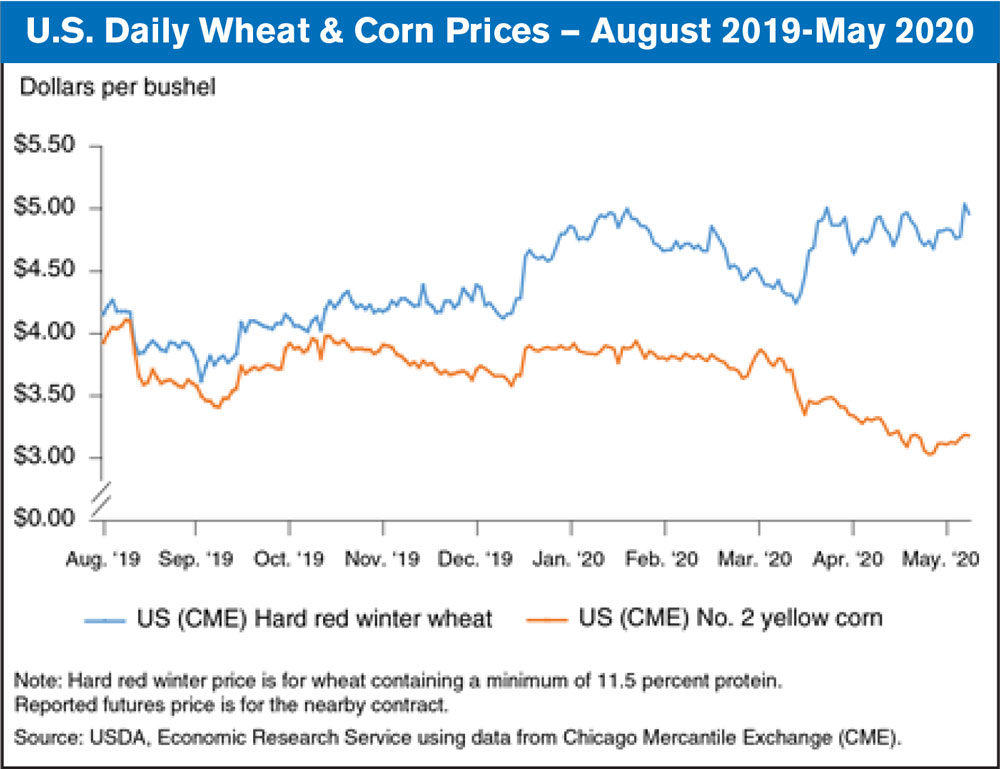

Wheat and corn prices tend to move in parallel, with cash and futures wheat prices historically being slightly above those for corn. For example, between August 2019 through March 2020, the average difference between futures contract prices of hard red winter wheat and yellow corn was about $0.58 per bushel and similar in size to their typical price spread. However, when efforts to contain the outbreak of COVID-19 brought about widespread stay-at-home orders, this wheat and corn price series began to diverge significantly. The widening spread came at a potentially impactful time for farmers, whose planting decisions could have been influenced by the perceived relative profitability of corn and spring wheat (winter wheat is planted in fall of the prior year and sowing would not be affected by recent developments).

From the end of March through mid-May, the price difference for the leading wheat futures contract surged to $1.54 per bushel and well above the comparable average wheat-corn price margin. A spike in domestic retail flour, bread, and wheat-based product sales—related to greatly increased expenditures on food eaten at home—contributed to the observed wheat price increase. In contrast, stay-at-home orders significantly reduced fuel demand—10% of which is corn-based ethanol, thereby putting substantial downward pressure on the 2019-20 corn price. In the new marketing year, the margin between wheat and corn cash prices is expected to remain above the 5-year average, in part due to the continuation of COVID-19 related impacts on demand for wheat and corn products, and also due to contrasting supply expectations for each grain.

This chart is drawn from the Economic Research Service Wheat Outlook, published in May 2020 and has been updated using data from the Chicago Mercantile Exchange.

Post a comment

Report Abusive Comment