AgJunction Inc. recently reported financial results for the fourth quarter and full year ended Dec. 31, 2020.

Management Commentary

“At the beginning of last year, I don’t think anyone could have predicted just how disruptive 2020 would be due mostly to the COVID-19 pandemic,” said Dr. M. Brett McMickell, president and CEO of AgJunction. “We continued developing in strategically important areas in off-road automation, such as sensor fusion, terrain mapping, vision tracking, and mobile applications. Although our 2020 sales results aren’t exactly where we thought they’d be when we started the year, we made great strides in prudently managing costs and optimizing our product mix, which led to a significant increase in our gross margin and improved bottom line profitability.

“During the fourth quarter, optimism returned to our indirect channel as we saw more OEMs restart development planning for their next generation equipment. In fact, we entered into agreements to provide various autosteering applications to two leading OEMs, Komatsu and Ploeger. Currently, we are continuing to focus heavily on maintaining strong partnerships with our existing OEM and VAR partners, while also working towards new partnerships that we expect to have news on in the coming months.

“Our direct channel saw strong momentum with 75% year-over-year revenue growth in our e-commerce store. This parallels the introduction of new AgJunction products, including the Wheelman Pro HP and Wheelman Flex HP, which are derived from the innovations we had made for our indirect channel. Additionally, we launched our first subscription offering through our e-commerce store."

Fourth Quarter 2020 Financial Result

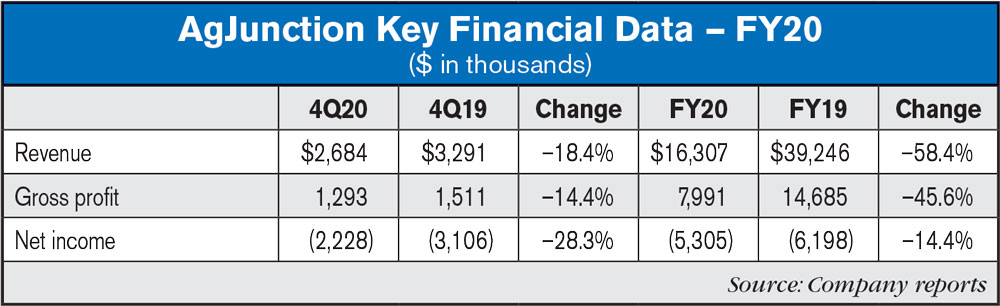

Total revenue in the fourth quarter of 2020 was $2.7 million compared to $3.3 million in the fourth quarter of 2019. The decrease is primarily due to reduced revenue volume from a North American VAR customer. This was partially offset by the large increase in the EMEA region attributable to revenue earned for product software access requirements, as well as an increase in the APAC region due to expansion into China and higher demand in Japan.

Gross profit in the fourth quarter of 2020 was $1.3 million compared to $1.5 million in the fourth quarter of 2019. Gross margin increased to 48.2% compared to 45.9% in the fourth quarter of 2019. The margin improvement was attributable to better cost management and the shifting of the Company’s product mix to more higher margin software offerings.

Net loss in the fourth quarter of 2020 improved to $(2.2) million compared to a net loss of $(3.1) million in the fourth quarter of 2019. The improvement was primarily a result of the aforementioned reduction in facilities costs and overall decrease in total operating expenses.

EBITDA in the fourth quarter of 2020 improved to $(1.4) million compared to $(2.3) million in the fourth quarter of 2019.

Full Year 2020 Financial Results

Total revenue in 2020 was $16.3 million compared to $39.2 million in 2019. Excluding $24 million of revenue generated from the BPO in the prior year, revenue increased 6.6% as a result of continued execution of the Company’s strategy.

Gross profit for the full year was $8 million compared to $14.7 million in 2019. Gross margin increased significantly to 49% compared to 37.4% for the full year. The substantial margin improvement was attributable to a higher margin product mix and improved manufacturing efficiencies.

Total operating expenses for the year improved to $13.2 million compared to $21.1 million in the previous year. The improvement was predominantly driven by cost savings from departmental consolidation, site closures, travel cost reductions and IT expenditure reductions.

Net loss for the full year improved to $(5.3) million compared to a net loss of $(6.2) million in the prior year. The improvement was primarily a result of the aforementioned decrease in total operating expenses.

EBITDA for the full year improved to $(2.6) million compared to $(3.6) million for the full year 2019.

Cash and cash equivalents at Dec. 31, 2020, totaled $6.8 million compared to $17.2 million at the end of 2019. Working capital was $13.7 million at Dec. 31, 2020 as compared to $19.2 million at the end of 2019. The Company continues to operate debt free and has access to an un-utilized $3.5 million line of credit.

Related Content

Ag Equipment Manufacturers — Executive Compensations: Ag Equipment Intelligence has gathered financial data from the filings of the ag industry’s key publicly-traded manufacturers and compiled its own list of these companies’ executives’ compensations.

Post a comment

Report Abusive Comment