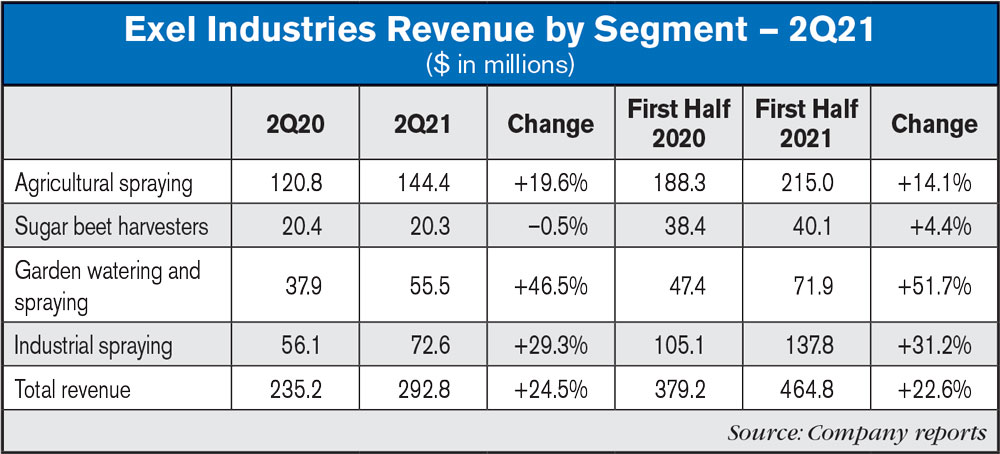

With revenue of $292.8 million, the second quarter of 2021 saw a $57.5 million (24.5%) acceleration of growth. Like-for-like revenue was $297.8 million, putting organic growth at 27.1%. The performance continues the pick-up already seen in Q4 last year, as well as a good first quarter. The first lockdown period during Q2 2020 resulted in the abrupt closure of points of sale, mainly penalizing the garden spraying and watering activity, with less of an impact on agricultural activities.

All geographical areas are growing, in particular Europe-Africa, but also Asia-Pacific, where Sames Kremlin expanded revenue strongly. There was also good momentum in agricultural spraying in North America. Exchange rate variations had a negative impact of $6.1 million on revenue.

Agricultural Spraying generated revenue of $144.4 million, an increase of $23.6 million (19.6%).

This growth can be attributed to good momentum in the self-propelled sprayer and spare parts segments, driven notably by North America and Australia.

Sugar Beet Harvesters revenue was $20.3 million, a slight decline of $0.1 million (0.5%).

Q2 is not particularly representative of this highly seasonal business. That said, it does confirm growth in spare parts and used machinery revenue, particularly in Eastern Europe.

Garden Watering and Spraying revenue was $55.5 million, an increase of $17.6 million (46.5%).

An excellent quarter and the best sales in the last five years. The growth levers described in Q4 2020 and Q1 2021 are still at work (growth market, best-in-sector service, lockdown) and were supplemented by new drivers, namely the rebuilding of retailers’ stocks and pre-Brexit stockpiling in the UK. This comes against the backdrop of heavy pressure on Chinese supplies due to container and plastic shortages.

Industrial Spraying, with revenue of $72.6 million, saw growth of $16.3 million (29.3%), bearing in mind that there is no longer any difference in scope attributable to iNTEC, which has been consolidated since the end of Q1 2020.

iNTEC and spare parts sales were strong. In the “projects” activity, the company benefited from deferrals from Q4 2020 to Q2 2021.

Outlook

The group is cautious about extrapolating this growth to the rest of the year. The shifting of billing from H1 to H2 2020 (COVID impact) make for a more demanding basis of comparison.

Agricultural Spraying

The good trend in agricultural commodity prices in recent months, government support measures (U.S., Australia, France, Germany) and the suspension of customs duties on French wine in the US (losses of $480.7 million per year) are boosting the company's order book. Frosts are expected to have a limited effect on viticulture, but a more pronounced one on the fruit growing segment. Steel prices are up, and Exel is adjusting prices on a case-by-case basis. At this stage, the company has not noted any critical difficulties linked to the shortage of electronic components.

Sugar Beet Harvesters

The order book is now bigger than at the same point last year, a direct result of the action plans implemented to develop the Terra Variant range in liquid manure spreading and anaerobic digestion, and international sales of sugar beet harvesters. Beet prices are trending up, but last season’s yields were affected by beet yellows virus, and those of the next harvest will bear the impact of frost, albeit to a lesser extent.

Garden Watering and Spraying

The company's order book is currently higher than it was last year. Exel has implemented a policy of anticipating orders and deliveries with customers in order to reconstitute stocks and meet consumer demand. The revenue trend is very strong, but this business is highly dependent on the weather, and it is only after Q3 that the full-year outlook becomes clearer. In addition, the company has been feeling severe pressure on plastic raw materials for several months, in terms of both price and availability.

Industrial Spraying

The strong trend in the furniture sector continues to reflect change in household behavior (DIY, home decoration, etc.). However, the recovery of the automotive sector remains fragile, with at this stage a recovery in Asia and an uncertain outlook in other areas threatened by tension on deliveries of electronic components.

Post a comment

Report Abusive Comment