As U.S. farmers launch the 2020 planting season, they will confront the usual, and in some cases unusual challenges. Fuel prices won’t be one of them. According to the Energy Information Administration (EIA), oil market volatility is at an all-time high and prices are at a nearly 20 year low.

And, in this case, the coronavirus isn’t necessarily the primary cause.

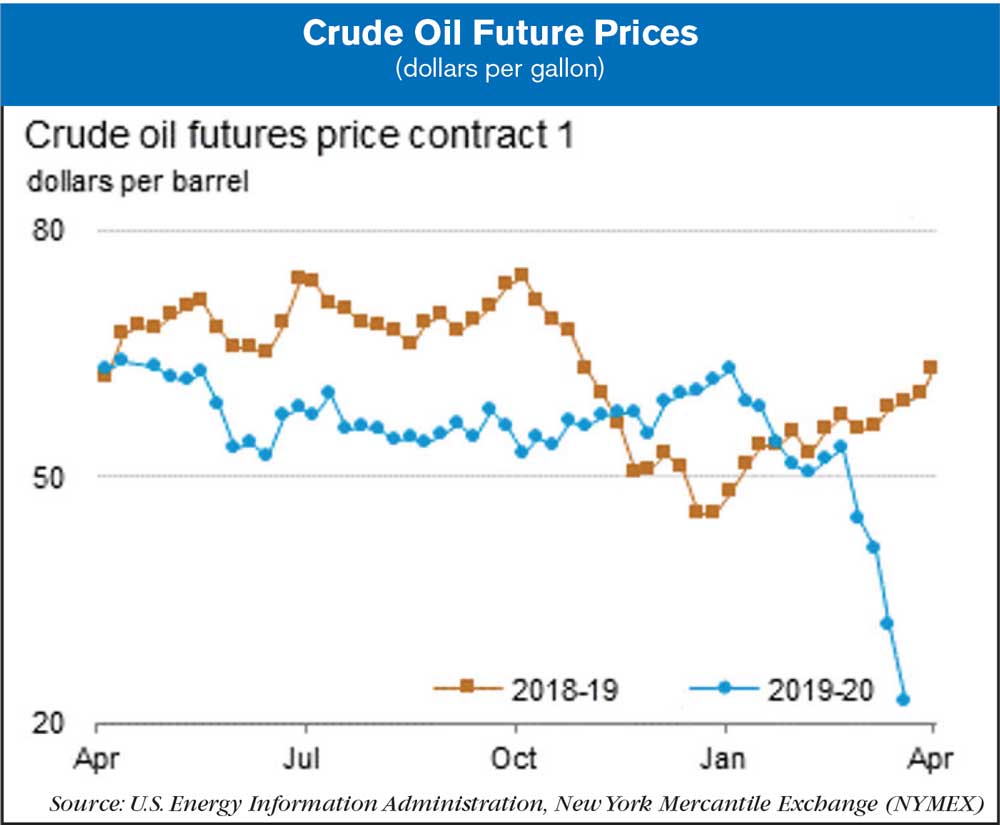

Crude oil prices have fallen significantly since the beginning of 2020, largely driven by the economic contraction caused by the 2019 novel coronavirus disease (COVID19) and a sudden increase in crude oil supply following the suspension of agreed production cuts among the Organization of the Petroleum Exporting Countries (OPEC) and partner countries.

With falling demand and increasing supply, the front-month price of the U.S. benchmark crude oil West Texas Intermediate (WTI) fell from a year-to-date high closing price of $63.27 per barrel on Jan. 6 to a year-to-date low of $20.37 per barrel on March 18, the lowest nominal crude oil price since February 2002.

This, of course, is impacting the price consumers and farmers are paying for fuel.

