The latest episode of On the Record is now available! In this week's episode we discuss growers equipment purchasing — and other capital investment —plans. While the Capital Investment Index from the Ag Economy Barometer went down, growers still indicated they are still optimistic about purchasing equipment. In the Technology Corner, we look at cyber security issues for dealers. Also in this episode: CNH Industrial and AGCO both have good first quarters, the rising costs of both new and used equipment and Cervus Equipment's first quarter results.

This episode of On the Record is brought to you by Agrisolutions.

Agrisolutions is the market leader in wearable parts, components, accessories and solutions for tillage, seeding, planting, fertilizing, hardware and inventory management solutions. Improve performance and durability with a wide range of in-field and extended life solutions. To learn more about Agrisolutions and their globally recognized brands, such as Bellota, Ingersoll Tillage and Trinity Logistics, visit Agrisolutionscorp.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Farm Capital Index Declines, Equipment Purchase Plans Still Positive

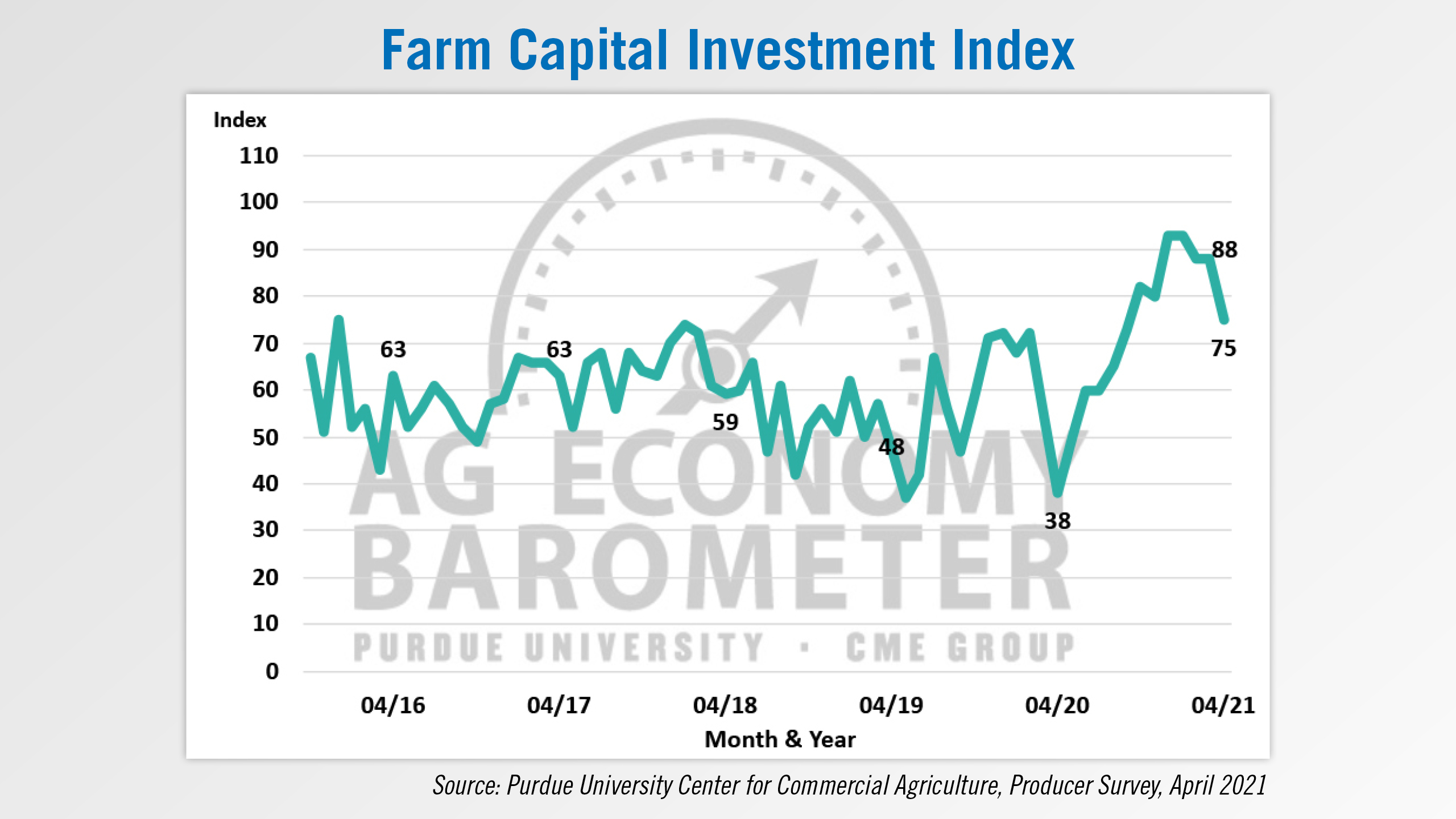

While the Purdue Center for Commercial Agriculture’s Ag Economy Barometer was largely unchanged in April at 178, the Capital Investment Index was down 13 points to 75.

