According to a recent report from the Federal Reserve Bank of Dallas, bankers responding to the first-quarter survey reported overall better conditions across most regions of the Eleventh District. They noted good crop yields and rising prices, while also expressing caution about continued dry conditions. “Crop prices are encouraging; however, we are still dry, and unless we receive good spring rains, most producers will be looking to insurance early,” said one survey respondent. Cattle sales continue to do well, and demand for rural properties remains strong.

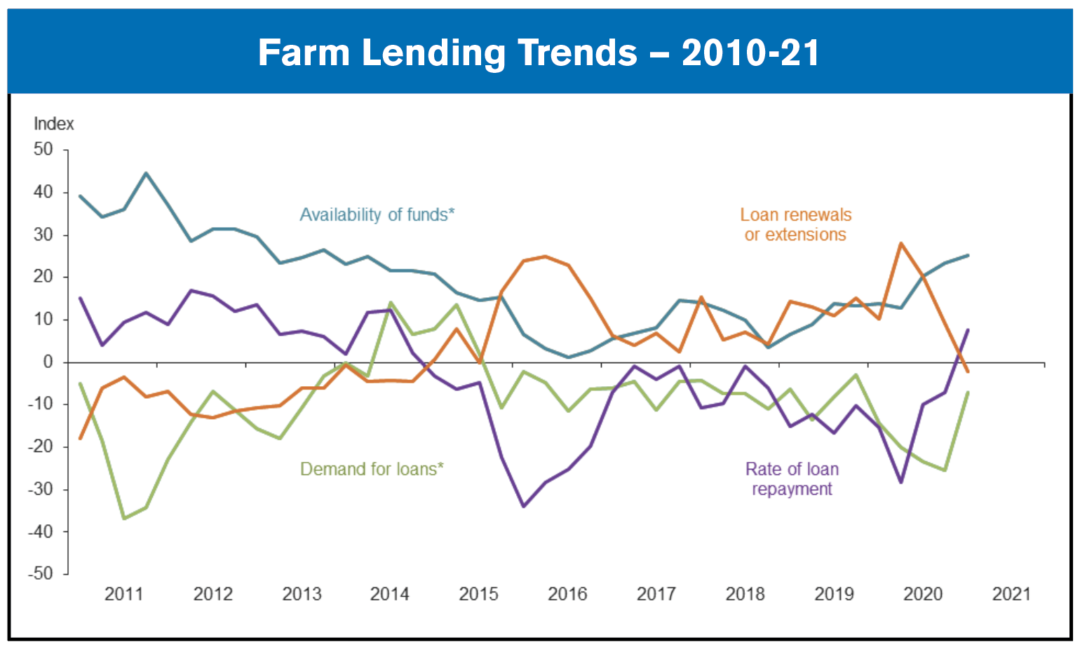

Demand for agricultural loans continued to decline, with the loan demand index registering its 22nd quarter in negative territory. Loan renewals or extensions fell this quarter while the rate of loan repayment increased for the first time since 2014. Loan volume decreased across all major categories compared with a year ago except for farm real estate, non-real-estate farm and operating loans.

Irrigated and ranchland values increased, but dryland values were flat this quarter. According to bankers who responded in both this quarter and first quarter 2020, nominal irrigated cropland and ranchland values increased year over year in Texas and southern New Mexico.

The anticipated trend in farmland values index grew in first quarter 2021, suggesting respondents expect farmland values to continue increasing. The credit standards index remained in positive territory, indicating further tightening of standards on net.

Post a comment

Report Abusive Comment