The latest episode of On the Record is now available! In this week’s episode, AGCO announced this week its intention to buy the ag assets of Boyd Co., establishing a dealership that is a wholly owned subsidiary of AGCO. In the Technology Corner, Ben Thorpe discusses John Deere’s recent acquisition of spectrum broadband licenses during an FCC auction. Also in this episode, dealers report their outlook for 2020 new equipment revenues has improved significantly from their forecast a year ago, the Ag Economy Barometer shows the number of farmers planning equipment purchases in the year ahead is growing, and Alamo reports pent-up demand is fueling its ag sales.

On the Record is brought to you by Bellota.

For Bellota, the key to quality in their planting and tillage parts is the perfect balance between hardness and toughness that is attributed to the 8 million product units they produce every year.

Professionals around the world understand that working with Bellota products makes their tilling, planting and seeding work more precise and uniform, producing less breakages and time-consuming stops. Improve profitability with Bellota’s durable, long lasting line of products.

Visit BellotaAgrisolutions.com

Bellota - a growing brand of Agrisolutions.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

AGCO Acquires Ag Stores from Boyd Co.

AGCO is getting into the retail business. The OEM announced its intent to acquire the ag assets of Cat dealer Boyd Co. in Louisville. The wholly owned subsidiary will operate as AgRevolution and is expected to begin operation on Jan. 1, 2021.

According to AGCO, the launch of AgRevolution is a unique situation and the result of Boyd’s decision to focus on its core heavy construction equipment business and AGCO’s commitment to continue serving customers in the area. Though it will be a wholly owned subsidiary of AGCO, AgRevolution will operate in a manner similar to that of AGCO’s independent dealerships, according to the company.

AgRevolution plans to operate Boyd’s current dealership locations in Columbia and Mayfield, Ky., and temporarily share space with Boyd’s construction dealership locations in Hopkinsville, Ky., and Evansville, Ind. In addition, the new dealership is currently identifying additional permanent locations and building its staff from current Boyd ag employees as well as seeking new employees.

Stacy Anthony has been pegged to lead AgRevolution. He had been the CEO of Claas dealer MirTech Harvest. Before that he spent 12 years with John Deere dealer Brandt as the international sales manager.

Dealers on the Move

This week’s Dealers on the Move include Pape Machinery and Lansdowne Moody.

John Deere dealer Pape Machinery has acquired Washington Tractor’s 12 stores in Washington state. Pape now has 35 ag locations throughout Washington, Idaho, Oregon and California.

Kubota dealer Lansdowne Moody has acquired Hlavinka Equipment’s Kubota dealership operations in Rosenberg and Bay City, Texas. The dealership now has 8 Kubota dealerships in Texas.

Deere Acquires Spectrum Broadband Licenses

Rural broadband connectivity plays a major role in precision farming reliability, and recent spectrum acquisitions by John Deere hint the company could be looking to create dedicated wireless networks for its users.

The FCC recently concluded its Citizens Broadband Radio Service, or CBRS, spectrum auction, where licenses for exclusive access to the CBRS broadcast band were sold. Licenses were auctioned at the county level, and Deere walked away with 5 licenses worth over half a million dollars.

Jeff Johnston, lead communications economist for CoBank, says these licenses represent “a significant upgrade over Wi-Fi based networks.”

Johnston also says Deere could use these licenses to create dedicated wireless networks, which could be a boost to equipment sales as broadband connectivity becomes more reliable in underserved areas.

“If Deere is looking at markets today where there’s no connectivity, the farming market, the community, is not necessarily in any sort of rush to upgrade their equipment, because they can’t take advantage of a lot of the new technology that’s on this equipment, because there’s just not sufficient connectivity. So if there’s areas out there that Deere sees as problematic to sales of new equipment in those markets, what they could theoretically do is say, ‘OK, we recognize that. So what can we do to fix it? Well, we can go out and we can acquire some spectrum. We can build our own fixed wireless networks in these areas, and we can perhaps bundle LTE or eventually maybe even 5G connectivity services in these markets with our equipment.”