This month’s decline for the Capital Investment Index leaves it just slightly ahead of where it was before the pandemic got underway in winter 2020 when it stood at 72.

The drop was somewhat surprising given farmers strong financial performance. The Farm Financial Performance Index rose to a record high reading of 138 in April, up 13 points from a month earlier and 83 points higher than in April 2020.

The investment index is based upon a question that asks producers if now is a good time or a bad time to make large investments in things like buildings and equipment.

However, there is some good news.

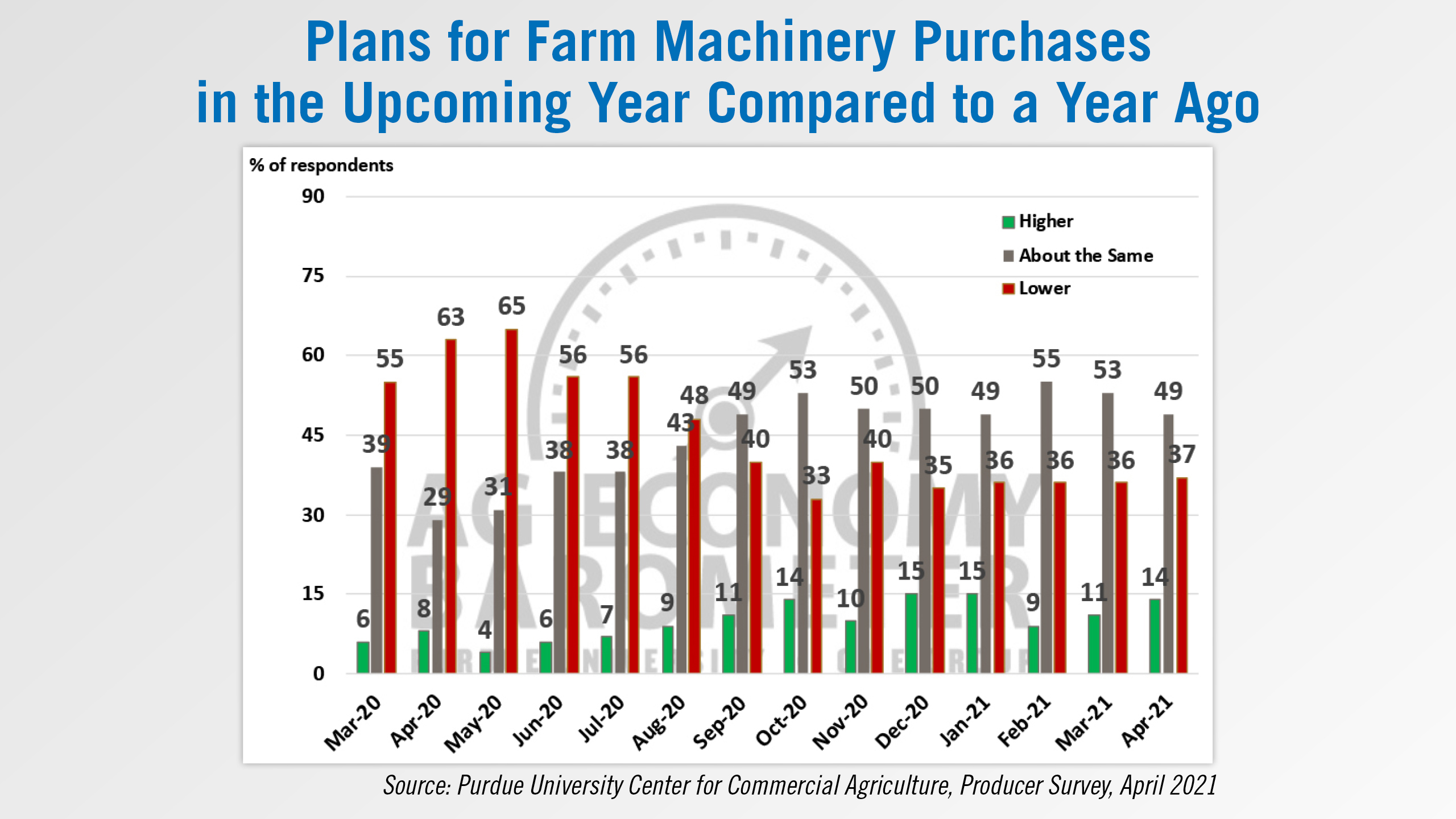

When asked more specifically about their plans concerning equipment purchases, farmers’ optimism was still evident. Compared to March, more producers said they plan to increase their machinery purchases and fewer farmers said they plan to hold their future purchases unchanged from a year earlier

Dealers on the Move

This week’s Dealers on the Move include Claas dealers Alberta Ag Centre and Nebraska Harvest Center.

Alberta Ag Centre has been assigned additional Claas territory following the acquisition of Smith’s Equipment Sales in Lougheed, Alberta, and opening a new facility in Stettler, Alberta. In addition, the dealership will add a new location in Medicine Hat this summer.

Nebraska Harvest Center announced plans to open a new store near Columbus, Neb. Construction has begun and the store should be ready for business as early as September of this year. This is Nebraska Harvest Center’s 5th location.

Assess Risk to Avoid Cyber Threats

When talking with dealerships about technology, the conversations tend to be in the context of sales, service and support of precision farming systems. But there is an arguably more critical technology discussion that should be taking place within dealerships.

While cyber security is acknowledged as a threat, dealers — especially mid-size and even single-store operations — aren’t always thinking about how to stay insulated against increasingly invasive scams.

Email phishing, ransomware and data theft are scalable shakedowns that cyber criminals deploy on unprepared dealerships. Trying the anticipate and understand the severity of threats can be overwhelming, but a risk assessment allows dealerships to identify where they are most vulnerable.

Wayne Selk, director of professional services with ConnectWise, an IT management consulting company, notes that there is often a disparity between what dealers deem most valuable in terms of technology infrastructure vs. the investment they make to protect it. But the consequences are real if dealers don’t weigh their risk of exposure with the need to have proper protections in place.

“It's not so much about the fact that I'm a small company today, it's what is it that I have that's valuable to me? Because someone is going to end up commoditizing that if they can get their hands on it and I'm going to be out of business, or I'm going to have a torched brand or reputation. When you start looking at this from a different perspective, and say, ‘What is it that makes me so important today? Why am I making money?’ And you boil it down to the data that you have — intellectual property, customer information, credit cards — then that can be commoditized by a bad actor regardless of the size of your business.”

Look for more coverage of how dealerships can protect themselves from cyber threats, and other essential business technology evolutions in the June Showcase issue of Farm Equipment magazine.

