Ag equipment manufacturers and dealers have in recent weeks released their quarterly earnings. Sales for equipment manufacturers and/or their agricultural segments largely improved the last three months. Meanwhile, Canada’s largest dealership network announced it was opening a used equipment outlet in Kansas, marking the most recent step in its foray into the U.S. in accordance with its 5 year growth plan.

AGCO Has Another Strong Quarter with 11.5% Year-Over-Year Sales Growth

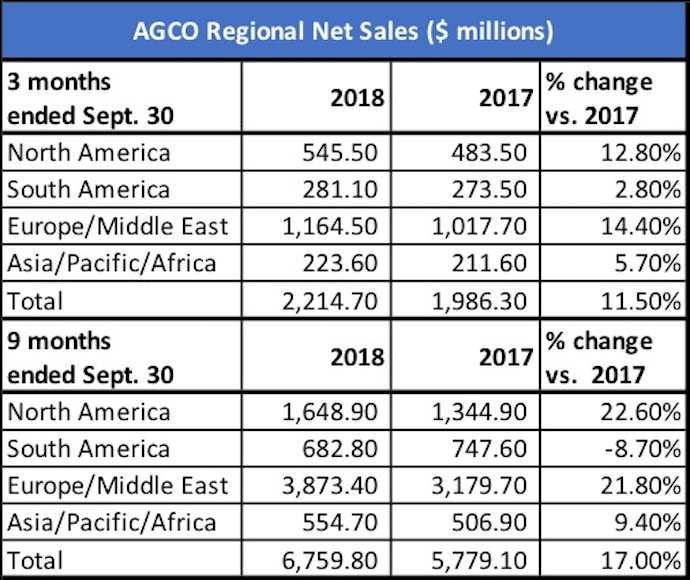

AGCO reported net sales of approximately $2.2 billion for the third quarter of 2018, an increase of approximately 11.5% compared to the third quarter of 2017. Excluding unfavorable currency translation impacts of approximately 5.9%, net sales in the third quarter of 2018 increased approximately 17.4% vs. the third quarter of 2017.

Net sales for the first 9 months of 2018 were approximately $6.8 billion, an increase of approximately 17% compared to the same period in 2017. Excluding favorable currency translation impacts of approximately 1.8%, net sales for the first 9 months of 2018 increased approximately 15.1% compared to the same period in 2017.

North America. AGCO’s North American net sales increased 22.2% in the first 9 months of 2018 compared to the same period of 2017. The largest increases were in sprayers, high horsepower tractors and hay tools. Precision Planting, which was acquired in the fourth quarter of 2017, contributed sales of approximately $97.2 million in the first 9 months of 2018. Sales grew approximately 14.2% compared to the first 9 months of 2017.

South America. Net sales in the South American region increased 8.6% in the first 9 months of 2018 compared to the first 9 months of 2017, excluding the impact of unfavorable currency translation.

2018 Outlook. AGCO’s net sales for 2018 are expected to reach $9.3 billion, reflecting improved sales volumes, positive pricing, acquisition and foreign exchange impacts. Gross and operating margins are expected to improve from 2017 levels due to higher net sales and benefits resulting from the company’s cost reduction initiatives, partially offset by increased engineering expenses and material costs.

Related Content: AGCO Has Another Strong Quarter with 11.5% Year-Over-Year Sales Growth.