Johnston adds that the 5 counties that fall under Deere’s licenses remain unknown, but given their high price point, likely contain a high population of wireless users.

2020 Revenue Estimates Beat Predications from 2019

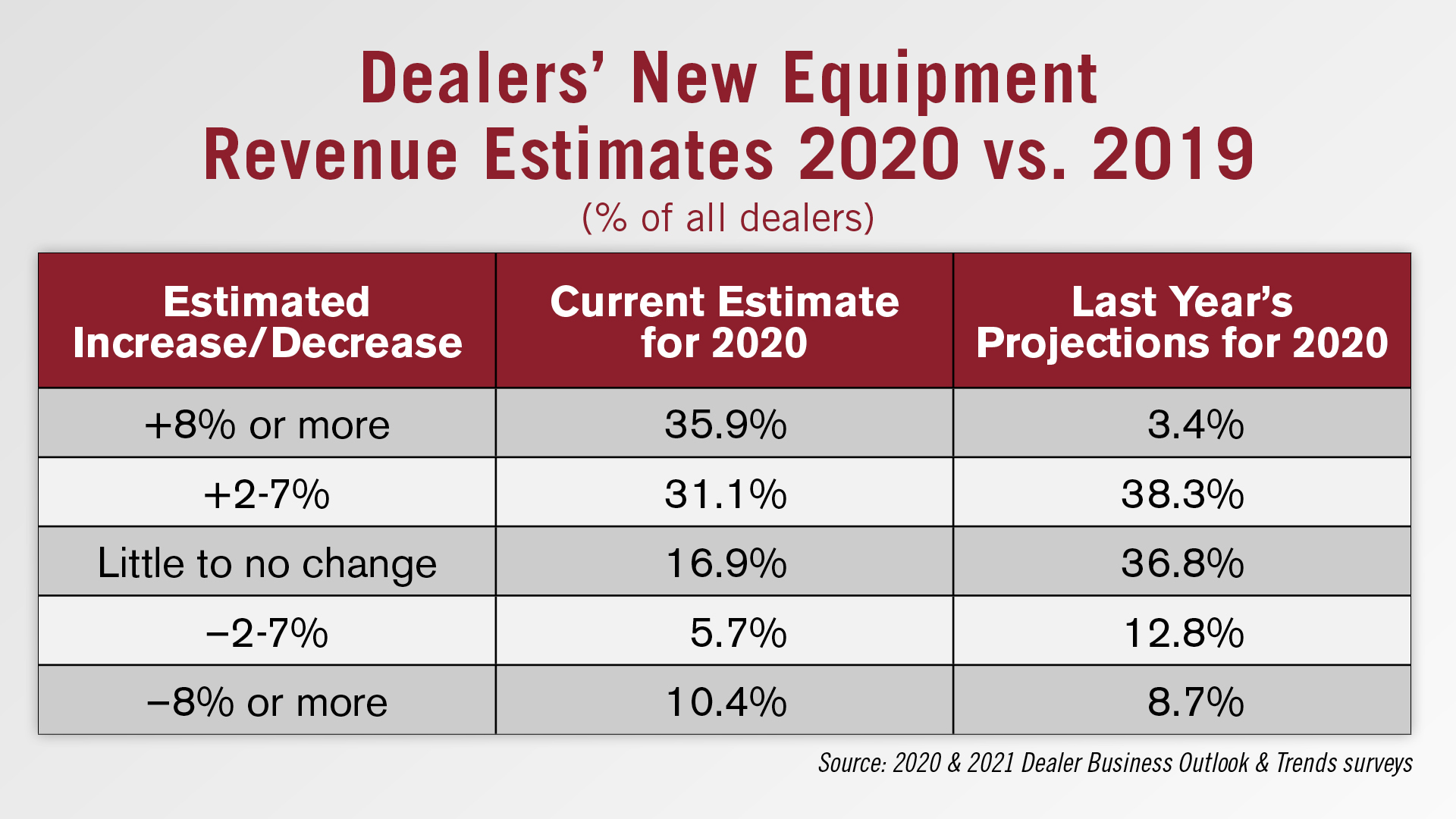

According to the results of Ag Equipment Intelligence’s 2020 Dealer Business Outlook & Trends survey, dealers have significantly increased their estimates for 2020 revenues from what they had forecast for the year.