AGCO Net Sales Up 23.4% in 1Q21

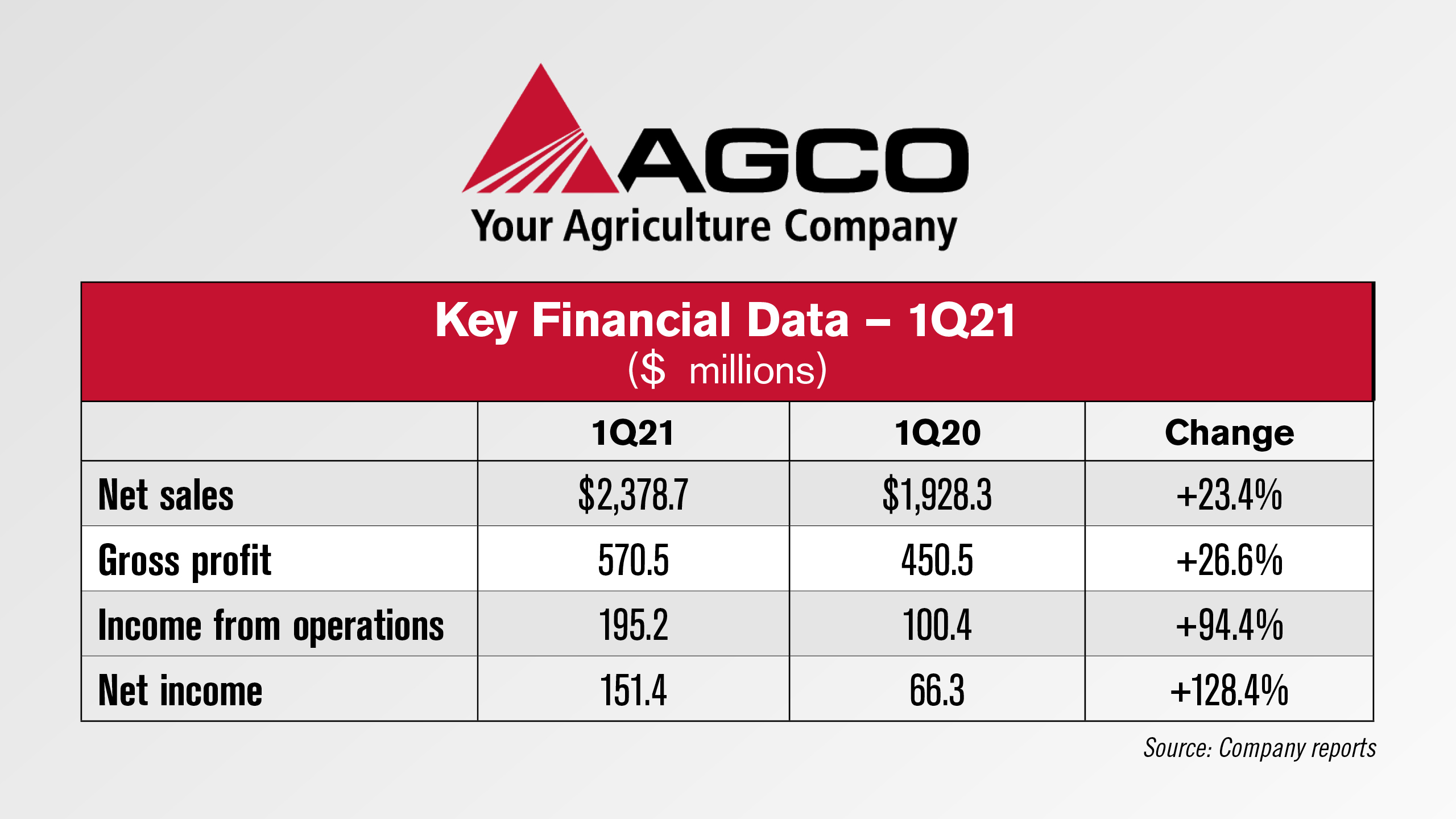

In its most recent earnings report, AGCO reported net sales for the first quarter were approximately $2.4 billion, an increase of 23.4% compared to the first quarter of 2020.

Gross profit for the quarter was $571 million, up 27% from $451 million in the first quarter of 2020. Income from operations for the first quarter rose over 94% to $195 million, and net income rose 128% to $151 million.