While Ag Sales Rise 4%, CNHI 3Q18 Revenues Flat

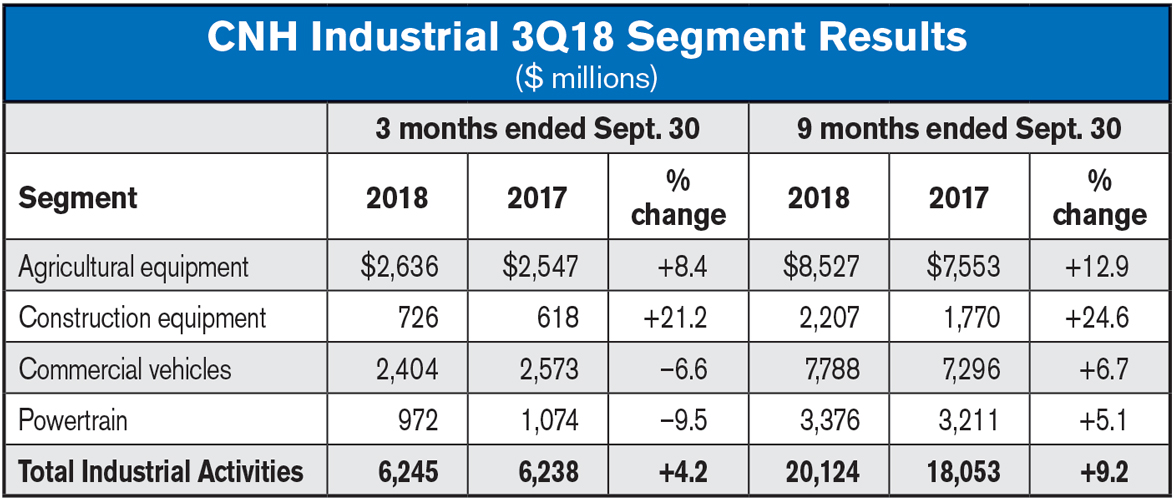

CNH Industrial reported 2018 third quarter consolidated revenues of $6.8 billion, with net income up 285% to $231 million.

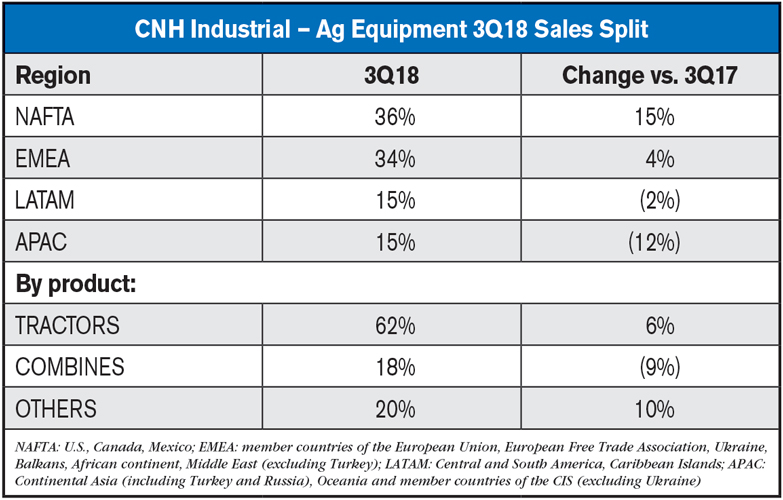

Industrial Activities net sales were flat compared to the third quarter of 2017 (up 4% on a constant currency basis), with an 18% improvement in construction equipment and a 4% increase in agricultural equipment offset by declines in Commercial Vehicles and Powertrain

Agricultural equipment’s net sales increased 4% in the third quarter of 2018 compared to the third quarter of 2017 (up 8% on a constant currency basis). The increase was primarily the result of price realization across all regions and higher sales volumes in NAFTA, partially offset by a revenue decrease in APAC, primarily Australia. Anticipated raw material cost increase was offset by manufacturing efficiencies and lower warranty cost due to improved quality performance. Similar to previous quarters, Agricultural Equipment maintained increased product development spending by 10%, related primarily to precision farming and compliance with Stage V emissions requirements.

2018 Outlook. Despite increasing uncertainties related to the trade policy environment and raw material inflationary headwinds, together with foreign exchange volatility in the emerging economies, CNH Industrial is confirming its 2018 guidance, which calls for net sales of Industrial Activities at approximately $28 billion.

