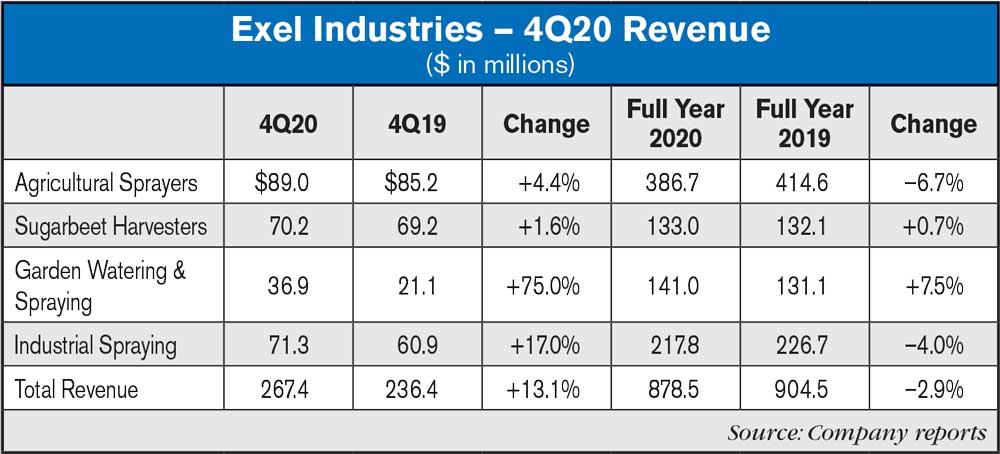

In the fourth quarter of 2020, Exel Industries generated revenue of $267.4 million, up $31.1 million (+13.1%) compared with fourth quarter 2019. At constant foreign exchange rates and scope, fourth quarter revenue amounted to $254.6 million, up 7.7% from fourth quarter 2019.

The change in scope and exchange rates effect in the fourth concern the following items:

- A favorable change in scope (+$17 million) following the acquisition of iNTEC, which has been consolidated since February 2020.

- An adverse currency effect (–$4.2 million) chiefly attributable to the Australian dollar, the Russian ruble and the Mexican peso

Agricultural Spraying

Revenue was $89 million, up $3.7 million (+4.4%), due to the deferral of deliveries and billing from the third quarter to the fourth quarter, during which Exel Industries was able to manufacture more machines despite COVID-19, thanks to the adaptability of our teams.

Sugarbeet Harvesters

Revenue was $70.2 million, up $1.1 million (+1.6%). The company duly met the challenge of delivering over 50% of annual sales during the fourth quarter within the unusual context of the health crisis.

Garden Watering & Spraying

Revenue was $36.9 million, up $15.8 million (+75%). The optimistic forecast for the third quarter was borne out. Fourth quarter 2020 revenue marked a record high. The garden watering market remains fairly unpredictable, being heavily dependent on the weather. Numerous market operators source their supplies in Asia, requiring them to stock products ahead of season, and affording them little flexibility. Although the company had difficulty in making timely deliveries to our customers due to the COVID-19 crisis, it believes that the location of its production sites in Europe enabled it to provide a better service than the competition.

Industrial Spraying

Revenue was $71.3 million, up $10.4 million (+17%), of which $17 million is attributable to the consolidation of iNTEC. At constant foreign exchange rates and scope, revenue fell in the wake of the difficulties in the automotive industry (primarily in Europe and North America) and the deferral of major summer projects until winter 2021.

Responses to the productivity and environmental challenges facing the automotive industry are being found in the innovative bonding solutions developed by iNTEC. Among other benefits, bonding allows the use of lighter composite materials, thereby increasing the operating range of electric vehicles and reducing consumption in fuel-burning engines.

Annual Revenue

For the full financial year ended Sept. 30, 2020, the Exel Industries Group generated revenue of $878.7 million, down $26 million (–2.9%) compared with end September 2019. At constant foreign exchange rates and scope, revenue came to $848.3 million, down $56.4 million (–6.2%). Although the company ended its first financial half-year down 10%, this second half-year returned 3% growth.

In 2020, the company's agricultural activities recorded a slight increase, contrasting with the 5% fall in the global agricultural equipment market, despite the persistently low agricultural commodities prices.

The market for sugar-beet harvesters appears to have stabilized over the past 2 years, at the level to which the company adapted its industrial plant in a depressed climate for the sugar industry.

The garden-watering sector is averaging 4% annual growth. It has benefited from the upsurge in enthusiasm of locked-down households, exceptional weather and a creditable rate of service considering the very high business levels of the last quarter.

Finally, the industrial-spraying sector was impacted by the slowdowns in the automotive and aeronautical industries, reflected in a lower demand for wearing parts and the deferral of painting-booth installation projects. On a positive note, over 9 months of the financial year, iNTEC contributed revenue of $33.7 million.

2020-21 Forecast

Agricultural Spraying

Globally:

- A likely 2-4% fall on the French agricultural equipment market in 2021

- Government support plans (in France, Australia, the USA and elsewhere)

- Brighter short-term trends in agricultural prices.

For Exel Industries:

- Finalization of the transformation plan in France, well received by the distributors,

- New product launches.

Sugarbeet Harvesters

- Uncertainty surrounding areas allocated to sugar beet growing in view of depressed sugar prices and the specific difficulties in the agricultural sector

- Increase in sales in France of the company's Terra Variant (a fast, multi-purpose transport vehicle suitable for field use)

Garden Watering & Spraying

- Increase in production capacities and productivity in line with rising demand. Furthermore, the company believes its European production will become a major asset as consumers are seeking locally-manufactured products

Industrial Spraying

- Gradual recovery in the automotive industry

- Buoyant trends for new products

- Materialization of synergy gains between SAMES KREMLIN and iNTEC.

Post a comment

Report Abusive Comment