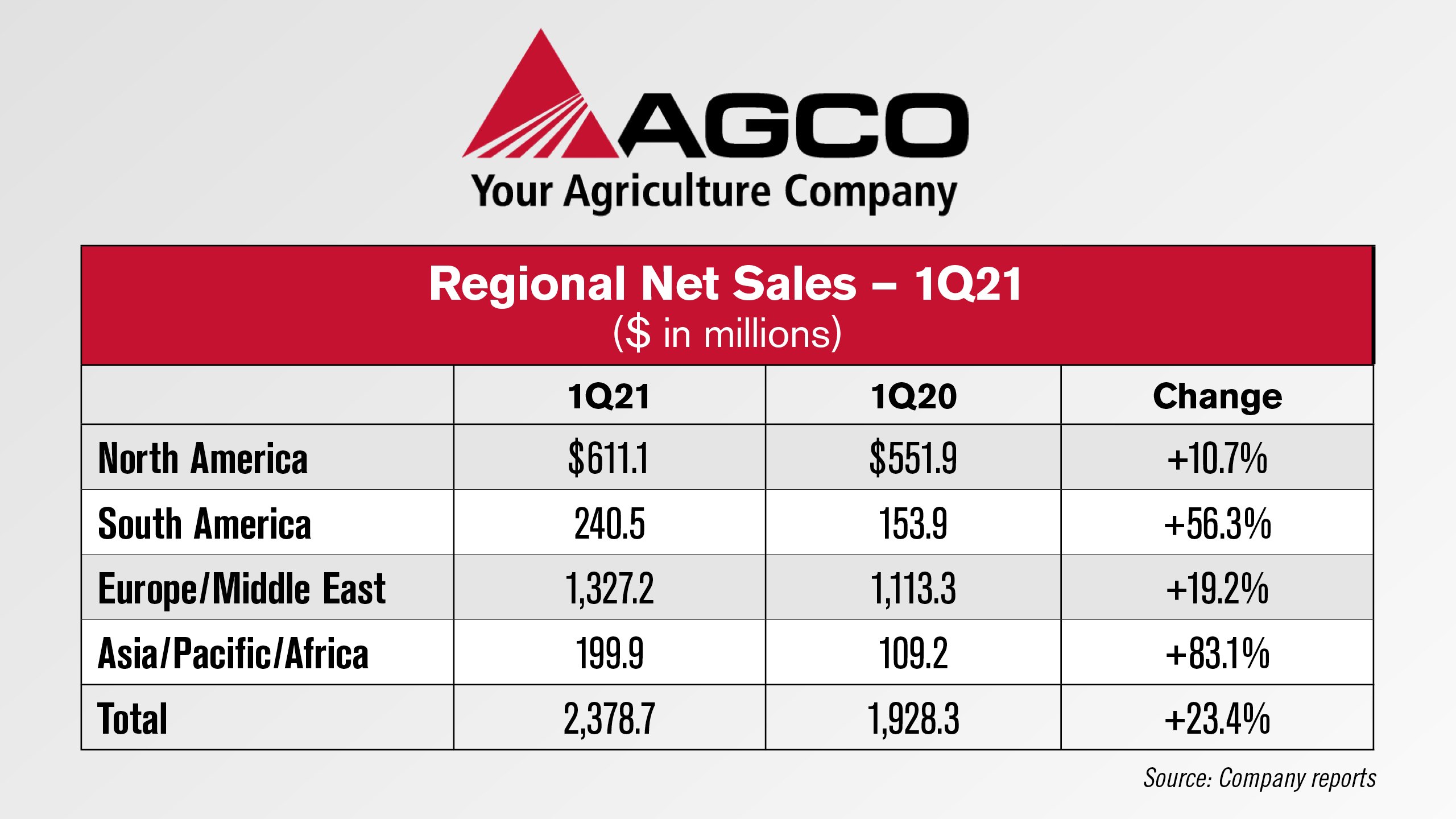

By region, North American net sales were up almost 11% to $611 million in the first quarter of 2021. It was reported that increased sales of tractors, parts, grain and protein equipment and Precision Planting products generated most of the increase.

AGCO’s Europe/Middle East net sales increased 19% year-over-year in the first quarter. AGCO achieved sales growth in Europe in all major markets with high horsepower tractors and parts showing the largest increases.

South America net sales were up 56% year-over-year to $241 million in the first quarter, while Asia/Pacific/Africa net sales were up 83% to $200 million.

AGCO reported it expected net sales in 2021 to range between $10.6 billion and $10.8 billion, reflecting improved sales volumes, pricing and positive foreign currency translation.