Related Content: While Ag Sales Rise 4%, CNHI 3Q18 Revenues Flat

Kubota Posts 8.2% Gain in 3Q18; Ag & Industrial Machinery Up 8.7%

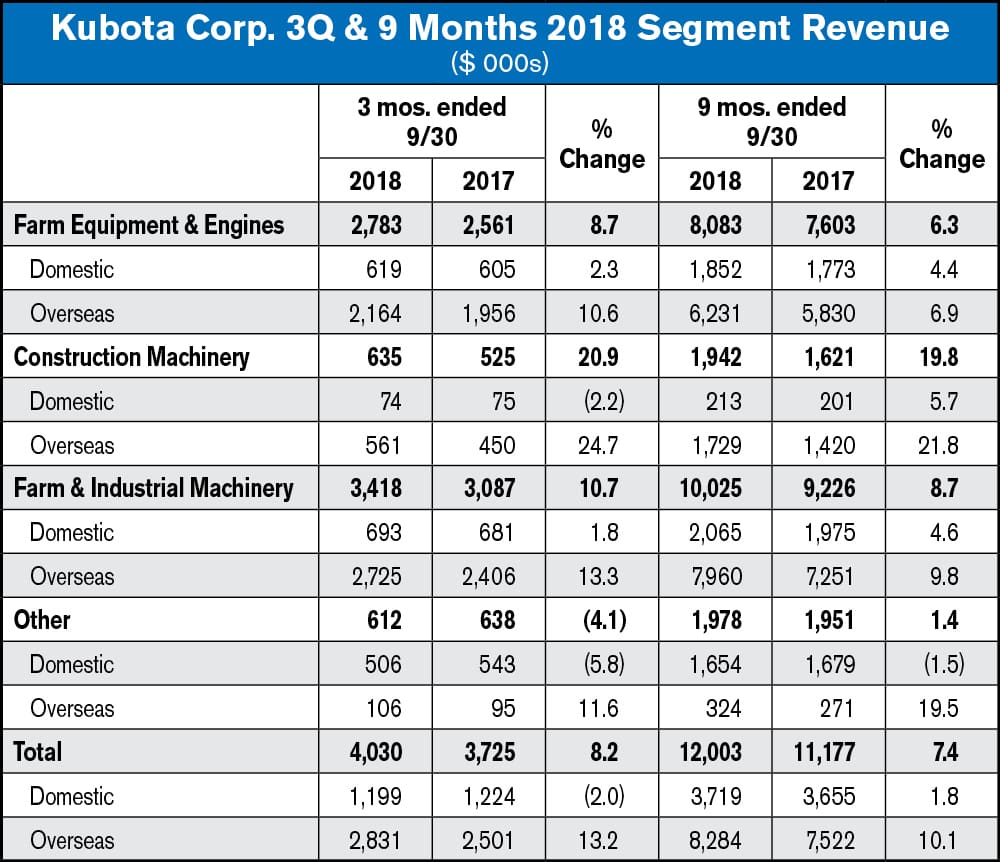

Overseas sales drove much of Kubota Corp.’s increased revenues in the third quarter and first 9 months of 2018, ended Sept. 30. Overall, the company reported revenues in the third quarter were $4.03 billion, up 8.2% vs. the same period last year. For the first 9 months of year, revenues rose by 7.4%, to $12 billion.

Through the first 9 months of the year, domestic revenue increased 1.8%, to $3.72 billion. Kubota says this was the result of increased revenue in Farm & Industrial Machinery. For the same reason, overseas revenue increased 10.1% vs. the same period in the prior year to $8.3 billion.

Revenue from Kubota’s Farm & Industrial Machinery segment increased by 8.7% vs. the same period in the prior year to about $10 billion and accounted for 83.5% of consolidated revenue through the first 9 months of 2018.

Domestic revenue increased by 4.6% from the same period in the prior year to $2.1 billion. Overseas revenue increased by 9.8% from the same period in the prior year to nearly $8 billion. In North America, sales of construction machinery and engines increased due to solid demand for construction. Sales of utility vehicles increased the introduction of new models as well. Sales of tractors increased as a result of continuous expansion of demand.

Kubota revised its forecasts for revenue for the year ending Dec. 31, 2018, upward to $16.1 billion, an increase of $877 million from the previous forecasts. The company said this revision was made because overseas revenue in tractors and construction machinery is expected to increase significantly mainly in North America compared with the previous forecasts.

