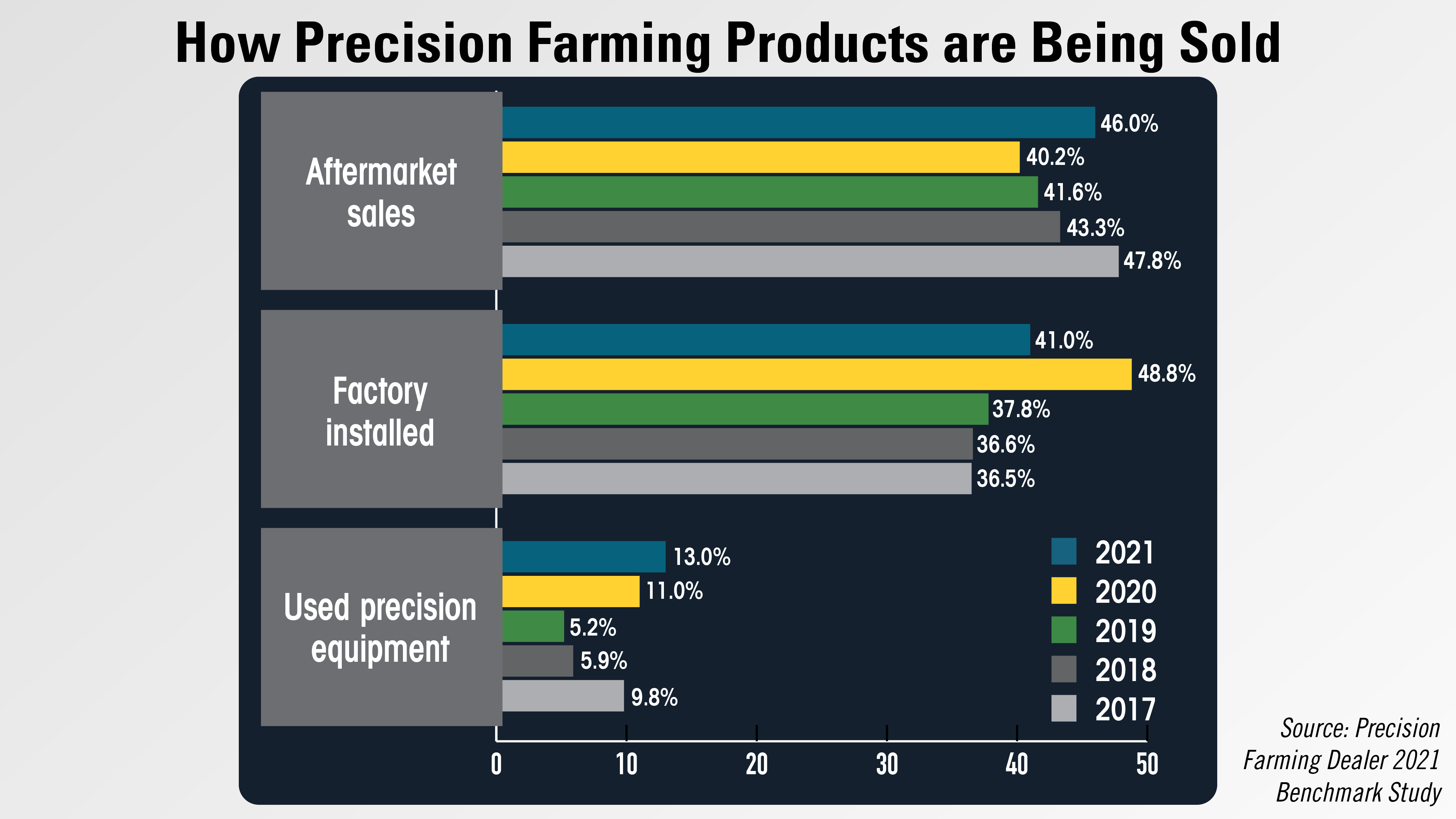

After 5 years of dealers reporting declining aftermarket precision sales, in the 2021 Precision Farming Dealer Benchmark Study, 46% of dealers said their precision products are being sold as aftermarket sales vs. 40% in last year’s study.