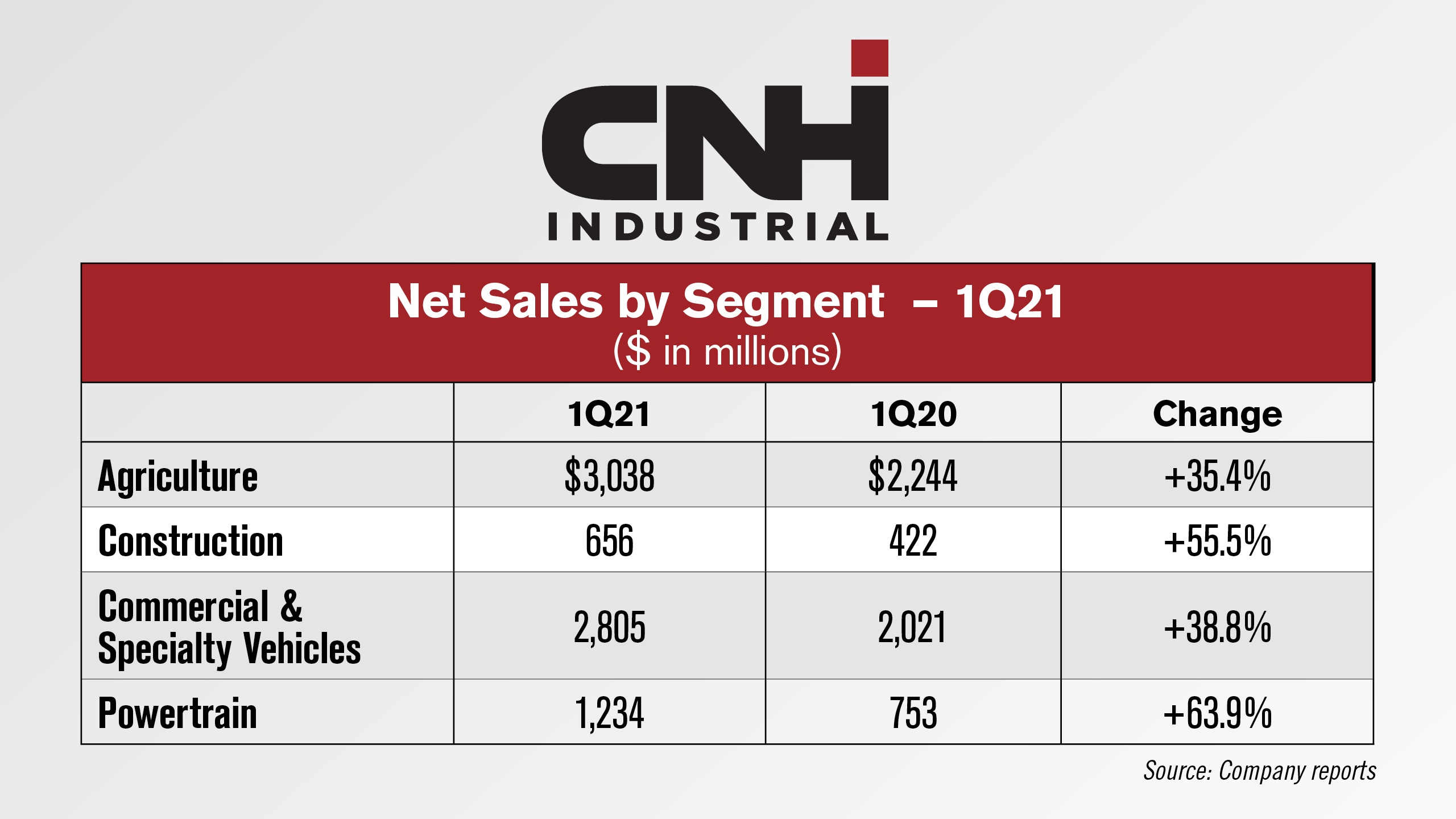

CNHI 1Q21 Ag Sales Up 35.4%

CNH Industrial reported consolidated revenues of $7.5 billion in its first quarter earnings, up 37% compared to the first quarter of 2020. The company also reported net income of $425 million, with strong performance from all segments year-over-year.

Agriculture net sales were up 35% in the first quarter to $3 billion, mainly due to higher industry demand, better mix, favorable price realization and reduced destocking actions. In North America, tractor demand was up 53% for tractors under 140 horsepower and up 15% for tractors over 140 horsepower, while combines were up 17%. In Europe, tractor and combine demand were up 20% and 14%, respectively.

Construction net sales were up 56% to $656 million, while powertrain net sales were up 64% to $1.2 billion.

Commercial and specialty vehicle net sales were up 39% to $2.8 billion in the first quarter of 2021, primarily driven by higher truck volumes. A recent report from Reuters confirmed CNH Industrial will include its defense and special vehicle business segments in the On-Highway portion of its planned business spin-off, instead of the Off-Highway portion that will include its agriculture business.

CNH Industrial says it expects strong demand to continue across regions and segments this year and that supply chain management will “remain diligent to address surging raw material prices, freight and logistics costs expected throughout the remainder of the year.”