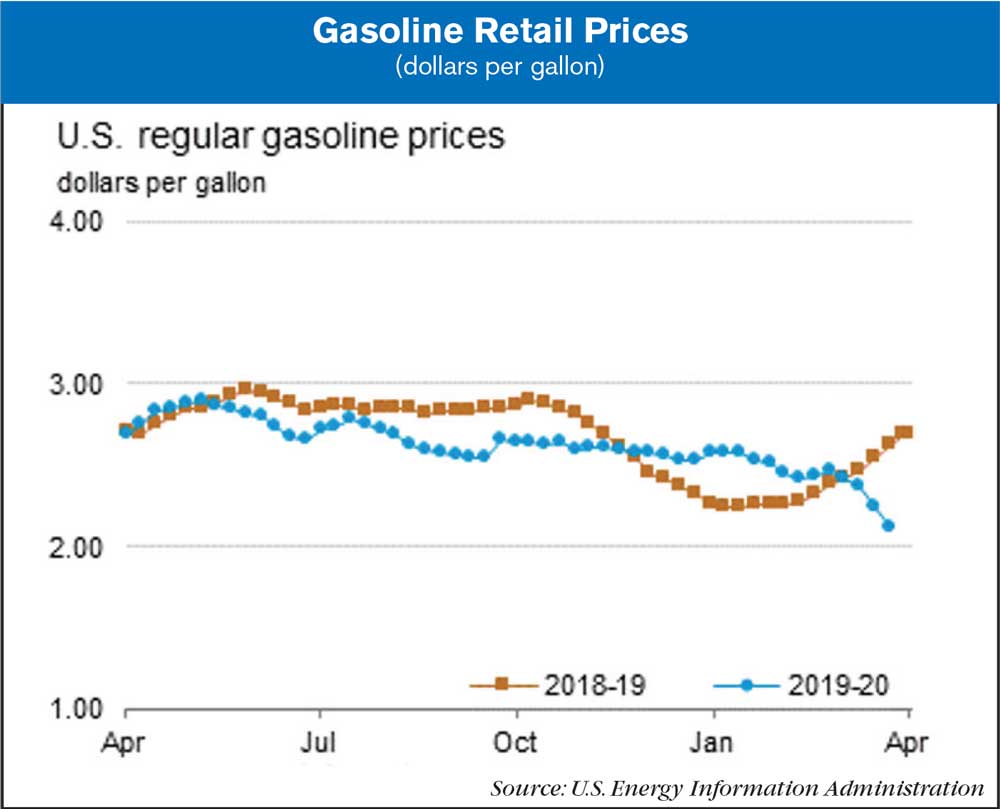

The U.S. average regular gasoline retail price fell nearly 13 cents from the previous week to $2.12 per gallon on March 23, 50 cents lower than a year ago. The Midwest price fell more than 16 cents to $1.87 per gallon, the West Coast price fell nearly 15 cents to $2.88 per gallon, the East Coast and Gulf Coast prices each fell nearly 11 cents to $2.08 per gallon and $1.86 per gallon, respectively, and the Rocky Mountain price declined more than 8 cents to $2.24 per gallon.

The U.S. average diesel fuel price fell more than 7 cents from the previous week to $2.66 per gallon on March 23, 42 cents lower than a year ago. The Midwest price fell more than 9 cents to $2.50 per gallon, the West Coast price fell more than 7 cents to $3.25 per gallon, the East Coast and Gulf Coast prices each fell nearly 7 cents to $2.72 per gallon and $2.44 per gallon, respectively, and the Rocky Mountain price fell more than 6 cents to $2.68 per gallon.

According to EIA, markets currently appear to expect continued and increasing market volatility, and, by extension, increasing uncertainty in the pricing of crude oil. Oil’s current level of implied volatility — a forward-looking measure for the next 30 days — is also high relative to its historical, or realized, volatility. Historical volatility can influence the market’s expectations for future price uncertainty, which contributes to higher implied volatility. Some of this difference is a structural part of the market, and implied volatility typically exceeds historical volatility as sellers of options demand a volatility risk premium to compensate them for the risk of holding a volatile security. But the current implied volatility of WTI prices is still higher than normal.

Post a comment

Report Abusive Comment