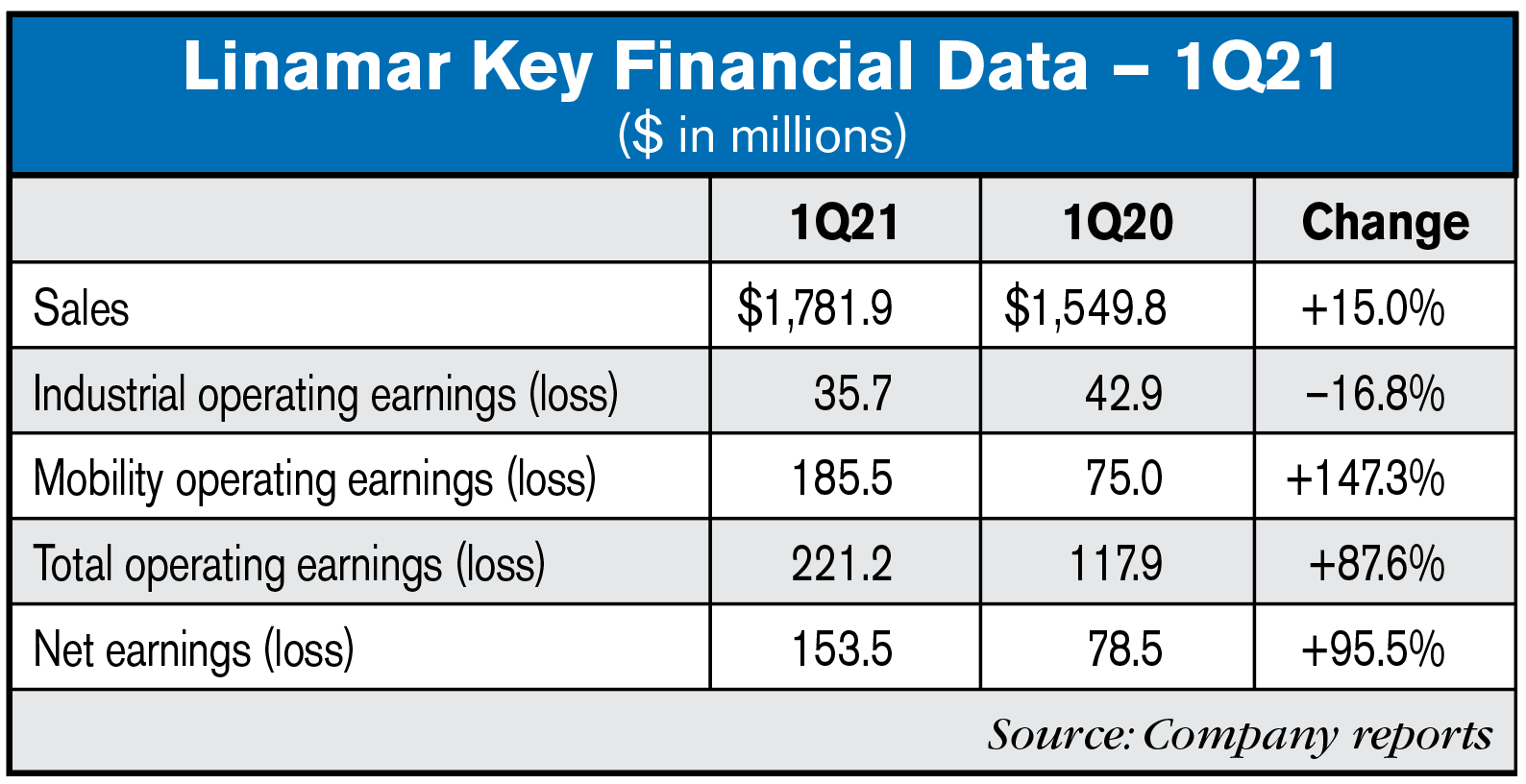

During the first quarter of 2021, Linamar experienced strong sales growth, up 15% vs. the first quarter 2020 and outstanding normalized net earnings growth, up 2.3 times in comparison to last year.

Strong normalized operating earnings growth in both segments. The mobility segment normalized operating earnings up nearly 2.5 times for 1Q21 and Industrial segment normalized operating earnings up nearly 1.5 times. Free cash flow was $166.2 million for 1Q21 compared to $147.1 million for the first quarter of 1Q20. Liquidity, measured as cash and cash equivalents and available credit as at March 31, 2021, is $1.6 billion an increase from $1.2 billion at March 31, 2020. New business wins maintain strong launch book of nearly $3.7 billion, with more than a third of Q1 2021 new business wins for electrified vehicles.

Strong Mobility market share gains were reported with double digit Content per Vehicle growth in North America and Asia Pacific with a record high in North America, and strong equipment sales demand for agricultural equipment coupled with market share growth in targeted core and expansion markets.

Operating Highlights

Sales for 1Q21 were $1,781.9 million, up $232.1 million from $1,549.8 million in 1Q20.

The Industrial segment (“Industrial”) product sales increased 16.5%, or $49.3 million, to $348.3 million in 1Q21 from 1Q20. The sales increase was due to:

- increased agricultural sales from stronger equipment sales demand and growing market share in targeted core and expansion markets; and

- additional access equipment sales primarily due to increased market share in North America for telehandlers, scissors and booms; partially offset by

- European access equipment sales declines primarily attributed to adverse conditions associated with the COVID-19 pandemic; and

- an unfavorable impact on sales from the changes in foreign exchange rates from Q1 2020.

Sales for the Mobility segment (“Mobility”) increased by $182.8 million, or 14.6% in 1Q21 compared with 1Q20. The sales in 1Q21 were impacted by:

- increased volumes for certain programs that the Company has significant business within North America and Asia;

- increased sales related to launching programs; and

- a favorable impact on sales from the changes in foreign exchange rates from 1Q20; partially offset by

- sales declines primarily attributed to adverse conditions associated with semi conductor chip supply issues impacting our customers.

The Company’s normalized operating earnings for 1Q21 was $221.3 million. This compares to normalized operating earnings of $103.5 million in 1Q20, an increase of $117.8 million.

Industrial segment normalized operating earnings in 1Q21 increased $14.5 million, or 46.2% from 1Q20. The Industrial normalized operating earnings results were predominantly driven by:

- increased agricultural sales from stronger equipment and parts sales demand; and

- a net increase in access equipment volumes; partially offset by

- an unfavorable impact on sales and expenses from the changes in foreign exchange rates from 1Q20.

“We have come out of the gate very strong in 2021 with earnings up dramatically, double digit sales growth and continued free cash flow.” said Linamar CEO Linda Hasenfratz, “New business wins are off to a strong start, notably on the electric vehicle side, and we continue to be in a very strong position in terms of cash and our balance sheet. We continue to play a leading role as well in fighting the pandemic with regular testing of employees, an active vaccination clinic and other community support initiatives. Vaccinations and testing are how we get through these next months, it is critical we all step up to take part.”

Click here for more Industry News.

Related Content

Ag Equipment Manufacturers — Executive Compensations: Ag Equipment Intelligence has gathered financial data from the filings of the ag industry’s key publicly-traded manufacturers and compiled its own list of these companies’ executives’ compensations.

Post a comment

Report Abusive Comment