Based on the latest survey, 67% of dealers estimate their 2020 new equipment revenues will be up by at least 2%. That’s up over 25 percentage points from the 41.7% of dealers in 2019 who forecast 2020 new equipment revenues would be up by at least 2%.

Those expecting sales to be up 8% or more saw a significant increase. In 2019, just 3.4% of dealers estimated their new equipment revenues would be up 8% or more. The 2020 report shows that 35.9% of dealers now estimate their new equipment revenues to be up by 8% or more.

Last year, over a third of dealers predicted their 2020 new equipment revenues would be flat. Just shy of 17% of dealers say their current forecast is for flat revenues from new equipment in 2020.

The full 2020 Dealer Business Outlook & Trends Report will be available to Ag Equipment Intelligence subscribers later this month.

Farmer Machinery Purchase Plans Strengthen

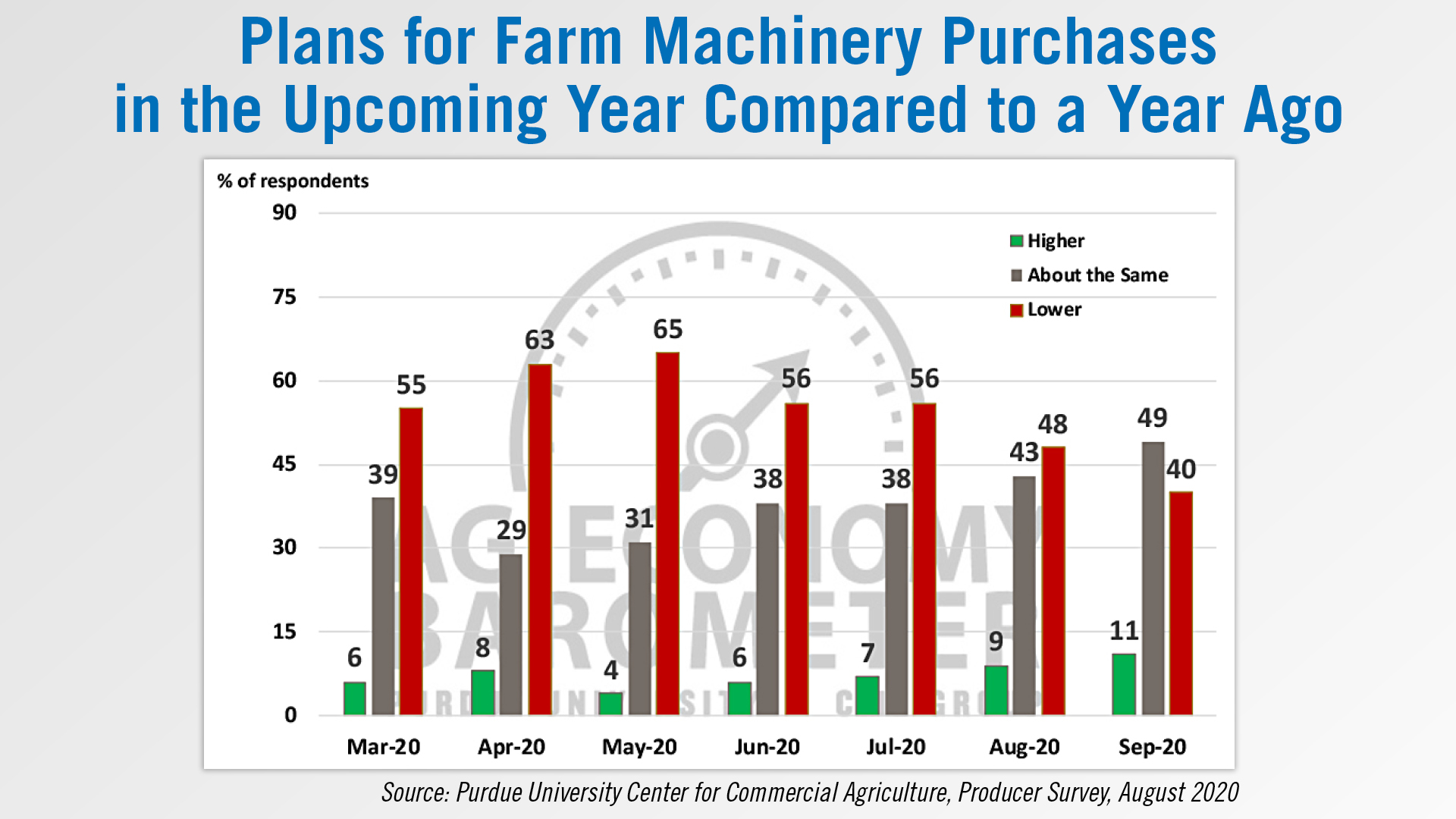

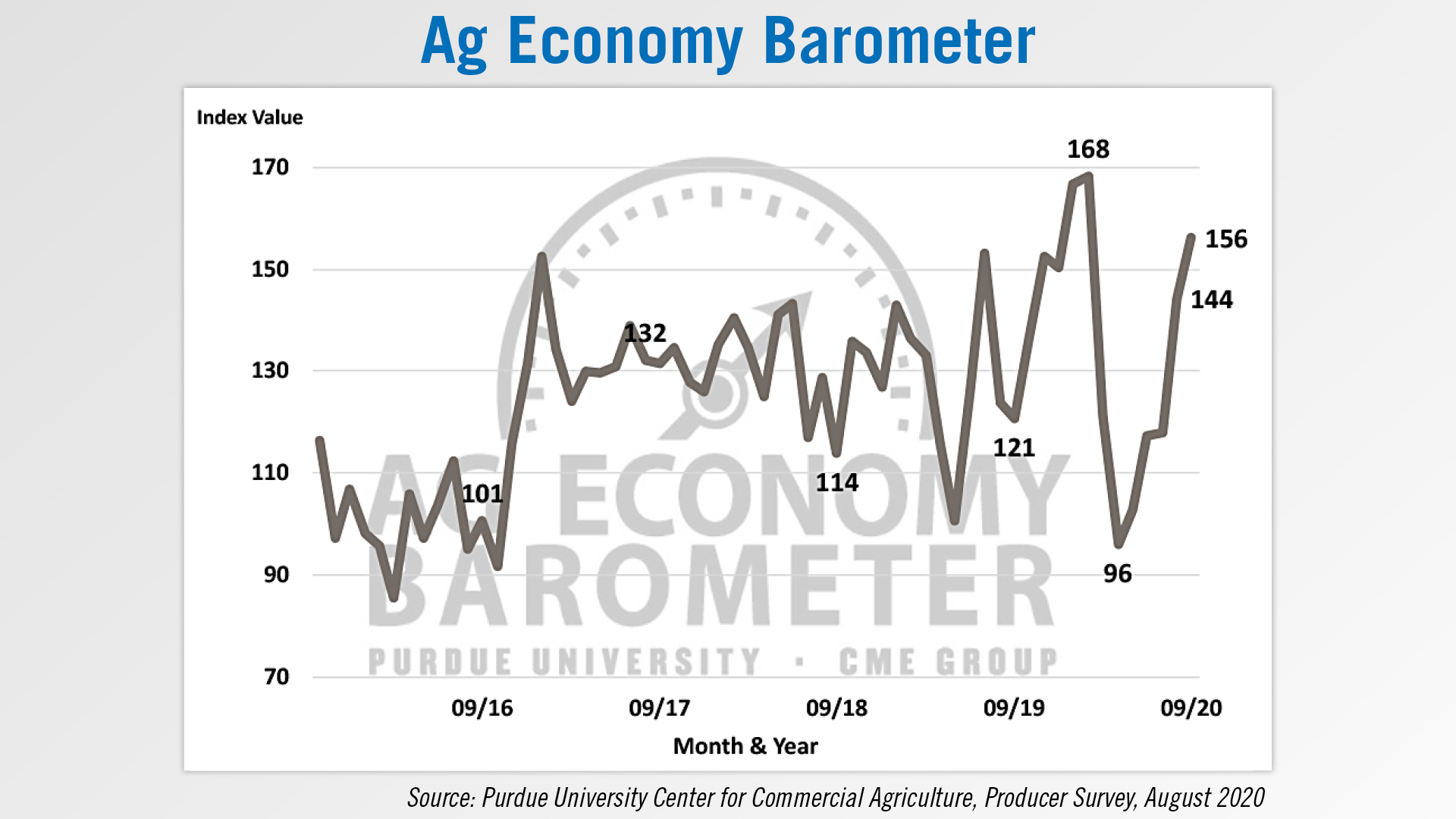

The latest Ag Economy Barometer from Purdue’s Center for Commercial Agriculture suggests that farmers are more confident about investing in machinery. The September Farm Capital Index rose to a reading of 73, the highest reading yet in 2020.

When asked about their plans for purchasing farm machinery in the upcoming year compared to a year ago, 11% said they plan to purchase more than in the previous year. This percentage had been on a steady incline since May.