The percentage of dealers selling their precision farming products through aftermarket had declined since 2017 when 48% of dealers said that’s how they sell their precision products.

The percentage of dealers who reported precision products were being sold factory-installed declined to 41% vs. 49% in 2020. This is after several years of growth in this category, from 37% in 2017 to 49% in 2020. Used precision equipment sales saw a slight increase to 13% from 11% in 2020, a record high for the last 5 years.

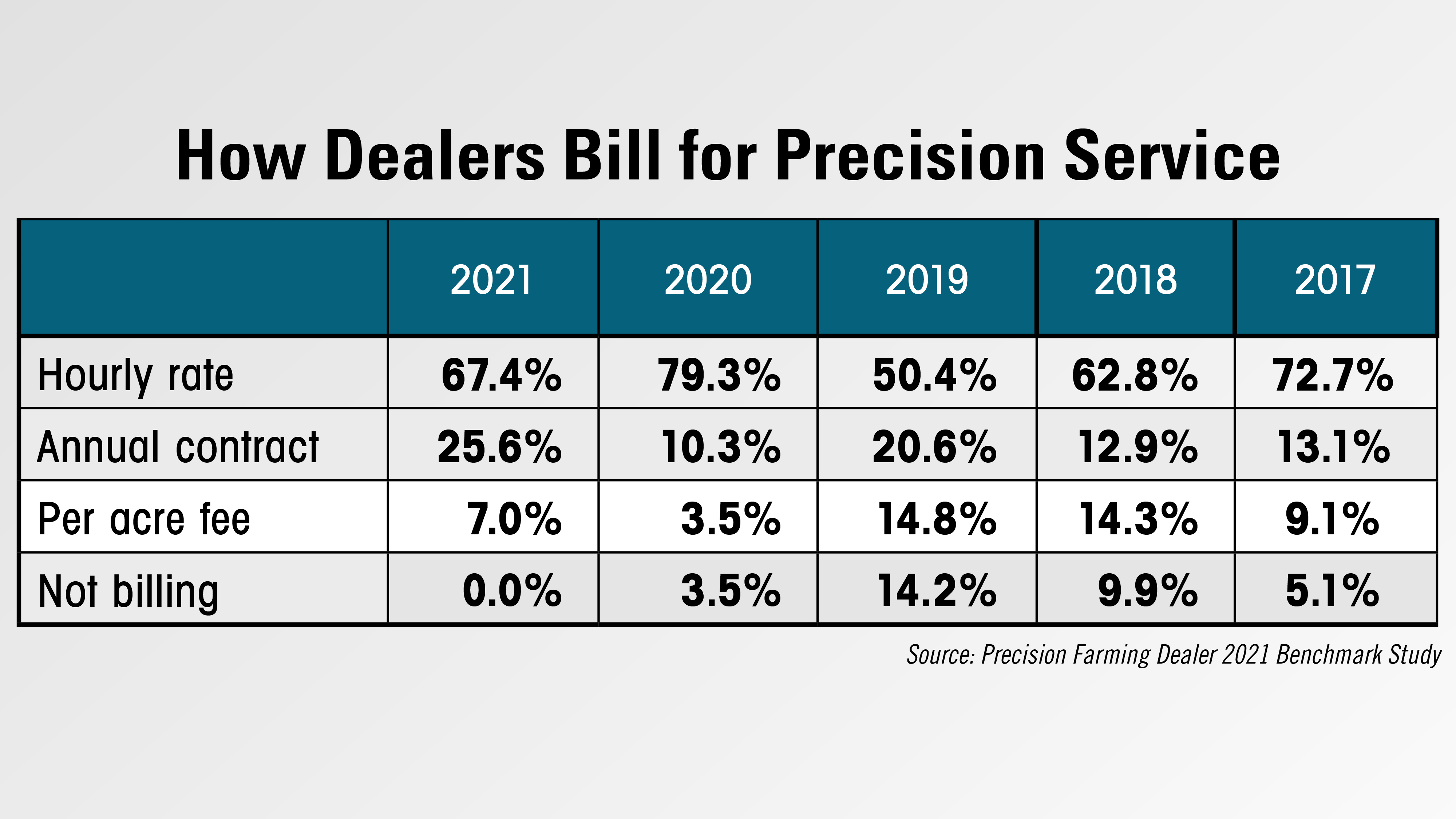

As more equipment comes with precision tech factory-installed, there’s been a push to focus the precision business on service and billing customers accordingly. The number of dealers who are billing for precision service via annual contracts increased to 26% in 2020 from 10% last year. Billing an hourly rate continues to be the most popular method dealers use, with 67% of respondents saying the bill this way, but this was down from 79% in 2020. Just 7% of dealers are charging a per acre fee.

CNHI Acquires Raven Industries

CNH Industrial’s autonomy game is getting a boost thanks to its acquisition of Raven Industries. The deal builds on a long-term partnership between the two companies and will enhance CNH’s position in the market by bringing autonomous and precision ag technology in house.

Mig Dobre, an analyst with Baird Equity Research who reports on Titan Machinery and Deere & Co., said in a note to investors, “The transaction underscores the importance of developing and integrating precision, AI and autonomous technologies while also serving as a reminder of Deere’s differentiated technology suite and the impact it has on the company’s competitive position.”

He adds that CNHI is “paying a rich multiple for Raven” despite more than 50% of its revenues being generated from non-core businesses, and “the multiple paid provide a clue on rapidly evolving competitive dynamics,” and because of that. Baird continues to view Deere as the industry leader.

