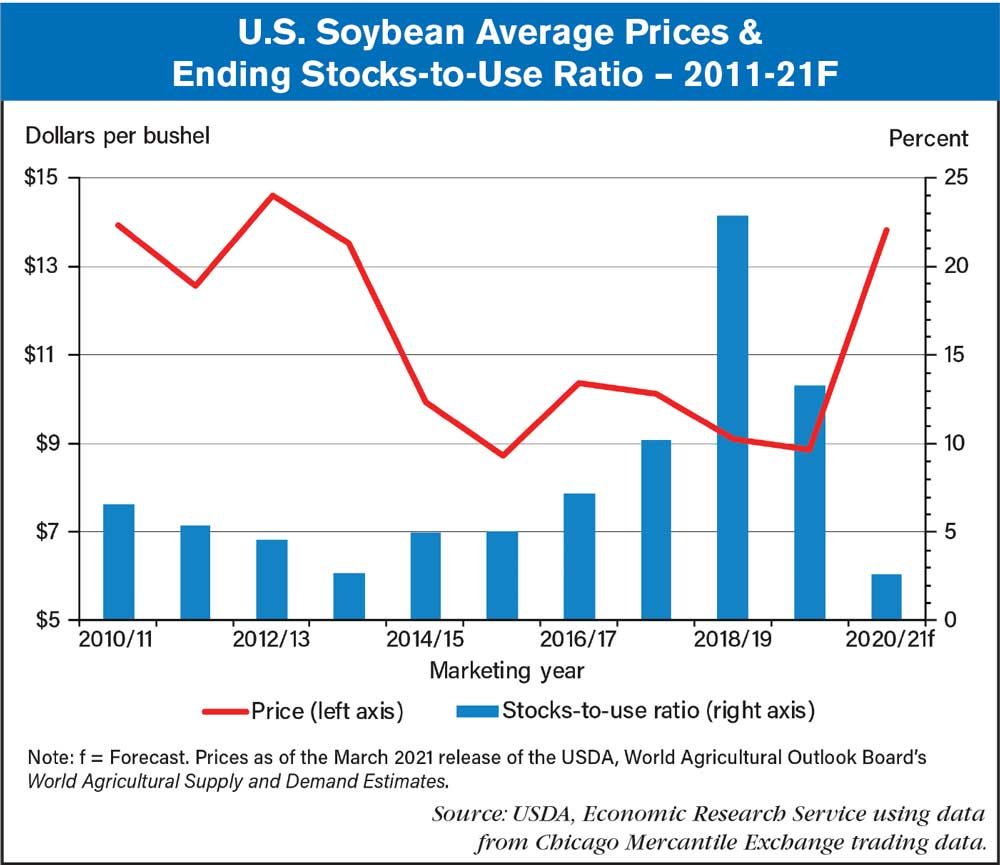

Expanded U.S. soybean exports — led in part by increased Chinese buying under the United States-China Phase One trade deal in combination with greater demand by domestic processors — are tightening the availability of U.S. soybeans this marketing year (September 2020-August 2021).

With demand far surpassing increases in supply, USDA forecasts the inventory of soybeans by the end of the current marketing year to plunge to 120 million bushels. If realized, that would be lower than at any point since the historically low stock level of 92 million bushels in 2013-14. The forecast soybean stocks-to-use ratio, which is a measure of the market’s relative balance between ending supplies and total demand, is 2.6% — a notable decrease from the 13.3% of last year. Commodity prices and stocks have an inverse relationship: lower levels of stocks contribute to higher prices and higher levels of stocks contribute to lower prices. Rapidly declining soybean stocks continue to create the possibility of even higher prices, with February soybean prices already up to $13.82 a bushel, higher than any marketing year since 2012-13. The March Grain Stocks report from the National Agricultural Statistics Service will provide greater information on how fast the situation is changing. T

his chart is drawn from the USDA, Economic Research Service’s March 2021 Oil Crops Outlook report.

Post a comment

Report Abusive Comment