CNH Industrial reported first quarter consolidated revenues of $7.5 billion (up 37% compared to the first quarter of 2020), net income of $425 million and adjusted EBIT of Industrial Activities of $545 million (up $693 million), with strong performance from all segments year-over-year. Industrial Activities net cash was $0.6 billion as of March 31, 2021, with free cash flow seasonally negative by $0.4 billion.

General improvement in market demand and in customer sentiment reflected increased economic activity globally and stronger commodity prices. CNH Industrial said it remains cautious about the future impacts on its end-markets and operations of restrictions on social interactions and business operations to limit the resurgence of the COVID-19 pandemic.

"Furthermore, rising demand is adding pressure to our supply chain, requiring diligent coordination to keep our production at desired levels," the company says. "Adverse market trends in raw materials (particularly steel), freight and logistics costs have impacted our product cost performance in the first quarter. Increasing input costs are expected in the second quarter, and pressure is likely to continue throughout the remainder of the year."

The company's order book in Agriculture more than doubled year-over-year for both tractors and combines, driven by strong growth in North America for tractors, and in South America for combines. Construction order book was up year-over-year in both Heavy and Light sub-segments, with increases in all regions. Truck order intake in Europe was up 96% year-over-year, with light duty trucks up 95% and medium & heavy-duty trucks up 101%.

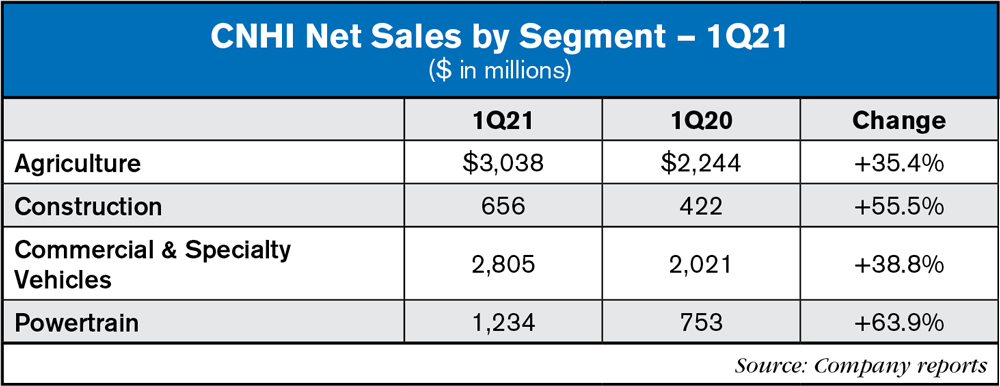

Net Sales by Segment

Agriculture

In North America, tractor demand was up 53% for tractors under 140 HP, and up 15% for tractors over 140 HP; combines were up 17%. In Europe, tractor and combine demand were up 20% and 14%, respectively. South America tractor demand was up 31% and combine demand was up 28%. Significant increase in demand for tractors and combines was also noted in Rest of World.

Net sales were up 35%, mainly due to higher industry demand, better mix, favorable price realization and reduced destocking actions.

Adjusted EBIT was $399 million, with Adjusted EBIT margin at 13.1%. The $375 million increase was driven by higher volumes, favorable mix, positive price realization and improved income from non-consolidated joint ventures. Higher raw material and freight costs partially offset favorable product cost and quality performances.

Construction

Global demand for construction equipment increased in both Heavy and Light sub-segments, with Heavy up 38% and Light up 24%. Demand increased 41% in both Rest of World and South America, 25% in North America, but decreased 2% in Europe.

Net sales were up 55%, as a result of higher volumes, re-alignment of production levels to retail performance, and better price realization.

Commercial and Specialty Vehicles

European truck market was up 22% year over year, with light-duty trucks (“LCV”) up 24%, while medium and heavy trucks (“M&H”) were up 17%. South American truck market was up 17% in LCV and up 32% in M&H. Order book is strong across all regions. Bus market decreased 19% in both Europe and South America.

Net sales were up 39%, primarily driven by higher truck volumes.

According to a report from Reuters, CNH Industrial will include its defense and special vehicle business segments in the On-Highway portion of its planned business spin-off, contrary to its original plan.

Powertrain

Net sales were up 64% due to higher sales volume. Sales to external customers accounted for 47% of total net sales (44% in first quarter 2020).

Adjusted EBIT increased $84 million to $115 million, with Adjusted EBIT margin at 9.3%, due to favorable volume and mix, partially offset by higher freight costs and higher spending for regulatory programs.

2021 Outlook

The Company expects strong demand to continue across regions and segments. To best serve customers, supply chain management will remain diligent to address surging raw material prices, freight and logistics costs expected throughout the remainder of the year. Positive price realization will partially offset supply chain challenges. As a result, the Company is updating the 2021 outlook for its Industrial Activities as follows:

- Net sales up between 14% and 18% year on year including currency translation effects

- SG&A expenses lower/equal to 7.5% of net sales

- Free cash flow positive between $0.6 billion and $1 billion

- R&D expenses and capital expenditures at around $2 billion.

Post a comment

Report Abusive Comment