Related Content: Kubota Posts 8.2% Gain in 3Q18; Ag & Industrial Machinery Up 8.7%

Cervus Reports Both Total Revenue & Ag Sales Up 9%

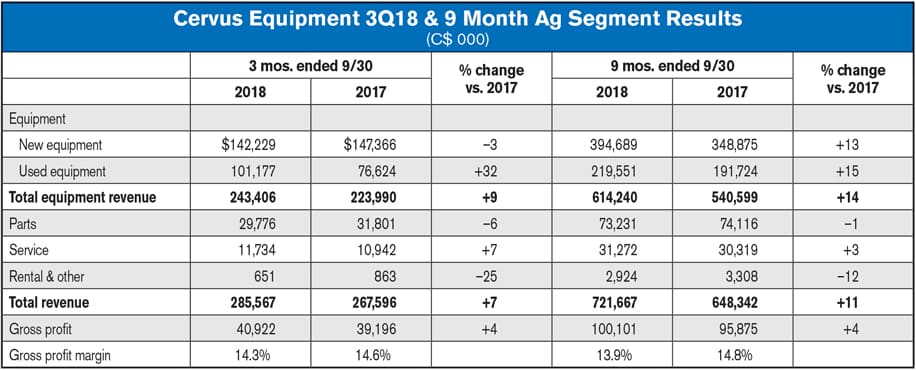

Cervus Equipment Corp. announced that third quarter profitability growth was driven by performance in its Transportation segment, as well as solid agricultural results for the quarter ended Sept. 30, 2018.

“In our Agriculture segment, Western Canadian producers experienced difficult harvest conditions in the third quarter, increasing demand for our reliable, well-conditioned used equipment,” said Graham Drake, Cervus Equipment’s president and CEO. “With favorable weather returning in October, harvest has resumed along with our parts and service support for producers in their critical window. Looking ahead, we will continue to leverage opportunities to market used agricultural equipment and parts in the fourth quarter.”

Cervus achieved record third quarter equipment sales in its Agriculture segment, increasing 9% compared to the third quarter of 2017, while equipment gross profit margins contracted.

Income in the third quarter of 2018 was $12.2 million, a $2.7 million increase compared to income of $9.5 million for the same period of 2017.

Total service gross profit margin percentage increased by 3.6% in the third quarter of 2018, compared to the same period in 2017, due to continued service optimization progress.

Related Content: Cervus Reports Both Total Revenue & Ag Sales Up 9%

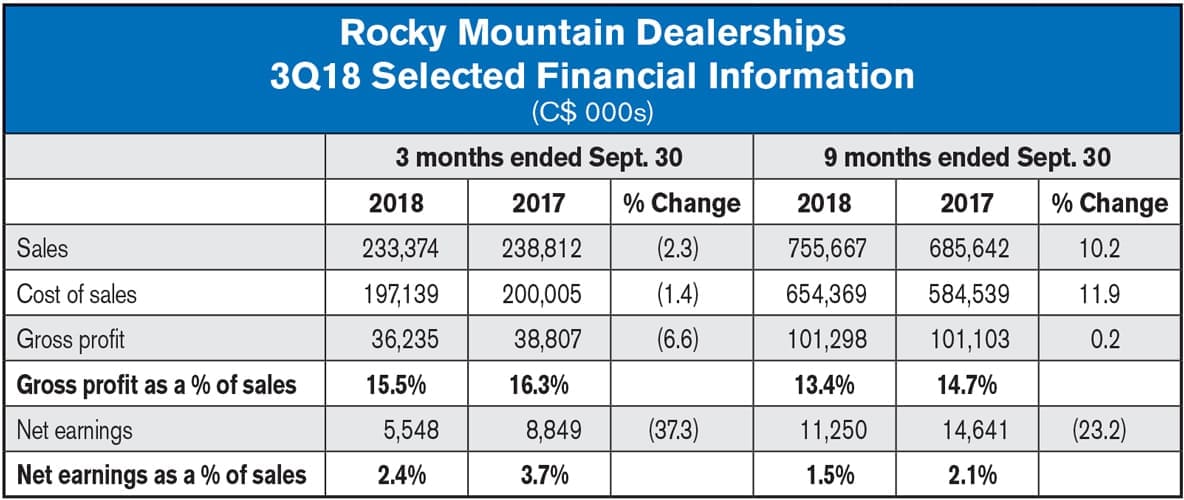

RME 3Q18 Earnings Slip 2%; To Open Used Equipment Outlet in Kansas

Rocky Mountain Dealerships (RME), Canada’s largest agriculture equipment dealer, today reported its financial results for the 3 and 9 months ended Sept. 30, 2018. RME also announced that it will begin selling late-model used equipment to farmers based in the U.S. via an outlet store in Tonganoxie, Kan., which is located on the outskirts of

Kansas City.

