After severe declines in equipment and software investment in the first and second quarter of 2020 due to the effects of COVID-19 and the impact of social distancing measures, investment in equipment and software bounced back in the third quarter as the U.S. economy began to reopen. While there is a great deal of uncertainty given the pandemic, annualized growth appears likely to remain positive in the fourth quarter, bringing the annual equipment and software investment growth forecast to the –4.9-6.4% range. The forecast for the broader U.S. economy in the fourth quarter is less certain, though annual U.S. GDP growth for 2020 is forecast between –3.8-4.8%, according to the fourth quarter update to the 2020 Equipment Leasing & Finance U.S. Economic Outlook released by the Equipment Leasing & Finance Foundation.

Highlights from the fourth quarter update include:

- Equipment and software investment is forecast to grow between 0-10% (annualized) in the fourth quarter.

- The contraction in the U.S. economy in the second quarter was unprecedented, with high-contact service industries bearing the brunt of the damage. Although third quarter growth will set records, the unpredictable nature of the public health crisis is clouding fourth quarter GDP projections. Labor market health and the availability of federal stimulus will be critical factors to watch, as will the pandemic’s trajectory. Growth will suffer if another wave hits.

- The U.S. manufacturing sector has bounced back more quickly than expected. Though a shade over half of the 1.4 million lost manufacturing jobs have returned and job growth was relatively modest in September, other industry indicators such as shipments and new orders suggest that the manufacturing sector will strengthen in late 2020 and early 2021.

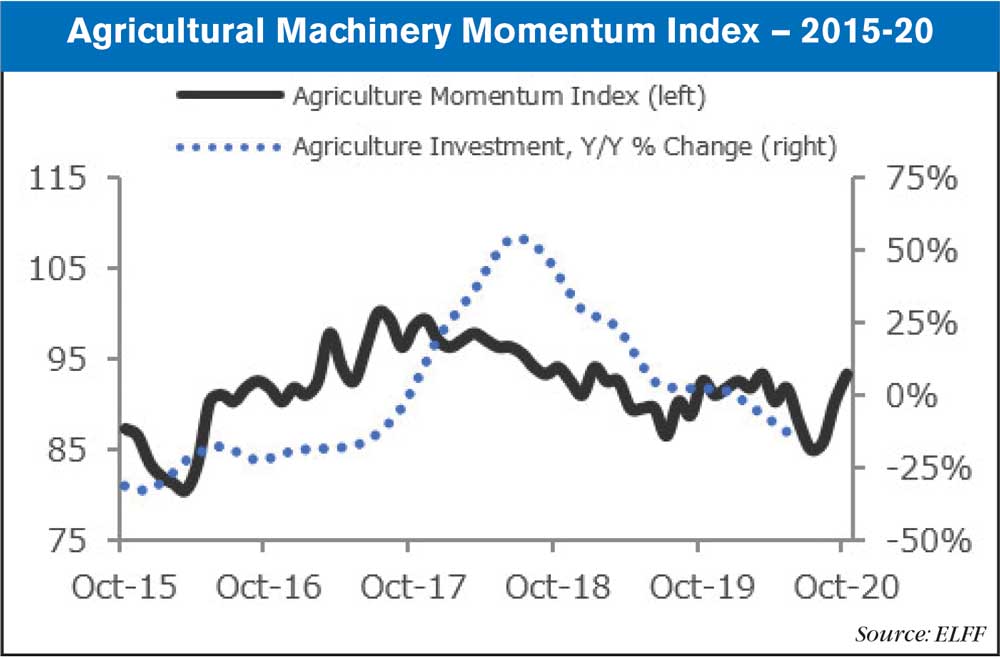

Investment in Agricultural Machinery dropped 39% (annualized) in the second quarter of 2020 and is down 16% from one year ago. The Agriculture Momentum Index improved from 90.3 (revised) in September to 93.3 in October. In August, the M1 Money Supply rose 1.2%, but Lamb & Mutton Production fell 11%, the sharpest monthly decline since late 2019. Overall, the Index suggests that agricultural machinery investment growth may have hit a turning point and should begin to improve over the next six months.

Post a comment

Report Abusive Comment