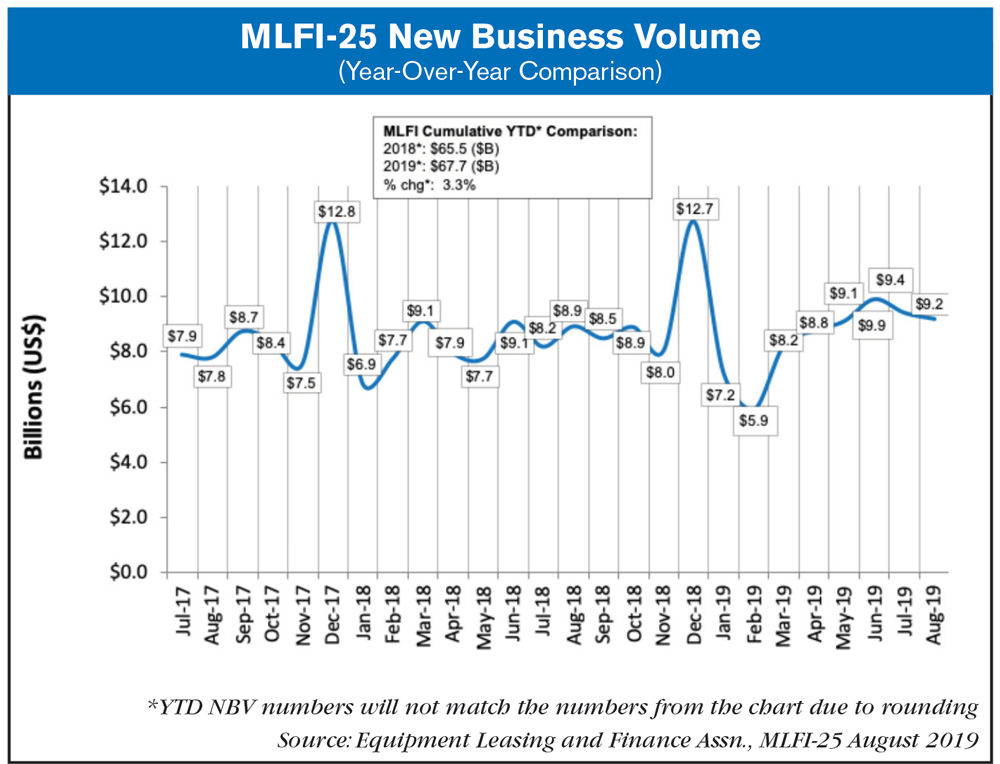

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for August was $9.2 billion, up 3% year-over-year from new business volume in August 2018. Volume was down 2% month-to-month from $9.4 billion in July. Year to date, cumulative new business volume was up 3% compared to 2018.

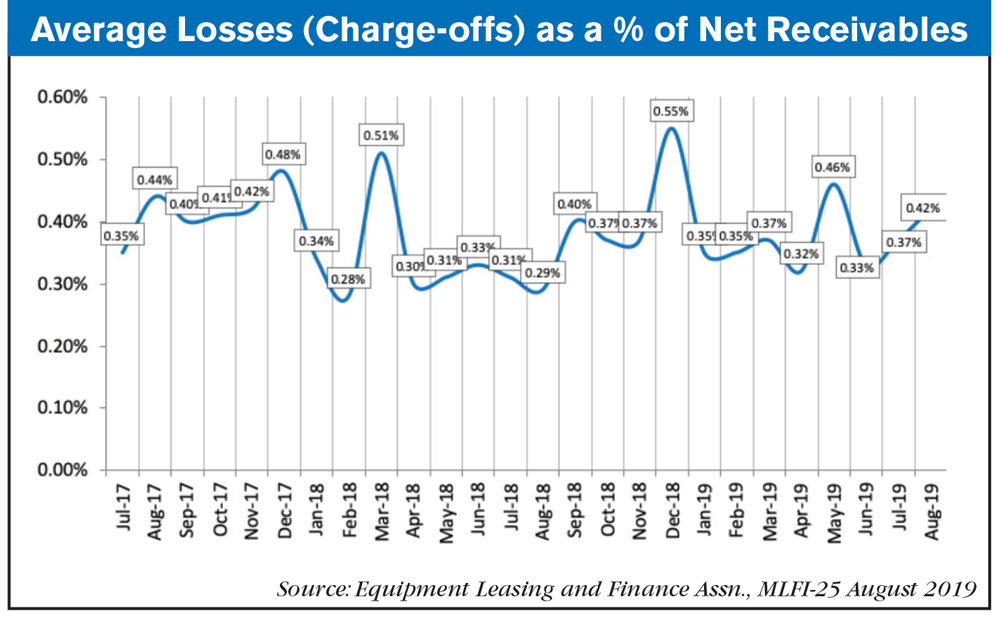

Receivables over 30 days were 2%, unchanged from the previous month and up from 1.9% the same period in 2018. Charge-offs were 0.4%, up from 0.3% the previous month, and up from 0.2% in the year-earlier period.

Credit approvals totaled 76.6%, up from 75.7% in July. Total headcount for equipment finance companies was down 2.1% year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in September is 54.7, down from the August index of 58.9.

ELFA president and CEO Ralph Petta said, “New business volume reported by member-respondents grew modestly in August, as the U.S. economy continues to perform well. A variety of economic indicators all point to a continued pattern of sustained, moderate growth in many sectors within the equipment finance industry.”

Richard E. Barry, president, Merchants Bank Equipment Finance, said, “August monthly and year-to-date new origination volume activity demonstrates a consistent increase over last year's monthly and year-to-date results. Credit quality continues to be actively monitored as month-over-month charge-offs rose slightly. The August MLFI-25 points to the continued desire of business owners to invest in efficient and productive capital equipment solutions for their enterprises.”

Post a comment

Report Abusive Comment