The company reported that total sales decreased 2.3% or $5.4 million to $233.4 million compared with $238.8 million for the same period in 2017. Gross profit declined by 6.6% or $2.6 million to $36.2 million from $38.8 million for the same period in 2017.

Early snowfalls across the Canadian Prairies stalled harvest activity throughout mid- to late-September, decreasing in-season demand across all categories. Despite the impact of the unusual harvest, compared to the second quarter of 2018, RME continued to draw down its inventory of new and used equipment even with the addition of $30 million in inventory from the acquisitions of John Bob Farm Equipment and Olds in the third quarter.

Kansas Used Equipment Outlet

Rocky Mountain’s move into the U.S. was expected. During an interview with Ag Equipment Intelligence last summer, the dealership group said expanding its geographical reach would be part of its 5 year growth plan.

According the RME, the new facility is situated in close proximity to the sizeable U.S. agricultural markets of Kansas, Iowa, Nebraska, Missouri and Oklahoma as well as manufacturing facilities from which new equipment is routinely being shipped to RME locations within Canada. “By backhauling late model used equipment to our new Kansas location, we are able minimize the associated transportation costs.”

Garrett Ganden, RME president and CEO, says of the announcement, “This undertaking establishes a beachhead for RME in the U.S. market at a time when the equipment profile is aging due to several years of depressed new unit deliveries. We believe that our lightly-used, competitively-priced equipment is well positioned to refresh this aging profile. This additional equipment distribution channel represents a new growth avenue for RME and does so with minimal capital commitments and start-up costs.”

Related Content:

- Rocky Mountain Dealerships 3Q18 Earnings Slip 2%; To Open Used Equipment Outlet in Kansas

- Rocky Mountain Equipment Aims High with 5 Year Growth Plan; U.S. Expansion a Strong Possibility

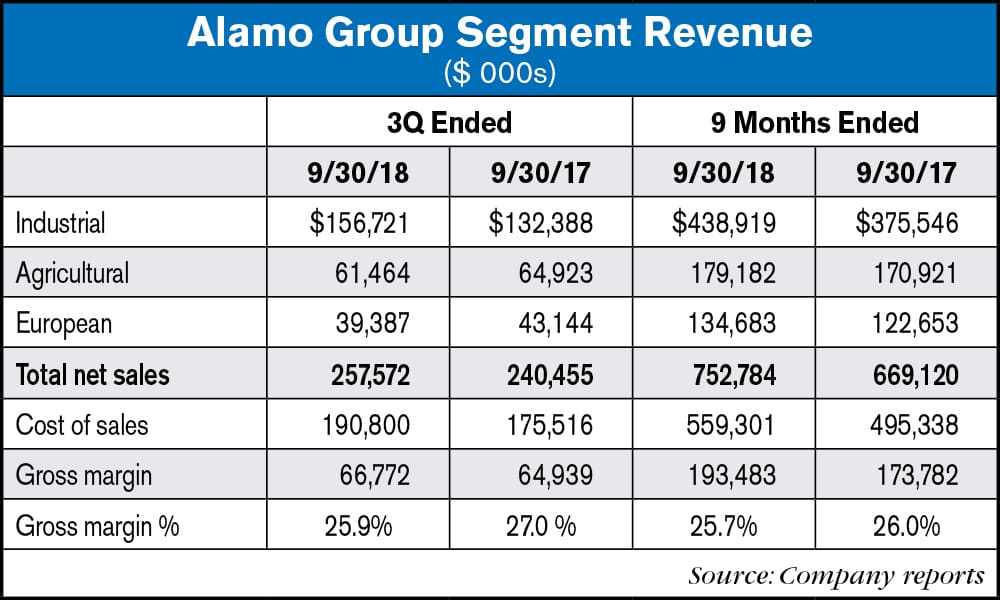

Alamo Reports Net Sales Gain of 7% in 3Q18, But Ag Slips 5%

Alamo Group reported record net sales and net income for the third quarter and first 9 months for the period ended Sept. 30, 2018.

