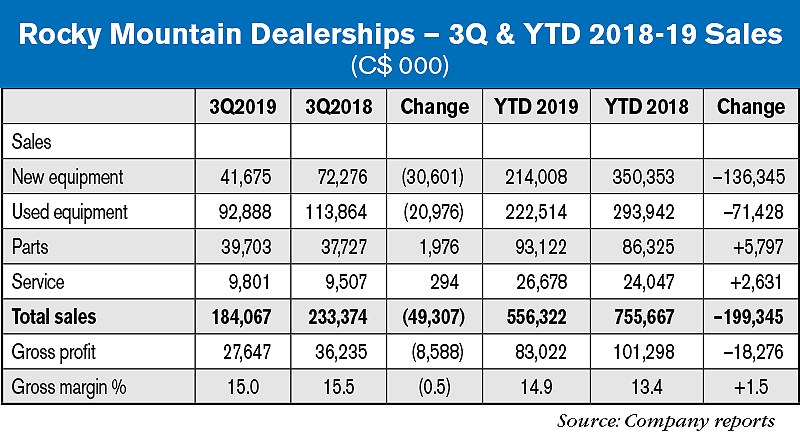

Rocky Mountain Dealerships (TSX:RME) Canada's largest farm equipment dealer group, posted a 21.1% decrease in total sales during the third quarter of 2019 ending Sept. 30. Sales during the period declined by $49,307 to $184,067 from $233,374 during the same period in 2018. The company says the decrease was due primarily to declines in new and used same store equipment sales of $31,271 and $21,467, respectively.

At the same time, RME recorded its “second largest inventory decrease in its history,” according to Garrett Ganden, RME’s president and CEO.

“Our focus was on reducing inventories and strengthening the balance sheet, which defensively positions RME against an uncertain macroeconomic outlook. We continued to make positive progress on the higher margin, product support side of the business, with an increase in revenues of $2.3 million (4.8%) year-over-year,” said Ganden.

“There was little change in the political and macroeconomic uncertainty which has persisted throughout the year and continues to weigh on industry sales. Deliveries of new agriculture units in the Canadian marketplace continued to decline in the third quarter, which are now approaching levels not seen since 2004,” he said.

Equipment Inventories

Total equipment inventory decreased by $55,953 (10%) to $504,327 compared to $560,280 in the second quarter of 2019 — the second largest equipment inventory decrease in RME’s history. Total equipment inventory increased $38,498 (8.3%) compared to the same period in 2018. Gross profit as a percentage of sales decreased to 15% compared to 15.5% for the same period in 2018. Product support revenues increased by $2,270 (4.8%) to $49,504 compared with $47,234 in the same period of 2018. Operating SG&A decreased $1,897 (9.1%) to $18,860 compared with $20,757 for the same period in 2018. As a percentage of sales, operating SG&A increased to 10.2% compared with 8.9% for the same period in 2018.

The period-over-period decline in gross profit is primarily a function of reduced overall sales levels, as well as reductions in realized pricing on used agriculture equipment sales. The third quarter is typically our best opportunity to sell-down our inventory levels while harvest equipment is in-season. The company said, “During the third quarter of 2019, we priced our inventory competitively in order to maximize our participation in what was a depressed market for agriculture equipment.

“We achieved a measure of success in this regard, posting a $61,654 reduction in overall inventory during Q3 2019, our largest third quarter inventory reduction since 2013. In so doing, transactional margins, namely on used agriculture equipment contracted during the quarter. These reductions in gross profitability were partially offset by a favorable shift in sales mix toward higher margin product support revenues.”

Trade Disputes

According to RME management, unresolved trade disputes surrounding Canadian agriculture commodities continued to weigh on crop prices and farmer sentiment during the third quarter. Trade barriers between Canada and several of its agriculture commodity trading partners continue to impede farmers’ ability to deliver their crops to key end markets. China, with its ban on Canadian canola, joins India, Saudi Arabia and others in implementing trade barriers affecting Canadian agriculture products including canola, wheat and lentils.

The severity of these disputes continues to weigh on agriculture commodity prices and overall farmer sentiment which, in turn, tempers demand for RME's product and service offerings. In its September 2019 Ag Tractor and Combine report for Canada, the Assn. of Equipment Manufacturers reported year-to-date sales declines in major product categories including 4WD tractors (down 33%) and self-propelled combines (down 28%), a manifestation of this downturn in sentiment.

Crop Outlook

Snowfall in several regions and heavy rain in others stalled 2019 harvest activity, with all three Canadian Prairie Provinces reporting significant delays in harvest progress as of the end of the third quarter. These conditions continue to temper customer demand for equipment.

All three Canadian Prairie Provinces reported significant delays in harvest completion with Alberta 34% complete (5 year average of 54%), Saskatchewan 47% complete (5 year average of 75%)2 and Manitoba 67% complete (3 year average of 76%).

Subsequent to the end of the quarter, harvest has continued to progress. While all three provinces continue to trail historical averages, overall, farmers have made up some ground thus far in October. While these weather conditions are expected to negatively impact both grade and yield, the precipitation has helped replenish topsoil moisture levels.

In its Oct. 18, 2019, Outlook for Principal Field Crops, Agriculture and Agri-Foods Canada estimates seeded area to be relatively comparable to last year with higher yields boosting overall production of principal field crops in 2019 over 2018 levels. However, with a considerable amount of the crop still in the fields, the impact of recent weather conditions on area harvested and grade is uncertain.

Post a comment

Report Abusive Comment