Dealer Optimism Negative in May

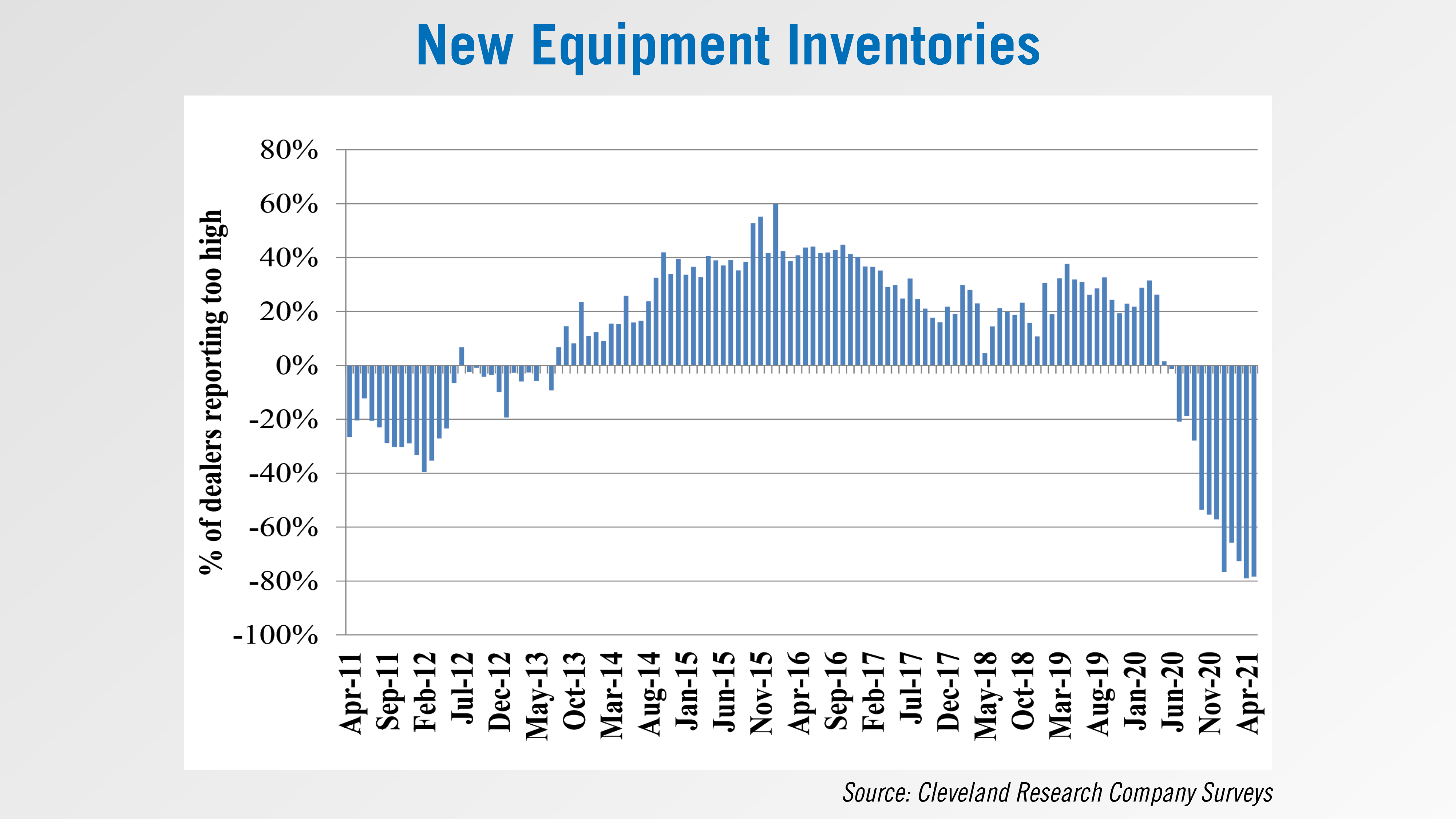

For the first time since April 2020, dealer optimism turned negative in May, according to the latest Dealer Sentiments & Business Conditions report. A net 2% of dealers reported being less optimistic compared to the previous month in May. This compares to April when a net 24% of dealers reported being more optimistic.

