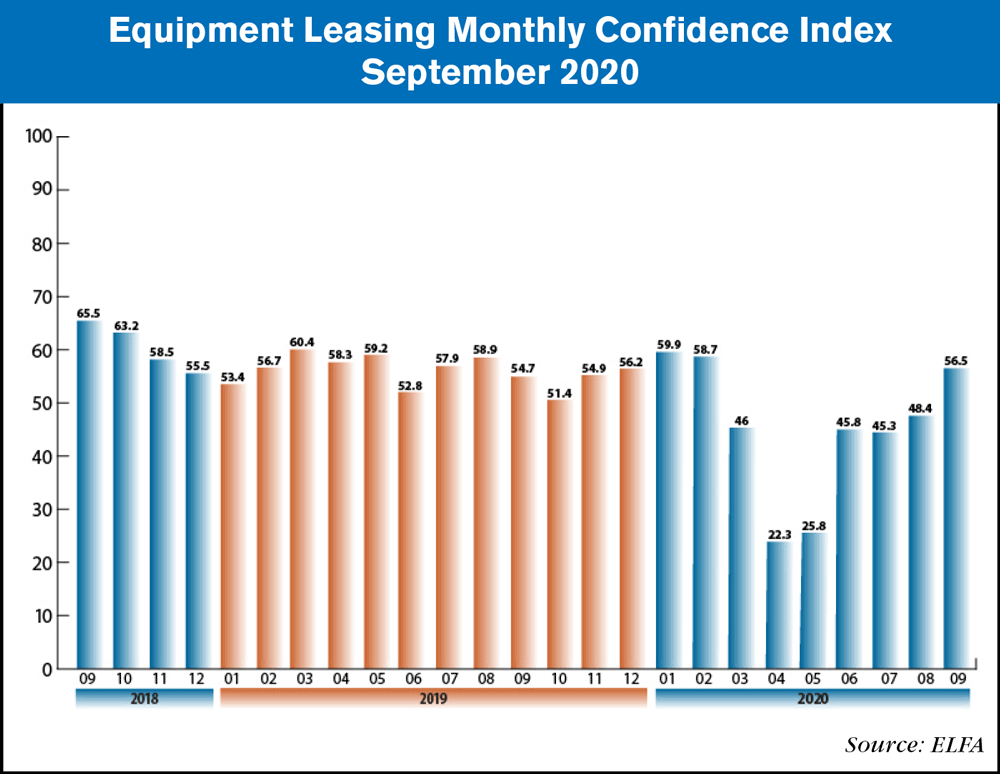

The Equipment Leasing & Finance Foundation (the Foundation) releases the September 2020 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 56.5, an increase from the August index of 48.4.

The Foundation also releases highlights of the COVID-19 Impact Survey of the Equipment Finance Industry, a monthly survey of industry leaders designed to track the impact of the coronavirus pandemic on the equipment finance industry.

When asked about the outlook for the future, MCI-EFI survey respondent Dave Fate, president and CEO, Stonebriar Commercial Finance, said, “The equipment finance industry has always been resilient. The debt and equity markets are strong with lots of liquidity, and election noise will be over soon.”

Survey Results

The overall MCI-EFI is 56.5, an increase from the August index of 48.4.

- When asked to assess their business conditions over the next four months, 35.7% of executives responding said they believe business conditions will improve over the next four months, up from 24.1% in August. 46.4% believe business conditions will remain the same over the next four months, a decrease from 51.7% the previous month. 17.9% believe business conditions will worsen, a decrease from 24.1% in August.

- 28.6% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 13.8% in August. 64.3% believe demand will “remain the same” during the same four-month time period, a decrease from 65.5% the previous month. 7.1% believe demand will decline, a decrease from 20.7% in August.

- 17.9% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up slightly from 17.2% in August. 78.6% of executives indicate they expect the “same” access to capital to fund business, an increase from 75.9% last month. 3.6% expect “less” access to capital, a decrease from 6.9% the previous month.

- When asked, 17.9% of the executives report they expect to hire more employees over the next four months, up from 13.8% in August. 71.4% expect no change in headcount over the next four months, an increase from 69% last month. 10.7% expect to hire fewer employees, down from 17.2% the previous month.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month. 46.4% of the leadership evaluate the current U.S. economy as “fair,” down from 48.3% in August. 53.6% evaluate it as “poor,” up from 51.7% last month.

- 50% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 31% in August. 39.3% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 44.8% last month. 10.7% believe economic conditions in the U.S. will worsen over the next six months, down from 24.1% the previous month.

- In September, 28.6% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 31% last month. 71.4% believe there will be “no change” in business development spending, an increase from 48.3% in August. None believe there will be a decrease in spending, down from 20.7% last month.

Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“Steady application counts and approval ratios continue to tell the story of opportunity in our space. I expect the election cycle will be turbulent and affect business.” David Normandin, CLFP, president and CEO, Wintrust Specialty Finance

Independent, Middle Ticket

“We are seeing pipeline opportunity remaining steady across a broad spectrum of industries.” Daniel Krajewski, president and CEO, Sertant Capital, LLC

Post a comment

Report Abusive Comment