OMAHA, Neb., July 9, 2019 — Lindsay Corp. (NYSE: LNN), a global manufacturer and distributor of irrigation and infrastructure equipment and technology, today announced results for its third quarter ended May 31, 2019.

Third Quarter Summary

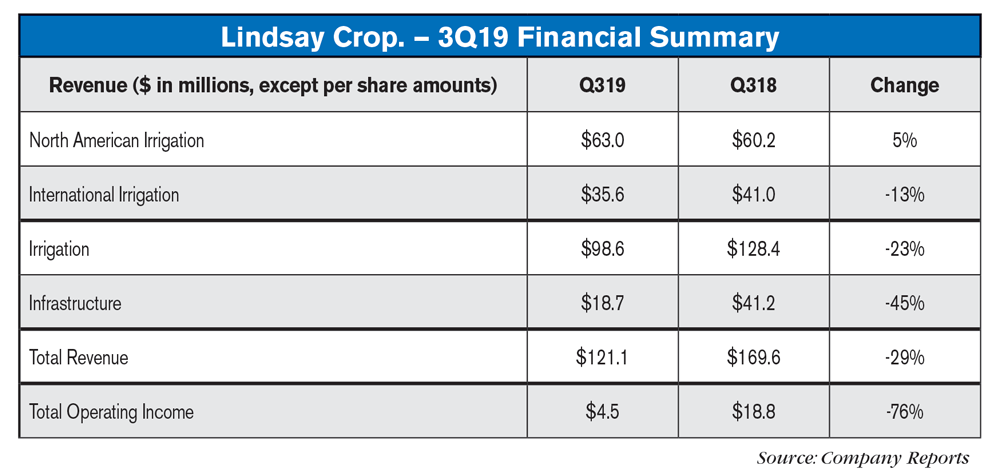

Revenues for the third quarter of fiscal 2019 were $121.1 million, a decrease of $48.5 million, or 29%, compared to revenues of $169.6 million in the prior year third quarter. Approximately $27.2 million of the decrease in revenues was attributable to previously announced business divestitures in the irrigation segment as part of the Company’s Foundation for Growth initiative.

Net earnings for the quarter were $2.9 million, or $0.27 per diluted share, compared with net earnings of $10.4 million, or $0.96 per diluted share, for the same period in the prior year. In addition to the impact of lower revenues, net earnings for the quarter were reduced by after-tax costs of $2.6 million, or $0.23 per diluted share, related to the Company’s Foundation for Growth initiative. Excluding these additional costs, net earnings for the third quarter would have been $5.5 million, or $0.50 per diluted share. Net earnings for the same period in the prior year, adjusted for Foundation for Growth costs, would have been $17.9 million, or $1.66 per diluted share. Net earnings in the prior year included $1.5 million, or $0.14 per diluted share, related to the business divestitures.

“Low commodity prices and uncertainty regarding the outcome of trade negotiations continued to weigh on farmer sentiment and demand for irrigation equipment during the quarter,” said Tim Hassinger, President and Chief Executive Officer. “Along with that, strong Road Zipper System® sales in the prior year third quarter resulted in a challenging year over year comparison.”

Segment Results

Irrigation segment revenues for the third quarter of fiscal 2019 were $98.6 million, a decrease of $29.8 million, or 23%, compared to $128.4 million in the prior year third quarter. Excluding the impact of the divestitures, North America irrigation revenues of $63.0 million increased $2.8 million, or 5%, compared to the prior year. Higher revenue from engineering project services and the impact of higher average selling prices were partially offset by lower irrigation equipment unit volume and lower sales of replacement parts. International irrigation revenues of $35.6 million decreased $5.4 million, or 13%, compared to the prior year. Excluding the negative impact of differences in foreign currency translation compared to the prior year, international irrigation revenues decreased $2.7 million, or 7 percent.

Irrigation segment operating margin was 11.2% of sales (11.7% adjusted) in the third quarter, compared to 9.1% of sales (14.1% adjusted) in the prior year. The prior year benefited from the recovery of $2.5 million in previously reserved accounts receivable that did not repeat. In addition, lower sales of irrigation equipment and replacement parts in North America resulted in a lower margin mix in the current quarter.

The backlog of unshipped orders at May 31, 2019 was $42.5 million compared with $55.8 million at May 31, 2018. Approximately $12.4 million of the reduction in backlog resulted from business divestitures. Excluding the impact of the divestitures, irrigation segment backlogs were higher and infrastructure backlogs were lower compared to the prior year. Subsequent to the end of the quarter, a $15.0 million Road Zipper System® order was received from a customer in Japan, with delivery expected to begin in the fourth quarter of fiscal 2019.

Analysis

Lindsay posted revenues of $121.1 million for the third quarter of 2019, missing the Zack's Consensus Estimate by 11.6%. According to analysts at Zack's Equity Research, Lindsay has been unable to beat consensus revenue estimates for the last four quarters. "This quarterly report represents an earnings surprise of -38.27%. A quarter ago, it was expected that this irrigation equipment maker would post earnings of $0.62 per share when it actually produced earnings of $0.02, delivering a surprise of -96.77%. Over the last four quarters, the company has not been able to surpass consensus EPS estimates," said Zack's analysts.

To view the full earnings report, click here.

Post a comment

Report Abusive Comment