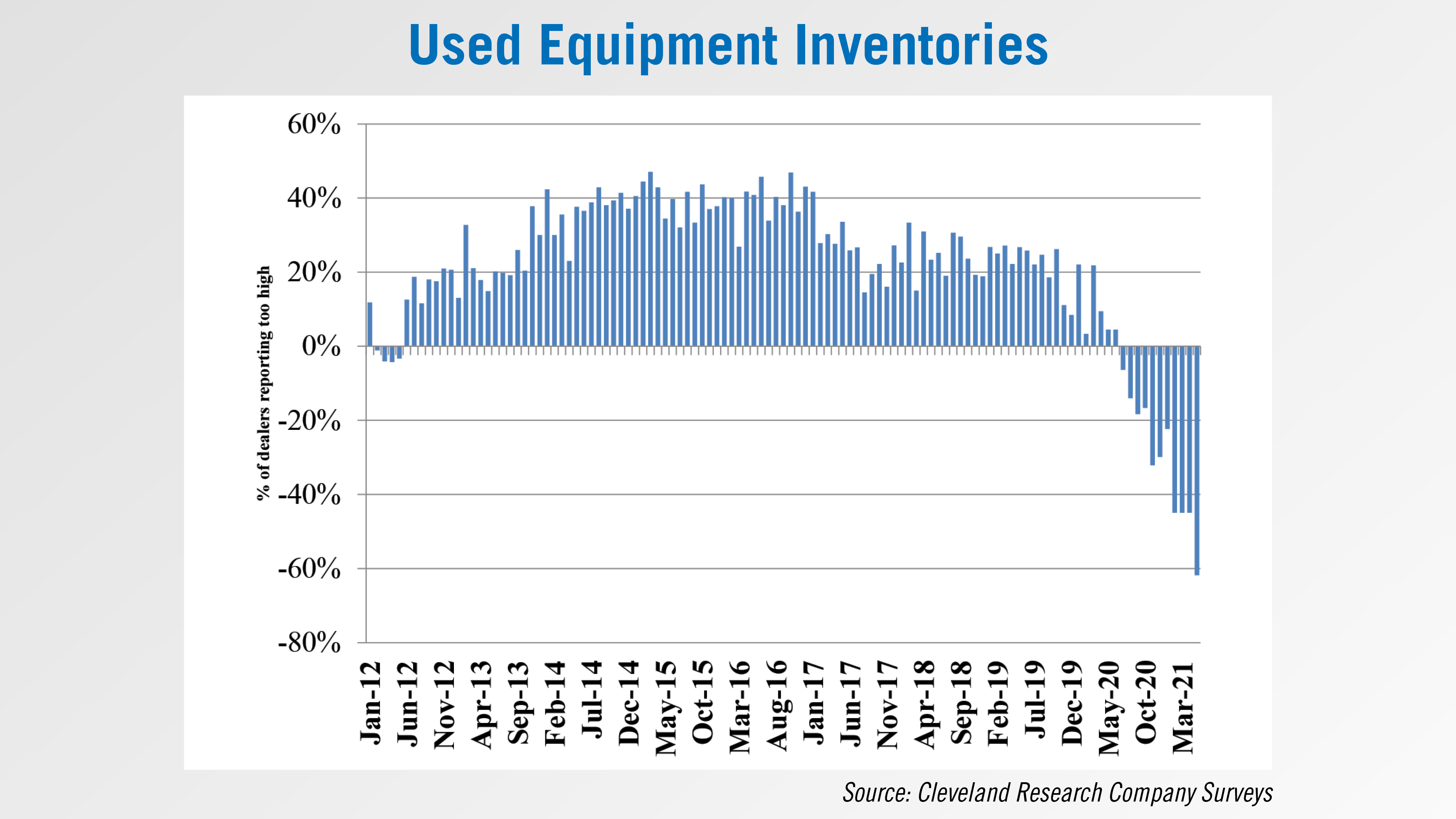

While crop prices continue to be strong and farmer demand for equipment is there, the lack of inventory continues to be a problem. In fact, a net 78% of dealers reported their new equipment inventory is too low. Similarly, a net 62% of dealers said their used equipment inventory is too low – the most in the history of the survey.

One dealer commented, “The market is still very hot across the board from big ag to consumer products; supply is the limiting factor and becoming more and more of a problem.”

Another said, “New whole goods inventory levels are depleted. We have zero new tractors on hand. Order fulfillment is delayed by manufacturers. Estimated delivery time on some units has been pushed to 12 months from date of order.”

