The Deutz engines business was already feeling the impact of the coronavirus pandemic in the first quarter of 2020 and, as the year progressed, all areas of the Company’s business were noticeably affected, as expected, in terms of both activities and performance.

The expectation even at the start of this year was that Deutz’s engine business would decline overall in 2020. The main reason for this was the downturn in key customer industries against the backdrop of the weakening economy. This, along with effects relating to the advance production of engines before new emissions standards came into force, had already led to a low level of orders on hand at the end of 2019.

The coronavirus pandemic and its global impact on all economic activity put a further heavy burden on Deutz’s engine business in what was already a challenging market environment. In the reporting period, this led to an overall sharp decline in the sales figures presented below and thus in the company’s earnings performance.

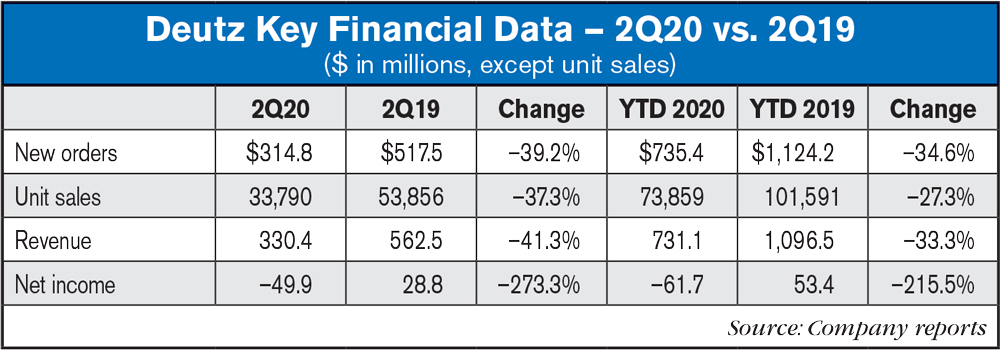

The Deutz Group’s revenue fell by 33.3% compared with the first six months of 2019 to $731.2 million. The disproportionately strong decrease in revenue, relative to the decrease in unit sales, was the result of negative product mix effects. From both a regional and an application segment perspective, revenue declined across the board in the reporting period. In the EMEA region, only the Middle East recorded a rise in revenue. This was attributable to new dealers in the service business. Revenue totaled $330.5 million in the second quarter of 2020, which was down by 41.3% compared with the corresponding period of 2019.

In the period under review, the new orders received by Deutz fell by 34.6% year-over-year to $735.4 million. This was due not only to the sharp drop in new orders triggered by the coronavirus crisis but also to the high level of new orders in the prior-year period as a result of customers building up their inventories of engines before new emissions standards came into force. Customers then sold these engines, putting a further strain on the business.

The Construction Equipment, Material Handling, Agricultural Machinery and Stationary Equipment application segments recorded double-digit percentage reductions in new orders. By contrast, the Miscellaneous application segment and the service business continued to notch up year-on-year increases, of 16.4% and 0.8% respectively. The sharp rise in the Miscellaneous application segment was primarily due to the growth in new orders for rail vehicle drive systems. New orders in the second quarter of 2020 decreased by 39.2% year-over-year to $314.8 million.

The Deutz Group sold a total of 73,859 engines in the reporting period, which was 27.3% fewer than in the first half of 2019. Miscellaneous was the only application segment with an increase in unit sales, registering a substantial rise of 112.7% that was largely attributable to the introduction of small outboard motors known as trolling motors. The ramp-up of these motors enabled Deutz subsidiary Torqeedo to more than double its sales of boat motors to a total of 16,244, which equates to a year-on-year rise of 163.8%.

In the EMEA region (Europe, Middle East, and Africa), Deutz’s biggest sales market, unit sales went down by 30.5% compared with the prior-year period to 37,763 engines. In the Americas region, unit sales fell by 47.4% to 14,726 engines. By contrast, unit sales in the Asia-Pacific region grew by 10.8% owing to the aforementioned ramp-up at Torqeedo.

In the second quarter of 2020, Deutz sold a total of 33,790 engines, including 7,721 Torqeedo drives. The equivalent figures for unit sales in the prior-year period had stood at 53,856 engines and 4,487 electric boat drives.

2020 Outlook

Compared with the market assessment from March of this year, the forecasts for the diesel engine customer industries relevant to Deutz have been largely lowered for 2020 as a result of the coronavirus pandemic and its impact on the global economy. Demand for construction equipment is expected to fall sharply in Europe and North America, whereas moderate growth is anticipated in China due to large-scale infrastructure projects and other factors.

The agricultural equipment sector is forecast to decline in all regions, partly because of the generally low level of agricultural commodity prices. Moreover, structural changes in the tractor market are likely to have an adverse impact in China.

In view of the impact of the coronavirus pandemic on the global economy and the resulting effect on the Company’s business activities and business performance, Deutz decided at the end of March 2020 to revoke the guidance published in the 2019 group management report. This decision continues to apply and it is therefore still not possible to provide updated guidance for 2020 at the present time.

Post a comment

Report Abusive Comment