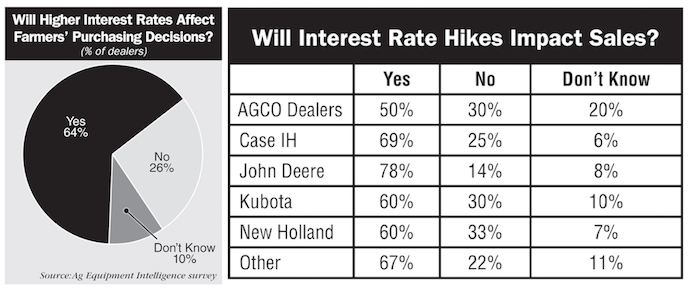

Nearly two-thirds of farm equipment dealers surveyed in earlier this year expect higher interest rates on retail equipment will cause their farm customers to think twice before deciding to buy new equipment in 2018.

Ag Equipment Intelligence editors’ discussions with ag lenders, as well as reports from various districts of the Federal Reserve Bank points to probably 3 increases during 2018 of about 0.25% each, or less than a 1% overall in rate increases for the year.

The survey conducted by Ag Equipment Intelligence asked dealers, Would a modest interest rate increase affect customers’ equipment purchasing decision?

Overall, 64% of dealers expect higher rates will impact farmers’ decision to purchase equipment. A little over one-quarter (26%) don’t think higher rates will affect buying decisions and 10% don’t know.

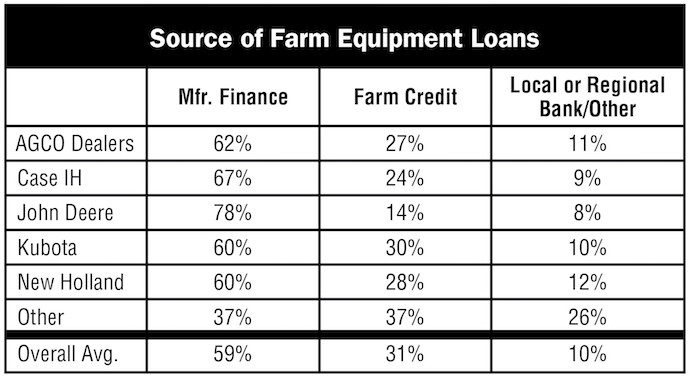

The survey also asked, What percentage of retail loans for farm equipment that you sell are financed by your manufacturer, Farm Credit System and local and regional banks or other lending institutions?

Not surprisingly, about 60% of dealers’ retail loans originate with their manufacturers. By equipment brand, John Deere dealers were most reliant on their supplier’s finance division, as nearly 80% of retail loans coming through the company. Two-thirds of Case IH dealers retail loans originate with the CNH Industrials Financial Services operations.

The next major lender for ag equipment retail loans were with associations connected to the Farm Credit system, which comprised 27% of customer borrowing. Dealers who do not carry any of the 5 major brands relied most on the Farm Credit system compared with the branded dealerships. Local and regional banks or other lenders accounted for about 13% of farm machinery loans, with “other” dealers utilizing their services most often.

Post a comment

Report Abusive Comment