Alamo reported record net income and net sales for a third quarter, with a net income of $23.5 million, up 41.9%, and net sales at $257.6 million, up 7.1%. The first 9 months saw record net income and net sales as well, with net income of $56.9 million (up 38.5%) and net sales of $752.8 million (up 12.5%). The company reported a backlog at $251.2 million, up 38.8% compared to the previous year’s third quarter.

The company’s Agricultural Division net sales in the third quarter of 2018 were $61.5 million, compared to $64.9 million in the prior year, a decrease of 5.3%. For the first 9 months of 2018, the division’s net sales were $179.2 million vs. $170.9 million in the prior year, an increase of 4.8%.

Regarding the ag division’s performance, Ron Robinson, Alamo Group’s president and chief executive officer, commented, “We are concerned about the agricultural outlook which had been showing signs of strengthening, but now is faced with a backdrop of declining farm incomes and the impact that new tariffs are having on demand for certain agricultural commodities. Our Agricultural Division results, while off, are still good, primarily due to improvements in our operational efficiencies which helped mitigate the impact of higher input costs and lower sales.”

Related Content: Alamo Reports Net Sales Gain of 7% in 3Q18, But Ag Slips 5%

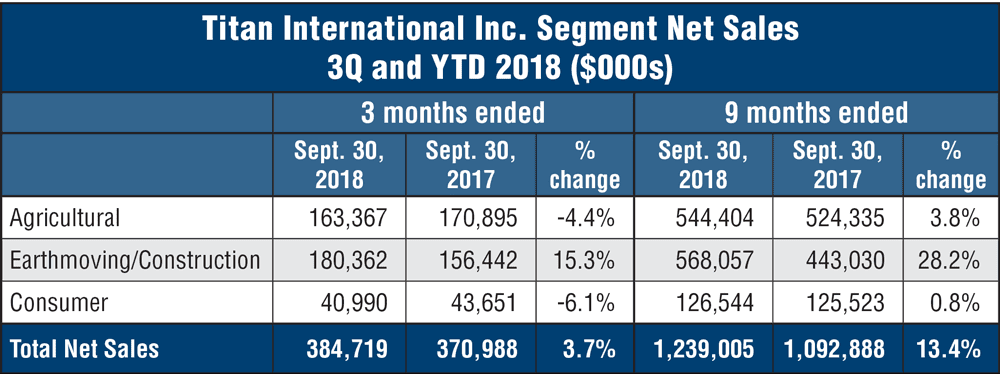

TWI Posts 3.7% 3Q18 Net Sales Gain

Titan International (TWI) on Friday reported results for the third quarter ending Sept. 30.

The global tire manufacturer reported net sales for the quarter were $384.7 million, an increase of 3.7% compared to net sales of $371 million for the same time period in 2017. Net sales increased nearly 10% on a constant currency basis.

Net sales for the first 9 months of the year were $1.24 billion, a 13.4% increase vs. net sales of $1.09 billion for the first 9 months of the previous year.

Sales in Titan’s ag segment for the third quarter were roughly $163.4 million, a 4.4% decline from the nearly $170.9 million the year prior. However, sales for the first 9 months of 2018 were $544.4 million, an increase of 3.8% over the $524.3 million recorded the same time period last year.

Paul Reitz, president and chief executive officer of Titan, says he expects strong performances in the future, given the upward trend of ag machinery sales. He says optimism for 2019 comes from early orders and aging equipment fleets.

“In North America, sales of large to mid-sized ag machinery have seen a mild upturn over the past year, and small equipment sales have maintained a strong, upward trend,” says Reitz. “Generally speaking, dealers are optimistic about prospects for improving both new and used equipment revenues moving into next year.”

Related Content: Titan International Reports 3.7% Net Sales Increase in 3Q

Post a comment

Report Abusive Comment