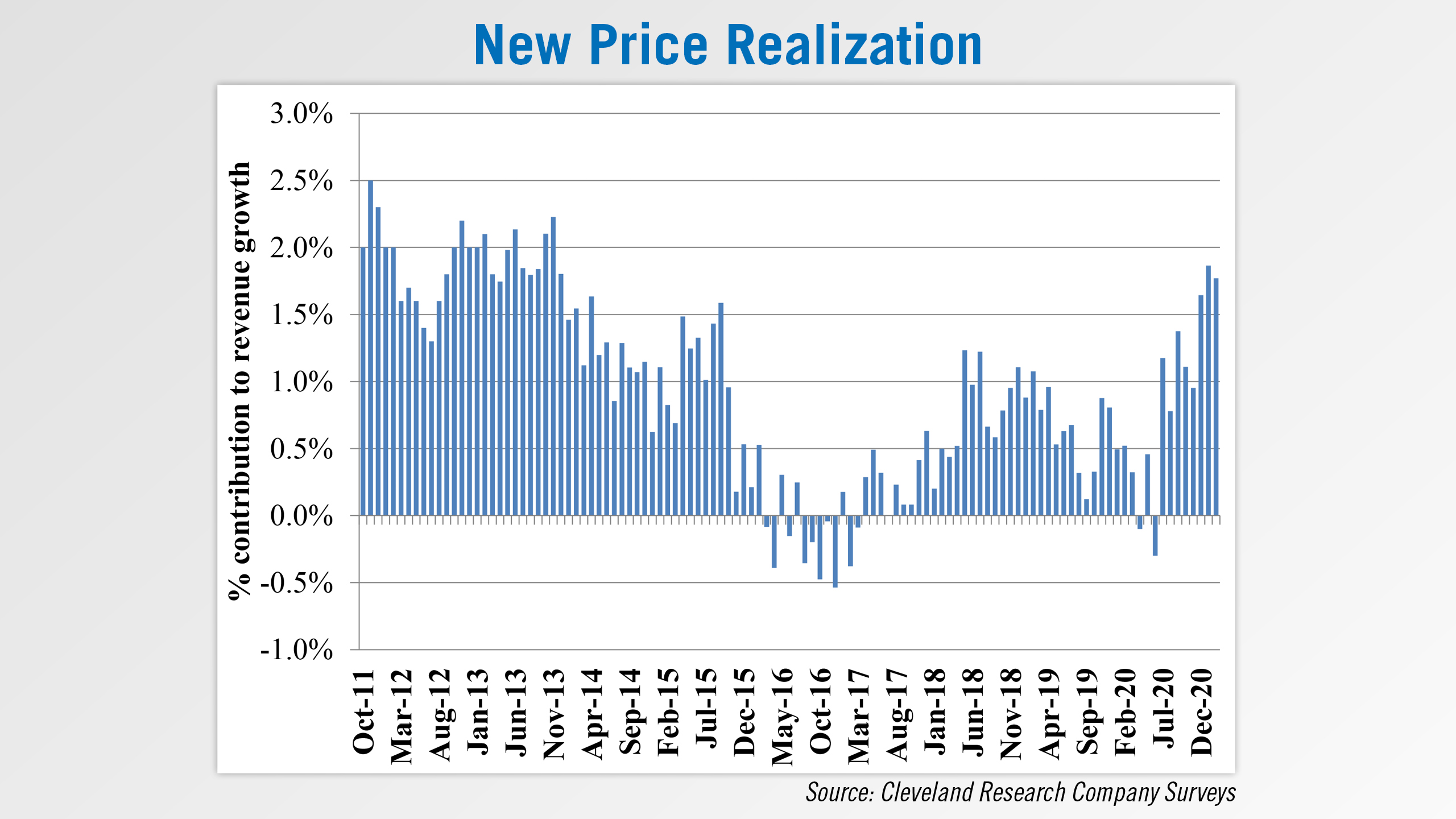

Equipment Prices Continue to Rise

According to the latest Dealer Sentiments & Business Conditions report, equipment prices continued to rise in March.

Price contribution was up 2.6% in March compared to up 1.8% the previous month. This is the highest increase since we started the monthly Dealer Sentiments survey in 2011.

Dealer commentary suggests the increase in price is largely the result of freight and material surcharges. One dealer in the Appalachia/Northeast region said, “We are being hit with 3-6% surcharges, especially with steel products.”

A dealer in the Corn Belt noted they are “seeing more and more surcharges related to freight and materials every day.” And another Corn Belt dealer noted they were recently hit with their 3rd price increase.

One Canadian dealer noted they are being told 2022 models will have a 4% or higher price increase.

Looking at used equipment prices, in March pricing was up 5% vs. up 3% the previous month. Used utility tractors saw the highest increase at up 6% in March, followed by row-crop and compact tractors, which were each up 5%. Combine pricing was flat for the month.