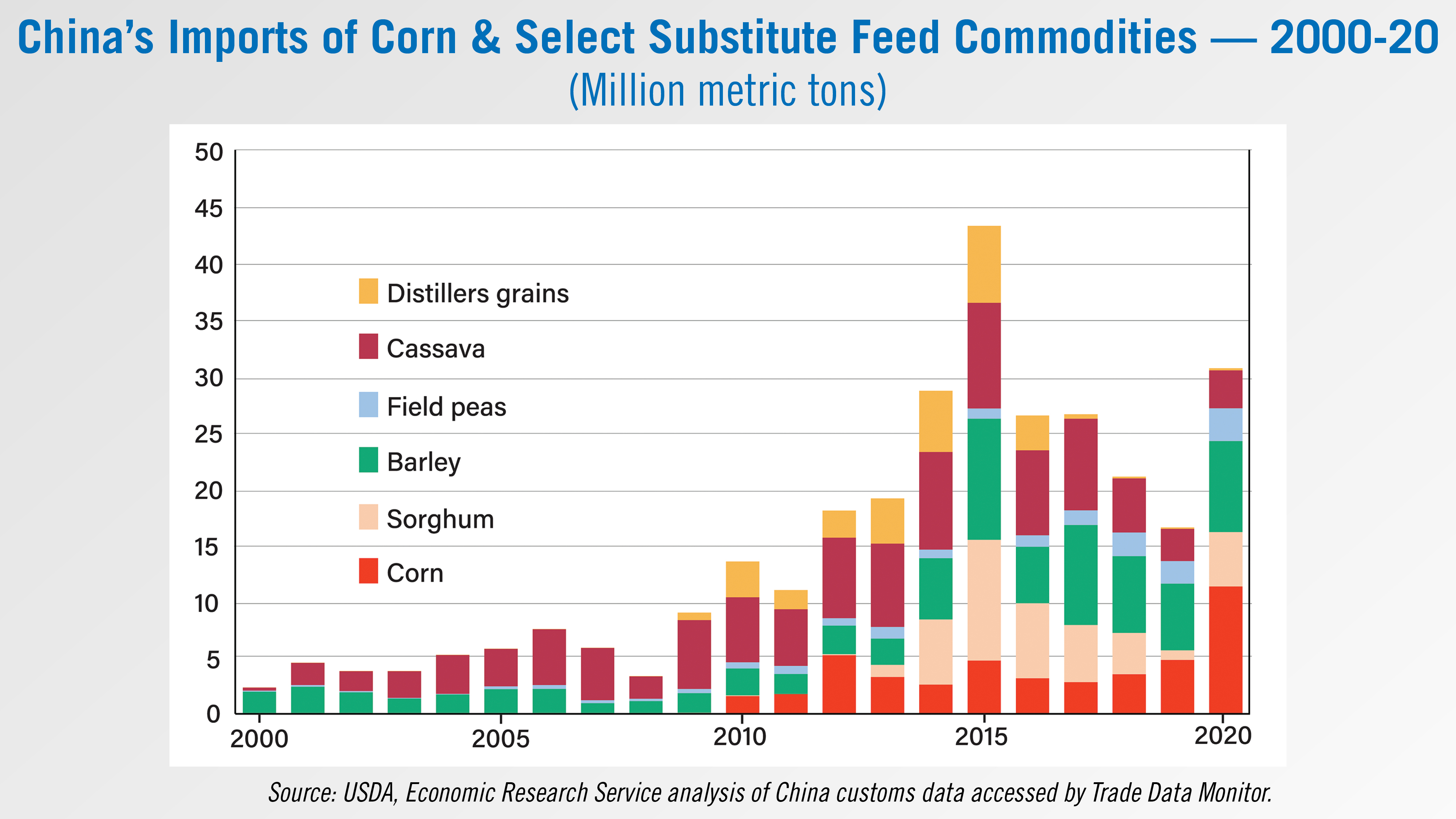

China’s Corn Imports Rebound in 2020

According to a recent report from the USDA, China’s corn imports jumped to a record 11.3 million metric tons in 2020, more than twice the volume imported in past years. The increase reflected rapidly increasing Chinese corn prices and China’s commitment to buy U.S. ag products under the Phase One trade agreement between China and the U.S.

Imports of all feed ingredients were relatively low during 2019 because of high tariffs on U.S. commodities and a lull in feed demand due to an epidemic that reduced China’s swine herd. In 2020, imports of corn and its substitutes increased to a combined total of more than 30 million metric tons. Large purchases by Chinese state-owned companies and a rapid increase in Chinese corn prices appear to have driven the increase in corn imports — which exceeded the quota for the first time. Rebuilding of the swine herd and waivers of retaliatory tariffs on U.S. sorghum may have contributed to the increase in imports of substitutes.

Post a comment

Report Abusive Comment