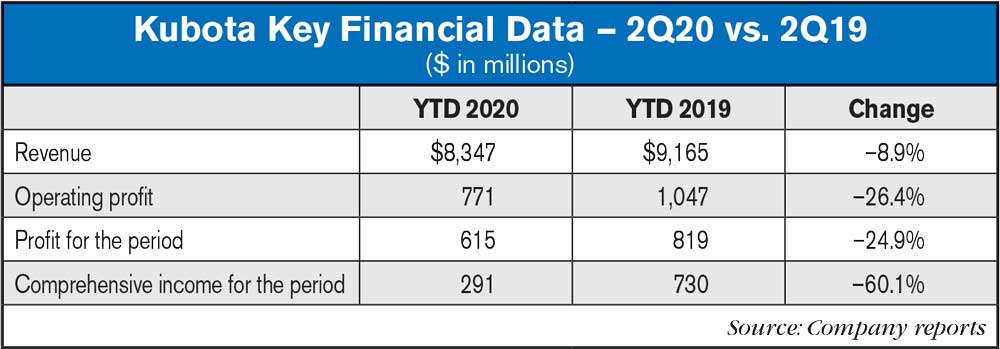

For the six months ended June 30, 2020, revenue of Kubota Corporation and its subsidiaries (hereinafter, the “Company”) decreased by ¥86.7 billion or $820 million (–8.9%) from the same period in the prior year to ¥884.2 billion ($8.4 billion).

Domestic revenue decreased by ¥19.9 billion or $190 million (–6.4%) from the same period in the prior year to ¥290.2 billion ($2.7 billion) because of decreased revenue in Farm & Industrial Machinery, Water & Environment and Other.

Overseas revenue decreased by ¥66.8 billion or $630 million (–10.1%) from the same period in the prior year to ¥594 billion ($5.6 billion) because of significantly decreased sales of construction machinery, tractors, and engines. On the other hand, revenue in Water & Environment increased.

Operating profit decreased by ¥29.3 billion or $280 million (–26.4%) from the same period in the prior year to ¥81.7 billion ($770 million) because profitability of products, which were shipped in this fiscal year, in its manufacturing bases deteriorated due to a significant reduction in production in the fourth quarter of 2019. In addition, there were some negative effects from significantly decreased sales in the overseas markets and unfavorable foreign exchange rates.

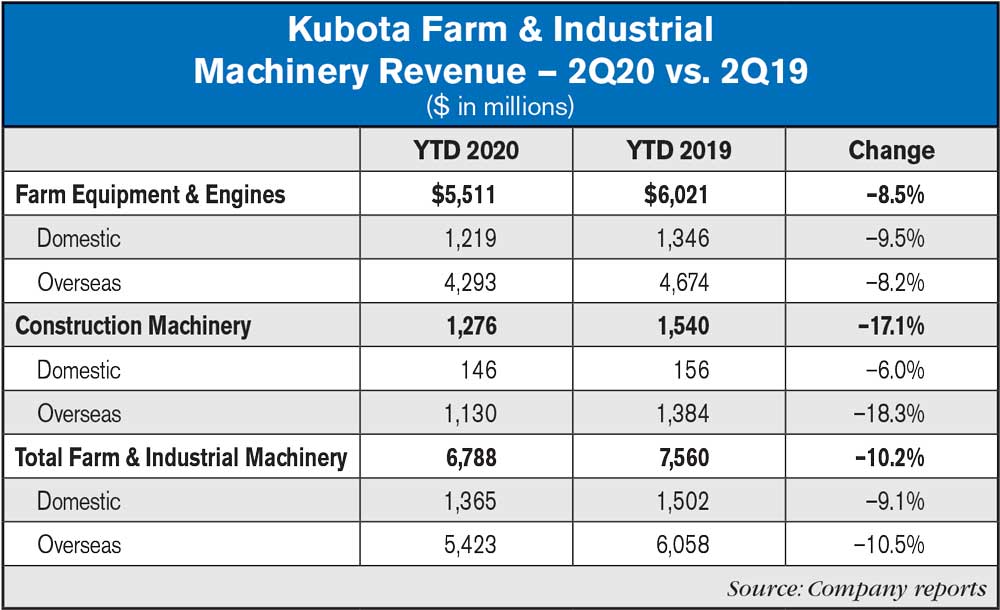

Farm & Industrial Machinery Segment

Farm & Industrial Machinery is comprised of farm equipment, agricultural‐related products, engines and construction machinery.