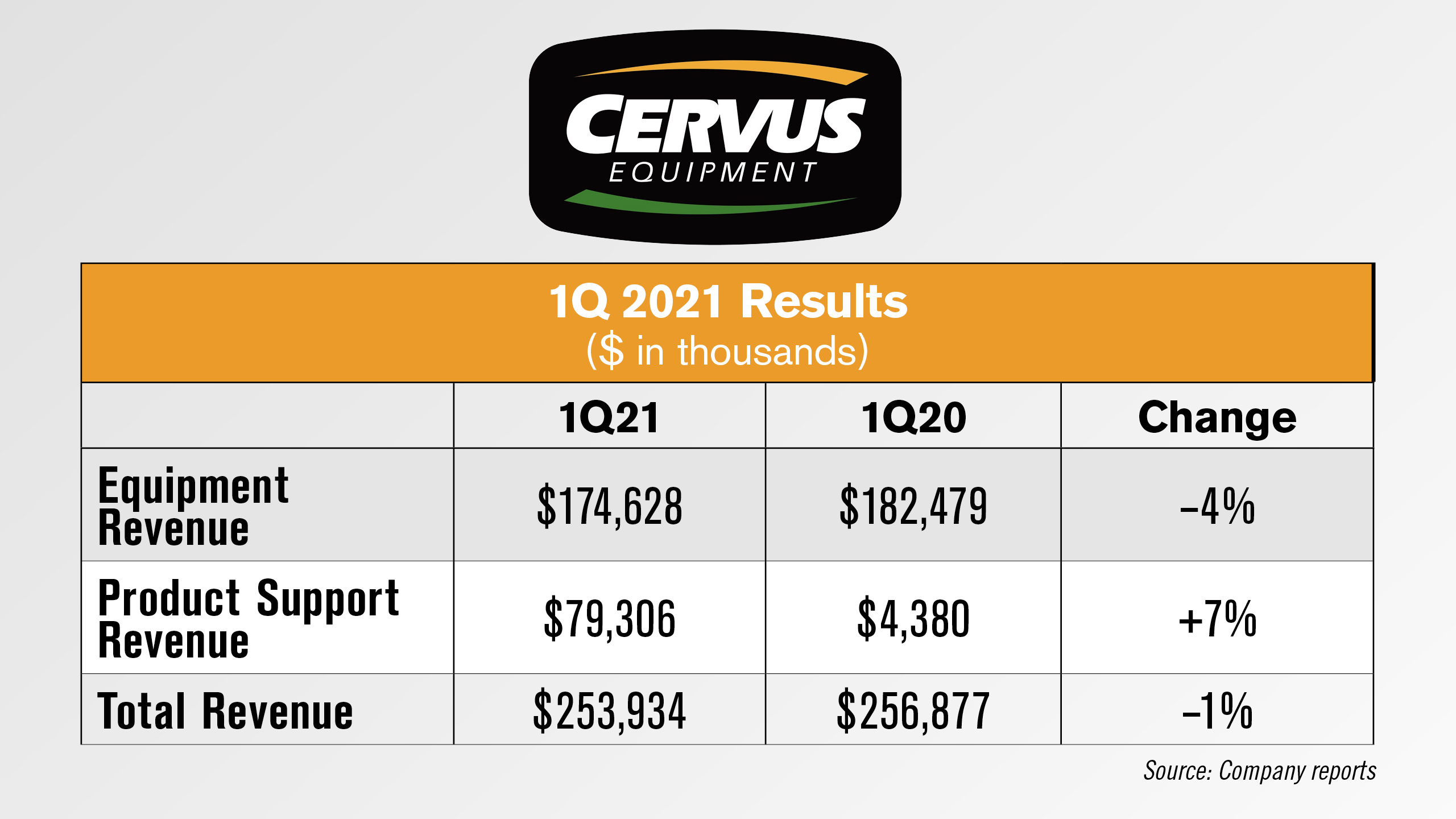

Cervus Revenue Down 1% in 1Q 2021

Cervus Equipment, Canada’s largest John Deere dealership group, announced its first quarter results this morning.

Total revenue was down 1% in the quarter, comprised of a 4% decrease in equipment revenue, partially offset by a 7% increase in product support revenue. The majority of this change was driven by Cervus’ Agriculture segment.

Agriculture revenue decreased 1% in the quarter, driven by a 5% decrease in equipment revenue as deliveries were delayed by the manufacturer, compared to the first quarter of 2020, when sales were accelerated by customers in anticipation of currency-driven price increases.

The decrease in equipment revenue was partly offset by a 13% increase in product support revenue in the quarter, as Cervus executed on strategic parts initiatives, including online and on the road parts sales, and the addition of two new locations after the first quarter of 2020.

Post a comment

Report Abusive Comment