Valmont Industries, a global provider of engineered products and services for infrastructure development and irrigation equipment and services for agriculture, reported financial results for the second quarter ended June 29, 2019.

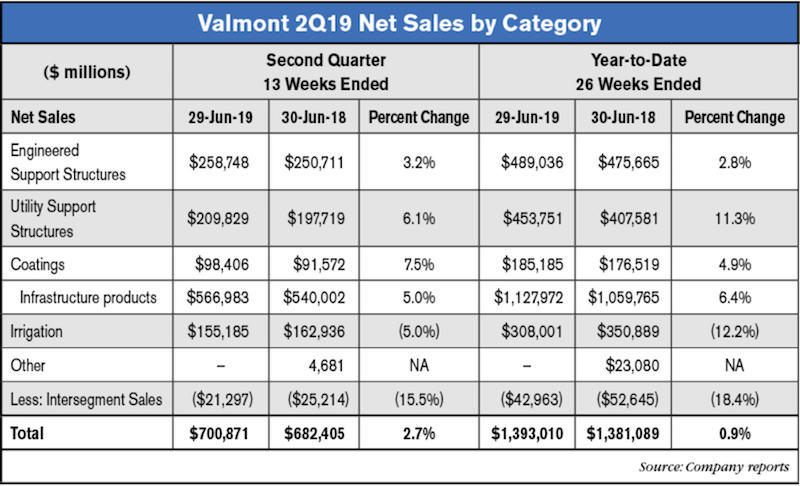

Revenues grew 2.7% to $700.9 million; excluding a 2.0% unfavorable currency impact and revenue from the divested grinding media business of $4.7 million, sales would have increased 5.5%. Operating income remained flat at $63.7 million or 9.1% of sales, compared to $63.7 million or 9.3% of sales ($70.7 million adjusted1 or 10.4% of sales).

North America sales of $102.8 million were 9.7% below 2018 sales of $113.9 million. Adverse weather conditions and continued low net farm income levels are weighing on farmer sentiment and demand. International irrigation sales of $52.4 million were 6.7% higher compared to last year, driven by stronger demand in Brazil and the EMEA region, partially offset by unfavorable currency impacts.

“We had a good quarter across the majority of our businesses, despite substantial, unfavorable comparisons in the Irrigation segment, and we exceeded last year's performance after excluding non-recurring expenses,” said Stephen G. Kaniewski, President and Chief Executive Officer. “Sales growth was led by robust transportation and wireless communication demand, particularly in North America markets, revenue from acquisitions, and favorable pricing across the portfolio. We experienced favorable demand in three of our four segments.”

Overall, Valmont’s irrigation segment accounts for 22.1% of total sales. This part of the company’s business includes agricultural irrigation equipment, parts and services, and tubular products, water management solutions and technology for precision agriculture.

Global sales of $155.2 million were 4.8% lower than last year. Excluding a 1.5% unfavorable currency impact, sales would have decreased 3.3%.

North America sales of $102.8 million were 9.7% below 2018 sales of $113.9 million. Adverse weather conditions and continued low net farm income levels are weighing on farmer sentiment and demand. Pricing discipline, a more favorable product mix and higher technology sales were offset by lower volumes.

International irrigation sales of $52.4 million were 6.7% higher compared to last year, driven by stronger demand in Brazil and the EMEA region, partially offset by unfavorable currency impacts.

Segment operating income was $21.5 million, or 13.9% of sales, compared to $27.7 million, or 17.0% of sales in 2018. Pricing discipline was more than offset by lower volumes and factory deleverage.

To view the full earnings report, click here.

Post a comment

Report Abusive Comment