While nearly half of farmers plan to keep their equipment purchasing levels at about the same as a year ago, the number who plan to reduce their purchases has been declining over the last several months. In September, 40% of farmers said they planned to purchase less equipment, down from 48% in August, and from a high of 65% in May.

Overall, the Ag Economy Barometer reading improved by 12 points to 156. The index is up 38 points since July and is 60 points higher than its 2020 low established back in April.

The improvement occurred against the backdrop of USDA’s Sept. 18 announcement of the second round of Coronavirus Food Assistance Program (CFAP 2) payments for U.S. agricultural producers. The program provides up to $14 billion in additional assistance to agricultural producers determined to have suffered from market disruptions and costs because of COVID-19.

If farmer sentiment continues on an upward trajectory and if crop yield projections are met, it could mean a solid 4th quarter for farm equipment sales.

Pent-Up Demand Will Fuel Alamo Sales

The Alamo Group reports that they’re seeing the effect of several years of pent up demand and as result are anticipating improvement in ag equipment sales going forward.

Alamo manufactures mowers, rotary cutters, tillage tools and other equipment for agriculture and infrastructure maintenance.

In a note to investors following the Colliers International Securities 2020 Investor Conference, Michael Shlisky, analyst with Colliers, said his takeaways were positive, especially in Ag, although Ag fundamentals are not necessarily outstanding.

Shlisky also pointed out that “The company had not appreciated the dealer destocking that had been going on over the last few years, but reorder activity is finally picking up. Alamo’s latest dealer survey has indicated that the majority believe that inventories are too low.”

Alamo management says social distancing requirements have hobby farmers and homeowners with large acreage focusing on maintenance. The Bush Hog zero-turn business continues to grow and Alamo has been gradually turning around the Dixie Chopper business as well. Dixie Chopper had strong brand recognition when it was acquired, but dealers had been starved of inventory and Alamo has been pushing re-stocking activity.

Following the company’s second quarter earnings release, Ron Robinson, Alamo Group's president and CEO, said “Our Agricultural Division products are holding up at a little better pace [than Industrial segment] since the agricultural industry is functioning reasonably well and seems to have less downside since this sector had already been operating at a reduced level for the last several years.”

Post a comment

Report Abusive Comment