Revenue in this segment decreased by 10.2% from the same period in the prior year to ¥719 billion ($6.8 billion), and accounted for 81.3% of consolidated revenue.

Domestic revenue decreased by 9.1% from the same period in the prior year to ¥144.6 billion ($1.4 billion). Sales of farm equipment and agricultural‐related products decreased mainly due to adverse reaction from rushed demand before the consumption tax hike and a negative effect from voluntary restraint of sales activities along with the infection spread of COVID‐19.

Overseas revenue decreased by 10.5% from the same period in the prior year to ¥574.4 billion ($5.4 billion). In North America, retail sales had been strong mainly due to solid demand since April and a positive effect from introduction of new models. However, wholesales of construction machinery and tractors decreased because of adverse reaction from carryover of shipment of some products from the fiscal 2018 to the fiscal 2019 caused by typhoon, which had occurred in 2018, and delay in production and shipment caused by suspended operations in its manufacturing bases resulting from the infection spread of COVID‐19. In addition, sales of engines also significantly decreased from the same period in the prior year mainly due to a reduction in production of OEM clients resulting from the infection spread of COVID‐19 and a deterioration in oil and gas market.

In Europe, sales of construction machinery, tractors, and engines significantly decreased mainly due to some negative effects from business suspension by dealers and a reduction in production of OEM clients for engines along with the infection spread of COVID‐19. In Asia outside Japan, sales of tractors in Thailand decreased due to a negative impact of water shortage, which had continued since the prior year and inventory adjustments by dealers. On the other hand, sales of engines in China increased due to recovered demand after resumption of economic activities. In addition, sales of farm equipment increased due to a positive effect from introduction of a new model.

Operating profit in this segment decreased by 25% from the same period in the prior year to ¥87.1 billion ($820 million) mainly due to significantly decreased revenue in the domestic and overseas markets and a deterioration in profitability of products, which were shipped in this fiscal year, in its manufacturing bases, while there were some positive effects from raised product prices and declined material prices.

2020 Forecasts

The Company did not announce the forecasts for the year ending Dec. 31, 2020, as it was difficult to calculate the reasonable forecasts under the uncertain circumstances about the scale of the infection spread of COVID‐19 and the timing of end of COVID‐19. However, the Company has determined the forecasts as follows based on the information available at the present time and its business trends of the first half of this year because economic activities have been resumed gradually in the domestic and overseas markets.

Consolidated revenue for the year ending Dec. 31, 2020 is forecast to decrease by ¥140 billion ($1.3 billion) from the prior year to ¥1,780 billion ($16.8 billion). The Company expects the infection spread of COVID‐19 will settle gradually. However, the negative impact of COVID‐19 is expected to continue throughout the year because the pace of a recovery in demand after the resumption of economic activities is expected to be slow and it is expected to take time for a recovery in production, including parts procurement. As a result, the negative impact on consolidated revenue is expected to be a decrease of around ¥158 billion ($1.5 billion).

Operating profit is forecast to decrease by ¥51.7 billion ($490 million) from the prior year to ¥150 billion ($1.4 billion) mainly due to a negative impact of the yen appreciation and a deterioration in profitability of products in manufacturing bases along with reduced production volumes, in addition to significantly decreased revenue in the domestic and overseas markets. Profit before income taxes is forecast to decrease by ¥54 billion ($510 million) from the prior year to ¥155 billion ($1.5 billion).

(These forecasts are based on the assumption of exchange rates of ¥107=US$1 and ¥120=€1.)

Post a comment

Report Abusive Comment